In the world of insurance, finding the right policy that aligns with your financial goals and needs is crucial. One such option gaining popularity is Modified Premium Whole Life Insurance.

This insurance plan provides coverage for a lifetime with a low initial premium that increases gradually after a certain time. It is an ideal plan for people trying to improve their financial situation in the future, allowing them to manage the rising premium costs easily.

However, modified premium whole life insurance might not be the best fit for everyone. Understanding its working, and weighing its pros and cons in this article would help you make an informed decision. But let’s with some basic information.

What is Modified Life Insurance?

Modified Life Insurance is a unique variation of traditional whole life insurance that offers a distinctive approach to premium payments. It combines the stability of a whole-life policy with a modified premium structure, providing policyholders with a degree of flexibility during the initial years.

The “modified” aspect refers to a specific premium payment schedule that typically involves lower premiums in the early years of the policy. While the premiums start lower, they often increase to a predetermined level after a specified period, stabilizing for the remainder of the policy’s duration. This approach allows policyholders to enjoy the benefits of whole life insurance, such as lifetime coverage and a consistent death benefit, while managing their cash flow more effectively in the early years.

Moreover, like traditional whole life insurance, Modified Whole Life Insurance builds cash value over time. The policyholder can access this cash value through policy loans or withdrawals, providing a financial cushion that can be used for various purposes, such as supplementing retirement income or covering unforeseen expenses.

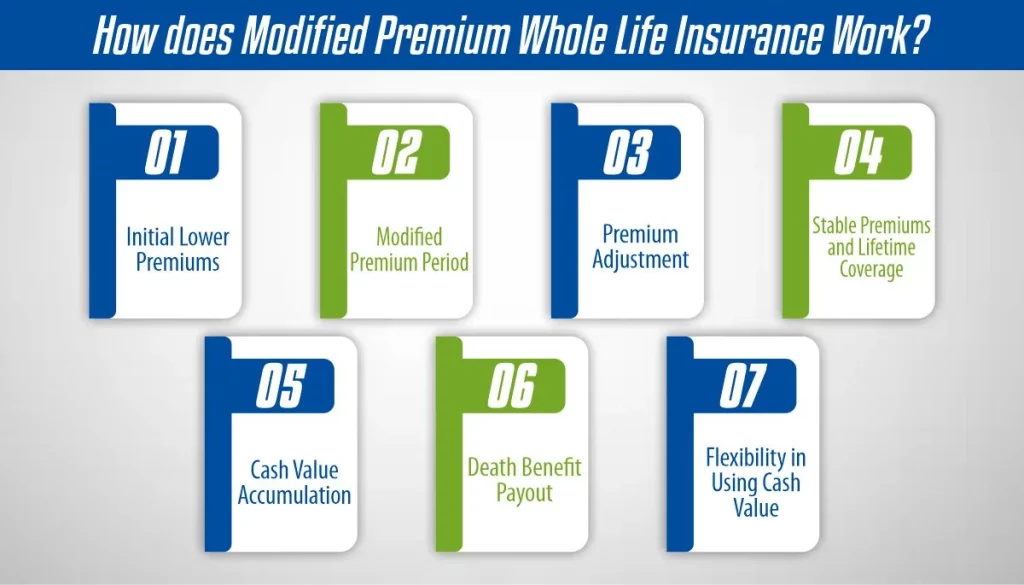

How does Modified Premium Whole Life Insurance Work?

Modified Whole Life Insurance operates on a unique payment structure, offering a balance between affordability and stability. Here’s a breakdown of how it typically works:

1- Initial Lower Premiums

The premium for a modified whole life policy is lower-than-average during the initial years, making it more accessible for individuals who may have budget constraints or prefer lower premiums early in their financial journey.

2- Modified Premium Period

During the modified premium period, which usually spans a set number of years (commonly 5 to 10 years), policyholders enjoy the benefit of these lower premiums. This period allows for financial flexibility in the short term.

3- Premium Adjustment

After the initial period, the premiums on a Modified Whole Life Insurance policy typically increase to a predetermined level. This adjustment is made to ensure the policy can sustain its cash value buildup and provide the guaranteed death benefit.

4- Stable Premiums and Lifetime Coverage

Following the premium adjustment, the policy enters a phase of stable and consistent premiums for the remainder of the insured’s life. This guarantees lifetime coverage, and the death benefit remains in force as long as the premiums are paid.

5- Cash Value Accumulation

Similar to traditional whole life insurance, a portion of the premiums paid goes towards building cash value within the policy. This cash value grows over time and can be accessed by the policyholder through policy loans or withdrawals.

6- Death Benefit Payout

In case of the policyholder’s death, the beneficiaries receive a death benefit. This benefit remains consistent throughout the policy’s duration, providing a financial safety net for loved ones.

7- Flexibility in Using Cash Value

The accumulated cash value offers policyholders financial flexibility. They can use it for various purposes, such as supplementing retirement income, funding education expenses, or covering unexpected financial needs.

Benefits and Drawbacks of Modified Life Insurance

Modified Whole Life Insurance offers a unique set of advantages and drawbacks. Let’s explore them:

Benefits

- Affordability in Initial Years: The policy starts with lower premiums, making it more accessible for individuals with budget constraints or those looking for affordable coverage in the early stages of their financial journey.

- Flexible Premium Payments: During the modified premium period, policyholders enjoy flexibility in premium payments. This can be advantageous for those with fluctuating incomes or specific financial goals during the initial years.

- Cash Value: Like traditional whole life insurance, Modified Whole Life Insurance builds cash value over time. This cash value can be accessed through policy loans or withdrawals.

- Lifetime Coverage: The policy ensures coverage for the entire lifetime of the insured, offering peace of mind and a guaranteed death benefit for beneficiaries.

- Stable Premiums Over Time: After the initial period, premiums typically stabilize, providing predictability in long-term financial planning. This stability can be attractive for those seeking consistent premium payments.

Drawbacks

Initial Premium Adjustment: The transition from lower initial premiums to higher, stabilized premiums after the modified period may pose a financial challenge for some policyholders.

- Complexity in Comparison: Understanding the complexities of Modified Whole Life Insurance can be more complex than traditional policies, requiring careful consideration and comparison before making a decision.

- Potential for Overpayment: Depending on the policy and individual circumstances, some policyholders may end up paying more over time compared to other life insurance options.

- Limited Investment Growth: The cash value component may not grow as actively as other investment options, potentially limiting the policy’s overall wealth-building potential.

- Not Ideal for Short-Term Needs: Individuals seeking coverage primarily for short-term needs may find the initial lower premiums less relevant, as other insurance options may better suit their requirements.

Cost of Modified Coverage Premium Whole Life Insurance

Creating an accurate and specific cost table for Modified Coverage Whole Life Insurance requires detailed information, as costs can vary based on factors such as age, health, coverage amount, and the insurance provider. However, here is a sample table for you providing you information about initial and adjusted premium along with coverage amount:

| Age | Initial Annual Premium (Years 1-5) | Adjusted Annual Premium (After Year 5) | Coverage Amount |

| 30 | $800 | $1,200 | $250,000 |

| 40 | $1,000 | $1,500 | $500,000 |

| 50 | $1,500 | $2,000 | $750,000 |

| 60 | $2,000 | $2,500 | $1,000,000 |

Note that these figures do not represent actual quotes. It’s crucial to obtain personalized quotes from insurance providers based on individual circumstances. Additionally, consulting with an insurance professional can help determine the most suitable coverage and premium structure for specific financial goals and needs.

How Much Does Life Isurance Cost?

Should you get Modified Premium Whole Life Insurance?

The decision to get Modified Whole Life Insurance depends on various factors, and it’s essential to carefully evaluate your financial goals, preferences, and individual circumstances. Here are some considerations to help you determine if this type of insurance is suitable for you:

1. Financial Flexibility

If you value flexibility in premium payments, especially during the initial years when your budget may be more constrained, Modified Whole Life Insurance offers a unique advantage.

2. Long-Term Financial Planning

If you are looking for a long-term financial plan with consistent premium payments after an initial period, this type of insurance may align with your goals.

3. Cash Value Benefits

If you appreciate the idea of building cash value within the policy over time, which can be accessed for various purposes, such as supplementing retirement income or covering unexpected expenses.

4. Commitment to Lifetime Coverage

If you seek a policy that provides coverage for your entire lifetime, ensuring a guaranteed death benefit for your beneficiaries, Modified Whole Life Insurance can offer this security.

5. Estate Planning Considerations

If you are considering life insurance as part of your estate planning strategy, the death benefit from this policy can be utilized to cover estate taxes or leave a financial legacy for your loved ones.

Factors to Consider

Cost Comparison

Compare the costs of Modified Whole Life Insurance with other types of life insurance to ensure it aligns with your budget and provides value for your specific needs.

Future Financial Projections

Consider your anticipated future income and financial stability, as this will influence your ability to manage the adjusted premiums after the initial period.

Health and Age

Your age and health can impact the cost of insurance. It’s advisable to obtain quotes based on your specific circumstances to assess affordability.

Understanding Policy Terms

Familiarize yourself with the terms of the policy, including the length of the modified premium period, how premiums adjust, and the potential growth of cash value.

Consultation with a Professional

Seek guidance from a qualified insurance professional or financial advisor. They can help you assess your needs, provide personalized advice, and ensure that the chosen policy aligns with your overall financial plan.

Ultimately, the decision to get Modified Premium Whole Life Insurance is a personal one that should be based on a thorough assessment of your financial situation and goals. Taking the time to understand the policy terms, comparing options, and seeking professional advice can contribute to making an informed decision.

Conclusion

In the end, modified premium whole life insurance offers a unique blend of flexibility, stability, and long-term financial benefits. As with any financial decision, it’s essential to carefully assess individual needs and consult with a qualified insurance professional to determine if this type of policy is the right fit. By understanding the features and benefits, individuals can make informed choices that contribute to their overall financial well-being

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.