Welcome to the world of smart life planning, where your age isn’t just a number – it’s your ticket to smart savings on life insurance. In this guide, we’ll take the art out of lifetime savings, and turn complicated insurance jargon into simple, budget-friendly options. Get ready to explore the ins and outs of policy backing, as we uncover practical tips to ensure your loved ones stay safe without draining your bank account.Ever wonder how your age can be your financial ally? We are here to spill the beans. From decoding safe age to navigating the twists and turns of policy backing, life insurance can feel like a breeze – accessible, affordable, and uniquely yours. Let’s turn the page on insurance problems and step into a world where your age is a well-played ace in the financial security game.

What is the Save Age in Life Insurance?

The concept of the save age in life insurance revolves around finding the sweet spot where you can secure optimal coverage without breaking the bank. Simply put, the younger you are when you purchase a life insurance policy, the more favorable your premiums are likely to be.Why does age matter? Insurance companies assess risk when determining premium rates, and age is a significant factor in this calculation. Younger individuals generally present lower risks to insurers, as they are statistically less likely to face health issues or other life-threatening circumstances.So, the save age in life insurance is essentially the period where you can capitalize on your youth, securing a policy that not only meets your coverage needs but also does so at a cost-effective rate. By understanding and leveraging the safe age, you can make informed decisions that set the stage for long-term financial security.Should Your Life Insurance Policy Be Backdated?

The decision to backdate your life insurance policy is a subtle one and depends on various factors unique to your situation. Backdating essentially involves selecting an earlier effective date for your policy, usually to lock in a lower premium based on your age at the time of application.Here are some considerations to help you decide whether your life insurance policy should be backdated:- Cost Savings: Backdating can lead to lower premiums since they are calculated based on your age at the time of application. If you’re looking to save on overall policy costs, backdating might be a strategic move.

- Health Considerations: If your health has significantly improved since the original application date, backdating may not be as advantageous. In such cases, your current health status may qualify you for competitive rates without the need for backdating.

- Financial Situation: Consider your current financial situation and whether you can afford to pay the backdated premiums. While backdating may offer savings in the long run, it involves paying the premiums retroactively to the selected effective date.

- Policy Expiry: Keep in mind that backdating affects the term of your policy. If you backdate your policy by six months, for example, your coverage period effectively starts six months earlier, potentially impacting when your coverage expires.

- Consultation with an Expert: It’s advisable to consult with a financial advisor or insurance expert. They can provide personalized guidance based on your specific circumstances and help you make an informed decision.

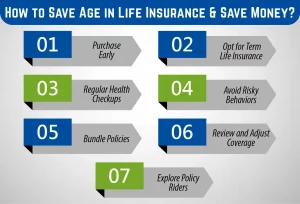

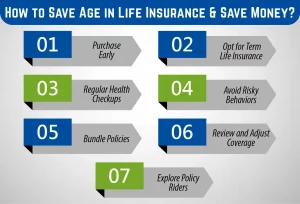

How to Save Age in Life Insurance and Save Money?

Saving age on life insurance is a strategic move that can translate into significant cost savings over the life of your policy. Here’s a breakdown of effective ways to save age in life insurance and, in turn, save money:1- Purchase Early

The golden rule is to buy life insurance as early as possible. Insurance premiums are often directly tied to age, and younger individuals generally enjoy lower rates. Locking in a policy at a younger age can result in substantial long-term savings.2- Opt for Term Life Insurance

Consider choosing term life insurance, especially if you are looking for cost-effective coverage. Term policies offer protection for a specific period, and their premiums are typically more affordable than those of permanent life insurance.3- Regular Health Checkups

Maintain good health, as it directly impacts your insurability and premium rates. Regular health checkups and a healthy lifestyle can contribute to lower premiums. Insurance companies often offer better rates to individuals with a clean bill of health.4- Avoid Risky Behaviors

Insurance companies assess risk factors when determining premiums. Engaging in risky behaviors such as smoking or participating in extreme sports can lead to higher premiums. By avoiding such behaviors, you not only enhance your well-being but also save on insurance costs.5- Bundle Policies

Consider bundling your life insurance with other insurance policies like home or auto insurance. Many insurance providers offer discounts for bundled policies, providing an opportunity for additional savings.6- Review and Adjust Coverage

Regularly review your life insurance policy and adjust the coverage as needed. Life circumstances change, and your coverage should reflect your current financial situation. By ensuring your coverage aligns with your needs, you can avoid overpaying for unnecessary protection.7- Explore Policy Riders

Policy riders are additional features that can be added to your life insurance policy. Some riders may help you save money by providing flexible options or additional benefits. Explore available riders and assess if any align with your needs.How Long Can You Backdate a Life Insurance Policy?

The ability to backdate a life insurance policy typically comes with certain limitations, and the specific rules can vary among insurance providers. In general, insurance companies may allow policyholders to backdate a policy for a specified duration, usually up to six months from the date of application.Here are key points to consider regarding the duration for which you can backdate a life insurance policy:Policyholder Age

Insurance Company Policies

Purpose of Backdating

Premium Payments

Consultation with the Insurer

What Happens When an Insurance Policy is Backdated?

When an insurance policy is backdated, it means that the effective date of the policy is set to a date in the past, typically before the actual application date. This can have several implications, both in terms of premium calculations and the overall administration of the insurance policy.Here’s what happens when an insurance policy is backdated:Premium Calculation

The primary impact of backdating is on premium calculations. The premium for a life insurance policy is often determined based on the age of the insured at the time of application. By backdating, the insurance company recalculates the premiums, considering the lower age of the insured at the earlier effective date.Premium Payment

If the policy is backdated, the policyholder is generally required to pay the premiums retroactively from the selected effective date. This means catching up on the missed premium payments for the period being backdated. The policyholder must settle any outstanding premiums before the policy becomes active.Policy Term Adjustment

Backdating affects the term of the insurance policy. If the policy is backdated by, for example, six months, the coverage period effectively starts six months earlier than the application date. This adjustment can impact when the coverage expires.Underwriting Considerations

The underwriting process, which assesses the risk associated with insuring an individual, may take into account the health status and other relevant factors at the backdated effective date. This is crucial for determining the appropriateness of the backdating request.Policy Activation

The insurance policy is not considered active until the backdated premiums are paid. Once the policyholder fulfills the premium payment obligations, the policy becomes active, and the coverage takes effect from the backdated effective date.It’s important for policyholders to carefully consider the implications of backdating, including the financial commitment required to pay retroactive premiums. While backdating can result in lower premiums based on a younger age, individuals should weigh the benefits against the costs and ensure that it aligns with their overall financial strategy.Tips to Save on Life Insurance

Securing life insurance is a vital financial decision, but it doesn’t have to break the bank. Here are some practical tips to help you save on life insurance while still ensuring that you provide financial protection for your loved ones:Purchase Early:

Act sooner rather than later. Premiums are often lower for younger individuals, as age is a significant factor in determining life insurance rates. Lock in a lower rate by purchasing a policy when you’re younger and healthier.Choose Term Life Insurance:

Consider term life insurance for cost-effective coverage. Term policies offer protection for a specific period, and their premiums are generally more affordable than those of permanent life insurance.Maintain Good Health:

Your health directly influences your insurability and premium rates. Adopt a healthy lifestyle, including regular exercise and a balanced diet. Non-smokers often qualify for lower premiums, so consider quitting smoking to save on costs.Shop Around:

Don’t settle for the first quote you receive. Compare rates from multiple insurance providers to find the best deal. Different companies may offer varying premiums for similar coverage.Bundle Policies:

Explore the option of bundling your life insurance with other insurance policies, such as home or auto insurance. Many insurers provide discounts for bundled policies, leading to overall cost savings.Consider Group Insurance:

Check if your employer offers group life insurance as part of the employee benefits package. Group policies often have lower premiums, and some companies even provide coverage without requiring a medical exam.Conclusion

Save age in life insurance is a strategic approach to securing financial protection for your loved ones while minimizing the impact on your wallet. By understanding the safe age for life insurance, exploring the option of backdating policies, and implementing smart money-saving tips, you can make informed decisions that align with your long-term goals.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.