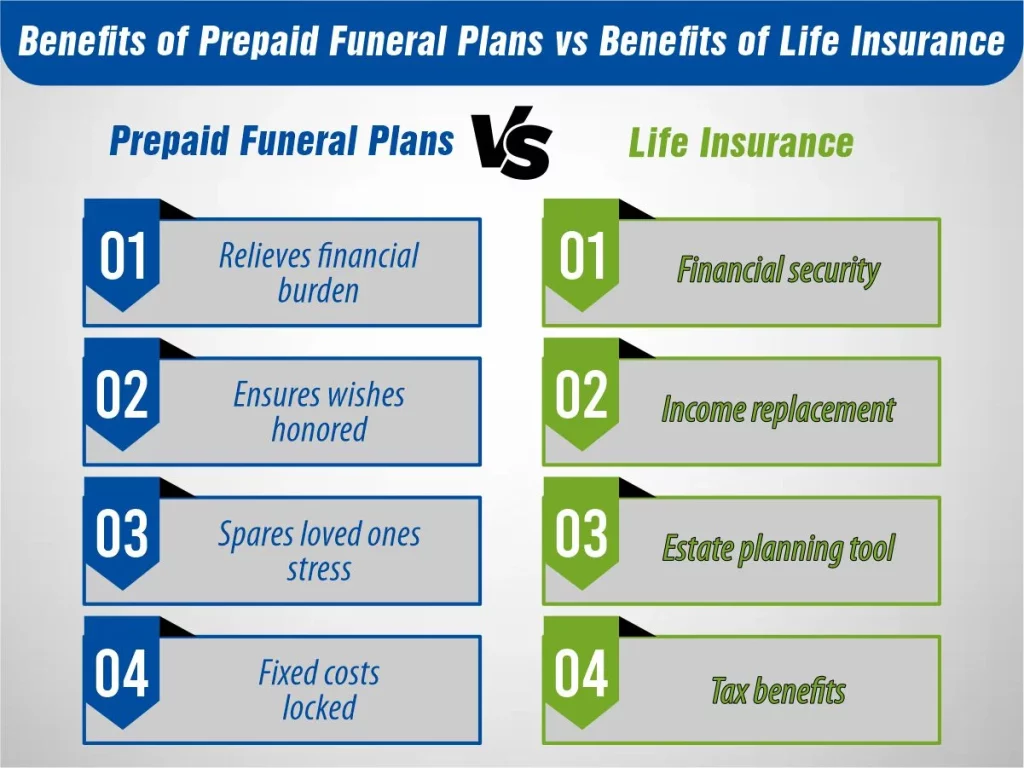

In life, planning for the unavoidable is a responsible step towards ensuring peace of mind for yourself and your loved ones. Two common options for doing such planning may involve prepaid funeral plans and life insurance policies.

While both serve the purpose of providing financial help during very hard times and covering your loved ones, they also differ significantly in their approaches and benefits. Want to know how? Read out this blog post.

In this blog post, we’ll explore the details of prepaid funeral plans vs life insurance to help you make a smart choice that matches up with your needs and preferences.

What are Prepaid Funeral Plans?

Prepaid funeral plans, also called preneed funeral plans or funeral pre-arrangements are plans that are made in advance to cover the costs of end-of-life expenses. Such plans are usually offered by funeral homes or providers and they allow the individuals to pay for their end-life services at present prices, thus saving them potentially and their families from inflationary rise in the future.

Key Features of Prepaid Funeral Plans:

- Financial Security: By prepaying for your funeral, you can relieve your loved ones of the financial burden associated with funeral expenses. This can provide them with peace of mind during a difficult time.

- Customization: Prepaid funeral plans often allow for customised funeral arrangements according to your preferences, including the choice of casket, ceremony, and other details.

- Protection against Price Inflation: One of the significant advantages of prepaid funeral plans is the protection against rising funeral costs. By paying in advance, you protect yourself from the impact of inflation on funeral expenses.

- Transferability: In many cases, prepaid funeral plans are transferable if you move to a different location or change your mind about the funeral home.

- Payment Options: Providers may offer flexible payment options, allowing you to pay for the plan in a lump sum or through installment payments.

Overall, prepaid funeral plans offer peace of mind by allowing individuals to make arrangements according to their preferences and secure the cost of their funeral services in advance.

Pros and Cons of Prepaid Funeral Plans

- Pros:

- Provides financial security for your family.

- Allows for customization of funeral arrangements.

- Protects against inflationary increases in funeral costs.

- Transferable in many cases.

- Flexible payment options are available.

- Cons:

- Lack of portability if you move to a different area.

- Limited investment growth potential compared to life insurance policies.

- Potential for loss if the funeral home goes out of business.

What are Life Insurance Policies?

Life insurance policies are contracts between an individual and an insurance company, designed to provide financial protection to the policyholder’s beneficiaries upon the policyholder’s death. In exchange for regular premium payments, the insurance company promises to pay out a lump-sum death benefit to the designated beneficiaries when the insured individual passes away.

There are several types of life insurance policies, including:

1- Term Life Insurance

Provides coverage for a specific period, such as 10, 20, or 30 years. If the insured individual dies during the term of the policy, the beneficiaries receive the death benefit. Term life insurance typically does not accumulate cash value.

2- Whole Life Insurance

Offers coverage for the insured’s entire life, as long as premiums are paid. Whole life insurance policies have a cash value component that grows over time and can be accessed by the policyholder through loans or withdrawals.

3- Universal Life Insurance

Similar to whole life insurance but provides more flexibility in premium payments and death benefits. Universal life insurance policies also have a cash value component that earns interest over time.

Life insurance policies serve various purposes, including providing income replacement for dependents, covering funeral expenses, paying off debts, and estate planning. The type of policy chosen depends on the individual’s financial goals, budget, and personal circumstances.

Key Features of Life Insurance Policies:

- Death Benefit: The primary feature of a life insurance policy is the death benefit, which is the amount paid out to the designated beneficiaries upon the death of the insured individual.

- Premiums: Policyholders are required to pay regular premiums to keep the life insurance policy active. Premium amounts can vary based on factors such as the insured individual’s age, health, coverage amount, and type of policy.

- Coverage Options: Life insurance policies offer different coverage options to suit the needs and preferences of policyholders. Term life insurance provides coverage for a specific period, while permanent life insurance policies offer coverage for the insured’s entire life.

- Cash Value Accumulation: Permanent life insurance policies, such as whole life include a cash value component that accumulates over time. This cash value grows tax-deferred and can be accessed by the policyholder through loans or withdrawals during their lifetime.

- Flexibility: Life insurance policies often offer flexibility in terms of premium payments, coverage amounts, and investment options. Policyholders may have the option to adjust their coverage or premium payments as their financial situation changes.

Tax Benefits: The death benefit paid out to beneficiaries is typically tax-free, providing a valuable source of tax-free income for the beneficiaries. Additionally, the cash value accumulation in permanent life insurance policies grows tax-deferred.

Pros and Cons of Life Insurance Policies

- Pros:

- Provides financial protection for your beneficiaries.

- Offers flexibility in premium payments and coverage options.

- Accumulates cash value over time.

- The death benefit is typically tax-free.

- Can be used to cover various expenses, including funeral costs.

- Cons:

- Premiums can be more expensive compared to prepaid funeral plans.

- Complexities in policy terms and conditions.

- Cash value accumulation may be subject to market fluctuations.

- Medical underwriting may be required, which could result in higher premiums for individuals with pre-existing health conditions.

Prepaid Funeral Plans vs Life Insurance: Key Differences

Prepaid funeral plans vs life insurance serve different purposes and have distinct features. Here are the key differences between the two:

Prepaid Funeral Plans

- Purpose

Prepaid funeral plans are specifically designed to cover the costs associated with funeral services and related expenses, such as casket, burial or cremation, and funeral home fees.

- Payment Structure

With prepaid funeral plans, individuals pay for their funeral services in advance, either in a lump sum or through installment payments. These payments are made directly to the funeral home or provider offering the plan.

- Cost Coverage

Prepaid funeral plans lock in the cost of funeral services at today’s prices, protecting against inflationary increases in the future. They typically cover specific funeral expenses agreed upon at the time of purchase.

- Customization

Many prepaid funeral plans allow for customized funeral arrangements according to the individual’s preferences, including the choice of casket, ceremony type, and other details.

- Portability

Prepaid funeral plans may not be portable if the individual moves to a different location, potentially requiring them to transfer the plan to a new provider or lose the benefits altogether.

How Much Does Life Isurance Cost?

Life Insurance

- Purpose

Life insurance policies provide financial protection to the policyholder’s beneficiaries upon the policyholder’s death. The death benefit can be used to replace lost income, pay off debts, cover living expenses, and provide for the policyholder’s dependents.

- Payment Structure

Policyholders pay regular premiums to keep the life insurance policy active. Premium amounts vary based on factors such as the insured individual’s age, health, coverage amount, and type of policy.

- Cost Coverage

Life insurance policies offer a death benefit that is typically larger than the premiums paid, providing financial security to the beneficiaries. The death benefit can be used for various purposes, including funeral expenses, mortgage payments, and living expenses.

- Cash Value Accumulation

Permanent life insurance policies, such as whole life and universal life, include a cash value component that accumulates over time. Policyholders can access this cash value through loans or withdrawals during their lifetime.

- Flexibility

Life insurance policies offer flexibility in terms of premium payments, coverage amounts, and investment options. Policyholders can adjust their coverage or premium payments as their financial situation changes.

In summary, prepaid funeral plans are focused solely on covering funeral expenses and offer limited flexibility, while life insurance policies provide broader financial protection and flexibility for policyholders and their beneficiaries. The choice between the two depends on individual preferences, financial goals, and circumstances.

Making the Right Choice: Prepaid Funeral Plans vs Life Insurance

When deciding between prepaid funeral plans vs life insurance, it’s essential to consider your individual circumstances, preferences, and financial goals. Here are a few factors to keep in mind:

- Financial Situation: Assess your current financial situation and determine how much you can afford to allocate toward funeral expenses.

- Long-Term Goals: Consider your long-term financial goals and whether you prefer the flexibility and potential investment growth offered by life insurance policies.

- Health Status: If you have pre-existing health conditions, obtaining life insurance coverage may be more challenging and expensive, making a prepaid funeral plan a viable alternative.

- Family Dynamics: Take into account the needs and preferences of your beneficiaries and how they would prefer to receive financial support in the event of your passing.

- Consultation: It’s advisable to consult with a financial advisor or insurance professional who can provide personalized guidance based on your unique circumstances.

The Bottom Line

Both prepaid funeral plans vs life insurance policies serve as valuable tools for planning for the future and providing financial security for your loved ones. While prepaid funeral plans offer the convenience of prepaying for funeral expenses and locking in today’s prices, life insurance policies provide broader financial protection and investment potential.

Ultimately, the right choice depends on your individual preferences, financial goals, and family dynamics. By carefully evaluating the pros and cons of each option and seeking professional guidance, you can make an informed decision that brings peace of mind to you and your loved ones.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.