Accidental death is a sobering topic that no one likes to dwell on, but understanding the complexities of insurance coverage can provide valuable peace of mind. Homeowners often prioritize protecting their homes and belongings against unforeseen events like fires or storms. However, many of us may wonder: does homeowners insurance cover accidental death?

In this comprehensive guide, we’ll explore the ins and outs of homeowners insurance coverage, what it typically entails, and whether accidental death falls under its purview. We’ll also discuss how to get accidental death coverage to ensure the necessary protection for you and your loved ones in the event of an accidental death.

Let’s get started!

What is Homeowners Insurance Coverage?

Homeowners’ insurance coverage provides financial protection for homeowners against a range of risks and liabilities related to their property. It typically includes several key components. Firstly, dwelling coverage protects the physical structure of your home, including the walls, roof, floors, and foundation, from damage caused by covered perils such as fire, windstorm, theft, vandalism, and more.

This coverage helps pay for repairs or rebuilding your home in the event of a covered loss. Additionally, homeowners insurance includes coverage for other structures on your property, such as detached garages, sheds, fences, and more, for which covered perils may also be damaged.

Personal property coverage is another essential component of homeowners insurance, safeguarding your belongings inside and outside your home. This coverage helps replace or repair personal belongings like furniture, clothing, appliances, electronics, and more if they are damaged, destroyed, or stolen due to covered perils.

Moreover, liability coverage protects homeowners from financial responsibility if someone is injured on their property or if they accidentally cause damage to someone else’s property. It covers legal fees, medical expenses, and other costs associated with lawsuits up to the policy limits.

In short, homeowners insurance coverage offers comprehensive protection for your home and financial well-being in the face of unforeseen events.

Does Homeowners Insurance Cover Accidental Death?

Homeowners insurance is designed to protect your home and belongings from covered perils such as fire, theft, and natural disasters. However, it typically does not provide coverage for accidental death. Homeowners insurance is property insurance and is not meant to serve as a substitute for life insurance or accidental death insurance.

Suppose you’re concerned about providing financial security for your loved ones in the event of your accidental death. In that case, you may want to consider purchasing a separate accidental death and dismemberment (AD&D) insurance policy. AD&D insurance provides a lump-sum payment to your beneficiaries if you die or suffer a serious injury as a result of an accident.

It’s important to review your insurance needs with a qualified insurance agent or financial advisor to determine the best coverage options for your situation.

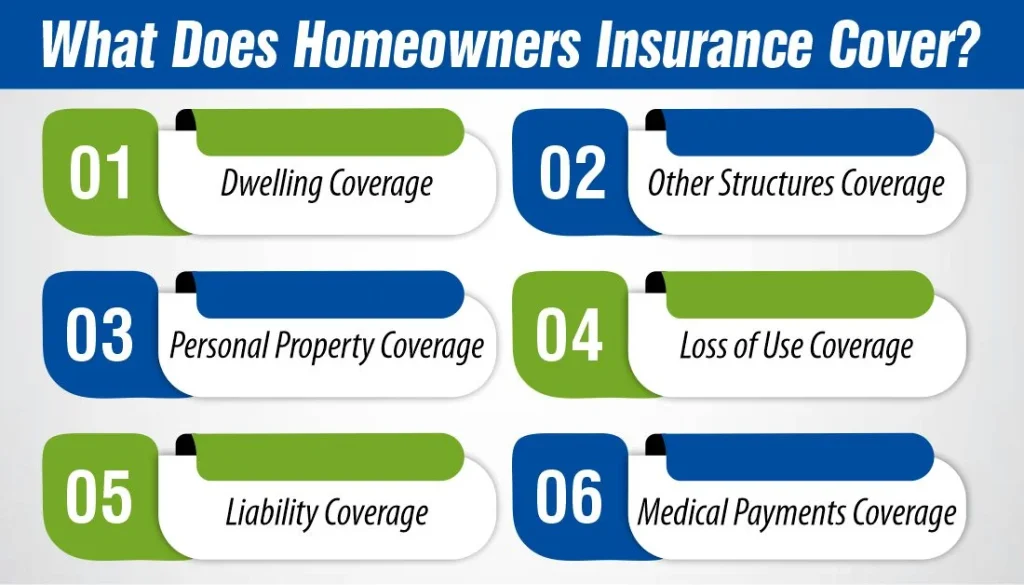

What Does Homeowners Insurance Cover?

Homeowners insurance provides financial protection against damage to your home and belongings, as well as liability for injuries or property damage to others. Here’s a breakdown of what homeowners insurance typically covers:

1- Dwelling Coverage

This covers damage to your home’s structure caused by covered perils such as fire, windstorms, hail, lightning, theft, and vandalism. It typically includes the main house and attached structures like a garage or deck.

2- Other Structures Coverage

Homeowners insurance protects structures on your property that are not attached to your home, such as a detached garage, shed, or fence.

3- Personal Property Coverage

This covers your belongings, including furniture, clothing, electronics, and appliances, if they are damaged, destroyed, or stolen. It also covers items you take with you outside your home.

4- Loss of Use Coverage

If your home is damaged and becomes uninhabitable, loss of use coverage helps pay for additional living expenses, such as hotel stays, meals, and storage, while your home is being repaired or rebuilt.

5- Liability Coverage

This protects you if someone is injured on your property or if you or a family member accidentally damages someone else’s property. Liability coverage covers legal fees, medical bills, and other expenses up to the limits of your policy.

6- Medical Payments Coverage

The insurance policy also pays for medical expenses if someone is injured on your property, regardless of who is at fault.

How Much Does Life Isurance Cost?

It’s important to note that homeowners insurance typically does not cover damage caused by floods, earthquakes, neglect, or normal wear and tear. You may need to purchase separate insurance policies or endorsements for these types of risks. However, it’s a good idea to review your homeowners’ insurance policy annually with your insurance agent to ensure you have adequate coverage for your needs.

How to get Accidental Death Coverage?

To get accidental death coverage, you have several options:

- Standalone Accidental Death Insurance

You can purchase a standalone accidental death insurance policy from an insurance company. These policies typically provide a lump-sum payment to your beneficiaries if you die as a result of an accident.

- Accidental Death and Dismemberment (AD&D) Insurance

AD&D insurance is often available as a standalone policy or as a rider to a life insurance policy. It provides a benefit if you die or are seriously injured as a result of an accident.

- Life Insurance with Accidental Death Benefit

Some life insurance policies include an accidental death benefit rider, which provides an additional benefit if you die due to an accident. This rider is usually available for an additional premium.

- Employer-Sponsored Coverage

Some employers offer accidental death coverage as part of their employee benefits package. Check with your employer to see if this coverage is available to you.

When considering accidental death coverage, it’s important to review the policy terms and conditions carefully to understand what is covered, any exclusions that may apply, and the amount of coverage provided. You may also want to compare quotes from multiple insurance companies to find the best coverage at the most affordable price.

Do You Have to Have Accidental Death Liability?

Accidental death liability insurance is not a standard insurance product. However, if you are referring to accidental death coverage, such as accidental death and dismemberment (AD&D) insurance, it is typically optional. AD&D insurance provides a benefit if you die or are seriously injured as a result of an accident.

While AD&D insurance is not required, it can provide valuable financial protection for you and your loved ones in the event of an accident. It is often available as a standalone policy or as a rider to a life insurance policy. If you are interested in AD&D insurance, you can purchase a policy from an insurance company or inquire about adding a rider to your existing life insurance policy.

The Bottom Line

We hope you are now clear about “Does Homeowners Insurance Cover Accidental Death?” Understanding homeowners insurance coverage is essential for protecting your home and belongings against unforeseen events. By familiarizing yourself with the key components of homeowners insurance, you can make informed decisions about your policy and ensure you have the coverage you need to protect your financial well-being.

Frequently Asked Questions (FAQs)

1- What is the difference between homeowners insurance and accidental death insurance?

Homeowners insurance primarily covers property damage and liability, protecting your home and belongings. Accidental death insurance, on the other hand, provides financial compensation in the event of accidental death or serious injury, offering additional security for your loved ones beyond property protection.

2- Is accidental death coverage included in standard homeowners insurance policies?

No, accidental death coverage is typically not included in standard homeowners insurance policies. Homeowners insurance focuses on property protection rather than life insurance, so it’s important to consider additional coverage for accidental death.

3- Why should I consider purchasing accidental death insurance if I already have homeowners insurance?

Accidental death insurance provides specific coverage for death resulting from accidents, offering additional financial security for your loved ones beyond what homeowners insurance offers. It can help cover expenses such as funeral costs, medical bills, and outstanding debts.

4- Can I purchase accidental death insurance separately from my homeowners insurance?

Yes, accidental death insurance is often available as a standalone policy or as a rider to a life insurance policy, allowing you to tailor your coverage to your specific needs and ensure you have the protection you need.

5- What types of accidents are covered under accidental death insurance?

Accidental death insurance typically covers a wide range of accidents, including but not limited to car accidents, falls, drowning, and accidental poisoning, among others. It provides financial protection for your beneficiaries in the event of your accidental death.

6- Are there any exclusions or limitations to accidental death insurance coverage?

Like any insurance policy, accidental death insurance may have exclusions or limitations. It’s crucial to review the policy terms carefully to understand what is covered and any circumstances where coverage may not apply, such as death resulting from illegal activities or self-inflicted injuries.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.