Yes , When it comes to securing your financial future, understanding high-value life insurance is crucial. Get into our insightful discussion on 10 million dollar life insurance policies. You might be wondering if such a significant investment is necessary or beneficial for your financial goals.

Table of Contents

ToggleIn this blog, we’re going to shed light on who might need this level of coverage, the process of acquiring it, and its potential impact on your financial security. Whether you’re managing a substantial business, looking after a large family, or planning for long-term financial stability, this exploration will help you understand the value and suitability of these policies

Join us as we navigate the essentials of securing your financial future. Most experts say that people have to buy an insurance plan that should be 10 to 15 times their annual income. It would be helpful especially when you own a business or want an amount for real estate property. A 10 million dollar Life Insurance Policy can be a solution for you.

What is a 10 Million Dollar Life Insurance Policy?

A 10-Million Dollar Life Insurance Policy is a substantial coverage plan designed primarily for individuals with significant financial responsibilities or assets. This type of policy ensures that in the event of the policyholder’s untimely passing, a substantial sum of money – in this case, $10 million – is provided to their beneficiaries. It’s particularly relevant for high-net-worth individuals, key business executives, or anyone with large estates or significant family obligations.

Such policies are available in various forms, including term life, whole life and permanent life insurance.

1- Term Life Insurance

One of the most common life insurance types that lasts for a particular time frame. It is much cheaper than a permanent life insurance plan and has only a few tax rules and restrictions. If you need a coverage option to protect your family financially in your absence, term life insurance is the best go-to option.

2- Whole Life Insurance

It’s one of the types of permanent life insurance and perfect for those looking for lifelong coverage. The policy does not expire and also offers a cash value component to the policyholder, that’s why whole life insurance is much more expensive than term life.

3- Universal Life Insurance

Another famous type of permanent insurance is universal life which offers flexibility with the amount of the premiums. Moreover, the policy also allows you to use cash value component accumulation to pay the premiums if you want to.

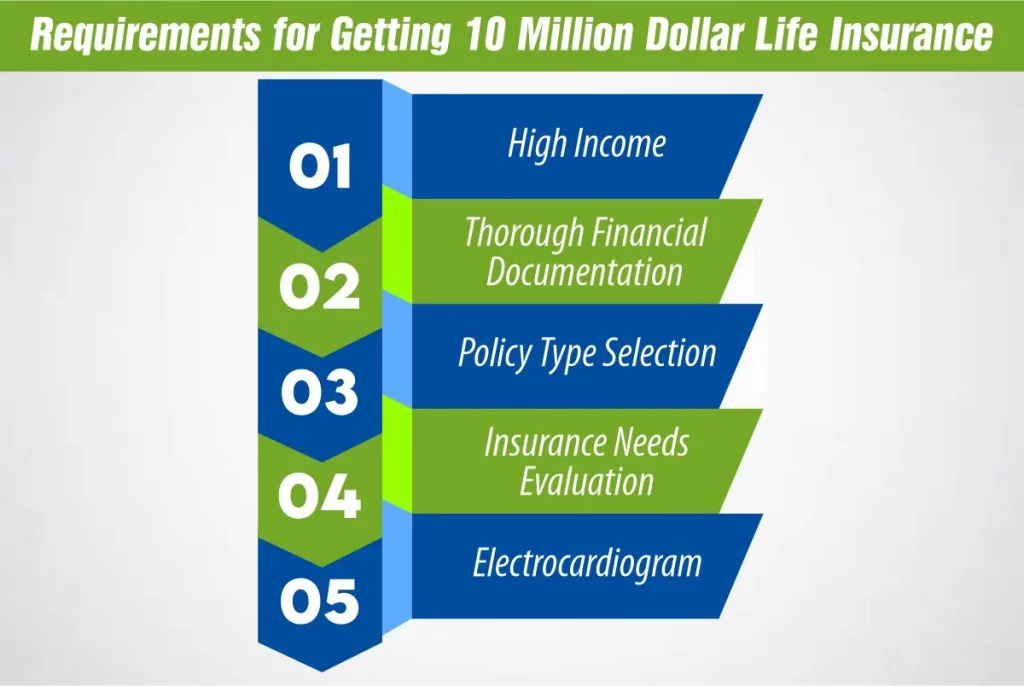

Requirements for Getting 10 Million Dollar Life Insurance

To obtain such substantial coverage, specific requirements and qualifications must be met. These criteria encompass factors like income, financial documentation, policy type selection, and the assessment of your insurance needs.

Additionally, a medical evaluation, including an electrocardiogram, may be necessary to determine your overall health. Now, let’s delve into the specific requirements set forth by MLife Insurance for obtaining life insurance.

High Income:

A substantial income is essential as it reflects your ability to afford the premiums associated with a 10 million life insurance policy, ensuring that you can maintain coverage over time

Thorough Financial Documentation:

Comprehensive financial documentation is crucial for insurers to assess your financial stability, helping them determine the level of risk they’re assuming and the appropriate premium rates.

Policy Type Selection:

Choosing the right policy type aligns your coverage with your financial goals, ensuring that your insurance serves its intended purpose, whether for long-term wealth preservation or short-term protection.

How Much Does Life Isurance Cost?

Insurance Needs Evaluation:

Evaluating your financial obligations and future plans helps determine the adequate coverage amount, ensuring that your loved ones are adequately protected in case of your passing.

Electrocardiogram:

The requirement for an electrocardiogram underscores the importance of assessing your heart health, as it can influence your insurability and the premiums you’ll pay for your policy. A healthy heart can lead to more favorable terms.

How much is a 10 million dollar life insurance policy?

When it comes to the cost of a 10 million dollar, the differences between term life and whole life insurance are substantial. While term life insurance is more affordable, with a 40-year-old woman potentially paying around $500 a month, whole life insurance is significantly pricier, possibly costing around $11,000 a month for the same individual.

The cost disparity mainly stems from the comprehensive nature of whole life insurance. However, actual rates vary greatly depending on factors such as age, health, gender, and lifestyle, underscoring the importance of personalized quotes to gauge the exact cost for your specific situation.

How do you get a 10 Million Dollar Life Insurance Policy?

A life insurance policy is a significant decision that requires a careful and informed approach. Following a structured process is crucial to ensure the policy aligns perfectly with your unique financial situation and long-term objectives.

It’s not just about purchasing insurance; it’s about making a strategic choice that impacts your financial security and legacy. Adhering to this process ensures you make an informed, well-considered decision that truly benefits you and your loved ones.

Assess Your Needs:

Look closely at your finances. A 10 million life insurance policy is typically for those with sizable assets or businesses. Ask yourself: Do you have debts or obligations that need covering? Are there family members who depend on your income? This policy can secure their future.

Choose the Right Policy:

Term life insurance covers you for a set period and is usually cheaper. It’s good if you need coverage for a specific time, like while paying off a mortgage. Permanent life insurance, like whole or universal life, lasts a lifetime and can build cash value, making it a long-term financial tool.

Detailed Application:

The application process is thorough. Insurance companies will review your health, lifestyle, and financial status to gauge risk. Expect to provide medical history, undergo a physical exam, and submit financial documents like income statements.

Seek Expert Advice:

Navigating high-value life insurance can be complex. Financial advisors or specialized insurance agents can guide you, explain the nuances of different policies, and ensure you’re getting a policy that matches your needs.

Compare and Choose:

Finally, shop around. Each insurance company has different offerings and rates. Comparing them helps you find the policy that gives you the most value, considering factors like premiums, coverage terms, and added benefits.

Reasons for Buying a 10 Million Dollar Life Insurance Policy

Securing Your Family’s Future:

With a $10 Million Life Insurance policy, you’re not just covering everyday expenses; you’re ensuring your family maintains their lifestyle and future goals without financial worry. It’s about giving them a secure future, no matter what happens.

Safeguarding Business Interests:

For business owners, this policy is crucial to protect your life’s work. It ensures that your business can continue or be properly settled, safeguarding the interests of your partners and employees.

Efficient Estate Management:

The 10 Million Life Insurance policy is a smart move for estate planning. It provides the funds needed to handle estate taxes and other obligations, ensuring your wealth is passed on efficiently and according to your wishes.

Flexibility in Financial Planning:

These policies often come with options that can adapt to your changing financial needs, making them a dynamic tool in your overall financial strategy.

Building a Legacy Beyond Wealth:

This policy allows you to leave a lasting impact, whether it’s through supporting your children’s education, contributing to charities, or funding community projects.

Frequently Asked Questions (FAQ)

Q1: Can anyone get a life insurance policy from MLife Insurance?

Obtaining a life insurance policy from MLife Insurance is indeed possible, but eligibility is stringent. To secure such coverage, you’ll typically need a substantial income, approaching or exceeding one million dollars per year.

Q2: Are medical exams required for 10 million dollar life insurance policies?

Yes, a comprehensive medical examination is a mandatory step in the underwriting process. However, it’s important to note that having certain health conditions won’t necessarily disqualify you.

Q3: Should I choose a term or whole life policy?

Your choice between a term or whole life policy from MLife Insurance should align with your long-term financial goals. Whole life policies, while more expensive, provide lifelong coverage, whereas term policies, while more affordable, only cover a specified period.

Q4: What’s the bottom line when considering such a large policy from MLife Insurance?

To qualify for a 10 million dollar life insurance policy from MLife Insurance, you’ll need a considerable estate and solid financial backing. It’s essential to compare your options diligently before selecting an insurance provider.

Q5: What’s the difference between term and whole life policies at this coverage level from MLife Insurance?

Term life policies are more budget-friendly and provide coverage for a specific duration. On the other hand, whole life policies offer lifelong coverage but come with a higher price tag.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.