Last Updated on: July 4th, 2025

- Licensed Agent

- - @M-LifeInsurance

It’s not impossible to get life insurance for seniors over 80, but a little hard to find. People who are aged and still want to cover final expenses and leave something behind for their loved ones. We will help you to get better options, although the options are limited and they are often expensive compared to other policies. This article will help you understand what types of life insurance are best for seniors over 80, what to expect in terms of cost, and how to choose the right plan for your needs.

How Life Insurance for Seniors Over 80 Works

As we know, our needs change as we get older. For seniors over 80, having life insurance is still helpful for their final expenses and even for their family’s financial safety. Here is a question: How does life insurance for seniors over 80 work?

Table of Contents

ToggleHere is the answer;

Life insurance for seniors over 80 will work a little differently than the policies of younger people. At this age, most policies are designed to cover final expenses, such as funeral costs or small debts. These policies are smaller with the high monthly payments because there are health risks for seniors due to their age. Most seniors over 80 choose simplified or guaranteed issue whole life insurance, which doesn’t require a medical exam. These plans offer peace of mind by helping loved ones handle costs after the policyholder passes away.

Types of Life Insurance Available for Seniors Over 80

Most of the life insurance companies offer coverage for seniors over 80. Here are some of the types that you can get as a senior.

1. Guaranteed Issue Life Insurance

Guaranteed issue life insurance is one of the simplest and easiest options for seniors who are looking for life insurance. There is no need to take a medical exam or answer health questions. If you are the right age and you can pay monthly payments, you will be accepted.

This policy will give you a smaller coverage amount that ranges from $5,000 to $25,000. For this, the monthly payments are often higher than other insurance polices. This type of insurance is a good choice for helping pay for funeral costs and other small final expenses.

2. Simplified Issue Life Insurance

With simplified issue life insurance, you don’t need a medical exam, but you will have to answer a few basic health questions. This helps the insurance company decide your risk level. If you’re in fairly good health for your age, you could get better rates than with guaranteed issue policies. Coverage amounts are generally higher than guaranteed issue plans and can go up to $50,000 or more. It’s a good choice for seniors who want some coverage but don’t want the hassle of a medical exam.

3. Final Expense Insurance

Final expense insurance is also known as burial insurance. This is the type of whole life insurance that will cover end-of-life expenses like funeral, cremation, and small expenses. This policy will give you a small coverage amount that is between $2000 and $25000. In this policy, the monthly payments will stay the same for life, and the policy will not expire as long as you keep moving.

4. Whole Life Insurance

As the name suggests, the whole life insurance will cover your entire life. It also builds cash value over time, and if you want that money, you can borrow at any time. The coverage amount is smaller for people over 80, and the monthly payments are higher due to age. But still, this insurance will give a payout to your family no matter when you pass away. This is a good choice if you want lifetime protection.

5. Term Life Insurance (Limited Availability)

Term life insurance is hard to get for people who are over 80. But there are some companies that are still offering short-term options like 5 or 1-year policies. These plans only provide cover for the set period and only pay out if you pass away during this period. This you are still alive after the set time, your policy will expire, and you have to renew it.

Best Life Insurance Companies for Seniors

When choosing the insurance company, this is the most important thing that you have to look for: which company gives you the best payment plans and benefits? Here are some of the best life insurance companies for seniors over 80:

- Mutual of Omaha: Offers final expense insurance with flexible coverage amounts and good prices.

- AARP (through New York Life): Made for older adults, with easy approval and strong customer service.

- Gerber Life Insurance: Offers guaranteed acceptance policies that don’t require a medical exam.

- Colonial Penn: Offers guaranteed acceptance life insurance for seniors with clear and easy-to-understand rules.

- Transamerica: Offers both final expense and whole life insurance plans designed for older people.

Is It Worth Getting Life Insurance at 80?

Many seniors who are 80 or 80 above ask the question, that Is it worth getting life insurance at 80? The answer will depend on the personal circumstances, financial goals, and the person’s health status.

Reasons to Consider Life Insurance Over 80

- Cover Funeral Costs

Funerals can be very expensive. Life insurance can help your family pay for it.

How Much Does Life Isurance Cost?

- Leave a Gift

Even a small policy can leave money behind for your loved ones.

- Pay Off Debts

If you still owe money, life insurance can help so your family doesn’t have to pay it.

- Peace of Mind

It feels peaceful when you know that your family will not have to worry financially when you pass away.

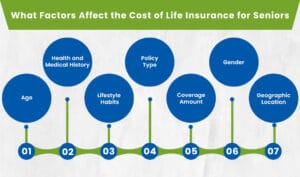

What Factors Affect the Cost of Life Insurance for Seniors?

Several factors influence life insurance costs for seniors, especially those over 80:

1. Age

The older you are, the higher your monthly payments will be.

2. Health and Medical History

Pre-existing conditions such as heart disease, diabetes, or cancer can significantly increase premiums or cause disqualification.

3. Lifestyle Habits

Smoking and alcohol use increase premiums.

4. Policy Type

Guaranteed issue policies are more expensive than simplified issue due to the lack of health screening.

5. Coverage Amount

Higher death benefits cost more.

6. Gender

Women generally pay less due to a longer average life expectancy.

7. Geographic Location

Insurance costs can vary by state due to differing regulations and mortality rates.

Conclusion

People who are over 80 will get limited options when it comes to buying a life insurance policy. But it’s not impossible that there are some insurance companies that are offering insurance policies to people over 80. Just make sure that you have the right guidance to buy the policy, and this will bring peace of mind to you and your family as well.

1. Can someone who is 80 years old get life insurance?

Yes, people over 80 can still get life insurance. The option for seniors are limited but there are some companies who offer coverage to help the final expenses.

2. What type of life insurance is best for seniors over 80?

Guaranteed issue and final expense insurance are good options. They don’t require a medical exam and help cover funeral costs and small debts.

3. Is it worth getting life insurance at age 80?

It can be worth it if you want to help your family pay for funeral costs, leave a small gift, or cover any debts.

4. How much does life insurance cost for someone over 80?

Costs are higher due to age and health risks. Prices depend on the type of policy, coverage amount, and health status.

5. Do I need a medical exam to get life insurance after 80?

There will be no medical exam for people over 80 if they buy guaranteed or simplified life insurance.

Secure peace of mind today, get affordable life insurance for seniors over 80.

Compare quotes now and find the right coverage for your needs.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.