Do you think which life insurance policy can give you access to cash almost immediately? When it comes to life insurance, many people focus solely on the death benefit. However, some policies offer the added benefit of generating cash value right away, which can be a financial lifesaver in times of need.Understanding which type of life insurance policy generates immediate cash value can help you make a more informed decision. In this blog post, we’ll explore the different life insurance options that build cash value quickly, compare their benefits, and provide tips on how to maximize your policy’s cash value. Whether you’re looking for stability, flexibility, or growth potential, we’ve got you covered.

There are several types of life insurance policies that generate cash value over time. These policies are considered permanent life insurance, meaning they provide coverage for your entire life as long as premiums are paid. Here are the main types:

What is Cash Value in Life Insurance?

Cash value in life insurance refers to the portion of your policy that accumulates savings over time. It is a feature of permanent life insurance policies, such as whole life, universal life, and variable life insurance. As you pay premiums, a portion of the money goes into a cash value account, which grows tax-deferred.This means you don’t pay taxes on the interest, dividends, or capital gains earned within the policy. You can access the cash value through loans, withdrawals, or by using it to pay premiums. The amount of cash value and how quickly it accumulates depends on the type of policy you have and how it is managed.Which Type of Life Insurance Policy Generates Immediate Cash Value?

Single premium whole life insurance policies are a type of permanent life insurance that generates immediate cash value. These policies require a single, upfront premium payment, after which the policy is fully funded and begins accumulating cash value immediately. The cash value grows over time, and you can access it through loans or withdrawals.Single premium universal life insurance works similarly, but with more flexibility in premium payments and death benefits. You can choose to pay a single premium or periodic premiums, and the policy accumulates cash value based on interest rates and market performance.On the other hand, no exam term life insurance policies provide immediate coverage without requiring a medical exam. While these policies do not accumulate cash value, they offer a simple and quick way to secure life insurance protection.Lastly, traditional whole life insurance policies also accumulate cash value over time, but the growth is typically slower compared to single premium policies. These policies require regular premium payments over the life of the policy. Types of Life Insurance Policies That Generate Cash Value

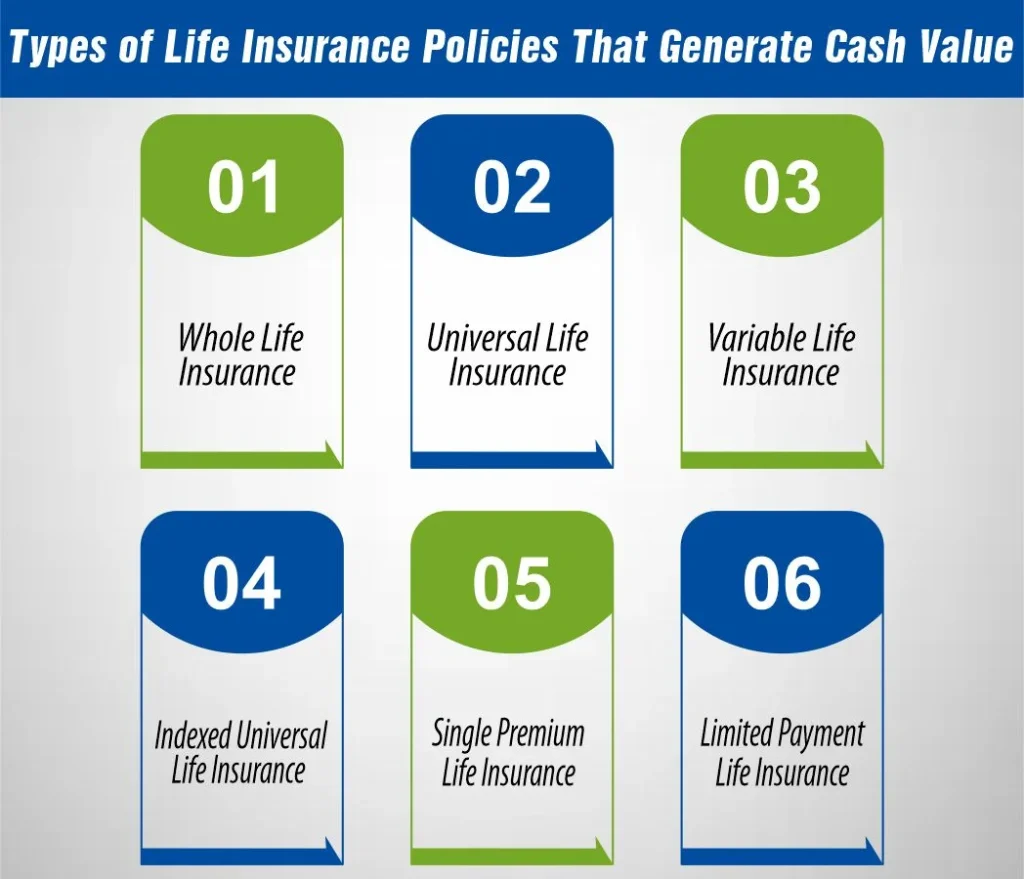

Types of Life Insurance Policies That Generate Cash Value

There are several types of life insurance policies that generate cash value over time. These policies are considered permanent life insurance, meaning they provide coverage for your entire life as long as premiums are paid. Here are the main types:1- Whole Life Insurance

This is the most common type of permanent life insurance. It offers a guaranteed death benefit, guaranteed cash value growth, and level premiums. A portion of your premium goes into a savings component that accumulates cash value over time.2- Universal Life Insurance

Universal life insurance provides more flexibility than whole life insurance. You can adjust your premium payments and death benefit as your needs change. The cash value grows based on a minimum interest rate guaranteed by the insurer.3- Variable Life Insurance

With variable life insurance, you can allocate your cash value among a variety of investment options, such as stocks, bonds, and mutual funds. The cash value and death benefit can fluctuate based on the performance of your investments.4- Indexed Universal Life Insurance

This type of policy ties the cash value growth to a stock market index, such as the S&P 500. It offers the potential for higher returns than a traditional universal life policy, but also comes with more risk.5- Single Premium Life Insurance

As mentioned earlier, single premium life insurance requires a one-time lump sum payment. It immediately builds cash value and typically offers a guaranteed death benefit.6- Limited Payment Life Insurance

With this type of policy, you pay premiums for a specified period, such as 10 or 20 years, after which the policy is fully paid up. The cash value continues to grow even after you’ve stopped paying premiums.These policies provide a combination of life insurance protection and a savings or investment component, making them suitable for individuals looking to build cash value over time.Advantages and Drawbacks of Single-Premium Life Insurance Policy?

A single-premium life insurance policy offers both advantages and drawbacks, making it essential to carefully consider whether it aligns with your financial goals and circumstances.Advantages

Immediate Cash Value

Lifetime Coverage

Guaranteed Death Benefit

Tax Benefits

Drawbacks

High Upfront Cost

Limited Flexibility

Lower Returns

Opportunity Cost

Factors Affecting Immediate Cash Value

Several factors influence the amount and speed of cash value accumulation in a life insurance policy. Understanding these factors can help you make a more informed decision.1- Premium Amount

Higher premiums generally contribute to faster cash value growth. With whole life insurance, a significant portion of the premium goes into the cash value component. In universal and variable life insurance, the premium amount can be adjusted, which directly affects cash value accumulation.2- Policy Fees and Charges

All life insurance policies come with fees and charges. These can include administrative fees, cost of insurance charges, and investment management fees for variable policies. High fees can slow down cash value growth, so it’s important to understand these costs upfront.3- Investment Performance

For variable life insurance, the cash value depends on the performance of the underlying investments. Good investment choices can lead to rapid cash value growth. Conversely, poor investment performance can result in slower growth or even a decrease in cash value.4- Dividend Payments

Some whole life policies pay dividends, which are a portion of the insurer’s profits. These dividends can be used to increase the policy’s cash value. While not guaranteed, dividends can significantly enhance cash value growth.5- Policy Loans and Withdrawals

Borrowing against the cash value or making withdrawals can affect the policy’s growth. Loans must be repaid with interest; otherwise, the unpaid loan amount will be deducted from the death benefit. Withdrawals reduce the cash value and the death benefit.Comparing Immediate Cash Value Policies

To determine which policy best suits your needs, consider the following comparisons:1- Whole Life Insurance vs. Universal Life Insurance

- Cash Value Growth: Whole life offers guaranteed growth, while universal life offers flexible premiums and potentially higher growth based on interest rates.

- Flexibility: Universal life is more flexible, allowing adjustments to premiums and death benefits. Whole life is more rigid but offers stability.

- Risk: Whole life is lower risk with guaranteed returns. Universal life’s returns can vary based on interest rates.

2- Whole Life Insurance vs. Variable Life Insurance

- Cash Value Growth: Variable life can offer higher growth potential based on investment performance, while whole life provides steady, guaranteed growth.

- Investment Options: Variable life allows for investment choices, which can be advantageous for those comfortable with market risks.

- Risk: Whole life is low-risk with guaranteed cash value. Variable life involves higher risk due to investment fluctuations.

3- Universal Life Insurance vs. Variable Life Insurance

- Cash Value Growth: Universal life’s growth depends on interest rates, while variable life’s growth is tied to investment performance.

- Flexibility: Both offer flexible premiums, but variable life offers more control over investments.

- Risk: Universal life is less risky with interest-based growth. Variable life involves higher risk due to market volatility.

How to Maximize Immediate Cash Value?

To get the most immediate cash value from your life insurance policy, consider these strategies:- Pay Higher Premiums: Paying higher premiums can accelerate cash value growth. If your budget allows, consider opting for a policy with higher premiums to build cash value more quickly.

- Choose Policies with Lower Fees: Select policies with lower administrative and management fees. High fees can eat into your cash value growth, so look for insurers that offer competitive fee structures.

- Leverage Dividend-Paying Policies: If you choose a whole life policy, opt for one that pays dividends. Use these dividends to increase your cash value, pay premiums, or purchase additional coverage.

- Monitor Investment Performance: For variable life policies, keep an eye on your investments. Regularly review and adjust your portfolio to maximize returns. Consider working with a financial advisor to make informed investment decisions.

- Avoid Frequent Loans and Withdrawals: Limit the frequency of loans and withdrawals from your cash value. While these can be useful, they reduce the growth potential of your policy. Use them sparingly and plan for repayment.

Conclusion

Hope now you are clear about which type of life insurance policy generates immediate cash value. Choosing the right life insurance policy that generates immediate cash value requires careful consideration of your financial goals and risk tolerance. Evaluate your financial situation, understand the policy details, and consider consulting with a financial advisor. By making an informed choice, you can secure a life insurance policy that not only provides protection but also builds a valuable financial resource for the future.References:

https://mcfieinsurance.com/which-type-of-life-insurance-policy-generates-immediate-cash-value/https://www.quickquote.com/which-type-of-life-insurance-policy-generates-immediate-cash-value/#:~:text=Single%20premium%20whole%20or%20universal%20life%20insurance%20policies%20are%20the,or%20whole%20life%20insurance%20policy.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.