Last Updated on: August 28th, 2024

Reviewed by Dylan Whitman

- Licensed Agent

- - @M-LifeInsurance

Have you ever wondered what happens if you miss a life insurance payment? Do you lose your coverage right away?

The grace period for life insurance payments is a helpful feature that ensures your policy stays active even if you miss a payment deadline. It provides a safety net, giving you extra time to pay your premium without the risk of losing your coverage. Understanding how the grace period works can provide peace of mind and help you maintain continuous protection for your loved ones. Let’s discuss more about it, let’s start:

What is a Grace Period for Life Insurance policy?

Typically, all insurers provide a grace period for the payment of the premium towards the policy. The grace period is typically 30 or 31 days from the due date of the insurance premium.

The grace period provides you with security in the event of a financial emergency, forgotten check, or anything else that may get in the way of the payments you owe the life insurance company.

Luckily, the grace period for life insurance payment provides a buffer of time, usually around 30 days, in which you can send the missed payments owed to the carrier.

Your coverage continues for as long as you’re in the grace period.

Should you pass away while the grace period is in effect, the policy will issue the full payout to beneficiaries of your policy, minus the premiums you owe.

Grace periods help to ensure your beneficiaries receive your life insurance payout even if you’re incapable of paying the premium bill.

The grace period also helps avoid the need for underwriting.

You must check your policy documents for the exact grace period applicable to your policy. No penalty – either as interest or delayed payment – is required to be paid if the full premium is deposited during the grace period of your policy.

Is there a grace period for life insurance payments?

Grace period for life insurance payment anywhere from 30 to 60 days, and your life insurance remains in force during the grace period. You can make a late payment without being charged interest and still be covered.

Companies need to ensure that you retain your coverage, this is why Life insurers will do all they can to ensure you retain your coverage. Unfortunately, it can be challenging to reinstate your life insurance policy term once the policy has expired, lapsed, or canceled.

It is important to note that your insurer may ask you to provide more information to support an insurability consideration, like a medical examination. Your policy may not be reinstated if you have developed a new medical condition, or you may go without life insurance because you did not pay your premiums on time or within the grace period.

Most life insurance policies — including term life insurance — can be reinstated within five years of lapsing if overdue premiums are paid and loans against cash value are satisfied.

If you have a level premium term life policy, you can still pay your premiums due based on your original issue age.

To avoid a policy cancellation, talk with your agent. There are options for catching up with premium payments owed for permanent life insurance, such as making partial payments, suspending your insurance coverage for some time, or using the policy’s cash value to cover premium payments due.

How Much Does Life Isurance Cost?

Check with your insurance company for a grace period for life insurance payment options. Don’t rely on grace periods to keep your life insurance policies.

What happens after the grace period for term life insurance is over?

In case you don’t renew your term life insurance plan during the grace period, your policy lapses, and your loved ones are left without financial protection in case of your death. A lapsed term insurance policy is a huge loss for the policyholder because he loses the entire premium he paid so far and the insurance coverage as well.

However, if the policyholder dies during the grace period, his family is eligible to receive the death benefit after deduction of the unpaid premium.

What Happens in the Case of Death of the Insured Person During the Grace Period?

In case you die during the grace period, your beneficiary will receive the death benefit, as reduced by the past-due premium. In case of the death of the insured on the due date of the premium or within the grace period, the premium corresponding to the policy month in which the insured dies shall be deducted from the Death Benefit.

Other than this, nothing can affect the life insurance grace period death benefit in the insurance policy as long as the death occurs within the grace period.

What If You Are Moving from One Insurance Company to Another?

Never cancel a life insurance policy that you are replacing. If you cancel a policy THERE IS NO GRACE PERIOD. You can let it go into the grace period if your new policy is close to going, but you and your agent should be very careful not to let your life insurance coverage lapse until the new policy is In Force. That way, you are never without coverage.

Grace Period Explained

The grace period is the time after a missed insurance premium is due when a life insurance policy will not lapse even though the payment is past due. It means, you still have your life insurance coverage In Force.

The grace period is a very useful feature, whose inclusion in every life insurance policy is mandated by every single state in the United States.

The Minimum Grace Period varies from 28-31 days depending on individual state laws, but some insurance companies may give longer grace periods.

The grace period officially begins the day the missed premium payment is due and ends at the close of business after the prescribed number of days has passed.

In whole-life, universal life, or variable universal life insurance policies, the grace period would only be effective if there was no remaining cash value in the policy, and the premium payment was due.

If a grace period for life insurance payment is missed while cash value remains, it is unlikely that a policy will go into “Grace Period Status”.

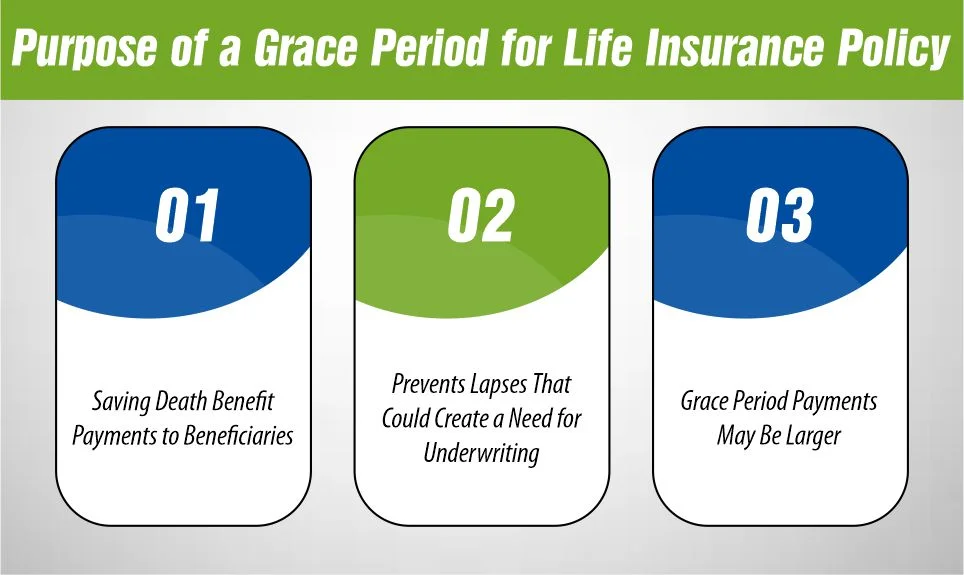

Purpose of a Grace Period for Life Insurance Policy

– Saving Death Benefit Payments to Beneficiaries

The grace period serves two extremely useful purposes for life insurance owners and beneficiaries.

This is very important to the beneficiaries of the policy, who may be relying on the proceeds of the death benefit to provide for them after an insured person passes away.

This is all the more important because it is easy for an insured/owner to miss a payment when the insurer is near death.

The owner may be in the hospital, either because they are sick or they are visiting the insured, and the family may overlook bills for a brief time.

It is also easy to miss a bill during life changes such as moving and changing addresses, or spending time denied a death claim, there would be a lot of beneficiaries who were counting on the money left in the lurch for what could be a very valid reason for being late.

The grace period helps preemptively resolve disputes of this nature, facilitates fairness in the life insurance industry, and promotes a standardized healthy, and ethical business environment.

– Prevents Lapses That Could Create a Need for Underwriting

If a policy lapses, an insurance company is not obligated to reinstate the policy without underwriting.

Most insurers will provide a period after lapse that an owner can still Submit a Reinstatement Payment of premiums owed (plus any penalty), and bring the policy back into good standing without the need for the insured to pass through the underwriting process again. After this period, underwriting may be required, including a physical examination.

The real significance of this is that if an insured person has a material change in health, the insurance company can deny reinstatement.

If a policy did not have a grace period, insurance companies would be able to pick and choose the most favorable clients each time a payment was slightly late, and this would be often.

– Grace Period Payments May Be Larger

Policy owners need to be aware that a grace period payment may be larger than the premium payment that was due.

The calculation for grace period payments can be complicated and vary between insurance products and insurance companies. Always check with your life insurer before a policy goes into the grace period to understand the repercussions and additional costs.

Protective life insurance grace period

The grace period in a Protective Life Insurance policy is the period, say 31 days, after the date that your money is due. This is the period when you can make your payment and not lose your insurance coverage. It’s essentially a cushion that provides a little more time if payment is not made before the due date and the policy is not immediately terminated.

However, it is crucial to understand that if you fail to make the payment by the end of the grace period, the policy can terminate, and this means that you will no longer have life insurance. If this happens you may have to purchase a new policy or additional charges may be charged to reinstate the old policy. That is why it is always advisable to pay the premiums fully and on time although the grace period is there to help sometimes.

Conclusion:

In summary, the grace period is an important aspect of life insurance that offers flexibility when life gets busy. It allows you to keep your coverage intact, even if you’re a bit late with a payment. By knowing about the grace period for life insurance payment and how it works, you can avoid lapses in coverage and ensure that your life insurance continues to protect you and your family when it matters most.

References:

- https://money.com/what-is-the-grace-period-in-life-insurance/

- https://www.fidelitylife.com/life-insurance-basics/life-insurance-101/life-insurance-grace-periods/

- https://www.usnews.com/insurance/glossary/insurance-grace-period

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.