Have you ever wondered why life insurance is so crucial for police officers? With the daily risks they face, ensuring their family’s financial safety is a top priority. How can they protect their loved ones if the unthinkable happens? Let’s dive into What police life insurance is? Can police officers get life insurance? why life insurance is essential for those who serve and protect us.

Why Do Police Officers Need Life Insurance?

Concisely, each day police officers are faced with risks and challenges in their line of duty, this makes life insurance crucial. undefined

- Income Protection

The police profession has always been considered as one fraught with risks. What would happen to their families in the event one of them died suddenly, say, an officer? Police life insurance is an investment that guarantees that the quality of life of their loved ones will be kept high in the absence of the insured person.

- Groceries

- Utility bills

- Education costs

Without life insurance, the sudden loss of income can leave families in a dire financial situation. Life insurance helps prevent this by replacing lost income.

- Debt Protection

Like most people, police officers often have significant debts. This can include:

- Mortgages

- Car loans

- Credit card debt

If an officer were to pass away, these debts wouldn’t just disappear. They could become a burden on the family left behind.

- Employer-Sponsored Coverage

Many police departments offer life insurance as part of their benefits package. But is this coverage enough? Often, it’s limited and might not cover all the needs of an officer’s family. Here’s why police life insurance is important:

- Higher Coverage Amounts: Employer-provided policies often have low limits.

- Portability: If an officer changes jobs, they might lose their employer-sponsored coverage.

- Customization: Individual policies can be tailored to specific needs and circumstances.

In short, therefore, depending on employer-sponsored life insurance may not guarantee full coverage. Additional policies can offer further coverage.

Police life insurance is not only about providing financial security. It’s about giving people the calmness of mind knowing that their loved ones shall be well provided for at all times. Regarding life insurance, police officers should consider sources of income and debt coverage, as well as improvement of employer-sponsored insurance. Therefore, if you or a family member is involved in the police force, you should consider the advantages of a solid life insurance plan. It is a simple change that can bring about significant improvement.

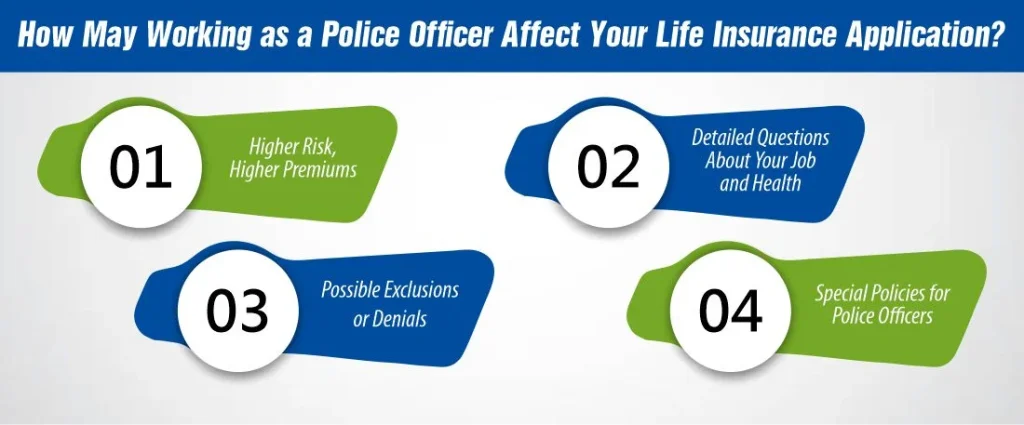

How May Working as a Police Officer Affect Your Life Insurance Application?

It implies that being a police officer is not just a typical kind of job where you work from 9 in the morning to 5 in the evening. It can certainly affect how life insurance companies will look at your application. Alright, let’s go to the specifics.

- Higher Risk, Higher Premiums

Police work is considered risky by insurance companies. This is because you are always in risky circumstances. This means that you might have to pay more for your premiums. Here’s why:

- Dangerous duties: Dealing with crime and emergencies daily.

- Stressful job: High stress can affect your health over time.

- Injury risks: Greater chance of getting hurt on the job.

- Detailed Questions About Your Job and Health

When you apply, be ready for a lot of questions. Insurers will ask about:

- Your specific duties: Are you in patrol, a detective, or in a special unit?

- Length of service: How long have you been in law enforcement?

- Your health: Any conditions related to job stress or physical demands?

They need this info to assess your risk level.

- Possible Exclusions or Denials

Sometimes, insurance companies might deny coverage or exclude certain risks. This means they won’t cover death from certain job-related incidents. It can be frustrating but don’t lose hope. Different insurers have different policies.

- Special Policies for Police Officers

Some insurance companies offer policies tailored for law enforcement. These policies might offer better coverage for job-related risks. Look for:

- Accidental death benefits: Extra payout if you die in an accident.

- Disability coverage: Coverage if you can’t work due to an injury.

- Full coverage: No exclusions for job-related risks.

These can be a good fit, so ask about them.

Working as a police officer can make getting life insurance a bit more complex. Higher premiums are usually expected while more questions can indeed be posed but there are times when there are choices available. Generally, it will be inadvisable to opt for the first policy that one comes across. Go tell and compare the best coverage for the situation you want. It is a common thing for people to protect others every day; one needs to ensure that their insurance protects your family.

In a follow-up question, you might be interested in knowing which kind of police life insurance

How Much Does Life Isurance Cost?

policies are most suitable for police officers.

Types of police life insurance:

It is not easy for policemen to act hard all day each time they put on their uniforms. They require life insurance that addresses their needs and requirements. However, they would like to know what kind is best. Let’s break it down:

- Term Life Insurance

Why consider term life insurance? Term life insurance is straightforward and affordable. It covers you for a set period, like 10, 20, or 30 years. If something happens to you during this time, your family gets the money.

- Affordable: Premiums are lower compared to other types of police life insurance.

- Simple: Easy to understand without any complicated terms.

- Temporary Needs: Perfect if you need coverage for a specific time, like while your kids are growing up.

- Whole Life Insurance

Is whole life insurance a good option? Whole life insurance is permanent. As long as you pay your premiums, it covers you for life. It also builds cash value that you can use later.

- Lifetime Coverage: Your family is always protected.

- Cash Value: It acts like a savings account you can borrow from.

- Stable Premiums: Payments don’t change over time.

- Universal Life Insurance

What about universal life insurance? Universal life insurance offers flexibility. You can change your premiums and death benefits as your needs change. It also builds cash value.

- Flexible: Adjust your policy as your financial situation changes.

- Cash Value Growth: Potential to grow your money over time.

- Customizable: Tailor the policy to fit your changing needs.

- Instant Decision Life Insurance

Need coverage fast? Instant decision police life insurance is quick and easy to get. Often, you don’t need a medical exam. This is great if you need coverage right away.

- Fast Approval: Get covered almost immediately.

- Convenient: No long application process.

- No Medical Exam: Skip the physical.

So, what’s the best life insurance for police officers? It depends on your needs.

- Term Life Insurance: Best for affordability and simplicity.

- Whole Life Insurance: Great for lifetime coverage and savings.

- Universal Life Insurance: Offers flexibility and growth.

- Instant Decision Life Insurance: Perfect if you need quick coverage without a hassle.

Think about your family and financial situation. Choose the police life insurance policy that best protects those who depend on you. After all, you protect others every day. Make sure you’re also protecting your loved ones.

How Much Does Life Insurance Cost For Police Officers?

As it has been seen, cost of life insurance for police officers depends on factors such as age, health status, lifestyle, type of plan, premiums and coverage amounts. Still, it has become a rare norm for the police officers to seek costly services.

| Policy Type | Coverage Amount | Approximate Monthly Premium |

| Term Life Insurance | $500,000 | As low as $30 |

| Whole Life Insurance | $500,000 | Depending on age, can be at least 10x more expensive than term life |

| Group Life Insurance | 3-4 times the annual salary | Varies (typically provided by the employer) |

| Instant Decision Life Insurance | $500,000 – $3 million | Varies based on provider and individual circumstances |

When Should Police Officers Purchase Life Insurance?

Life insurance is crucial for police officers. But when is the right time to buy it? Let’s dig into the details.

- Starting a Family

Are you planning to start a family or already have one?

Having kids or a spouse means others depend on your income. Police Life insurance ensures they’re taken care of if something happens to you. Buying life insurance when starting a family is a smart move.

- Buying a Home

Just bought a house? A mortgage is a significant financial commitment. If you pass away, life insurance can help your family pay off the mortgage and keep the home. It’s best to get life insurance when you buy a house to cover this debt.

- Early in Your Career

Why not buy life insurance early in your career? Young and healthy officers can lock in lower premiums. The earlier you buy, the cheaper it often is. Plus, getting it early means you’re covered from the start of your risky career.

- Changing Jobs

Did you just change jobs or roles within the force? New roles might come with different risks. It’s a good idea to reassess your life insurance needs whenever you change jobs or get a promotion. This way, your coverage stays relevant to your situation.

- Health Concerns

Are there health issues to consider? If you have or develop health problems, it might be harder or more expensive to get life insurance. Purchasing it while you’re healthy ensures you’re covered before any issues arise.

Think about your life stages and financial commitments. This is something that must be purchased before it is required to make sure that one has the best deal to offer in the market. This way, you will have the security that your family is safe and sound in good health.

Advantages of police life insurance

In their line of duty, police officers are exposed to numerous risks hence the need to take up a police life insurance policy. Why? So, here are the reasons.

- Financial Security for Family

What would happen to your family if something were to happen to you?

Police life insurance is a safety net. This means that in case you pass on, your family is provided with funds to pay for bills and other requirements. It ensures that they are not placed in a vulnerable position regarding their finances.

- Covering Debts

Need a mortgage or other types of loans? They can be paid off by life insurance. This means that your family will not have to worry if they will be able to pay the bills or pay the mortgage once you are no longer living.

- Replacing Income

How will your family get by without your income? Life insurance helps replace your income. It can cover daily costs like groceries and bills. This helps keep your family’s lifestyle stable.

- Peace of Mind

Isn’t it reassuring to know your family is protected? Having life insurance means you can worry less about your future. It lets you focus on your job, knowing they’ll be okay if something happens to you.

- More Than Just a Death Benefit

Did you know some policies do more than just pay out if you die? Some life insurance builds cash value you can use later. This can be handy for emergencies or big expenses.

- Special Coverage for Police

Are there policies just for police officers? Yes, some insurance companies offer special policies for law enforcement. These might cover job-related risks better. It’s a good idea to check these out.

Why get life insurance as a police officer? Life insurance is not just a policy; it is a way to prove that you care about the people that are special to you. It is one of those things in life that provides a secure feeling that your loved ones are provided for at the very least.

Conclusion:

So, why should police officers buy life insurance? Money offers the financial protection needed to support families, pays off existing debts, compensates for lost earnings, and gives people confidence. Isn’t it time to contemplate whether your current coverage is still sufficient to respond to your loved ones’ needs? Police life insurance cannot, however, bring back lost family members but it helps the families of the deceased officers to be consoled and to wail without having to worry over the future. They hope that in the future all citizens of the United States will be aware not only of the police who give their lives but also of society in terms of the care of family members of these saints.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.