Last Updated on: August 22nd, 2024

Thank you for reading this post, don't forget to subscribe!- Licensed Agent

- - @M-LifeInsurance

Planning for retirement is more crucial than ever, and while traditional savings vehicles like 401(k)s and IRAs are well-known, supplemental life insurance is emerging as a powerful tool for boosting retirement income. Unlike typical life insurance, supplemental policies can offer dual benefits—providing financial security for your loved ones and serving as a tax-advantaged source of income during your golden years. But how exactly can Supplemental life insurance for retirement income planning fit into your retirement strategy, and is it the right choice for your financial goals?

What is supplemental life insurance?

With supplemental life insurance, the employer or association decides how much free coverage employees or members get, and how much more they can buy. The amounts are usually in multiples of salary.

Because it’s negotiated on a group level, supplemental life insurance typically (though not always) costs less than individual insurance. In most cases, you won’t have to take a medical exam or even answer health questions. However, you could lose your coverage if you leave your job. Unlike employer health insurance, which you can pay to extend through a program called COBRA, supplemental life insurance does not provide this option.

A supplemental policy may come through your employer, but it doesn’t always have to. It may be worth considering depending on your life insurance needs and the coverage options available through the basic group life policy. Supplemental life insurance is sometimes focused on a particular need. For example, some people may buy a supplemental policy to pay for funeral and burial costs.

What is supplemental life insurance for retirement income planning?

A life insurance retirement plan is a permanent or cash value life insurance policy funded over time to build up a substantial cash value by the time you retire. Unlike term life policies, permanent life insurance policies are designed to last for your entire lifetime, and last as long as you make the payments. LIRPs may provide retirement savers with a supplemental source of income on top of their individual retirement account (IRA) and retirement plan distributions after they stop working.

Supplemental life insurance for retirement income planning lacks some tax advantages that IRAs and qualified plans can provide, but they offer a few benefits that standard plans cannot match. For example, there is no age requirement for certain types of distributions from a LIRP. IRAs and qualified plans will penalize you for any distributions taken before age 59 ½, barring exceptions. Furthermore, LIRPs can often guarantee the investor’s principal and interest unless the investor is contributing to a variable universal life insurance policy.

For those policies it applies to, that guarantee means that the insurer has promised a minimum interest rate and that your cash value is protected against loss. Conversely, variable universal life insurance plans have non-guaranteed interest rates that fluctuate with underlying assets and the market. In simple terms, one protects against loss while the other offers potentially higher gains but does not protect against loss.

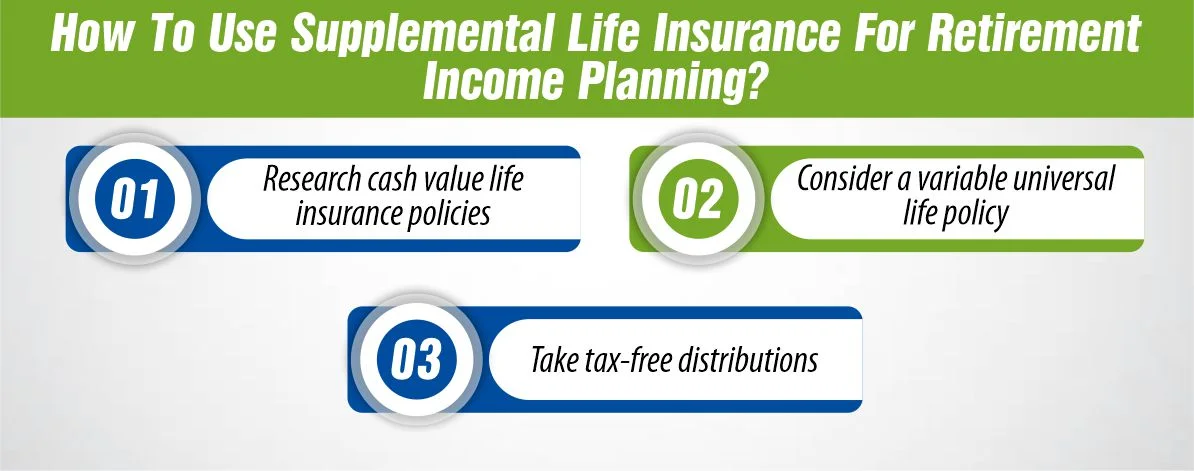

How to use supplemental life insurance for retirement income planning?

Funding a life insurance retirement plan is fairly straightforward, but you might want to consider working with a certified financial planner or a licensed insurance professional to ensure you are on the right track. Here are a few ways you might use life insurance in your retirement planning:

- Research cash value life insurance policies: After choosing a type of permanent life policy that suits you, you may want to start paying more than the minimum required premiums on the cash value life insurance policy. This helps you accumulate funds as the excess amount will go into the policy’s cash value and start building it up faster than it would otherwise. Even if you don’t overpay on the policy, a portion of your regular payment will still contribute to building cash value within your policy.

- Consider a variable universal life policy: A variable universal life policy allows you to invest the cash value in the financial markets. Although there is more risk with this type of policy, the rewards can be high as you make money when the financial indices rise.

- Take tax-free distributions: When you retire, you can take tax-free distributions from your policy’s accumulated cash value in the form of policy loans. However, if your loans exceed the amount you’ve paid into the cash value portion, that excess amount can be taxed, and it will also lower your available death benefit. It is also possible to take tax-free distributions from your Roth IRA if you have one, but the Roth doesn’t offer death benefit protection and limits how much you can put in it each year.

LIRPs may be an appealing way to supplement traditional retirement accounts. One additional note of caution is that if you contribute too much too quickly, the IRS could change your policy into a modified endowment contract (MEC), and the tax implications will change. Speaking with a licensed financial planner or insurance agent may help you achieve your financial goals without experiencing unwanted tax surprises.

Is supplemental life insurance for retirement income planning right for me?

The majority of the time, there are three main situations where a LIRP might be appropriate for retirement savers:

- High-income earners who are contributing as much to their traditional retirement savings vehicles such as IRAs and 401(k)s as possible, and are looking for additional avenues with which to save for retirement.

- Families with disabled or dependent children who must always be cared for. In this scenario, the death benefit will provide the funds necessary to support the children upon the death of the insured.

- Individuals with large financial goals for their retirement may find LIRPs to be an effective way to build a broader retirement savings base by branching into these plans on top of traditional retirement savings plans. Because LIRPs use life insurance as the investment vehicle, the IRS doesn’t set a maximum contribution amount for them.

Should I Use Life Insurance for Retirement Income?

Permanent life insurance is sometimes discussed as a way to save for retirement. Whether it’s variable, universal, whole life, or some other hybrid life insurance policy, these vehicles are sometimes touted for their tax-deferred potential and as a way to borrow money tax-free—a portion of the premiums go into an account that builds cash value along with the death benefit.

Borrowing money from life insurance may look appealing because of the tax benefit, especially if you need a loan due to a job loss or some other pressing need. But when it comes to creating a retirement plan using life insurance, investors may want to consider alternatives. It’s worth it to weigh the differences, for example, between investing in your 401(k) versus life insurance for retirement.

For starters, the inherent cost of life insurance within any kind of permanent life insurance policy can become very expensive to continue.

Sometimes the ongoing expense of a life insurance policy can eat up its investment value. People in their 80s or 90s sometimes let the policy lapse because it may no longer serve a purpose in their financial plan. However, if the policy lapses, the tax-advantage withdrawals become taxable in the year the policy ends—and a lot of people don’t realize that.

Here are three ideas to consider when balancing your insurance needs and retirement.

How Much Does Life Isurance Cost?

1. Buy term life insurance and invest the difference

Term life insurance can be significantly cheaper than permanent life insurance. Because of all the variables that come with life insurance—age, gender, health, family history, and more—it’s impossible to say just how much cheaper, but the difference can be significant.

The primary use for insurance is to protect people who need to guarantee that certain expenses get covered, such as ensuring children can go to college or paying off your mortgage. If you pass away early and your partner or spouse loses your income, then you need some protection to make sure those expenses still get paid.

In addition to keeping your family protected and paying off your debt, term life insurance allows you to use the savings in your policy to invest. Just be diligent about it. Pay yourself first by enrolling in automatic deposits to your retirement accounts, maxing out your contribution limit, and contributing enough to get any available employer match. If your employer offers a health savings account, you can also save money there for medical expenses now or in retirement.

2. Open and contribute to a Roth IRA

If you’re weighing whole life insurance versus an IRA, think about a Roth IRA as well. Insurance premiums aren’t tax-deductible, and although you don’t get a tax break when investing in a Roth IRA either, your tax benefit comes on the back side when you withdraw your gains tax-free. Of course, a traditional IRA often offers a tax break when contributions are made, and the decision between a traditional and Roth IRA is one individual investors need to make carefully.

Traditional and Roth IRAs have some restrictions and tax penalties when a person withdraws money before age 59½ that permanent life insurance policies don’t necessarily have.

In an insurance policy, such as universal or whole life, the returns are traditionally fairly low because the policy pays dividends and interest. With variable life policies, those investments tend to be somewhat expensive and limited.

3. Consider purchasing an annuity

The idea behind insurance is protection, and an annuity can offer its own protection by guaranteeing income in retirement, especially as you get closer to retirement when you’ll need income to replace your paychecks.

There are several types of annuities available, with the most basic being a single premium immediate annuity. You pay the insurance company a set amount—say, $100,000—and the company pays you a fixed amount on a regular basis (monthly, quarterly, or annually) that’s guaranteed for the rest of your life, and possibly the life of your spouse, depending on how the annuity is structured.

It’s important to note that annuities can be very complex financial products, and the most basic annuities are not always what we encounter or consider. Today’s investor may be more likely to encounter or explore more complex annuities, with investment, tax, and estate ramifications that add up to create a challenging, if still understandable, financial product. It’s important to grasp the details of annuities before taking action.

Although individual needs are different, people who buy annuities use them to cover fixed costs, such as utilities, mortgage or rent, property taxes, and other recurring obligations, and supplement other predictable sources of income like Social Security or pensions.

Conclusion

There are many potential approaches to saving for retirement, and navigating your options may seem daunting. Life insurance retirement plans (LIRPs) may be one way to build capital to support you after you quit working. Supplemental life insurance for retirement income planning uses specific types of life insurance to augment more traditional forms of retirement savings, like IRAs. Bankrate’s insurance editorial team breaks down what a LIRP strategy might look like and how it may help you save for retirement.

References:

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.