Are you looking for differences between accidental death & dismemberment vs life insurance? Well! Accidental Death & Dismemberment (AD&D) insurance and life insurance are both important forms of financial protection, but they serve different purposes.

Understanding the differences between them can help individuals make informed decisions about their insurance needs. In this comprehensive guide, we’ll explore the key distinctions between AD&D insurance and life insurance, their benefits, limitations, and how to determine which type of coverage is right for you.

Let’s explore together!

What is Accidental Death & Dismemberment (AD&D) Insurance?

Accidental Death & Dismemberment (AD&D) insurance is a type of insurance policy that provides coverage in the event of death or serious injury resulting from an accident. Unlike life insurance, which typically pays out in the event of death from any cause, AD&D insurance only pays benefits if the insured’s death or injury is directly caused by an accident.

Key Features of AD&D Insurance

- Coverage for Accidents: AD&D insurance provides coverage for accidental death, dismemberment, or loss of sight, speech, or hearing resulting from a covered accident.

- Limited Scope: AD&D insurance does not cover death or injuries resulting from illness, natural causes, or suicide. It only applies to accidents specified in the policy.

- Lump-Sum Benefit: In the event of a covered accident resulting in death or dismemberment, AD&D insurance typically pays out a lump-sum benefit to the insured or their beneficiaries.

- Affordable Premiums: AD&D insurance policies generally have lower premiums compared to traditional life insurance policies due to the limited scope of coverage.

What does Accidental Death & Dismemberment (AD&D) Insurance Cover?

AD&D insurance covers accidental death, dismemberment, or loss of sight, speech, or hearing resulting from a covered accident. Here’s a breakdown of what AD&D insurance typically covers:

Accidental Death: If the insured person dies as a direct result of a covered accident, AD&D insurance pays out a death benefit to the designated beneficiary.

Dismemberment: If the insured person loses a limb (such as an arm or leg) or loses sight, speech, or hearing as a direct result of a covered accident, AD&D insurance pays out a benefit. The amount of the benefit is typically a percentage of the total coverage amount, depending on the specific policy terms.

Paralysis: Some AD&D policies also cover paralysis resulting from a covered accident, paying out a benefit based on the severity of the paralysis.

Coma: In some cases, AD&D insurance may also provide a benefit if the insured person enters a coma as a result of a covered accident, with the benefit amount and duration specified in the policy.

It’s important to note that AD&D insurance does not cover death or injuries resulting from illness, natural causes, or suicide. It only applies to accidents specified in the policy.

What is Life Insurance?

Life insurance is a contract between an individual and an insurance company, where the insurer agrees to pay a specified amount of money to the insured’s beneficiaries upon the insured’s death. Life insurance provides financial protection to the insured’s loved ones in the event of their death, regardless of the cause.

Key Features of Life Insurance

- Comprehensive Coverage: Life insurance provides coverage for death resulting from any cause, including illness, accidents, natural causes, and even suicide after a certain waiting period.

- Variety of Policies: Life insurance policies come in various forms, including term life insurance, whole life insurance, and universal life insurance, offering flexibility to policyholders based on their needs and budget.

- Income Replacement: Life insurance can help replace lost income and provide financial support to the insured’s beneficiaries, such as paying off debts, covering living expenses, funding education, or leaving an inheritance.

- Cash Value Component: Some types of life insurance, such as whole life and universal life insurance, accumulate cash value over time, which can be accessed by the policyholder during their lifetime through loans or withdrawals.

What does Life Insurance Cover?

Life insurance provides coverage for death resulting from any cause, providing financial protection to the insured’s beneficiaries. Here’s what life insurance typically covers:

Death Benefit: If the insured person dies from any cause while the policy is in force, life insurance pays out a death benefit to the designated beneficiaries. This benefit is often a lump sum and is typically tax-free for the beneficiaries.

Terminal Illness: Some life insurance policies offer an accelerated death benefit that allows the policyholder to receive a portion of the death benefit if they are diagnosed with a terminal illness and have a limited life expectancy.

Cash Value Accumulation: Permanent life insurance policies, such as whole life insurance and universal life insurance, accumulate cash value over time. The policyholder can access this cash value through loans or withdrawals during their lifetime.

Debt and Expense Coverage: Life insurance can help cover debts, funeral expenses, and other financial obligations left behind by the insured, providing financial security to their loved ones.

Income Replacement: Life insurance can replace lost income for the insured’s beneficiaries, helping them maintain their standard of living after the insured’s death.

How Much Does Life Isurance Cost?

Life insurance does not typically cover intentional self-inflicted injuries or death resulting from illegal activities. The specific coverage and limitations of a life insurance policy may vary depending on the insurance company and the policy terms.

Key Differences Between Accidental Death & Dismemberment vs Life Insurance

There are several key differences between Accidental Death & Dismemberment vs life insurance. Understanding these differences can help individuals determine which type of coverage is right for their needs.

Here are the key distinctions:

1- Coverage Scope

AD&D insurance provides coverage specifically for accidents, such as those resulting in death, dismemberment, or loss of sight, speech, or hearing. Life insurance, on the other hand, provides coverage for death from any cause, including illness, natural causes, accidents, and even suicide after a certain waiting period.

2- Benefit Payout

AD&D insurance typically pays out a lump-sum benefit only in the event of a covered accident. In contrast, life insurance pays out regardless of the cause of death, providing more comprehensive financial protection to the insured’s beneficiaries.

3- Premiums

AD&D insurance premiums are generally lower than life insurance premiums due to the limited scope of coverage. However, the cost of AD&D insurance may vary based on the insured’s occupation, lifestyle, and other risk factors.

4- Purpose

AD&D insurance is often seen as supplemental coverage to complement life insurance, providing additional protection against accidents. Life insurance serves as a primary means of financial protection for loved ones in the event of the insured’s death.

5- Exclusions

AD&D insurance typically excludes coverage for death or injuries resulting from illness, natural causes, suicide, or activities considered high-risk by the insurer. Life insurance may have similar exclusions but generally provides broader coverage for a wider range of causes of death.

6- Duration of Coverage

AD&D insurance may be term-based, providing coverage for a specific period, or it may be provided as a rider to a life insurance policy. Life insurance can be term life insurance, which provides coverage for a specific term, or permanent life insurance, which provides coverage for the insured’s lifetime as long as premiums are paid.

Understanding these key differences can help individuals make informed decisions about their insurance needs and choose the right coverage to protect themselves and their loved ones.

Should You Get AD&D Insurance or Life Insurance?

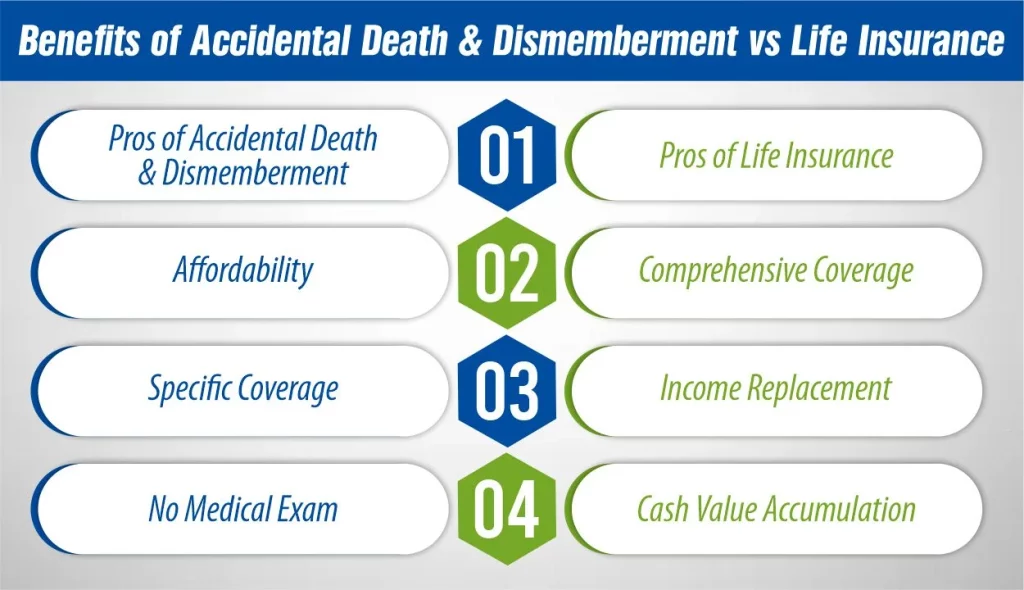

Choosing between Accidental Death & Dismemberment vs life insurance depends on your specific needs and financial situation. Here are the pros and cons of each policy to help you make an informed decision:

AD&D Insurance

- Pros

- Affordability: AD&D insurance premiums are generally lower than life insurance premiums, making it a cost-effective option for supplemental coverage.

- Specific Coverage: AD&D insurance provides specific coverage for accidents, offering financial protection in the event of accidental death, dismemberment, or loss of sight, speech, or hearing.

- No Medical Exam: AD&D insurance may not require a medical exam, making it easier to obtain for individuals with health issues.

- Cons

- Limited Coverage: AD&D insurance only covers accidents and does not provide coverage for death or injuries resulting from illness, natural causes, or suicide.

- Exclusions: AD&D insurance may exclude coverage for certain high-risk activities or pre-existing conditions, limiting its applicability.

- Lump-Sum Benefit: The lump-sum benefit provided by AD&D insurance may not be sufficient to cover long-term financial needs, such as replacing lost income or paying off debts.

Life Insurance

- Pros

- Comprehensive Coverage: Life insurance provides coverage for death from any cause, offering more comprehensive financial protection to the insured’s beneficiaries.

- Income Replacement: Life insurance can help replace lost income for the insured’s beneficiaries, ensuring their financial security.

- Cash Value Accumulation: Permanent life insurance policies accumulate cash value over time, which can be accessed by the policyholder during their lifetime.

- Cons

- Higher Premiums: Life insurance premiums are generally higher than AD&D insurance premiums, especially for comprehensive coverage.

- Medical Exam: Some life insurance policies require a medical exam, which may be a barrier for individuals with health issues.

- Complexity: Life insurance policies can be complex, with various types and options to choose from, requiring careful consideration to ensure the right coverage is selected.

Which Should You Choose?

If you’re looking for affordable supplemental coverage specifically for accidents, AD&D insurance may be a suitable option. However, if you’re seeking comprehensive financial protection for your loved ones in the event of your death, life insurance is likely the better choice. Consider your financial needs, risk factors, and budget when deciding between accidental death & dismemberment versus life insurance to ensure you choose the right coverage for your situation.

Conclusion

Accidental Death & Dismemberment vs life insurance serve distinct purposes in providing financial protection to individuals and their loved ones. While AD&D insurance offers coverage specifically for accidents, life insurance provides comprehensive coverage for death from any cause. So, consider your unique circumstances, risk factors, and financial goals and get the right coverage for you.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.