Do you have any idea how your loved ones will manage your final expenses? It’s a thought that crosses many minds, especially as we age. Final expense insurance, also known as burial or funeral insurance, is designed to ease this concern.

OpenCare, a leading provider in this field, offers comprehensive final expense plans tailored to fit various needs and budgets. These plans ensure that your end-of-life expenses are covered, providing peace of mind and financial protection for your family.

With affordable premiums, guaranteed acceptance, and customizable coverage amounts, OpenCare’s plans are a practical choice for those looking to secure their financial legacy. In this blog post, we’ll explore the key features, benefits, and application process of OpenCare’s final expense plans, helping you make an informed decision about your future.

Who is OpenCare, and Are They Legitimately Licensed?

OpenCare is a well-established insurance provider specializing in final expense insurance. They focus on helping individuals plan for their end-of-life expenses, ensuring that their loved ones are not left with financial burdens. OpenCare’s mission is to offer accessible, affordable, and comprehensive final expense plans tailored to meet the diverse needs of their clients.

However, a question may arise, are they legitimate and licensed? Well! Yes, OpenCare is a legitimately licensed insurance provider. They operate under strict regulations and are licensed to sell insurance in multiple states. Their legitimacy is backed by a commitment to transparency and customer satisfaction. OpenCare works with reputable insurance carriers to offer reliable and secure final expense plans.

This ensures that policyholders can trust the coverage they receive and have peace of mind knowing their loved ones will be taken care of when the time comes.

Key Features of OpenCare Final Expense Plans

Affordable Premiums: OpenCare’s plans are budget-friendly. They ensure you get adequate coverage without straining your finances.

Guaranteed Acceptance: Most plans do not require medical exams. Acceptance is guaranteed for those within a specific age range.

Fixed Premiums: Once you enroll, your premiums remain the same. This makes it easier to budget and manage.

Instant Coverage: Some plans offer immediate coverage. This is particularly beneficial for those with existing health conditions.

Flexible Coverage Amounts: You can choose a coverage amount that fits your needs. This ranges typically from $5,000 to $50,000.

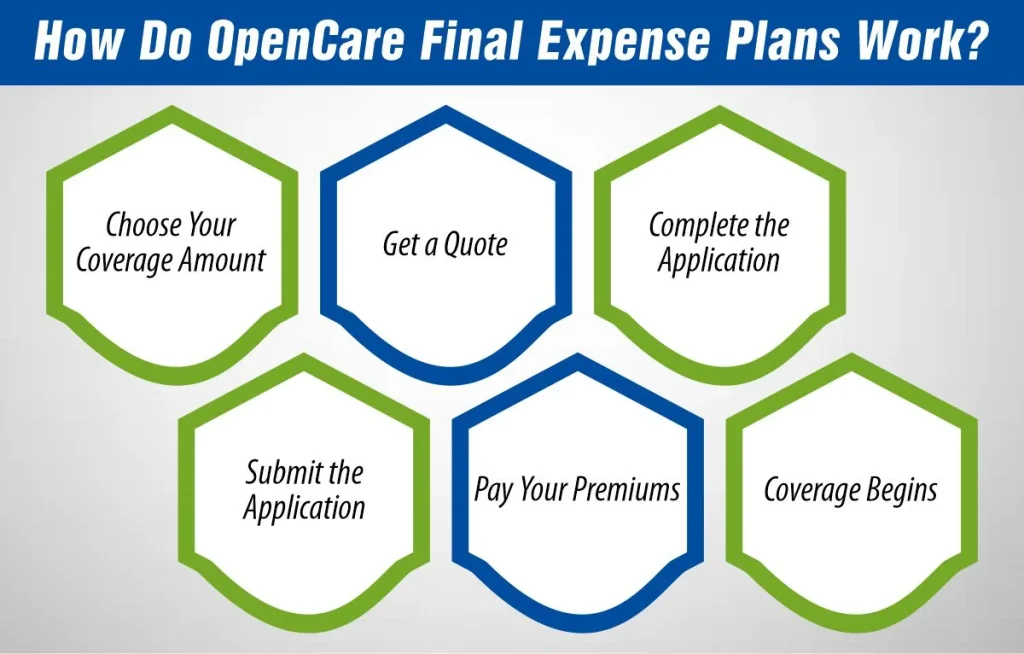

How Do OpenCare Final Expense Plans Work?

How Do OpenCare Final Expense Plans Work?

Understanding how OpenCare final expense plans work can help you make an informed decision about securing coverage. Here’s a detailed look at the steps involved:

1- Choose Your Coverage Amount

Decide on the amount of coverage you need. This depends on your anticipated end-of-life expenses, such as funeral costs, medical bills, and any outstanding debts. OpenCare offers a range of coverage options, typically from $5,000 to $50,000, allowing you to choose an amount that fits your specific needs and budget.

2- Get a Quote

Visit OpenCare’s website or contact an agent to request a free quote. You’ll need to provide some basic information, such as your age and desired coverage amount. This quote will give you an estimate of your monthly premiums, helping you understand the cost of the plan before you commit.

3- Complete the Application

Fill out the application form provided by OpenCare. This process is straightforward and can usually be completed online or over the phone. Most final expense plans from OpenCare do not require a medical exam, making it easier for seniors and those with health issues to qualify.

4- Submit the Application

Submit your completed application to OpenCare. Their team will review the information provided. If additional details are needed, they may contact you for clarification. The review process is typically quick, ensuring you don’t have to wait long for approval.

5- Pay Your Premiums

Once your application is approved, you will begin paying your premiums according to the payment schedule you selected. OpenCare offers flexible payment options, including monthly, quarterly, or annual payments, allowing you to choose what works best for your financial situation.

How Much Does Life Isurance Cost?

6- Coverage Begins

Your coverage starts as soon as your application is approved and your first premium is paid. Some plans offer immediate coverage, while others may have a short waiting period, typically two years. During this waiting period, the full benefit might not be paid out if you pass away, but premiums paid may be refunded with interest or a partial benefit may be provided.

By following these steps, you can secure an OpenCare final expense plan that ensures your end-of-life costs are covered. In this way you can make sure that your loved ones won’t face financial stress during an already difficult time.

Insurance Plans Offered by OpenCare

OpenCare offers a variety of insurance plans tailored to meet the diverse needs of their clients. Here’s a detailed look at the types of insurance plans available:

1- Final Expense Insurance

Final Expense Insurance is OpenCare’s flagship product. It is designed to cover end-of-life expenses such as funeral costs, medical bills, and other outstanding debts. Key features include:

- Guaranteed Acceptance: No medical exams are required, and acceptance is often guaranteed for individuals within a specific age range, typically 50 to 85.

- Fixed Premiums: Premiums remain the same throughout the policy, making it easy to budget for.

- Immediate Coverage Options: Some plans offer immediate coverage from day one, while others may have a short waiting period.

2- Whole Life Insurance

Whole Life Insurance provides lifelong coverage, ensuring that beneficiaries receive a death benefit no matter when the policyholder passes away. Features of OpenCare’s whole life insurance include:

- Lifetime Protection: Coverage lasts for the policyholder’s entire life, as long as premiums are paid.

- Cash Value Accumulation: These policies build cash value over time, which can be borrowed against or withdrawn.

- Fixed Premiums: Premiums remain level for the life of the policy.

3- Term Life Insurance

Term Life Insurance offers coverage for a specified period, such as 10, 20, or 30 years. This is an affordable option for those looking to provide financial protection for their families during crucial years. Features include:

- Affordable Premiums: Generally lower premiums compared to whole life insurance.

- Fixed Term: Coverage lasts for the chosen term, providing a death benefit if the policyholder passes away during this period.

- Renewable Policies: Some term policies can be renewed at the end of the term, though premiums may increase.

4. Guaranteed Issue Life Insurance

Guaranteed Issue Life Insurance is designed for individuals who may have difficulty obtaining traditional life insurance due to health issues. Key features include:

- No Medical Exams: Guaranteed acceptance without the need for a medical exam or health questions.

- Fixed Premiums: Premiums remain the same throughout the policy.

- Waiting Period: Typically includes a 2-year waiting period, during which only limited benefits are paid out if the policyholder passes away.

5- Simplified Issue Life Insurance

Simplified Issue Life Insurance requires only a few health-related questions, with no medical exam needed. It’s ideal for those who want a faster and easier application process. Features include:

- Quick Approval: Faster approval process compared to traditional life insurance.

- Affordable Coverage: Provides affordable premiums with a moderate amount of coverage.

- Fixed Premiums: Premiums do not increase over time.

How Much Do OpenCare Final Expense Plans Cost?

OpenCare final expense plans are designed to be affordable, providing comprehensive coverage without breaking the bank. Here’s a general overview of the estimated monthly premiums for OpenCare final expense plans:

| Age | Coverage Amount | Estimated Monthly Premiums (Male) | Estimated Monthly Premiums (Female) |

| 50-55 | $10,000 | $30 – $50 | $25 – $45 |

| 56-60 | $10,000 | $40 – $60 | $35 – $55 |

| 61-65 | $10,000 | $50 – $70 | $45 – $65 |

| 66-70 | $10,000 | $60 – $80 | $55 – $75 |

| 71-75 | $10,000 | $70 – $90 | $65 – $85 |

| 76-80 | $10,000 | $80 – $100 | $75 – $95 |

| 81-85 | $10,000 | $90 – $110 | $85 – $105 |

Factors Affecting Cost

- Age: Younger individuals generally pay lower premiums than older individuals.

- Health: Healthier individuals may qualify for lower premiums.

- Coverage Amount: Higher coverage amounts result in higher premiums.

- Gender: Women often pay slightly lower premiums than men.

Sample Premiums

- A 60-year-old male non-smoker may pay around $40-$60 per month for a $10,000 coverage plan.

- A 70-year-old female non-smoker may pay around $65-$85 per month for the same coverage amount.

Is The OpenCare Final Expense Plan Worth Buying?

The decision to purchase a final expense plan from OpenCare depends on your individual circumstances and financial goals. Here are some factors to consider when determining if an OpenCare final expense plan is worth buying:

1. Financial Protection

OpenCare final expense plans provide financial protection for your loved ones, ensuring that they are not burdened with end-of-life expenses. If you have limited savings or assets, a final expense plan can be a valuable investment.

2. Affordable Premiums

OpenCare offers final expense plans with affordable premiums, making it easier to fit into your budget. The cost of the plan is typically based on your age, health, and chosen coverage amount.

3. Guaranteed Acceptance

Most OpenCare final expense plans offer guaranteed acceptance, meaning you can qualify for coverage regardless of your health or medical history. This makes it an attractive option for individuals who may have difficulty obtaining traditional life insurance.

4. Fixed Premiums

With OpenCare final expense plans, your premiums are fixed for the life of the policy. This means you won’t have to worry about your premiums increasing as you get older or if your health deteriorates.

Overall, an OpenCare final expense plan can be a valuable investment for individuals looking to protect their loved ones from financial burden and provide them a reliable and straightforward solution for securing their financial future.

The Bottom Line

OpenCare final expense plans offer valuable benefits, providing financial protection and peace of mind. They are an excellent option for those looking to secure their end-of-life expenses without burdening their loved ones.

When planning for the future, consider an OpenCare final expense plan. It’s a practical step towards ensuring your loved ones are taken care of during a challenging time. By choosing OpenCare, you’re making a thoughtful decision that reflects care and responsibility.

Frequently Asked Questions (FAQs)

1- Who is eligible for Opencare plans?

Most OpenCare plans are available to individuals aged 50 to 85. However, some plans may have different age requirements. It’s best to check with OpenCare directly for specific eligibility criteria.

2- Are medical exams required for opencare?

In most cases, no medical exams are required. OpenCare offers guaranteed acceptance plans that do not consider medical history or pre-existing conditions.

3- Can I increase my coverage later?

Yes, you can often increase your coverage later. However, it may require a new application and approval. It’s advisable to choose a coverage amount that anticipates future needs.

4- What happens if I miss a payment?

If you miss a payment, OpenCare typically offers a grace period. During this time, you can make the payment without losing your coverage. It’s essential to stay in communication with OpenCare to avoid lapses in coverage.