Understanding Pyramid Schemes

Senior Life Insurance Company Overview

Is Senior Life Insurance Company a Pyramid Scheme?

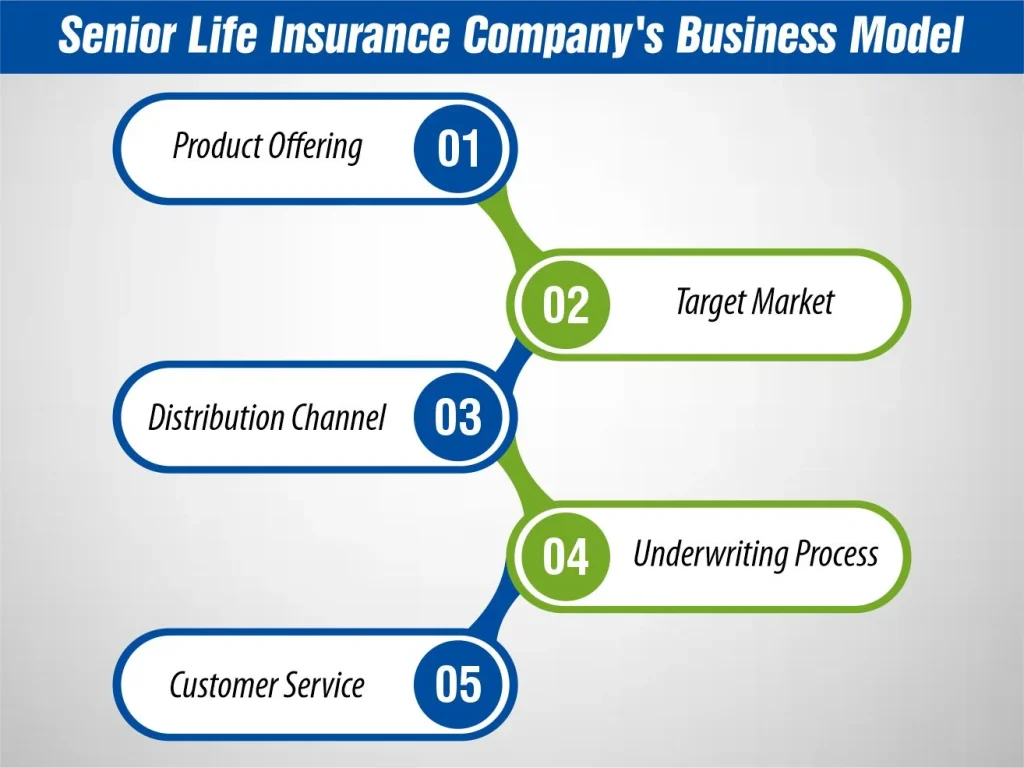

Senior Life Insurance Company’s Business Model

Senior Life Insurance Company operates as a traditional insurance provider, offering final expense life insurance to seniors. The company’s business model revolves around selling insurance policies that provide financial protection to policyholders and their beneficiaries in the event of the policyholder’s death.

Here’s a breakdown of Senior Life Insurance Company’s business model:

- Product Offering

Senior Life Insurance Company primarily offers final expense life insurance policies. These policies are designed to cover the costs associated with a policyholder’s funeral, medical bills, and other end-of-life expenses.

- Target Market

The company focuses on serving the senior population, as seniors are often more concerned about ensuring their final expenses are covered and may have difficulty obtaining coverage from other insurance providers due to age or health issues.

- Distribution Channel

Senior Life Insurance Company sells its insurance products through a network of agents. These agents work directly with clients to assess their insurance needs and recommend the most suitable insurance solutions.

- Underwriting Process

The company’s underwriting process is tailored to seniors, making it easier for them to qualify for coverage compared to traditional life insurance policies. This approach allows more seniors to obtain the insurance coverage they need.

- Customer Service

Senior Life Insurance Company is known for its commitment to customer service. The company’s agents provide personalized service to clients, helping them understand their insurance options and select the right coverage for their needs.

Essentially, Senior Life Insurance Company’s business model focuses on providing affordable, accessible, and customer-oriented insurance products to seniors.

Why the Confusion?

The confusion about whether Senior Life Insurance Company operates as a pyramid scheme may stem from misconceptions about how insurance companies operate, as well as general skepticism about financial products and services. Here are some reasons why there may be confusion:

1- Lack of Understanding

2- Similar Terminology

The terminology used in the insurance industry, such as “recruitment” (agents recruiting policyholders) and “downline” (policyholders and their beneficiaries), may be similar to the terminology used in pyramid schemes. This similarity in terminology can create confusion and lead to false assumptions about the nature of the business.

3- Negative Perceptions

4- Misinformation

In some cases, misinformation or false claims may be spread about Senior Life Insurance Company, leading to confusion and uncertainty about the company’s business practices.

How to Differentiate Between a Pyramid Scheme and a Legitimate Business?

Differentiating between a pyramid scheme and a legitimate business is crucial to avoid falling victim to fraudulent schemes. Here are key factors to consider when distinguishing between the two:

- Product or Service Focus

- Revenue Source

Legitimate businesses derive their revenue from the sale of products or services. while in a pyramid scheme, revenue comes primarily from recruitment fees or payments made by new members.

- Recruitment vs. Sales

Participants are incentivized to recruit new members to earn money in a pyramid scheme. In contrast, legitimate businesses may offer incentives for sales but primarily focus on selling products or services to generate revenue.

- Sustainability

Legitimate businesses can sustain themselves by continuously selling products or services. Pyramid schemes are inherently unsustainable, as they rely on recruitment to generate returns for existing members, eventually leading to a collapse when recruitment slows down.

- Transparency and Compliance

Legitimate businesses are transparent about their products, services, and business practices. They comply with legal and regulatory requirements. Pyramid schemes often operate covertly and may use deceptive tactics to recruit members.

- Legal Status

Conclusion

In this blog, hope you find the answer to “Is Senior Life Insurance Company a pyramid scheme?” Senior Life Insurance Company is a legitimate insurance provider, not a pyramid scheme. The company operates within the boundaries of the insurance industry, selling life insurance policies to seniors to help them cover final expenses. It’s important to differentiate between pyramid schemes and legitimate businesses, and Senior Life Insurance Company falls into the latter category.

How Much Does Life Isurance Cost?

Suppose you’re considering purchasing a life insurance policy from Senior Life Insurance Company or any other provider. In that case, it’s always a good idea to do your research and understand the terms and conditions of the policy before making a decision.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.