In today’s world, many couples are choosing to build their lives together without the traditional institution of marriage. While this choice offers freedom and flexibility, it also brings about unique challenges, especially when it comes to financial planning. One such challenge is obtaining life insurance as an unmarried couple.

Life insurance is a crucial financial tool that provides protection and financial security to your loved ones in the event of your passing. However, for unmarried couples, navigating the world of life insurance can be complex. From proving insurable interest to ensuring legal recognition, there are several factors to consider.

In this blog post, we will explore the question, “Can unmarried couples get life insurance?” We will discuss the challenges faced by unmarried couples, the options available to them, and how they can secure the financial future of their loved ones.

Whether you’re in a long-term relationship, living together, or considering your options, this post will provide valuable insights into life insurance for unmarried couples.

Can Unmarried Couples Get Life Insurance?

Yes, unmarried couples can get life insurance. Life insurance is not limited to married couples; it is available to anyone who has an insurable interest in another person. Insurable interest means that the policyholder would suffer financially if the insured were to pass away.

Unmarried couples can purchase individual life insurance policies to cover themselves, naming their partner as the beneficiary. Some insurance companies also offer joint life insurance policies for unmarried couples, which cover both partners under a single policy.

When applying for life insurance as an unmarried couple, you may need to provide additional documentation to establish insurable interest, such as proof of financial dependency or joint ownership of assets. It’s advisable to consult with an insurance agent or financial advisor to explore your options and find the right life insurance coverage for your needs.

Understanding Life Insurance for Unmarried Couples

Life insurance is a contract with an insurance company whereby an individual agrees to pay the insurance provider a sum of money throughout a certain time in exchange for a sum of money or a series of payments upon his/her death.

A death benefit will be paid to the beneficiaries according to the contract, and the policy owner shall keep paying premiums for the period. Mostly spouses and family members inherit the property. However, unmarried couples may also designate each other as beneficiaries, depending on the insurance company’s policies.

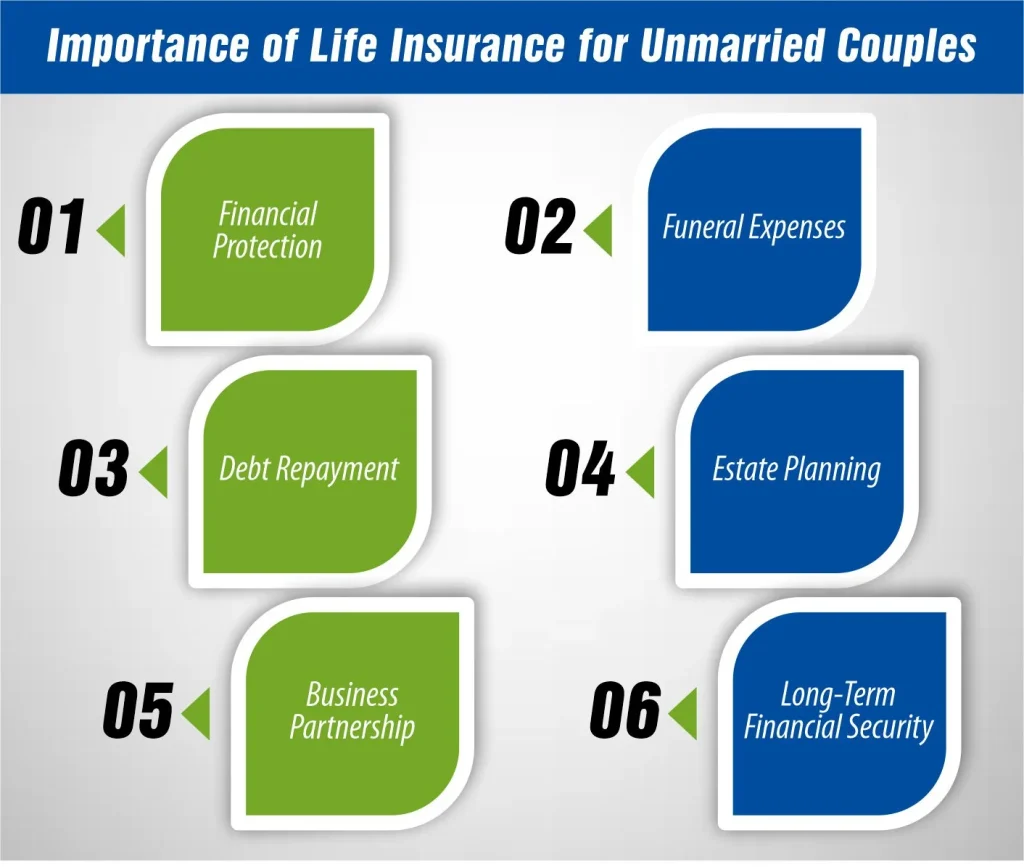

Importance of Life Insurance for Unmarried Couples

Importance of Life Insurance for Unmarried Couples

Generally, life insurance is considered as a financial instrument either for a married couple or anyone with a dependents. However, unmarried couples need to take also some additional factors into account as well. Here are some reasons why life insurance is important for unmarried couples:

1- Financial Protection

A life savings policy can take the place of a professional career for difficult times for your spouse if you die. It can assist you, for example, with maintaining the expenses of living, settling debts, and providing other financial needs, which means that your partner should not have an overwhelming amount of financial responsibility afterwards.

2- Funeral Expenses

The funeral costs are therefore a burden, and the amount of these expenses can be usually covered by the policy. This therefore may relieve your partner of the financial strain which can accompany a deadly condition.

3- Debt Repayment

Should your household be shared in joint details such as loans or debts co-owned with your partner, life insurance can act collectively to settle these debts, thus, your partner will be left solely responsible for the outstanding debts.

4- Estate Planning

Life insurance may be the necessary instrument for estate planning for the unit partner. It can help to exhume the income and upon your partner’s death, your assets can be circumscribed to maintain the wishes you kept.

5- Business Partnership

If the business you conduct relies on your partner, life insurance coverage can come in handy ensuring that your share of the business is safely protected, while at the same time, your partner is adequately financially supported and continues with the business.

6- Long-Term Financial Security

Life insurance can complement your partner in many ways, including providing a solution to financial security in the long term. This would, therefore, allow them to maintain their standards of living and accomplish their financial goals, even while they are not here.

Challenges Faced by Unmarried Couples

What are the possible challenges an unmarried couple may have to face in getting life insurance? Well! For an unmarried couple, the path of financial planning and life insurance is full of open challenges. Here are some common challenges faced by unmarried couples:

Legal Recognition

Unmarried couples usually receive fewer privileges legally compared to married couples. Such a move manifests itself, e.g., through deprivation or even the benefits and inherent rights such as in the case of inheritance, conservatism decision making or tax implications.

Insurance Coverage

It is also the case that some insurance policies, for instance, health insurance and life insurance, may not grant coverage to unmarried partners. This may be a difficult position for partners during private worst times.

Financial Dependency

Insurance companies usually present assurance proof in the form of financial dependence for purposes of being designated as the beneficiary. To prove this type of relationship on the unmarried individuals’ account, additional papers could be presented.

Beneficiary Designation

One of the commonest responses for spouse is to make beneficiaries of each other via scheduled statements, the unmarried couples may need to specifically include the mention of their partners in the statements of insurance policies and other financial accounts.

End-of-Life Decisions

Cohabiting partners may not have the right of decision-making in medical, or financial matters regarding their partner when they become incapacitated or die without any recognized legal arrangements.

Social Security Benefits

Where the divorced or unmarried partners are included, the case will most likely hear a decision requiring payment of other forms of Social Security benefits rather than those meant for the surviving spouses.

Life Insurance Options Available for Unmarried Couples

Looking for life insurance options for unmarried couples? There are several life insurance options available to them to provide financial protection for their partners. Here are some of the key options:

1- Individual Life Insurance Policies

Each partner can purchase a separate life insurance policy, naming their partner as the beneficiary. This allows each partner to choose the coverage amount and type of policy that best suits their individual needs.

2- Joint Life Insurance Policies

Some insurance companies offer joint life insurance policies for unmarried couples. These policies cover both partners under a single policy, with the death benefit paid out upon the first partner’s passing. Joint policies can be more cost-effective than two separate policies.

3- Domestic Partner Insurance Benefits

Some employers offer life insurance benefits for domestic partners. This can be a valuable option for unmarried couples to obtain life insurance coverage at a lower cost than individual policies.

4- Term Life Insurance

Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. It is often more affordable than permanent life insurance and can be a good option for unmarried couples looking for temporary coverage.

5- Permanent Life Insurance

Permanent life insurance, such as whole life or universal life insurance, provides coverage for the insured’s lifetime. It can be more expensive than term life insurance but offers lifelong protection and a cash value component.

6- Legal Documentation

Unmarried couples should also consider creating legal documents, such as wills, powers of attorney, and domestic partnership agreements. These documents can help ensure that their wishes regarding life insurance and other financial matters are followed in the event of incapacity or death.

By exploring these life insurance options and consulting with an insurance agent or financial advisor, unmarried couples can find the right coverage to protect their partners and provide financial security for the future.

Life Insurance Tips for Unmarried Couples

Being single is not a reason for unmarried couples to not have financial security, at all. The best example of this would be life insurance, which safeguards and gives peace of mind in case of sudden and unforeseen circumstances. Here are some valuable tips for unmarried couples to consider when purchasing life insurance:

Assess Your Needs:

Look at your financial position, while including the issues of debt, expenses and your future goals. To provide your partner with enough coverage to secure finances if you pass away, determine how much protection you will need.

Understand Policy Options:

Check out the types of life insurance products available, including term life insurance and permanent life insurance. Think about the necessary pros and cons of each kind of equipment and select the one that will satisfy your particular requirements.

Name Your Partner as Beneficiary:

Designate your spouse to be the beneficiary of your term life policy to provide the death benefit to your loved one when you die. Review and update beneficiary designations as often as you can, especially, after something major reaches status like marriage, divorce and birth of a child.

Consider Joint Policies:

Think over common life insurance policies for unmarried couples, where the assets can be given to the second one in case of the first death. These policies cover both partners under one insurance and hence they can be more practical than having two distinct insurances.

Review Employer Benefits:

Find out from your employer if your insurance provides for life partners of domestic partners. This plan should also have either some supplemental benefits or another insurer that can help your partner financially in case you have an accident.

Plan for the Unexpected:

Establish legal documents as essential tools of transfer such as wills, powers of attorney, medical power of attorney and healthcare directives. These records would make sure that your partner is secure and has the legal capacity to make the right decisions when you can’t or die.

Shop Around for Quotes:

Vary the quotes from different insurance companies to select a policy with the best coverage alternatives provided at the same time in affordable value. Insurance factors like premium rates, caps, or duration should be taken into account.

Review and Update Regularly:

Keep in mind that you need to review your policy life insurance regularly so that it will be accurate regarding all your financial situation and needs. Make the appropriate updates to your policy whenever considered necessary such as after any implication or any changes that may have occurred in your life.

By implementing the offered recommendations, unmarried couples can experience financial security and life insurance can benefit their future together.

Final Thoughts

Conclusively, unmarried partners will not be short of coverage, but, they may face some challenges that married partners wouldn’t. Through trying other choices and getting the input of financial planners as well as legal consultants unmarried couples may be able to make a financial plan that meets their needs and assures them security in the future.

Are you an unmarried couple looking for life insurance options? Contact us today to explore your options and find the right coverage for your unique situation.

References:

https://cfbinsurance.com/2023/09/19/life-insurance-for-unmarried-couples/

https://www.businessinsider.com/life-insurance-tips-unmarried-couples-financial-planners-2024-4

https://havenlife.com/blog/life-insurance-for-unmarried-couples/

Meet Alishba, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.

Importance of Life Insurance for Unmarried Couples

Importance of Life Insurance for Unmarried Couples