Key Takeaways

- Jonathan Lawson Colonial Penn actor

- Estimated net worth $1–$2 million

- Military veteran turned spokesperson.

When you heard something about Colonial Penn life insurance, you may think of one person right away after your thought, Jonathan Lawson. He is the friendly person and you see so many times in the TV commercials. With his calm voice and good looks, he has become the main spokesperson that people connect with the brand.

But many people are curious and ask questions like: Who is Jonathan Lawson? What is his background? How did he start his career? Does he really work for Colonial Penn? And how much is he worth?

In this article, we will talk about Jonathan Lawson and Colonial Penn. We’ll go over his life story, career highlights, if he is part of the company, and also answer some of the most common questions people search for online.

Who is Jonathan Lawson from Colonial Penn?

Jonathan Lawson is the known personality you have seen as the spokesperson in Colonial Penn’s TV commercials. In these ads, he talks about the benefits of guaranteed acceptance life insurance policies, which is one of the company’s most popular plans.

Before Jonathan Lawson was on TV commercials, he served in the U.S. military. When he ends his service in army he start working in television. His job with Colonial Penn made him very famous and trusted face, especially the seniors trust him more who are looking for low-cost life insurance or final expense plans.

Does Jonathan Lawson Work for Colonial Penn?

There is a very common question that people often ask that Does Jonathan Lawson really work for Colonial Penn?

So the answer is no. Jonathan is not an insurance agent, and he is not even a part of the company’s sales team. Instead, he is a paid spokesperson and actor. This means he appears in the commercials and shares the company’s scripted messages and make people get the information about the insurance plans. This is a normal marketing method in the insurance world. Many companies hire well-known or trusted faces to help build trust and connection with their audience.

Jonathan Lawson Colonial Penn Age

Another concern that people ask is: How old is Jonathan Lawson from Colonial Penn?

Jonathan Lawson does not share his exact birth year in public or on google, but there are a lot of sources that say that he is in his early to mid-40s. He looks so good and disciplined because he is has the army background and because of that he also look so professional when comes on TV.

Jonathan Lawson Colonial Penn Wife and Personal Life

Many people are curious about Jonathan lawson colonial penn wife and personal life. He is not like other spokespersons and celebrities who share their life on social media. He does not like to share it with public so he keeps this information very personal.

How Much Does Colonial Penn Pay Jonathan Lawson?

Colonial Penn has not shared Jonathan Lawson’s exact salary. But in general, spokespeople for big national commercials can make $100,000 to $500,000 each year. The amount depends on how long their contract is and how many people see the ads.

Since Colonial Penn commercials are shown all over the country, it is safe to think that Jonathan earns on the higher end of this range.

Jonathan Lawson Colonial Penn Wikipedia

Right now, Jonathan Lawson does not have a Wikipedia page. This makes people even more curious about his life and career. Most of the information about him can be found on blogs, insurance websites, and net worth pages. If he keeps working with Colonial Penn and becomes more active in the media, he may one day get his own Wikipedia page.

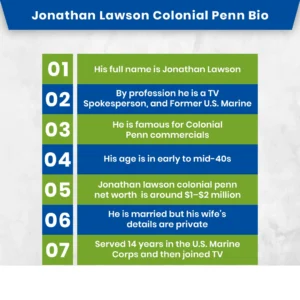

Jonathan Lawson Colonial Penn Bio

Here’s a quick overview of Lawson’s background and biography:

- His full name is Jonathan Lawson

- By profession he is a TV Spokesperson, and Former U.S. Marine

- He is famous for Colonial Penn commercials

- His age is in early to mid-40s

- Jonathan lawson colonial penn net worth is around $1–$2 million

- He is married but his wife’s details are private

- Served 14 years in the U.S. Marine Corps and then joined TV

Colonial Penn Jonathan Lawson: Why He Stands Out

Colonial Penn chose Jonathan Lawson as their spokesperson for a reason. Here’s why he stands out:

Trust from Military Service

His time in the Marine Corps makes him look strong, reliable, and trustworthy.

How Much Does Life Isurance Cost?

Friendly and Clear Style

The way he talks is simple and easy to understand, which is helpful for seniors looking for easy insurance plans.

Familiar Face

Since he has been in the commercials for many years, people now recognize and trust him.

Biography Net Worth Jonathan Lawson Colonial Penn

When people search for “biography net worth Jonathan Lawson Colonial Penn,” they mostly want to know about his career and financial success.

To keep it simple:

- His biography includes time in the U.S. military, then moving into acting, and later becoming a commercial spokesperson.

- His net worth is estimated at $1–$2 million.

Why Jonathan Lawson Became the Face of Colonial Penn

Colonial Penn has always picked spokespersons who show trust, simplicity, and friendliness. With Jonathan Lawson, the company keeps this tradition. His military background highlights values like discipline, honor, and reliability. These are the same qualities Colonial Penn wants people to think of when they see their life insurance plans.

Final Thoughts

Wrapping up everything about Jonathan Lawson. This is all the information that has been shared by him. Other than that he is not an insurance agent, but his job as the spokesperson for Colonial Penn has made him a familiar face in many American homes. His military service, professional style, and relatable personality help Colonial Penn share its message of simple and affordable life insurance.

Even he is not like other people who share their personal life on social media. He keeps everything private and hide every detail of family and wife. his role in the commercials has made him a trusted figure connected with the insurance company.

Ready to Explore Better Life Insurance Options?

While Jonathan Lawson has become a familiar face in Colonial Penn commercials, it’s important to look beyond the ads when choosing the right coverage. At MLife Insurance, we provide clear, unbiased guidance to help you compare policies and find affordable plans that fit your needs, not just what’s marketed on TV.

Get a free life insurance quote today and see why thousands of families trust us for reliable coverage and peace of mind.

FAQS

1. Does Jonathan really work for Colonial Penn?

No, Jonathan is not an insurance agent. But he is a paid spokesperson and actor who specifically comes in Colonial Penn commercials.

2. How much is Jonathan from Colonial Penn worth?

His net worth is estimated to be around $1 million to $2 million. But this is the estimated income, the real one is not revealed by himself for now.

3. Who is Jonathan Lawson’s wife?

Jonathan is married, but he doesn’t want to share anything so he keeps his wife’s details private and does not share them publicly.

4. Was Jonathan Lawson a Marine?

Yes, Jonathan served in the U.S. Marine Corps for 14 years before working in television and commercials.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.