Last Updated on: August 7th, 2024

Reviewed by Dylan Whitman

- Licensed Agent

- - @M-LifeInsurance

Life insurance is an important part of financial planning that helps protect you and your family. When looking at life insurance policies, two important terms often come up: face value and cash value. The face value is the amount of money your beneficiaries receive when you pass away. On the other hand, the cash value is like a savings account that grows over time and can be used while you’re still alive. Understanding the difference between Face value of life insurance vs cash value can help you choose the right policy that fits your financial needs and goals.

What is Face value?

The face amount, or face value, of a life insurance policy, is the amount of money an insurer will pay out to beneficiaries if the policyholder passes away. You choose the life insurance face amount when you buy a policy, and the amount is stated in your contract.

The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. So, if you buy a policy with a $500,000 face value, in most cases your life insurance company will pay out $500,000 to your beneficiaries when you die.

This value is predetermined and outlined in your policy’s schedule of benefits. It provides a financial safety net for your loved ones, ensuring they are taken care of in your absence.

What should the face value of your life insurance policy be?

You may wish to have a policy with a high face value to more adequately provide financial support for your beneficiaries. But keep in mind that the higher your policy’s face amount, the more you’ll likely pay for it. Picking the right face value comes down to balancing your loved one’s future needs and your current budget.

Insurers will generally cap a policy’s face value at a certain amount based on factors such as your age and your salary. A 20- or 30-year-old might be able to get a policy with a face value that’s roughly 50 times their salary right now, while a 60-year-old might only be able to get a face amount worth 10 times their current salary. That’s because insurers assume younger people will live longer, meaning the insurance company can make more money off their premiums to cover their policy’s face amount.

Ultimately, the right face value for you will depend on:

- Your salary

- Your outstanding debts, like a mortgage

- The anticipated financial needs of your partner/spouse or children with special needs

- The total number of dependents you have

- The likelihood your children will need money for their education

Determining the appropriate value of Face value of life insurance vs cash value for your circumstances may require research and careful thought.

What is Cash Value?

Cash value is a term used in the insurance industry that refers to the amount of money that an insurance policyholder can receive if they cancel or surrender their policy before it matures. It is different from the policy’s face value, which is the amount of money that the policyholder’s beneficiaries will receive upon their death. Cash value can be viewed from different perspectives, but most people consider it as a savings component of a life insurance policy.

Here are some key points to consider when discussing cash value:

1. Cash value is not the same as the premiums paid:

When a policyholder pays their premiums, a portion of that payment goes towards the policy’s cash value. However, the amount of cash value that accrues over time will depend on the insurance policy’s terms and conditions. It is essential to note that the cash value does not increase proportionally to the premiums paid.

2. The cash value can be used in different ways:

Policyholders can use the cash value in their policies in various ways, such as taking out a loan against it or using it to pay their premiums. In some cases, policyholders may be able to withdraw the cash value, but this may come with tax implications.

3. The cash value can vary depending on the type of policy:

The cash value of a life insurance policy can differ depending on the type of policy. For instance, whole life insurance policies tend to accumulate more cash value than term life insurance policies.

4. Cash value can be affected by fees:

Some insurance policies may have fees that can affect the cash value. These fees may include surrender charges, administrative fees, and mortality and expense charges.

Cash value is an essential component of many life insurance policies. It can provide policyholders with a savings component that they can use in different ways. However, it is essential to understand the terms and conditions of the policy, as well as any fees that may affect the cash value.

How Much Does Life Isurance Cost?

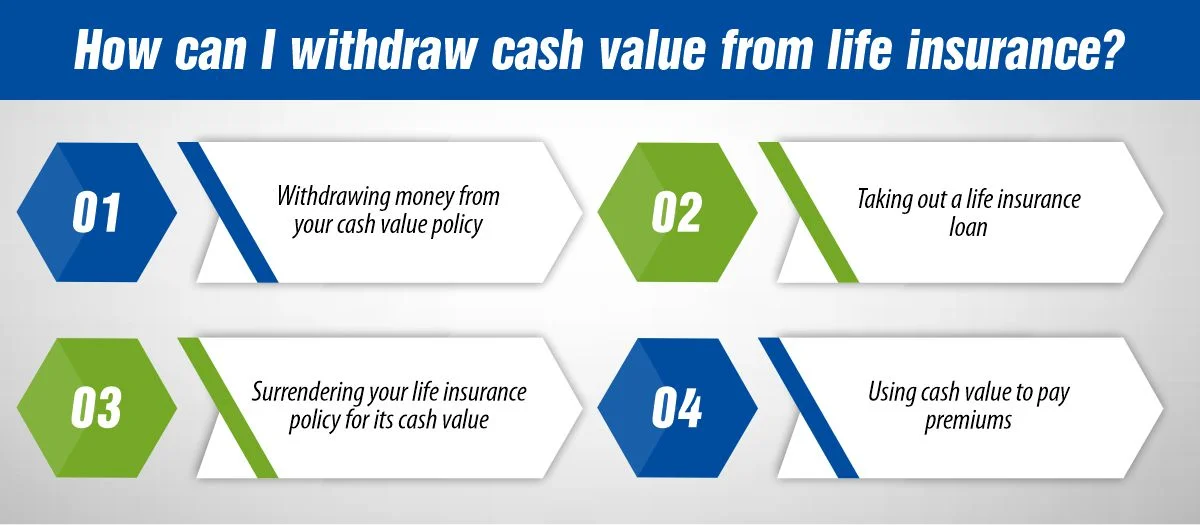

How can I withdraw cash value from life insurance?

Depending on the type of life insurance policy you have, here are four ways you may be able to access its cash value:

- Make a withdrawal

- Take out a loan

- Surrender the policy

- Use cash value to help pay premiums

– Withdrawing money from your cash value policy

You may be able to make a tax-free withdrawal from your permanent life insurance policy. But, if your withdrawal exceeds the amount you’ve paid so far into the cash-value portion of your policy, it’ll be taxed as income. Also, keep in mind that withdrawing your cash value funds reduces the death benefit that’s paid out to your beneficiaries when you pass away.

– Taking out a life insurance loan

You can typically borrow up to the cash value on your life insurance policy. This life insurance loan may include the portion of your paid premiums that have been designated for the cash value account, along with any accrued interest those funds have earned. According to the American Institute of CPAs, the life insurance loan isn’t considered taxable income. If you die before you repay the loan the outstanding amount is subtracted from your death benefit. Regardless, until you pay the loan back, your debt is accruing interest, which can decrease your policy’s potential death benefit.

– Surrendering your life insurance policy for its cash value

A surrender is essentially a cancellation of your policy (you’ll no longer be covered by life insurance). When you surrender your life insurance policy, your equity is the amount you’ve paid into the cash value portion of your account plus accrued interest. However, your insurer may subtract funds for any loans or unpaid premiums on the policy.

– Using cash value to pay premiums

If you’re short on cash, you may be able to use the cash value in your policy to help pay your life insurance policy’s premium. Check with your agent to see how this feature would work for your specific policy. Remember, though, if you deplete the funds in the cash value account entirely, it can cause your policy to lapse, which would end your life insurance coverage altogether.

Having emergency savings on a life insurance policy can be a source of comfort. But, since personal situations are unique, and the details of accessing cash value funds are complex, it’s a good idea to talk with your insurer or an insurance agent to help you decide what option might be best for you.

What should the face value of your life insurance policy be?

You may wish to have a policy with a high face value to more adequately provide financial support for your beneficiaries. But keep in mind that the higher your policy’s face amount, the more you’ll likely pay for it. Picking the right face value comes down to balancing your loved one’s future needs and your current budget.

Insurers will generally cap a policy’s face value at a certain amount based on factors such as your age and your salary. A 20- or 30-year-old might be able to get a policy with a face value that’s roughly 50 times their salary right now, while a 60-year-old might only be able to get a face amount worth 10 times their current salary. That’s because insurers assume younger people will live longer, meaning the insurance company can make more money off their premiums to cover their policy’s face amount.

Ultimately, the right face value for you will depend on:

- Your salary

- Your outstanding debts, like a mortgage

- The anticipated financial needs of your partner/spouse or children with special needs

- The total number of dependents you have

- The likelihood your children will need money for their education

Determining the appropriate face value for your circumstances may require research and careful thought.

Key difference of face value of life insurance vs cash value

| Objectives | Face value | Cash value |

| What it is | The amount of money your life insurance company has agreed to pay out when you die. | A savings component within your policy that grows on a tax-deferred basis. |

| Which policies have it | All life insurance policies. | Permanent life insurance policies, such as whole life insurance. |

| Who gets the money | Your beneficiaries, if you die while your policy is active. | You, if you choose to use it. Beneficiaries generally don’t receive the cash value, unless you have a policy such as universal life insurance with an increasing death benefit option. |

| How to access it | Your beneficiaries will need to submit a life insurance claim to your insurance company. | Contact your insurer to request a cash value loan or withdrawal. |

Conclusion

Deciding between Face value of life insurance vs cash value is a big choice that affects your financial future. The face value provides a guaranteed amount for your loved ones when you’re gone, giving them financial security. Meanwhile, the cash value grows over time and can be used for things like emergencies or retirement. Both options have their benefits depending on what you need right now and what you want for the future. As you think about your choices, consider what matters most to you. Do you want to focus on immediate protection for your family or on building a financial asset you can use while you’re alive?

FAQs

1- Are Cash Value Policy Premiums High?

Yes, cash value policy premiums are typically higher than regular life insurance because part of your payment goes toward savings.

2- How does face value influence my premiums?

In most cases, selecting a higher face value policy will result in paying more for life insurance. One way to help minimize premiums is by asking for quotes from several insurers for policies with the same face value to see which company offers you the lowest price. Since insurance quotes are free, gathering a handful is a great way to make an informed choice.

References:

- https://www.investopedia.com/ask/answers/013015/how-do-i-determine-face-value-life-insurance-policy.asp#:~:text=Key%20Takeaways-,The%20face%20value%20of%20a%20life%20insurance%20policy%20is%20the,face%20value%20of%20your%20policy.

- https://www.bankrate.com/insurance/life-insurance/face-value/#what-is-the-face-value-of-a-life-insurance-policy

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.