Is securing your family’s financial future a top priority for you? If so, you’ve likely considered various life insurance options. Among them, non-direct recognition whole life insurance stands out as a unique and potentially beneficial choice.

But what exactly is it, and why might it be the right fit for your financial plans? In this blog post, we’ll break down the ins and outs of non direct recognition whole life insurance. We’ll explain how it works, its benefits, and what to consider when choosing this type of policy.

By the end, you’ll have a clear understanding of how non-direct recognition can help you achieve long-term financial security along with peace of mind.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance designed to provide coverage for your entire life, as long as premiums are paid. Unlike term life insurance, which covers you for a specific period, whole life insurance combines a death benefit with a savings component known as cash value. This cash value grows over time and can be accessed through policy loans or withdrawals.

Key Features of Whole Life Insurance

- Lifetime Coverage: Whole life insurance ensures that your beneficiaries receive a death benefit whenever you pass away, provided premiums are current.

- Fixed Premiums: The premiums for whole life insurance remain constant throughout the policyholder’s lifetime, offering predictability in payments.

- Cash Value Accumulation: A portion of your premium payments contributes to the policy’s cash value, which grows at a guaranteed rate. This cash value can be used for loans, withdrawals, or even to pay premiums in later years.

Whole life insurance is often chosen for its stability and the dual benefit of providing both a death benefit and a savings component. It’s a reliable option for those looking to ensure their loved ones are financially secure while also building a financial asset that can be used during their lifetime.

Direct Recognition vs. Non Direct Recognition Whole Life Insurance

Now, let’s focus on the term “non-direct recognition.” When comparing whole life insurance policies, you may encounter the terms “direct recognition” and “non-direct recognition.” These terms relate to how an insurance company treats the cash value of your policy, especially when you take out a loan against it.

Direct Recognition

With direct recognition policies, the insurance company adjusts the dividends paid on the cash value when a loan is taken out. Essentially, the portion of the cash value used as collateral for the loan earns a different (usually lower) rate of return. This means that if you borrow against your policy, the dividends credited to the cash value may be reduced.

Non-Direct Recognition

On the other hand, non-direct recognition policies do not adjust the dividend rate based on policy loans. Regardless of whether you take out a loan, the entire cash value continues to earn dividends at the same rate. In essence, the growth of your cash value remains unaffected by any loans you might take against the policy.

Understanding the Difference

The main distinction between direct and non-direct recognition lies in how policy loans impact the growth of the cash value. With direct recognition, taking out a loan can potentially lower the dividend rate on the borrowed portion. In contrast, non-direct recognition ensures that the dividend rate remains consistent, regardless of any loans against the policy.

Choosing between direct and non direct recognition whole life insurance depends on your financial goals and preferences. Non-direct recognition policies can offer greater stability and predictability, as the growth of your cash value remains unaffected by loans. This can be advantageous if you plan to use your policy for loans or as part of your long-term financial strategy.

How Non Direct Recognition Whole Life Insurance Works?

Non-direct recognition whole life insurance operates differently from its direct recognition counterpart. Here’s how it works:

Policy Structure: Like any whole life insurance policy, non-direct recognition policies provide coverage for your entire life as long as premiums are paid. They consist of a death benefit and a cash value component.

Cash Value Growth: With non-direct recognition, the cash value of your policy continues to grow at the same rate, regardless of whether you take out a loan against it or not. This means that the dividend rate on the entire cash value remains consistent, unaffected by any policy loans.

Loan Provision: If you decide to take out a loan against your policy’s cash value, the insurance company does not reduce the dividend rate on the borrowed portion. This allows you to access funds without compromising the growth potential of your policy.

Consistent Growth: By maintaining a consistent dividend rate, non-direct recognition policies offer stable cash value growth over time. This can be advantageous for long-term wealth accumulation and financial planning.

Loan Repayment: When you take out a loan, you’ll typically repay it with interest. However, unlike with direct recognition policies where the borrowed portion may earn a lower dividend rate, the entire cash value in a non-direct recognition policy continues to earn dividends at the same rate. This ensures that your policy’s growth remains steady, even as you repay the loan.

Overall, non direct recognition whole life insurance provides policyholders with the assurance that their policy’s cash value will continue to grow consistently, regardless of any loans taken against it. This can offer greater financial flexibility and stability over the life of the policy.

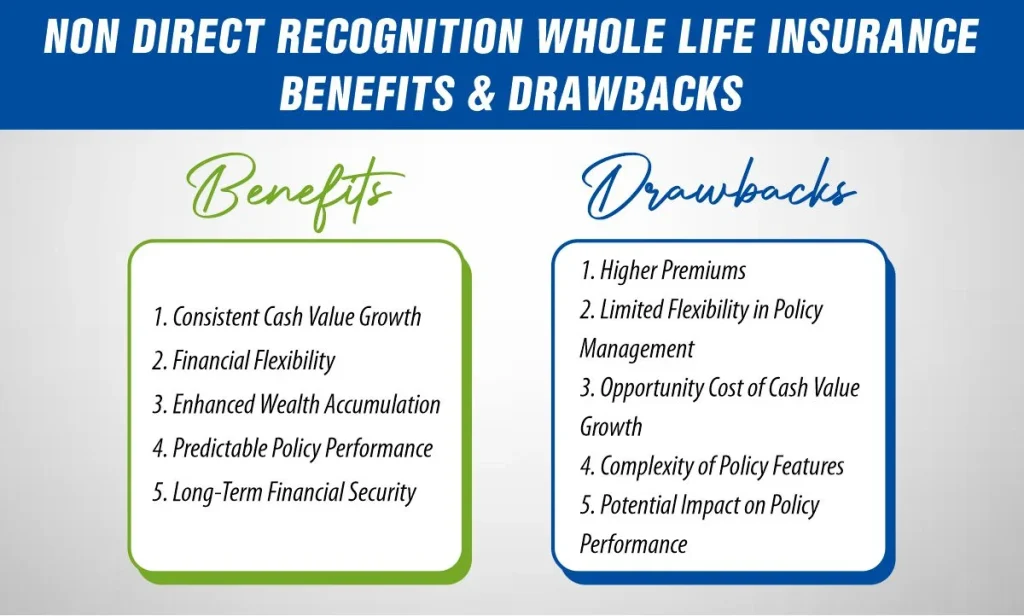

Benefits of Non Direct Recognition Whole Life Insurance

Non direct recognition whole life insurance offers several key benefits that make it an attractive option for individuals seeking long-term financial security:

1. Consistent Cash Value Growth

With non-direct recognition, the entire cash value of your policy continues to grow at the same rate, irrespective of whether you take out a loan against it or not. This means that the dividend rate remains consistent, providing stable growth over time. So, you can rely on steady cash value accumulation, enhancing the overall value of your policy.

2. Financial Flexibility

One of the significant advantages of non-direct recognition is the flexibility it offers in accessing funds. When you take out a loan against your policy, the dividend rate on the cash value remains unaffected. This allows you to access funds when needed without worrying about diminishing the growth potential of your policy.

3. Enhanced Wealth Accumulation

By maintaining a consistent dividend rate, non-direct recognition policies facilitate enhanced wealth accumulation over time. The steady growth of the cash value, coupled with the compounding effect of dividends, can significantly boost your financial resources.

4. Predictable Policy Performance

Non-direct recognition offers policyholders predictability in policy performance. Unlike direct recognition policies, where taking out a loan can potentially impact dividend rates, non-direct recognition ensures that the growth of your policy remains steady regardless of any loans against it.

5. Long-Term Financial Security

Ultimately, non-direct recognition whole life insurance is designed to provide long-term financial security for you and your loved ones. By offering stable cash value growth, financial flexibility, and predictable policy performance, it serves as a reliable financial tool for building wealth, protecting your family, and achieving your financial goals.

Drawbacks of Non Direct Recognition Whole Life Insurance

While non direct recognition whole life insurance offers many benefits, it’s essential to consider potential drawbacks before making a decision:

1. Higher Premiums

Compared to term life insurance or other types of insurance, whole life insurance typically comes with higher premiums. The cash value component and guaranteed coverage for life contribute to these higher costs. For some individuals, the premium payments may strain their budget or make whole life insurance less affordable compared to other options.

2. Limited Flexibility in Policy Management

Non-direct recognition policies may offer less flexibility in managing the policy compared to other types of life insurance. Policyholders may have limited options for adjusting premiums, coverage amounts, or payment schedules once the policy is in place.

3. Opportunity Cost of Cash Value Growth

While non-direct recognition policies maintain a consistent dividend rate, policyholders may miss out on potentially higher returns available from other investments. The cash value growth in whole life insurance policies is typically conservative compared to the potential returns from investing in stocks, bonds, or other financial instruments.

4. Complexity of Policy Features

Whole life insurance policies, including non-direct recognition, can be complex financial instruments with various features and provisions. Understanding the policy terms, including how dividends, loans, and cash value accumulation work, may require careful review and consultation with a financial advisor.

5. Potential Impact on Policy Performance

While non-direct recognition policies aim to maintain consistent cash value growth, there’s always the risk of factors beyond the policyholder’s control affecting policy performance. Economic conditions, changes in the insurance company’s financial stability, or adjustments to dividend rates could impact the overall performance of the policy.

Is Non Direct Recognition Whole Life Insurance a Right Option?

Determining whether non direct recognition whole life insurance is the right option depends on various factors, including your financial goals, risk tolerance, and individual circumstances. Here are some considerations to help you decide:

1. Long-Term Financial Goals

If your primary objective is to build long-term wealth and ensure financial security for yourself and your loved ones, non direct recognition whole life insurance may be a suitable option. The consistent cash value growth and guaranteed coverage for life can provide a reliable foundation for achieving your financial goals over time.

2. Need for Financial Flexibility

Non-direct recognition policies offer greater flexibility in accessing funds through policy loans without impacting cash value growth. If you anticipate needing access to cash value for emergencies, opportunities, or supplemental income during retirement, non-direct recognition can provide the financial flexibility you need.

3. Comfort with Predictable Returns

Non-direct recognition policies offer predictable returns, as the dividend rate remains consistent regardless of policy loans. If you prefer stability and predictability in your investments and are comfortable with the guaranteed growth of whole life insurance, non-direct recognition may align well with your investment strategy.

4. Budget Considerations

It’s essential to assess whether the premium payments for non-direct recognition whole life insurance fit within your budget. Whole life insurance premiums are typically higher than term life insurance, so you’ll need to ensure that you can afford the ongoing payments while still meeting your other financial obligations.

5. Understanding of Policy Features

Non direct recognition whole life insurance policies can be complex financial instruments with various features and provisions. Before committing to a policy, make sure you understand how dividends, loans, and cash value accumulation work, and how they align with your financial objectives.

The Bottom Line

Non direct recognition whole life insurance offers a unique and beneficial approach to handling policy loans and dividend payments. Maintaining a consistent dividend rate, provides steady cash value growth and greater financial flexibility. Whether you’re looking to secure your family’s future, retirement plan, or have a reliable source of emergency funds, this type of policy can be a valuable part of your financial strategy.

As with any financial decision, it’s crucial to do your homework and consult with a professional. With the right policy, you can enjoy peace of mind knowing that your investment will grow consistently, regardless of any loans you might take out.

References:

https://truthconcepts.com/direct-recognition-vs-non-direct-recognition-3/

Meet Alishba, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.