What if you could combine the protection of life insurance with the benefits of a flexible investment plan? Smart universal life insurance (SUL) does exactly that. It offers lifelong coverage and an opportunity to grow your wealth.Unlike traditional life insurance, SUL adapts to your changing financial needs, making it a versatile choice for many. Whether you’re planning for retirement, building an emergency fund, or securing your family’s future, SUL provides a unique blend of security and growth.In this comprehensive guide, we’ll explore how smart universal insurance works, its benefits, potential drawbacks, and strategies for maximizing its value. Let’s start with some basics!

Note: Premiums are estimated and may vary based on individual factors such as health, lifestyle, and coverage options. How is Smart Universal Insurance an affordable option?Smart Universal Life (SUL) can be considered an affordable option for several reasons:

What is Smart Universal Life Insurance?

Smart universal life insurance (SUL) is a type of permanent life insurance. This means it provides coverage for your entire life, as long as premiums are paid. But what sets it apart is its flexibility. You can adjust your premiums and death benefits to match your financial situation and goals. Moreover, part of your premium goes into a cash value account, which grows over time and can be accessed for various financial needs. This makes SUL a versatile tool for both insurance and investment purposes.Key Components of Smart Universal Life Insurance

Here are some of the major features of the smart universal life (SUL) insurance:Lifelong Coverage

Flexible Premiums

Cash Value Component

Adjustable Death Benefit

How Does Smart Universal Life Insurance Work?

Smart Universal Life Insurance (SUL) works by combining life insurance coverage with a savings component, providing both financial protection and investment growth opportunities. Here’s a detailed look at how it functions:1- Premium Payments

When you pay your premiums for a Smart Universal Insurance policy, the payment is split into two parts:- Cost of Insurance (COI): This portion covers the actual life insurance protection, including administrative fees and the cost of providing the death benefit.

- Cash Value Account: The remaining portion is allocated to a cash value account, which acts as a savings or investment component.

2- Cash Value Growth

The cash value account grows over time. The growth can be based on a fixed interest rate, a variable interest rate linked to market indexes, or other investment options offered by the insurer. The key aspects of cash value growth are:- Tax-Deferred Growth: The cash value accumulates on a tax-deferred basis, meaning you don’t pay taxes on the gains until you withdraw the money.

- Interest Accumulation: The cash value earns interest, which can vary depending on the performance of the chosen investment options.

3- Flexible Premiums and Death Benefits

A major feature of SUL is its flexibility:- Adjustable Premiums: You can increase or decrease your premium payments within certain limits. If your financial situation changes, you can pay more to build the cash value faster or pay less if you need to reduce expenses temporarily.

- Variable Death Benefit: You can also adjust the death benefit amount. This allows you to increase coverage if your needs grow (e.g., adding dependents) or decrease it if your financial obligations diminish.

4- Access to Cash Value

The cash value in your SUL policy is accessible and can be used in several ways:- Policy Loans: You can borrow against the cash value. These loans typically have low interest rates compared to traditional loans. However, unpaid loans reduce the death benefit.

- Withdrawals: You can make partial withdrawals from the cash value. Withdrawals may be tax-free up to the amount of premiums you’ve paid, but amounts exceeding this may be taxable.

- Surrender: If you choose to terminate the policy, you can receive the cash surrender value, which is the cash value minus any surrender charges and outstanding loans.

Death Benefit

Upon the policyholder’s death, the beneficiaries receive the death benefit. This benefit is generally tax-free and can be used to cover final expenses, pay off debts, or provide financial support to loved ones. If there are any unpaid loans or withdrawals, these amounts are deducted from the death benefit.Does Smart UL offer two death benefit options?

Yes, that’s right! Smart Universal Life Insurance (SUL) typically offers two death benefit options:1- Level Death Benefit (Option A)

Under this option, the death benefit remains constant throughout the life of the policy. The death benefit is equal to the initial face amount of the policy. Here’s how it works:- Consistent Payout: Regardless of the cash value accumulation, the death benefit remains the same.

- Cost Consideration: Generally, this option has lower premiums because the insurer’s risk doesn’t increase over time.

- Cash Value Integration: As the cash value increases, it effectively replaces a portion of the insurance component, which can lead to lower costs in maintaining the policy.

2- Increasing Death Benefit (Option B)

With this option, the death benefit consists of the initial face amount plus the accumulated cash value. This means the death benefit can grow over time as the cash value increases. Here’s how it functions:- Growing Payout: The death benefit rises in proportion to the cash value growth, providing higher potential payouts to beneficiaries.

- Higher Premiums: Premiums are generally higher compared to the level death benefit because the insurer’s risk increases as the cash value grows.

- Enhanced Financial Protection: This option can be beneficial for policyholders seeking to provide more comprehensive financial protection to their beneficiaries, especially as their cash value grows.

Choosing the Right Option

The choice between a level death benefit and an increasing death benefit depends on your financial goals and needs:- Level Death Benefit: Ideal if you prefer lower premiums and your primary goal is to provide a fixed amount of financial protection.

- Increasing Death Benefit: Suitable if you want the death benefit to grow over time, which can provide additional financial security to your beneficiaries.

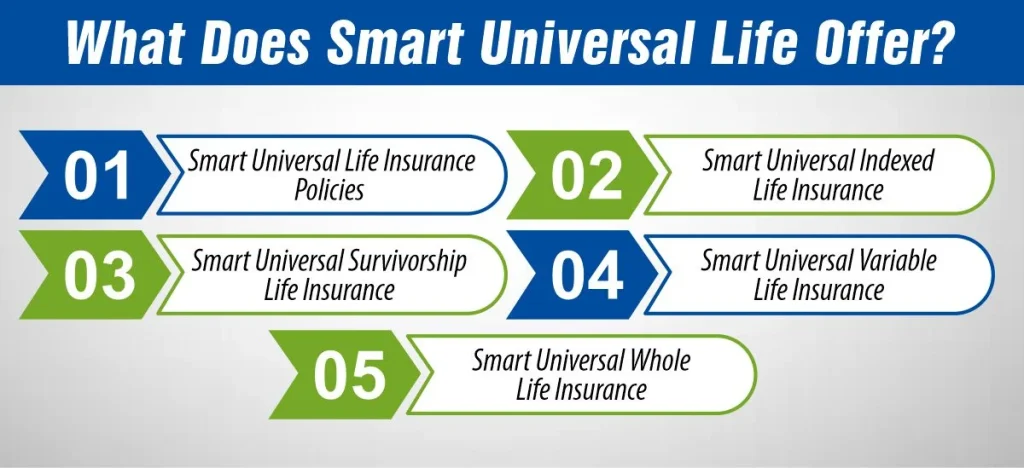

What Does Smart Universal Life Offer?

Smart Universal Life Insurance (SUL) offers a suite of products designed to meet diverse financial needs:1- Smart Universal Life Insurance Policies

These policies provide lifelong coverage with flexible premiums and a cash value component. Policyholders can adjust their premiums and death benefits according to their financial situation, while the cash value grows over time, providing additional financial security and investment potential.2- Smart Universal Indexed Life Insurance

Indexed life insurance policies offer the same benefits as traditional SUL policies but with the added advantage of potential growth linked to market indexes. This allows policyholders to participate in market gains while providing downside protection, making it an attractive option for those seeking growth opportunities with limited risk.3- Smart Universal Survivorship Life Insurance

Survivorship life insurance covers two individuals, typically spouses, under a single policy. The death benefit is paid out upon the death of the second insured, providing financial protection for both individuals’ beneficiaries. This type of policy is often used for estate planning purposes, helping to preserve wealth and minimize estate taxes.4- Smart Universal Variable Life Insurance

Variable life insurance policies offer investment options within the cash value component, allowing policyholders to allocate their funds to various investment accounts. While offering the potential for higher returns, variable life insurance carries investment risk, making it suitable for those comfortable with market fluctuations and seeking greater growth potential.5- Smart Universal Whole Life Insurance

Whole life insurance provides guaranteed coverage for life with level premiums and a guaranteed cash value component. These policies offer stability and certainty, making them suitable for individuals looking for long-term financial security and estate planning.Smart Universal Life Insurance Cost

Determining the cost of Smart Universal Life (SUL) Insurance can vary significantly based on several factors, including age, health status, coverage amount, and desired policy features. To provide a general idea, here are some estimated monthly premium ranges for SUL policies with different ages:| Age | Coverage Amount | Monthly Premium |

| 30 years | $250,000 | $50 |

| 40 years | $500,000 | $100 |

| 50 years | $1,000,000 | $200 |

| 60 years | $2,000,000 | $400 |

| 70 years | $3,000,000 | $600 |

1. Flexible Premium Payments

SUL policies offer flexible premium payment options. Unlike some insurance types that require fixed premiums, SUL allows you to adjust your payments within certain limits. This flexibility means you can pay higher premiums when you have extra funds or lower premiums during financially tight periods.2. Potential for Investment Growth

The cash value component of SUL earns interest, which can be based on market indexes or other investment options chosen by the insurer. Over time, the investment growth can increase your policy’s value, providing a financial cushion that can make the policy more affordable in the long run.3. Tax-Deferred Growth

The cash value in an SUL policy grows on a tax-deferred basis. This means you don’t pay taxes on the earnings until you withdraw them. Tax-deferred growth allows your savings to compound more efficiently, enhancing the cash value accumulation and potentially reducing the need for higher out-of-pocket premiums.4. Loans and Withdrawals

You can borrow against or withdraw from the cash value of your SUL policy. Policy loans typically have lower interest rates than traditional loans, and you can use the funds for any purpose. While it’s important to repay loans to maintain the policy’s death benefit, this feature provides a financial safety net, making it easier to handle unexpected expenses without disrupting your insurance coverage.5. Death Benefit Adjustments

SUL policies often allow you to adjust the death benefit amount. If your financial responsibilities decrease (e.g., children become financially independent), you can reduce the death benefit to lower your premiums. This adaptability ensures that you’re not overpaying for coverage you no longer need.6. Cost of Insurance Charges

The cost of insurance (COI) charges in SUL policies can vary based on your age, health, and other factors. However, because you have control over the premium payments and can build cash value, you can manage these costs more effectively. By maintaining good health and managing the policy well, you can keep these charges relatively low.Conclusion: Is Smart Universal Life Insurance Right for You?

Smart universal life insurance offers a blend of protection and investment. Its flexibility in premiums and potential for cash value growth make it an attractive option for many. However, it requires careful consideration and planning. By understanding your financial goals and consulting with a financial advisor, you can determine if SUL is the right fit for your financial strategy.References:

https://www.foresters.com/en/life-insurance/universal-life-insurance/smart-universal-life-insurancehttps://www.quora.com/unanswered/What-is-Smart-universal-life-insurance

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.