Last Updated on: March 10th, 2025

- Licensed Agent

- - @M-LifeInsurance

When you pass away, life insurance protects your family members financially. Before buying a policy, you must select beneficiaries who will receive the death benefit payment, also known as the payout. Your selection of proper beneficiaries plays a key role in directing your funds to the people you want to receive them.

Your life insurance policy contains two main beneficiary categories, which include primary and contingent. Primary beneficiaries hold the position to receive the policy payout first. The funds from a policy payout go to a contingent beneficiary who steps in only when the primary beneficiary dies or lacks the ability to receive benefits. Having both types of beneficiaries established helps eliminate funding disruptions and processing delays.

The payout process faces complications when a beneficiary passes away before the insurance company makes its payment. The insurance payout will go to your estate when you only have one deceased primary beneficiary and no alternate (contingent) beneficiary named in your policy. The legal process known as probate emerges when you die, which delays distribution time and reduces benefits through expenses for taxes and legal fees.

Periodic reviews of your beneficiary designations help prevent problems with the distribution process. Insurance payouts should be updated whenever significant life events occur, including marriage, divorce, and childbirth. A current insurance policy guarantees that your intended financial support reaches the loved ones you want to receive it.

Proactive planning through life insurance allows your family to experience easy and stress-free payouts from their policy.

How Beneficiaries Work in Life Insurance

As a life insurance policy owner, you need to designate beneficiaries before the policy becomes effective because they will receive the death benefit payout when you die. A life insurance policy has two distinct types of beneficiaries, which include primary and contingent.

- The primary beneficiary stands ahead in receiving insurance payout distributions. The insurance payout can be distributed among one or multiple named primary beneficiaries according to your specified breakdown.

- The contingent beneficiary acts as the backup option. The contingent beneficiary receives the funds whenever either the primary beneficiary dies before you or becomes unable to claim the payout.

Why is it important to name multiple beneficiaries?

Life insurance beneficiaries need to include both primary choices and backup selections to prevent legal hurdles when benefit distribution occurs. Your life insurance benefit payout might not reach your family members directly without naming backup beneficiaries because life events remain unpredictable.

What happens when there is no contingent beneficiary?

The insurance payment goes to your estate when the primary beneficiary dies without selecting a backup beneficiary. Probate begins when no contingent beneficiary exists and results in legal proceedings that delay the financial fund distribution. Probe leads to reduced payments because it creates expenses for legal fees together with estate taxes.

Regularly reviewing and updating beneficiary designations helps prevent unwanted problems from occurring. Your designated beneficiaries will obtain necessary financial assistance through your account because you have established proper payment protocols.

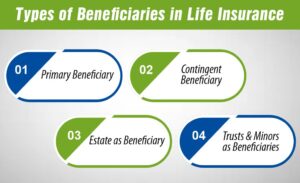

Types of Beneficiaries in Life Insurance

People who receive the life insurance payout after death must be selected when opening a life insurance policy. The comprehension of various beneficiary types allows you to direct your money to specific recipients.

- Primary Beneficiary: Primary beneficiaries have the highest priority to receive any payout funds. The primary beneficiary list can include one or more individuals with assigned percentage distributions for each person.

- Contingent Beneficiary: The backup position belongs to the contingent beneficiary. The contingent beneficiary takes possession of the funds whenever the primary beneficiary passes away or cannot receive the payout. The choice of a backup beneficiary helps avoid payment delays and legal issues.

- Estate as Beneficiary: The insurance policy proceeds will go to your estate when you have not designated any surviving beneficiaries. The legal process known as probate slows down fund distribution and reduces the payment amount through court costs and taxation. You should maintain regular updates with your selected beneficiaries.

- Trusts & Minors as Beneficiaries: The transfer of insurance benefits to minors poses difficulties because insurance companies are restricted from paying funds to unemancipated beneficiaries. The funds can be handled by a trust or a legal guardian until the child becomes an adult.

Efficient reviewing of your beneficiaries makes the payout process efficient and less cumbersome to your loved ones by avoiding legal complications.

What Happens If the Beneficiary Is Deceased?

Life insurance ensures financial support for your loved ones, but what happens if a beneficiary passes away? The insurance outcome depends on the beneficiary’s death timing as well as the existence of a designated contingent beneficiary.

If the Primary Beneficiary Dies Before the Policyholder

When your primary beneficiary dies without policy modifications, the beneficiary distribution moves down to the next listed contingent beneficiary. The payout from your policy follows your estate when there are no specified contingent beneficiaries because no one has been named to receive the benefits. This process can extend to probate expenses.

If the Primary Beneficiary Dies After the Policyholder but Before Claiming the Payout

When the primary beneficiary survives you, their inheritance would be added to their estate if they die before receiving the payment. State laws will determine the fund distribution if no will exists or if their will specifies the fund distribution.

If There’s No Contingent Beneficiary Listed

The death benefit payment goes to your estate when no designated contingent beneficiary exists. Estate taxes, together with legal delays, will decrease your family’s inheritance from your life insurance payout when you have no contingent beneficiary arrangement.

What Happens to Life Insurance Without a Valid Beneficiary?

Payment will follow your policy’s conditions when you lack valid beneficiaries because your estate becomes responsible for the funds. The protection of your loved ones depends on frequent examination and modification of your beneficiary information to prevent complications during the payout process.

How Much Does Life Isurance Cost?

Who Gets the Life Insurance Payout in Different Scenarios?

The amount of life insurance payments depends on the designated beneficiary along with any designated backup plan. When a policy owner picks different scenarios for payment distribution, this is what takes place:

- If a Contingent Beneficiary Is Named: Your specified contingent beneficiary will receive the insurance payout payments if you cannot take the funds or are no longer living. The designated recipient receives the funds by avoiding legal complications and waiting times.

- If No Contingent Beneficiary Is Listed: If the primary beneficiary is deceased and there is no contingent beneficiary, the payout typically goes to the policyholder’s estate. This can cause delays due to probate, where the court decides how to distribute assets. Probate may also reduce the payout due to legal fees and estate taxes.

- If the Policyholder’s Estate Receives the Payout: Life insurance proceeds that end up at the estate naturally transform into total assets of the policyholder. The payment amount follows the estate management procedures defined by the policyholder in their will. State laws will decide the recipients of insurance funds in case the deceased person did not create a valid will.

- If State Inheritance Laws Determine the Payout: State laws determine the money distribution process when an estate contains no valid beneficiaries and no formal will exists. Most insurance benefits flow directly to the nearest family members who are still living including spouses or children. The beneficiary distribution process extends over time as it does not necessarily match what the policyholder initially intended.

To avoid these complications, it’s essential to keep your beneficiary designations up to date.

Importance of Naming a Contingent Beneficiary

When making choices about life insurance benefits, the choice of a backup recipient is as essential as selecting your preferred recipient. Your life insurance payout has a backup arrangement through contingent beneficiaries to give the benefits to the suitable person in case the primary recipient becomes unable to receive them.

How a Contingent Beneficiary Prevents Complications

The role of a contingent beneficiary is to handle the payout when the primary recipient becomes unavailable to claim it. Probate becomes necessary when you lack a designated beneficiary, which means your estate takes possession of the funds while the legal process of probate delays fund access along with reducing the total amount due to payment of legal fees and taxes.

The Process of Updating and Changing Beneficiaries

People need to review their beneficiaries regularly because life situations transform over time. Changes such as marriage and divorce as well as the birth of children or the death of any beneficiary listed warrant revising your policy. Policy updates can be accomplished quickly through both online forms and direct entries accessible to most insurance companies.

How to Ensure Your Life Insurance Payout Goes to the Right Person

To protect your loved ones, always:

✔ List both primary and contingent beneficiaries.

✔ Provide accurate personal details (full name, relationship, contact information).

✔ Review your policy regularly to keep it up to date.

Your life insurance payment will get to its preferred recipient via a contingent beneficiary designation which prevents legal time delays and unintended issues.

Tips for Protecting Your Life Insurance Beneficiaries

Strategic planning determines how life insurance payments get delivered to the intended beneficiaries. The following steps serve to safeguard your beneficiaries:

- Keep Your Beneficiary List Up to Date: Relationship events, including marriage or divorce, and parenthood events, including childbirth, should be checked when choosing your policy beneficiaries. Periodic review of your policy keeps payouts directed toward their intended recipient.

- Consider Legal and Tax Implications: Legal tax problems may arise when giving assets to minors or estates through inheritance. A trust provides a suitable alternative when selecting a minor as beneficiary. A professional financial expert will assist you in making the right choices.

- Designate Contingent Beneficiaries: Having a secondary beneficiary appointed as your backup will help your payout avoid the probate process to prevent delays while also reducing expenses due to legal fees.

- Work With a Financial Planner or Attorney: A professional analyst assists individuals with complicated finances to align their insurance policy with their estate planning objectives.

FAQs

What is a primary beneficiary in life insurance?

A primary beneficiary stands in the first position to collect life insurance payment upon the policyholder’s death. You can choose one or more primary beneficiaries and set individual percentages on how much benefit each will get.

What is a contingent beneficiary?

The backup recipient of life insurance payout funds is designated as the contingent beneficiary. The life insurance money flows to the contingent beneficiary when either the primary claimant passes away or cannot receive the benefit.

What happens if the primary beneficiary dies before the policyholder?

The funds from life insurance policies usually go to the estate when the primary beneficiary dies before the policyholder without a named contingent beneficiary, thus triggering possible probate complications.

What happens if the primary beneficiary dies after the policyholder but before claiming the payout?

The funds from the life insurance policy become part of the primary beneficiary’s estate, which will be distributed according to their will or state regulations if they survive beyond the policyholder but precede the payout.

Why is naming a contingent beneficiary important?

The contingent beneficiary provides a simple method for life insurance payout transfer in cases where the primary recipient is unable to accept it. The arrangement prevents probate procedures and delays together with financial losses from tax-related expenses and legal costs.

Conclusion

Selecting a contingent beneficiary represents an essential measure to obtain straightforward and problem-free policy payouts through life insurance coverage. The contingent beneficiary assumes the role of payout recipient if the primary beneficiary cannot claim the insurance benefits, thus both avoiding delays and probate issues. Using this easy method allows the distribution of your intended financial support to reach your loved ones.

A life insurance policy needs periodic review along with updates and changes. New life situations, including marriage, divorce and childbirth, require review of your chosen beneficiaries. You should maintain an updated policy because it will direct your insurance payments immediately to your intended recipient without confronting legal complications.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.