What if you could secure lifetime financial protection without worrying about your policy lapsing? That’s the promise of No Lapse Guarantee Universal Life Insurance (NLG UL). In a world where financial stability is often uncertain, having a dependable safety net is invaluable.

NLG UL stands out among life insurance options, offering unique benefits like guaranteed lifetime coverage and flexible premiums. But what exactly makes this type of insurance so special, and is it the right fit for you? In this blog post, we’ll explore the ins and outs of NLG UL, breaking down its features, benefits, and considerations to help you make an informed decision about your financial future.

What is No Lapse Guarantee Universal Life Insurance?

No Lapse Universal Life Insurance (NLG UL) is a type of permanent life insurance that guarantees your policy will not lapse as long as you pay the required premiums. Unlike term life insurance, which only provides coverage for a specified number of years, NLG UL offers lifetime coverage.

The main feature is the no-lapse guarantee, which ensures that your policy remains in effect even if the cash value drops to zero, provided you meet the premium payment requirements. This type of insurance also allows for flexible premium payments and accumulates cash value over time, which can be accessed if needed.

Key Features of No Lapse Guarantee Universal Life Insurance

No Lapse Guarantee Universal Life Insurance (NLG UL) stands out due to its unique combination of benefits and flexibility. Here are the key features that make this type of policy attractive:

- Guaranteed Death Benefit: The policy provides a guaranteed death benefit that will be paid to the beneficiary upon the death of the insured, as long as the required premiums are paid.

- Fixed Premiums: No lapse guarantee insurance policies have fixed premiums that do not change over time, making it easier for policyholders to budget for their insurance costs.

- Cash Value Growth: Like other permanent life insurance policies, no lapse guarantee universal life insurance policies accumulate cash value over time, which can be accessed by the policyholder through loans or withdrawals.

- Flexible Coverage Amounts: Policyholders can choose the amount of coverage they need, within certain limits, and can adjust the coverage amount as their needs change.

- No Risk of Lapse: The key feature of this type of policy is the guarantee that the policy will not lapse as long as the required premiums are paid, providing policyholders with peace of mind.

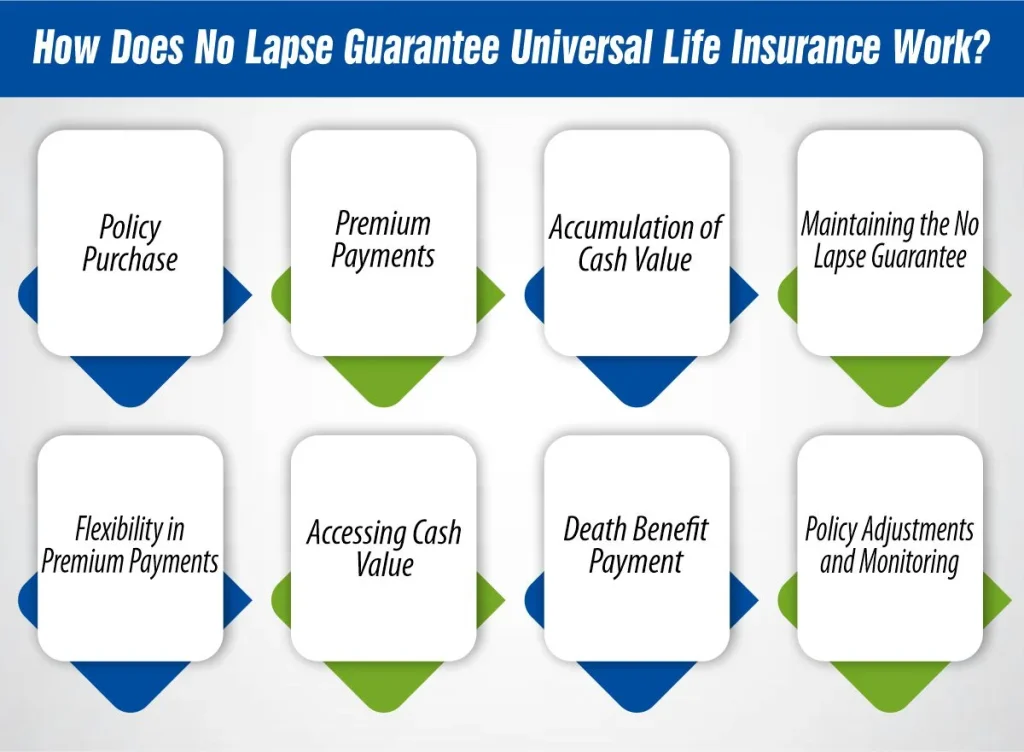

How Does No Lapse Guarantee Universal Life Insurance Work?

No-Lapse Guarantee Universal Life Insurance (NLG UL) operates with a structure designed to offer lifetime coverage and financial flexibility. Here’s a step-by-step explanation of how it works:

1- Policy Purchase

When you decide to purchase an NLG UL policy, you select the coverage amount and the no lapse guarantee period, which is often for your lifetime. The insurer then determines the premium amount based on factors like your age, health, and coverage amount.

2- Premium Payments

You commit to paying regular premiums to keep your policy active. These premiums can be flexible to a degree, but you must meet the minimum premium requirement to maintain the no lapse guarantee. The policy will outline the minimum premium needed to ensure the no lapse guarantee is in effect.

3- Accumulation of Cash Value

As you pay premiums, a portion of the money goes into the policy’s cash value account. This cash value grows over time, accumulating on a tax-deferred basis. The growth rate may be tied to market interest rates or a fixed rate set by the insurer.

4- Maintaining the No Lapse Guarantee

The no lapse guarantee is the defining feature of NLG UL. To maintain this guarantee, you must consistently pay at least the minimum required premium. If you meet this requirement, your policy remains active even if the cash value drops to zero.

5- Flexibility in Premium Payments

One of the key benefits of NLG UL is the flexibility in premium payments. While you must meet the minimum premium to keep the no lapse guarantee, you can vary your payments above this amount based on your financial situation. This allows you to pay more during financially stable periods and less when needed, as long as the minimum requirement is met.

6- Accessing Cash Value

Over time, the cash value of your policy grows. You can access this cash value through policy loans or withdrawals. Loans against the cash value typically come with favorable terms and do not have to be repaid immediately, but unpaid loans reduce the death benefit. Withdrawals reduce both the cash value and potentially the death benefit.

7- Death Benefit Payment

Upon your death, the policy pays out the death benefit to your beneficiaries. The amount is guaranteed as long as you have maintained the required premium payments to keep the no lapse guarantee in effect. The death benefit is typically tax-free for the beneficiaries.

8- Policy Adjustments and Monitoring

Throughout the life of the policy, it’s crucial to regularly review and monitor your NLG UL policy. Changes in your financial situation, health, or goals may necessitate adjustments to your premium payments or coverage amounts. Staying in touch with your insurance advisor can help you manage these adjustments effectively.

Benefits and Drawbacks of No Lapse Guarantee Universal Life Insurance

No-Lapse Guarantee Universal Life Insurance (NLG UL) offers a mix of advantages and potential downsides. Understanding both can help you make an informed decision about whether this type of policy suits your financial goals and needs.

Benefits:

Lifetime Coverage

NLG UL provides coverage for your entire life, not just a specified term. This ensures your beneficiaries receive a death benefit no matter when you pass away, as long as premium requirements are met.

No Lapse Guarantee

The no lapse guarantee ensures your policy remains active even if the cash value drops to zero, provided you continue to pay the required premiums. This offers peace of mind and financial stability, knowing your coverage won’t unexpectedly end.

How Much Does Life Isurance Cost?

Flexible Premiums

NLG UL allows for flexibility in premium payments. You can adjust how much you pay and when, within certain limits. This can help you manage your budget more effectively over time, adapting to changes in your financial situation.

Tax Advantages

The cash value growth is tax-deferred, meaning you don’t pay taxes on the growth until you withdraw it. Additionally, the death benefit is generally paid out to beneficiaries tax-free, which can be a significant financial advantage.

Policy Loans

You can borrow against the accumulated cash value of the policy. Policy loans typically have favorable terms and can provide liquidity when you need it most. However, it’s important to repay these loans to avoid reducing the death benefit.

Drawbacks:

Higher Cost

NLG UL is generally more expensive than term life insurance. The cost reflects the lifetime coverage and the added security of the no lapse guarantee. It’s crucial to ensure that you can afford the premiums in the long term.

Premium Requirements

To maintain the no lapse guarantee, you must consistently meet specific premium requirements. Failing to do so can result in the policy lapsing, even if there is cash value. This makes understanding and committing to the premium schedule essential.

Complexity

NLG UL policies can be complex, with various features and conditions that may be difficult to understand. This complexity can make it challenging to manage the policy without professional guidance, potentially leading to misunderstandings or mistakes.

Potential Impact on Death Benefit

Accessing the cash value through loans or withdrawals can reduce the death benefit. This means that while the cash value offers flexibility, it can also decrease the amount your beneficiaries receive if not managed carefully.

Less Cash Value Growth Compared to Other Investments

The cash value growth in an NLG UL policy is often slower compared to other investment options. If you’re primarily looking to build wealth, other investment vehicles might offer higher returns.

Cost of No Lapse Guarantee Universal Life Insurance

The cost of No Lapse Guarantee Universal Life Insurance (NLG UL) varies based on several factors, including the insured’s age, health, coverage amount, and the specifics of the policy. Below is a table providing an example of estimated annual premiums for different age groups and coverage amounts. These are approximate figures and actual premiums can vary based on individual circumstances and the insurer.

| Age | Coverage Amount | Excellent Health | Good Health | Average Health |

| 30 | $250,000 | $1,200 | $1,500 | $1,800 |

| 30 | $500,000 | $2,200 | $2,700 | $3,200 |

| 40 | $250,000 | $1,800 | $2,200 | $2,700 |

| 40 | $500,000 | $3,400 | $4,100 | $4,900 |

| 50 | $250,000 | $2,700 | $3,400 | $4,200 |

| 50 | $500,000 | $5,100 | $6,300 | $7,700 |

| 60 | $250,000 | $4,300 | $5,500 | $6,800 |

| 60 | $500,000 | $8,100 | $10,200 | $12,600 |

| 70 | $250,000 | $7,500 | $9,500 | $11,800 |

| 70 | $500,000 | $14,000 | $17,700 | $22,100 |

Factors Influencing Cost

- Age: Older individuals typically pay higher premiums due to increased risk of mortality.

- Health: Individuals in excellent health receive lower premiums compared to those with average health. Insurers assess health through medical exams and health history.

- Coverage Amount: Higher coverage amounts result in higher premiums. The cost increases proportionally with the death benefit.

- Policy Features: Additional features like riders (e.g., waiver of premium, accelerated death benefit) can increase the cost of the policy.

- Insurer: Different insurance companies have varying pricing structures. Comparing quotes from multiple insurers can help you find the best rate.

Is No Lapse Guarantee Universal Life Insurance Right for You?

Determining whether No Lapse Guarantee Universal Life Insurance (NLG UL) is right for you depends on your financial situation, goals, and priorities. Here are some factors to consider when evaluating if NLG UL aligns with your needs:

1. Long-Term Financial Security

If you’re seeking lifelong coverage and financial stability for yourself and your beneficiaries, NLG UL provides assurance that your policy will remain active as long as you pay the required premiums.

2. Estate Planning

NLG UL can be a valuable tool for estate planning, especially if you have significant assets or estate tax concerns. The guaranteed death benefit can help cover estate taxes and provide liquidity for your heirs.

3. Dependents’ Financial Stability

If you have dependents who rely on your income or support, NLG UL ensures they’ll receive a death benefit regardless of when you pass away. This can provide peace of mind knowing your loved ones are financially protected.

4. Flexibility Needs

NLG UL offers flexibility in premium payments, allowing you to adjust your payments within certain limits. If you anticipate changes in your financial situation over time, this flexibility can be beneficial.

5. Ability to Afford Premiums

Consider whether you can afford the premiums associated with NLG UL, as they are generally higher compared to term life insurance. Ensure the premiums fit comfortably within your budget, both now and in the future.

Conclusion

No Lapse Guarantee Universal Life Insurance is a powerful tool for those seeking long-term financial security. With its lifetime coverage, no lapse guarantee, and flexible premiums, it offers a range of benefits that can provide peace of mind and stability.

However, it’s essential to carefully consider your financial situation and needs before committing to a policy. By doing thorough research and seeking professional advice, you can find the NLG UL policy that best fits your goals and ensures your financial future is secure.

References:

https://www.nationwide.com/personal/insurance/life/universal/no-lapse-guarantee-UL-II/

https://www.marketwatch.com/guides/insurance-services/guaranteed-universal-life-insurance/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.