Ever wondered how independent insurance agents stay updated with the constantly changing insurance industry? This is where Insurance Marketing Organizations, or IMOs, come into play. These organizations are the backbone for agents, offering an extensive selection of insurance products, premier training, and critical marketing tools. But what exactly is an IMO, and why does it matter to you? Whether you’re an agent aiming to broaden your portfolio or a customer searching for the ideal policy options, getting to know how an IMO insurance works could be a game-changer. Let’s explore what makes IMOs such a vital element of the insurance world.

What is IMO Insurance?

IMO Insurance, or Insurance Marketing Organization insurance, isn’t a type of insurance policy. Instead, it refers to a service provided by Insurance Marketing Organizations (IMOs), companies that bridge the gap between insurers and insurance agents or brokers.

Here’s the simple breakdown:

Support for Agents: IMOs provide crucial support to independent insurance agents and brokers. They offer training, marketing tools, and administrative support to help these agents sell more effectively and manage their businesses.

Product Access: One of the biggest benefits of working with an IMO is access to various insurance products. IMOs negotiate with insurance companies to get agents the best products and rates. This means agents can offer more options to their clients—everything from life insurance to annuities.

Enhanced Commission Structures: Because IMOs work with many agents, they can often negotiate better commission structures. This can be more lucrative for agents than working directly with insurance companies.

Compliance and Regulation Help: Staying compliant with insurance laws and regulations is crucial but can be complex. IMOs help ensure that agents follow all legal requirements, which protects the agents, the IMO, and the clients.

In essence, IMO, insurance represents a network of services that supports insurance agents, helping them to be more successful and provide better services to their clients. It’s like having a backstage pass in the insurance concert—better access, support, and often, better pay.

What should I be looking for?

When you are looking to partner with an IMO insurance, think about these key factors:

- Experience: How long have they been in business? What is their track record of success?

- Carriers: How many carriers do they offer? Are they the most competitive products?

- Programs: What kind of marketing programs do they offer? Do they know what is working?

- Testimonials: What do other agents say about them? What do carriers say about them?

What Makes Up Life Insurance, IMO?

An IMO is a network that supports independent life insurance agents in several crucial ways. Here’s what makes up the backbone of a typical life insurance IMO:

Partnerships with Insurers:

IMO form partnerships with multiple life insurance companies. This allows them to offer a diverse range of products to agents, who, in turn, can provide more options to their clients.

Support Services:

They provide extensive support services to these agents, including training in new products, sales techniques, and regulatory compliance. This helps agents stay knowledgeable and effective.

Marketing and Lead Generation:

IMOs often assist agents with marketing and lead generation efforts, providing tools and resources to help them reach potential clients more effectively.

Technology Platforms:

Many IMOs offer technology platforms that help agents manage client relationships, policies, and back-office tasks more efficiently.

Regulatory Guidance:

Keeping up with insurance regulations can be daunting. IMOs help agents maintain compliance with industry laws and regulations, reducing the risk of penalties.

How Does an IMO Generate Revenue?

Now, onto the financial side of things. How does an IMO make money? Here are the key revenue streams:

Commissions from Product Sales: IMOs typically earn a portion of the commissions on the insurance policies sold by their support agents. Since they negotiate product access and terms with insurers, they arrange to receive a percentage of the commissions that flow from these sales.

Overrides: An override is a commission bonus given to IMOs based on the volume or quality of business their affiliated agents produce. If agents perform well, the IMO benefits directly from these enhanced earnings.

How Much Does Life Isurance Cost?

Membership Fees: Some IMOs charge agents membership or subscription fees for access to their services, tools, and product portfolios. This fee structure helps stabilize the IMO’s income, making it less dependent on sales fluctuations.

Consulting Fees: IMOs may also charge consulting fees for their expertise in compliance, marketing, and sales strategies. They provide specialized services to both insurance companies and individual agents.

Technology Services: With the insurance industry’s digital transformation, many IMOs develop proprietary technology solutions for client management, sales tracking, and more. They can monetize these platforms by charging agents a fee to use them.

Training Programs: IMOs often create comprehensive training courses on sales techniques, new insurance products, or regulatory compliance. These training programs can be another source of revenue, especially if they are well-regarded within the industry.

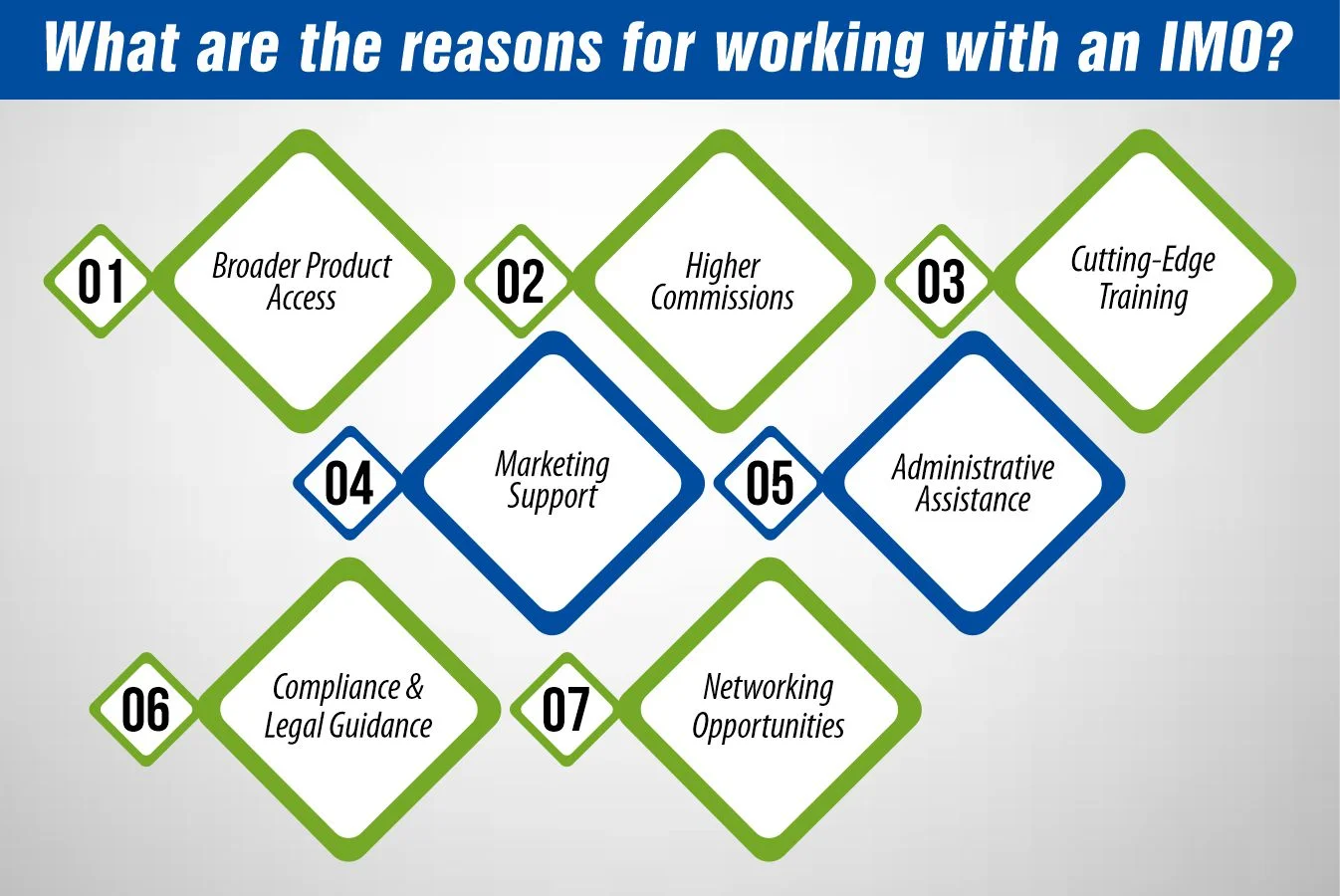

What are the reasons for working with an IMO?

What are the reasons for working with an IMO?

Broader Product Access:

IMOs partner with multiple insurance providers, which means that as an agent, you have access to a wide array of insurance products. This diversity allows you to better cater to your clients’ varied needs.

Higher Commissions:

Thanks to an IMO’s collective bargaining power, you often enjoy higher commission rates than you might secure. This can significantly boost your earnings.

Cutting-Edge Training:

IMOs provide ongoing training sessions that help you stay sharp and ahead of the curve. These sessions cover everything from the latest products to the most effective sales techniques and regulatory changes.

Marketing Support:

Need help figuring out where to start with marketing? Most IMOs offer robust marketing tools and strategies, helping you reach and attract more clients without breaking a sweat.

Administrative Assistance:

Handling paperwork and managing client data can be overwhelming. IMOs often provide administrative support to help you keep everything organized and running smoothly.

Compliance and Legal Guidance:

With constantly changing regulations, it’s easy to miss something important. IMOs help ensure compliance, avoiding fines and legal headaches.

Networking Opportunities:

Working with an IMO connects you to a network of fellow insurance professionals. These connections can be invaluable for sharing insights and growing your business.

What functions does an IMO perform?

Product Distribution: IMO insurance serve as intermediaries between insurance carriers and agents, facilitating a wider distribution of insurance products.

Agent Recruitment and Support: They actively recruit insurance agents and provide them with the support they need to succeed, from training to sales strategies.

Marketing and Lead Generation: IMOs develop and implement marketing strategies that boost their brand and generate leads for their agents.

Training and Education: Providing ongoing education about products, industry changes, and sales techniques is a cornerstone of an IMO’s function.

Regulatory Compliance: They ensure that they and their agents adhere to industry laws and regulations, safeguarding against legal issues.

Technology Provision: Many IMOs offer proprietary technology platforms that help agents manage relationships, track sales, and streamline operations.

By joining an IMO insurance, you’re not just getting help with sales; you’re getting a partner that helps you grow professionally while managing many of the more tedious aspects of the insurance business. It’s like having a co-pilot in your insurance career—one that’s equally invested in seeing you succeed.

What is the difference between an insurance FMO, IMO

| Aspect | Insurance FMO | Insurance IMO |

| Definition | An organization that provides support services to insurance agents, typically with a focus on a specific field or local region. | Similar to an FMO, but often operates on a larger scale, potentially national or international. |

| Focus | Often more specialized in certain products or markets, providing targeted support and resources. | May offer a wider range of products and services, catering to a broader audience. |

| Scale of Operation | May operate more locally or regionally, focusing on specific markets or types of insurance. | Usually has a larger operational scale, sometimes nationwide or global. |

| Services Offered | Similar services as IMOs such as training, marketing support, and regulatory compliance assistance. | Similar to FMOs but might include additional services due to larger scale, like more extensive marketing campaigns or advanced technology platforms. |

| Relationships | Direct relationships with fewer insurers, focusing on depth rather than breadth. | Typically have broader relationships with a range of insurers to offer diverse products. |

| Target Audience | Often targets more niche markets or specific types of agents who specialize in certain areas of insurance. | Targets a wider range of insurance agents and brokers, offering solutions for various insurance needs. |

This table outlines the general differences, but it’s important to note that some organizations may blend these roles or vary significantly in their services and structure. Whether you’re an agent looking to partner with an FMO or IMO, understanding these differences can help you choose the organization that best fits your needs and career goals.

Why Team Up with an IMO Insurance?

Getting involved with IMO Insurance can seem like a big step, but it comes with plenty of perks. Here’s why linking up with an IMO can be a game-changer for insurance agents:

Access to a Diverse Range of Products

Imagine walking into a store with shelves stocked with every type of product you could sell. That’s what it’s like with an IMO. They have relationships with various insurers, giving you access to various insurance products. This variety allows you to tailor solutions perfectly to each client’s needs, making you look like a hero because you can always pull the right product out of your hat.

Higher Commissions

Who doesn’t like a bigger paycheck? Due to their volume of business and relationships with insurers, IMOs negotiate better commission structures. This means more money in your pocket for the same amount of work. It’s like getting an upgrade to first class without paying extra.

Comprehensive Support

Would you like an assistant to handle the small details so you could focus on closing deals? IMOs offer that kind of comprehensive support. From training and technical assistance to marketing and administrative support, they’ve got your back on all fronts. It’s like having a pit crew in the race to the finish line, ensuring you’re always running at peak performance.

Streamlined Processes

Time is money, and IMOs understand that. They make processes faster and smoother, from application submissions to policy issuance. This efficiency not only saves time but also enhances the client experience. It’s like getting to the front of the line faster at an amusement park—getting to the fun part quicker, with less hassle.

Teaming up with an IMO means you’re not just working; you’re supercharging your work environment. You get the tools, resources, and support to meet and exceed your goals. And let’s be honest, who doesn’t want to be the best in the game? With an IMO, you’re well on your way.

Conclusion

In conclusion, Insurance Marketing Organizations (IMOs) play a crucial role in the insurance landscape by empowering agents with comprehensive services and access to various products. For agents, partnering with an IMO means enhanced opportunities for growth, better client service, and a competitive edge in a crowded market.

For clients, it translates to receiving well-informed advice and diverse policy options tailored to their unique needs. By bridging the gap between insurers and agents, IMO insurance ensure that everyone involved is better prepared to navigate the complexities of the insurance world. Whether you’re just starting in the industry or looking to expand your offerings, an IMO can be a valuable partner in your journey.

References:

https://redbirdagents.com/what-is-an-imo/

https://usa.experiorfinancial.com/independent-marketing-organization-imo/

https://dmi.com/what-is-a-life-insurance-imo-independent-marketing-organization/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.