While exploring options for financial planning, you may come across two most popular options, life insurance and mutual funds. Both serve different purposes and cater to various financial goals. Where life insurance provides security to your loved ones in case of your sudden demise, a mutual fund offers various opportunities for long-term wealth generation. So understanding the difference between them is important to make well-informed decisions about your investment. In this blog post, we’ll explore the difference between life insurance vs mutual funds, helping you navigate through the complexities and choose the best option suited to your needs.

What is Life Insurance?

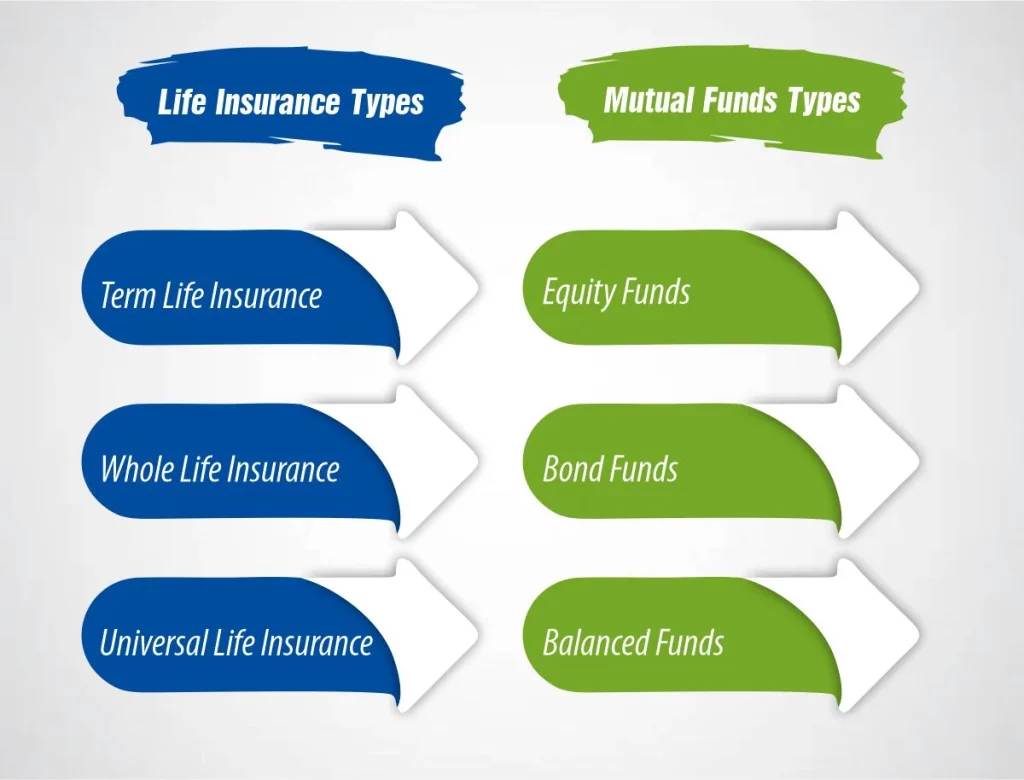

Life insurance is a financial product designed to provide a financial benefit to designated beneficiaries upon the death of the insured individual. Essentially, it acts as a safety net, ensuring that loved ones are financially protected in the event of the policyholder’s passing. There are several types of life insurance policies available, each offering different features and benefits. The most common types include term life insurance, whole life insurance, and universal life insurance.

1- Term Life Insurance

This type of policy provides coverage for a specified period, typically ranging from 10 to 30 years. If the insured passes away during the term of the policy, a death benefit is paid out to the beneficiaries. Term life insurance is often more affordable than other types of policies because it does not accumulate cash value over time.

2- Whole Life Insurance

Whole life insurance provides coverage for the entire lifetime of the insured individual, as long as premiums are paid. In addition to the death benefit, whole-life policies also have a cash value component that accumulates over time and can be accessed by the policyholder through loans or withdrawals.

3- Universal Life Insurance

Universal life insurance offers flexibility in premium payments and death benefits. Policyholders can adjust the amount and frequency of premium payments, as well as the death benefit amount, to suit their changing needs. Like whole life insurance, universal life policies also accumulate cash value over time. Overall, life insurance serves as a crucial tool for financial planning, offering peace of mind and financial security to families in times of need.

Advantages of Life Insurance

Life insurance offers a range of advantages that make it a valuable financial tool for individuals and families. Here are some of the key benefits:

- Financial Protection for Loved Ones

It provides financial protection to your loved ones in the event of your death. The death benefit paid out to beneficiaries can help replace lost income, cover living expenses, pay off debts, and maintain the family’s standard of living.

- Estate Planning and Tax Efficiency

- Cash Value Accumulation

Permanent life insurance policies, such as whole life accumulate cash value over time. This cash value grows tax-deferred and can be accessed by the policyholder through withdrawals. It can serve as a source of emergency funds or supplement retirement income.

- Flexible Coverage Options

Life insurance policies come in various forms allowing individuals to choose coverage that aligns with their specific needs, budget, and financial goals. Policyholders can adjust coverage amounts, premium payments, and death benefits according to their needs.

- Peace of Mind and Certainty

Knowing that your loved ones will be financially protected in the event of your passing can provide peace of mind and certainty for you and your family. Life insurance can help alleviate worries about the financial impact of unexpected events, allowing you to focus on enjoying life and pursuing your goals.

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professional fund managers or investment firms who make decisions about how to allocate the fund’s assets based on its investment objectives. Mutual funds come in various types, each catering to different investment objectives, risk tolerances, and financial goals. Here are some of the most common types of mutual funds:

1- Equity Funds

Equity funds, also known as stock funds, primarily invest in stocks or shares of publicly traded companies. These funds aim to provide capital appreciation over the long term by investing in companies with growth potential.

2- Bond Funds

Bond funds invest in fixed-income securities, such as government bonds, corporate bonds, municipal bonds, and other debt instruments. These funds aim to generate regular income through interest payments while preserving capital.

3- Balanced Funds

Balanced funds, also known as hybrid funds, invest in a mix of stocks and bonds to achieve a balance between growth and income. These funds typically maintain a predetermined allocation between equities and fixed-income securities, providing diversification and risk management.

Advantages of Mutual Funds

Mutual funds offer several advantages that make them a popular choice for investors looking to build wealth and achieve their financial goals. Here are some key advantages of mutual funds:

- Diversification

One of the most significant benefits of mutual funds is diversification. By pooling money from multiple investors, mutual funds invest in a diversified portfolio of stocks, bonds, or other securities. This diversification helps spread risk across different investments and asset classes, reducing the impact of volatility on the overall portfolio.

How Much Does Life Isurance Cost?

- Professional Management

Mutual funds are managed by experienced fund managers who have the expertise and resources to research, analyze, and make investment decisions on behalf of investors. These professionals monitor the financial markets, adjust the fund’s portfolio as needed, and strive to achieve the fund’s investment objectives.

- Accessibility

Mutual funds are accessible to a wide range of investors, regardless of their investment knowledge, experience, or capital. With mutual funds, investors can start investing with relatively small amounts of money, making them suitable for beginners or those with limited funds.

- Cost Efficiency

Mutual funds provide cost-efficient access to diversified investment portfolios. While individual investors may suffer significant costs when buying and selling individual securities, mutual funds benefit from economies of scale, allowing them to spread expenses across a larger asset base.

- Variety of Options

Mutual funds offer a wide range of investment options to suit different investment objectives, risk tolerances, and time horizons. Whether investors are seeking growth, income, capital preservation, or a combination of these goals, there are mutual funds available to meet their needs.

Life Insurance vs Mutual Funds: Key Differences

Life insurance vs mutual funds are two distinct financial products that serve different purposes and cater to different aspects of financial planning. However, here are the key differences between them:

1- Purpose

- Life Insurance: The primary purpose of life insurance is to provide financial protection to your loved ones in the event of your death by paying death benefits to designated beneficiaries.

- Mutual Funds: The primary purpose of mutual funds is to help investors grow their wealth over time by investing in a diversified portfolio of stocks, bonds, or other securities.

2- Risk and Return

- Life Insurance: Life insurance offers guaranteed death benefits to beneficiaries upon the insured individual’s death, regardless of market conditions.

- Mutual Funds: Mutual funds are subject to market risk, as the value of the fund’s underlying investments can fluctuate based on market conditions.

3- Liquidity

- Life Insurance: These policies generally do not offer the same level of liquidity as mutual funds. While some policies may allow for loans or withdrawals against the cash value, accessing funds from a life insurance policy may involve surrender charges, taxes, and other restrictions.

- Mutual Funds: Mutual funds offer higher liquidity compared to life insurance policies. Investors can buy or sell shares of mutual funds on any business day at the current net asset value (NAV), providing flexibility and access to funds when needed.

4- Tax Treatment

- Life Insurance: Life insurance policies offer tax advantages, including tax-free death benefits paid out to beneficiaries and tax-deferred growth of cash value.

- Mutual Funds: Mutual funds may have taxes on capital gains, dividends, and interest income generated within the fund.

5- Cost Structure

- Life Insurance: Life insurance policies typically involve upfront costs, including premiums, fees, and commissions. These costs may vary depending on the type of policy, coverage amount, and the insured individual’s age and health status.

- Mutual Funds: Mutual funds charge fees and expenses, including management fees, administrative fees, and operating expenses, which are deducted from the fund’s assets.

Choosing the Right Option for You: Life Insurance vs Mutual Funds

The decision between life insurance vs mutual funds depends on your financial goals, risk tolerance, and individual circumstances. If you’re primarily concerned about providing financial security for your loved ones, especially if you have dependents relying on your income, life insurance may be the preferred choice. On the other hand, if you’re looking to grow your wealth over the long term and are willing to accept market risk, mutual funds offer the potential for higher returns. It’s essential to assess your needs carefully and consult with a financial advisor to determine the most suitable option for your investment portfolio. In many cases, a combination of life insurance and mutual funds may offer a well-rounded approach to financial planning, providing both protection and growth opportunities.

Conclusion

Life insurance vs mutual funds are two distinct financial instruments with unique features and benefits. While life insurance offers protection against the risk of premature death, mutual funds provide opportunities for wealth accumulation through diversified investments. By understanding the differences between these options and aligning them with your financial goals, you can make informed decisions to secure your financial future effectively. Remember to seek professional advice and regularly review your investment strategy to adapt to changing circumstances and optimize your portfolio for long-term success.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.