Last Updated on: June 19th, 2025

- Licensed Agent

- - @M-LifeInsurance

Protect your loved ones after your life is the most important thing you have to think in your life and the best option is life insurance. Life insurance policies play a very important role in your life and after your life. There are so many options that you can consider when buying life insurance, but today we will focus on single premium life insurance, where there is no need to pay many small payments instead, you just have to make one payment.

In this article, we’ll explain the different types of single premium life insurance, such as whole life insurance and term life insurance, and also explore the benefits and drawbacks of each. You will have a good understanding of how this insurance works, and you can decide if a one-time payment policy is a good fit for your financial needs and future plans.

Table of Contents

ToggleSingle Premium Life Insurance

Single premium life insurance is the type of permanent life insurance where the person who is taking the policy is paying a single big amount at the start, and there is no need to pay the monthly and yearly small payments. This one-time payment covers the full cost of the policy, including the death benefit, so the coverage lasts for your whole life or until you cancel it.

Unlike regular life insurance that needs many payments over the years, this option is simple and easy, and you pay once and you’re fully covered. It can also grow in value over time and may offer some tax benefits.

Types of Single Premium Life Insurance

There are mainly two types of single-premium life insurance.

1. Single Premium Whole Life Insurance

The most common and easy form of single premium life insurance is Single Premium Whole Life Insurance. This policy combines a death benefit.

This is the most common form of single-premium life insurance. It combines a death benefit It also includes a cash value that slowly grows over time at a guaranteed rate. Since you pay the full amount up front, the policy stays active for your whole life, as long as the insurance company stays in business.

– Main Benefits

- Guaranteed death benefit: Your loved ones will receive a set amount of money when you pass away.

- Cash value grows with interest: The policy builds savings over time, earning interest.

- You can borrow money from the policy: You’re allowed to take a loan from the cash value if needed.

- One-time payment: You only pay once at the beginning, no need to pay monthly or yearly payments.

2. Single Premium Term Life Insurance

Some of the insurance companies out there offer term life insurance that you can pay for with one lump sum. This type of policy is less common. There is a difference compare to whole life insurance; term life only provides coverage for a set time period, like 10, 20, or 30 years. It only pays out if the person dies during that time. If they outlive the term, the policy ends and no money is paid out.

– Main Benefits

Here are the main benefits single premium term insurance provide;

- Coverage for a set time: The policy lasts for a specific number of years, like 10, 20, or 30.

- No cash value: This type of policy does not build savings or cash value.

- Lower cost: It usually costs less than permanent life insurance for the same death benefit.

- One-time payment: You pay the full amount once at the start no monthly or yearly payments.

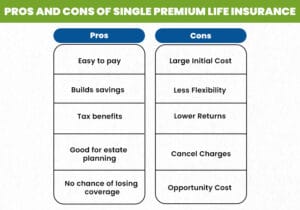

Pros and Cons of Single Premium Life Insurance

Before choosing single premium life insurance, it’s important to know the advantages of this type and disadvantages. Understanding the pros and cons can help you decide if it’s the right choice for you or not.

Pros

Let’s take a closer look at the benefits you get with single premium life insurance. Knowing the advantages will help you see why some people choose this type of policy.

- Easy to pay: You make one payment, and your life insurance is covered for life and then there are no more bills to pay.

- Builds savings: Whole life policies grow cash value that you can use while you’re alive.

- Tax benefits: The cash value grows without being taxed, and your beneficiaries usually don’t pay taxes on the death benefit.

- Good for estate planning: Helps pass on money to loved ones smoothly without worrying about future payments.

- No chance of losing coverage: Since you don’t have to make more payments, your policy won’t end because of missed bills.

Cons

Now, let’s look at some of the drawbacks to keep in mind before deciding if single premium life insurance is right for you.

- Large Initial Cost: You have to pay a big amount of money all at once, which might be too much for some people and difficult to afford.

- Less Flexibility: After you pay the lump sum, you usually can’t change the payment amount or adjust the policy later.

- Lower Returns: The money in the policy grows slowly and safely, but it usually doesn’t make as much profit as other investments might.

- Cancel Charges: If you decide to cancel your policy early, you might have to pay extra fees and get back less money than you paid.

- Opportunity Cost: Using a large sum for insurance means you can’t put that money into other things that might give you bigger financial gains.

How Much Does Life Isurance Cost?

Is Single Premium Life Insurance Right for You?

Single life insurance is right for you but it totally depends on your money situation. If you have a huge one big amount of money to pay it will be a good choice It’s also helpful if you want to leave money to your family in a way that can reduce taxes. Plus, it gives you guaranteed coverage, so you don’t have to worry about making payments or losing your policy. You can also borrow money from the policy’s cash value if you need to.

But if you want more choices, don’t want to pay a big amount all at once, or want to try to grow your money more through investments, other insurance or financial options might be better for you. It’s important to pick what works best for your needs before making a decision.

FAQs

1. Is single premium life insurance a good investment?

Single premium life insurance can be a good investment if your priority is lifelong coverage with a guaranteed death benefit and tax-deferred cash value growth. It is not primarily an investment product but an insurance policy with a savings component. If you want a conservative, low-risk way to grow cash value, it can be suitable. However, if you seek higher returns or liquidity, other investments may outperform.

2. Can I borrow against a single-premium whole life policy?

Yes, you can typically borrow against the cash value in a single premium whole life insurance policy. Loans can be used for emergencies or opportunities, but any unpaid loans reduce the death benefit.

3. What happens if I surrender my policy early?

Surrendering a single premium policy early may result in surrender charges and receiving less than your initial premium. It’s important to understand the surrender period and fees before purchasing.

4. How is single premium life insurance taxed?

The death benefit paid to beneficiaries is generally income tax-free. The cash value grows tax-deferred, and loans or withdrawals may have tax implications depending on how they are handled.

5. Who should consider single-premium life insurance?

Ideal candidates include individuals with a lump sum to invest, those who want permanent coverage without ongoing premiums, and people focused on estate planning or passing wealth efficiently.

Conclusion

Single premium life insurance is an easy way to protect your loved ones after your death by making just one payment at the start of buying an insurance policy. This policy comes in two main types.

The first type is whole life, which lasts your whole life and builds savings over time. The second is term life, which covers you for a set number of years. This insurance gives you guaranteed protection, tax benefits, and can help with passing on money. But it also has downsides like a big upfront cost and less chance to change the policy later. Whether it’s right for you depends on your money and goals. Think about the good and bad points, and talk to a financial advisor to see if it’s a good fit before deciding.

Ready to Secure Your Family’s Future with Single Premium Life Insurance?

If you’re looking for a simple, one-time payment solution to protect your loved ones and build lasting financial security, single premium life insurance could be the right choice for you. Take the next step today and consult with M-Life insurance to explore your options and find the perfect policy tailored to your needs and goals.

Don’t wait — protect what matters most with a single premium life insurance policy now!

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.