Are you a senior looking for life insurance that’s easy to get and comes with clear benefits? Finding the right coverage can be a headache, but AIG’s life insurance for seniors simplifies the process. Why deal with medical exams or endless paperwork when you don’t have to?

Whether you’re looking for the straightforward protection of term life insurance, the long-term benefits of whole life, or the flexibility of universal life insurance, AIG has options to consider.

What makes AIG stand out? For starters, they’re known for their financial stability and reliable customer service, which can be a huge relief during stressful times. Plus, they offer tailored solutions that can adapt to your changing life circumstances—whether you’re just starting, growing your family, or planning for retirement.

Are you thinking about how to secure your family’s financial future? AIG might have the right plan for you. Have you checked out AIG Life Insurance for Senior Review? what they offer, or are you curious about how it compares against other policies? Let’s dive into why AIG might be the stress-free choice you’ve been searching for.

About AIG Life:

AIG Life is a key player in the life insurance market, offering a variety of policies to meet the needs of different people. They provide term life insurance for those looking for temporary, cost-effective coverage, whole life insurance for lifelong coverage with an added savings component, and universal life insurance for flexible coverage with adjustable premiums and benefits.

Why consider AIG Life Insurance for Senior Review ? They’re not just about policies; they emphasize financial stability and responsive customer support, which can be incredibly reassuring during life’s uncertain moments. Plus, their policies are designed to evolve with your life stages, whether you’re navigating early career steps, expanding your family, or eyeing retirement.

Are you curious about how AIG Life can help secure your financial future or how it compares to others? Are you ready to find out which policy might be the best fit for you?

AIG Life Insurance Options for Seniors

As you enter your golden years, finding a life insurance policy that’s straightforward and hassle-free is crucial. AIG’s Guaranteed Issue Whole Life Insurance caters specifically to seniors, offering a range of benefits designed to provide comfort and ease during the policy process.

What is AIG’s Guaranteed Issue Whole Life Insurance?

AIG’s Guaranteed Issue Whole Life Insurance is tailored for individuals aged 50 to 80, providing a financial safety net without the need for medical exams or health questionnaires. Here’s what makes this policy stand out:

- Coverage Options: Policy amounts range from $5,000 to $25,000, allowing you to select the coverage that best suits your financial needs and end-of-life expenses.

- Eligibility Simplified: Available exclusively to seniors between 50 and 80 years old, this policy ensures that more people have access to insurance without the barriers of medical exams or extensive health questions.

Key Features of AIG’s Policy

- No Medical Exams: Forget the hassle of medical tests; signing up for this insurance doesn’t require any. It’s all about making your experience as smooth as possible.

- Same-Day Policy Decisions: Need coverage quickly? AIG offers decisions on your policy application the same day you apply. This means less waiting and more immediate peace of mind.

- Living Benefits: Unique to AIG, this policy includes living benefits, which can grant you access to up to half of your death benefit if you’re diagnosed with a terminal illness. This feature can be a financial lifeline, providing you with funds when you need them the most.

Why Choose AIG’s Guaranteed Issue Whole Life Insurance?

Choosing the right life insurance can be a pivotal decision in your senior years. AIG’s policy isn’t just about financial security after you’re gone; it’s also about making life more manageable if you face health challenges.

- Ease and Accessibility: With no medical exams and coverage available up to age 80, AIG removes common obstacles many seniors face in obtaining life insurance.

- Financial Flexibility: The living benefits feature allows for financial flexibility in challenging times, ensuring that the policy serves your needs when you most need assistance.

In summary, AIG’s Guaranteed Issue Whole Life Insurance offers a blend of simplicity, fast service, and compassionate features that address both your end-of-life financial concerns and potential needs during terminal illness. It’s designed not just as a policy but as a safety net that respects the challenges and needs of seniors today. Whether it’s covering funeral costs or providing a financial cushion for unexpected medical expenses, this insurance is about providing security and ease when it matters most.

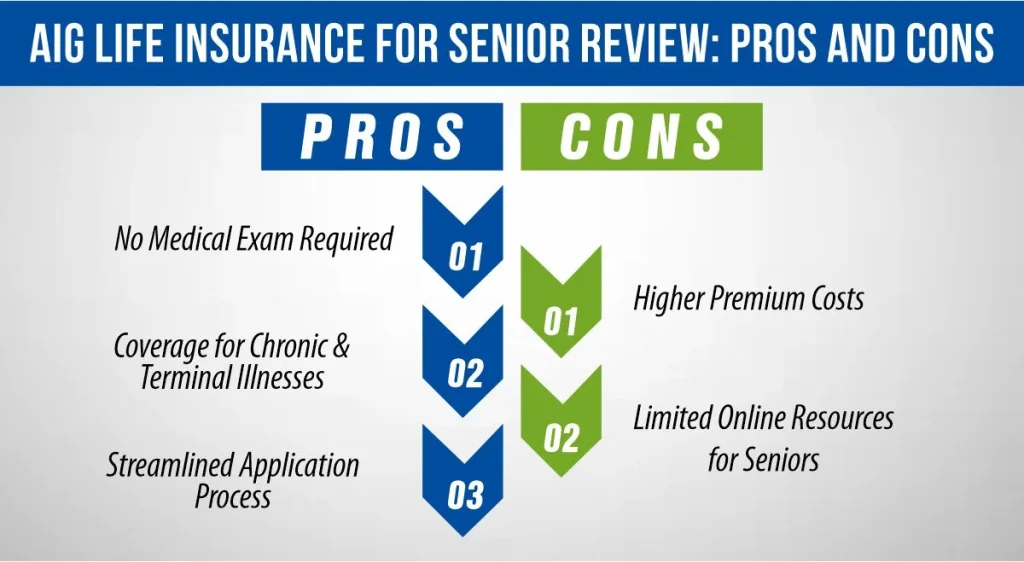

AIG Life Insurance for Senior Review: Pros and Cons

AIG Life Insurance for Senior Review: Pros and Cons

Choosing the right life insurance in your golden years is more than just a financial decision; it’s about peace of mind and ease of access. AIG offers options tailored for seniors, but how do they stack up? Let’s dive into the pros and cons to see if AIG could be your go-to for life insurance.

Pros of Choosing AIG Life Insurance for Seniors

- No Medical Exam Required: One of the most significant advantages of AIG is the no medical exam policy. If you prefer something other than hospital visits or extensive health check-ups, this is a big plus. You can get your life insurance sorted without stepping out of your comfort zone.

- Coverage for Chronic and Terminal Illnesses: AIG goes beyond the basic death benefit. Their policies often include riders that advance a portion of the death benefit if you’re diagnosed with a chronic or terminal illness. It’s financial support when you need it most, not just after you’re gone.

- Streamlined Application Process: We all appreciate simplicity, and AIG delivers just that. Their application process is straightforward and designed to be less of a hassle and more of a relief. You’re looking at a smoother ride to getting insured.

Cons of Choosing AIG Life Insurance for Seniors

- Higher Premium Costs: No medical exams and added benefits come at a price—literally. AIG’s premiums are generally higher compared to other life insurance types. If budget is a concern, this might be a sticking point.

- Limited Online Resources for Seniors: In the digital age, we love information at our fingertips. However, AIG’s online resources for senior plans are less robust than we’d like. Often, you’ll need to speak directly with an agent to get all the details, which might be something other than everyone’s cup of tea.

Is AIG the Right Choice for You?

Every senior has unique needs and circumstances. AIG’s life insurance for seniors offers a mix of convenience and comprehensive coverage, with the assurance of support during chronic or terminal illnesses. However, it’s worth weighing the higher cost and potential need for direct interactions with agents.

If you value ease and extensive coverage and are okay with a higher price tag, AIG could be a great fit. But if you’re budget-conscious or prefer handling things online, you should shop around. Remember, the best policy is one that gives you peace of mind without breaking the bank.

Pricing and Affordability of AIG’s Senior Life Insurance

Understanding the pricing structure is crucial when considering life insurance, especially for seniors who often manage fixed incomes. Let’s break down AIG’s pricing for senior life insurance and see how it compares in the market.

AIG’s Pricing Structure

AIG’s life insurance for seniors, particularly their Guaranteed Issue Whole Life Insurance, does not require a medical exam, which simplifies the process but can influence pricing. Premiums are typically higher because the insurer takes on more risk by not checking health details. For a basic coverage amount—say $10,000—the premiums can range significantly based on age, from approximately $50 to $150 monthly for individuals aged 50 to 80.

Market Comparison

Compared to other insurers, AIG’s rates are competitive, but they can shift higher due to added benefits like coverage for chronic and terminal illnesses. While you might find cheaper options, they may require medical exams or offer fewer benefits, presenting a trade-off between cost and convenience.

How Much Does Life Isurance Cost?

Age-Related Pricing Examples

- At age 50, a non-smoking male might pay around $50 per month for a $10,000 policy.

- At age 65, the same policy could cost about $90, reflecting the increased risk associated with age.

- At age 80, premiums might jump to $150 or more, showcasing the premium increase as risk increases with age.

Conclusion:

AIG’s senior life insurance offers easy-to-use and security, ideal for those who prioritize convenience and are willing to pay a bit more for comprehensive benefits. Here’s when AIG might be the right choice:

- If you prefer simplicity, No medical exams and a straightforward application process make AIG attractive if you want to avoid health screenings.

- If you need flexible benefits, the inclusion of chronic and terminal illness benefits can provide financial relief when health issues arise, making AIG a solid option for those considering future health scenarios.

However, if budget is a top concern and you are in good health, exploring other insurers that offer lower rates with medical exams might be worthwhile.

Next Steps

AIG Life Insurance for Senior Review Given the complexities of insurance pricing and personal needs, it is advisable to contact an insurance agent for personalized advice and a detailed quote. They can help tailor a policy that fits your budget while ensuring your coverage needs are met, providing peace of mind in your later years.

References:

https://finalexpensedirect.com/aig-life-insurance-for-seniors/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.