Last Updated on: April 7th, 2025

- Licensed Agent

- - @M-LifeInsurance

When buying a life insurance policy, one of the first things you’ll notice is the face value. But what does that actually mean? And how does it affect your loved ones when they need to use the policy the most?

Understanding the face value of a life insurance policy is key to making sure your family is financially protected in your absence. It helps determine how much money will be available for final expenses, debts, and future needs. In this guide, we’ll explain what face value is, how it works, what factors affect it, and how to choose the right amount for your situation.

What Is the Face Value of a Life Insurance Policy?

The face value of a life insurance policy is the death benefit amount the insurance company agrees to pay your beneficiary when you pass away. This is the amount written on the face of the policy, hence the name “face value.”

In simple terms, it’s the dollar amount printed on your policy — the amount your loved ones will receive upon your death. It is the promise the insurance company makes to pay a certain sum if the policyholder dies while the policy is active and all premium payments have been made.

For example, if you purchase a life insurance policy with a $250,000 face value, your beneficiary will receive $250,000 after your death, assuming all policy requirements are met. This payout can be used to cover funeral costs, pay off debts, or provide ongoing financial support for your dependents.

Face value is sometimes also referred to as:

- Policy’s death benefit

- Coverage amount

- Nominal value

It’s the most important number in your policy because it directly affects how much financial help your family gets when you’re no longer around.

How Face Value Works in Life Insurance

When you apply for a life insurance policy, you choose the amount of coverage you want. This becomes the face value. Once the policy is active and you continue paying your premiums, your beneficiaries will receive this full amount if you pass away.

Face value stays the same for most life insurance policies. However, there are certain types of policies and optional features (called riders) that can change the payout. Regardless of policy type, the face value represents the maximum amount the insurer is obligated to pay.

Key Points:

- Fixed Amount: Most policies have a fixed face value that does not change.

- Tax-Free Payout: In most cases, the death benefit is not taxed, providing a full payout to your beneficiaries.

- Payout Timing: The face value is paid out once the insurance company processes and approves the claim. This usually takes between 2 to 8 weeks depending on the complexity of the case and documentation.

Face Value vs. Cash Value: What’s the Difference?

If you have a permanent life insurance policy, such as whole life or universal life, it may build something called cash value over time. This can create some confusion about what your beneficiaries will actually receive.

Here’s the difference:

| Feature | Face Value | Cash Value |

| Purpose | Death benefit for beneficiaries | Living benefit you can borrow or withdraw |

| Access | After your death | While you’re alive |

| Grows Over Time | Usually fixed | May grow with interest or investment returns |

| Part of Death Benefit? | Not always | Sometimes added, sometimes not |

Cash value grows slowly and can be accessed while you’re alive. It’s like a savings component attached to your life insurance. However, when you die, the face value is typically what’s paid out — not the face value plus cash value — unless you’ve chosen a policy that explicitly includes both.

So, face value is what your loved ones get. Cash value is what you can use during your lifetime.

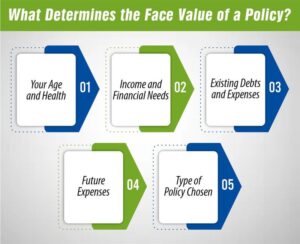

What Determines the Face Value of a Policy?

Several factors help determine how much face value you need or can qualify for. Choosing the right amount requires thoughtful planning about your current and future financial responsibilities.

1. Your Age and Health

- Insurance companies assess your life expectancy when underwriting a policy. Younger, healthier applicants can qualify for higher face values at lower costs because their risk of death is lower.

2. Income and Financial Needs

- Providers consider your annual income when approving higher face value policies. A general rule of thumb is to purchase a face value equal to 7 to 10 times your annual salary. This ensures your family can maintain their lifestyle without your income.

3. Existing Debts and Expenses

- Include your mortgage, car loans, credit card debt, student loans, and other financial obligations. Your life insurance should cover these so your family doesn’t inherit the burden.

4. Future Expenses

- Think about future financial needs such as children’s education, wedding costs, or long-term care for a spouse or parent. A higher face value ensures these expenses are taken care of.

5. Type of Policy Chosen

- Term life insurance typically allows for higher face values at a lower cost because it only provides coverage for a set number of years.

- Permanent policies like whole life or universal life often have lower face values due to the added savings and investment components.

Can Face Value Change Over Time?

While most life insurance policies have a fixed face value, there are scenarios where the amount can change. Understanding these will help you avoid surprises later.

Face Value Can Increase:

- Riders like an accidental death benefit may increase the payout if death occurs due to an accident.

- Increasing term policies or inflation-protection riders may raise the face value annually.

Face Value Can Decrease:

- Decreasing term insurance is designed to reduce the face value over time, often in line with a decreasing debt like a mortgage.

- If you borrow against your policy and don’t repay it, the insurer may subtract the loan from the face value upon death.

- Policy withdrawals or missed premium payments in certain types of policies can also reduce the payout.

Choosing the Right Face Value for Your Needs

Here’s a step-by-step guide to help determine how much face value your life insurance should offer:

How Much Does Life Isurance Cost?

Step 1: Estimate Your Family’s Financial Needs

Calculate how much your loved ones would need to:

- Cover funeral and burial costs (typically $7,000 to $12,000)

- Pay off debts like mortgages, car loans, credit cards

- Replace your income for several years

- Support long-term expenses such as education or retirement

Step 2: Subtract Existing Assets

List out what you already have that can be used toward these needs, including:

- Personal savings

- Retirement accounts

- Employer-provided life insurance

- Other investments

Step 3: Choose a Coverage Multiplier

Most experts suggest a life insurance face value of 7 to 10 times your annual income. If you make $60,000 a year, a policy ranging from $420,000 to $600,000 is a good starting point.

You can also use online calculators that account for age, income, debt, family size, and lifestyle.

Common Misunderstandings About Face Value

Let’s bust a few myths about face value:

Myth 1: “Face value includes the cash value.”

❌ Not always. In many permanent life insurance policies, only the face value is paid unless your policy is designed to add the cash value to the death benefit.

Myth 2: “Face value increases automatically over time.”

❌ Not unless you’ve added an inflation or increasing death benefit rider. Most face values remain fixed for the duration of the policy.

Myth 3: “Face value is the total amount I’ve paid into the policy.”

❌ Not true. In fact, the face value is typically much higher than the total amount you’ve paid in premiums. This is the core benefit of life insurance.

Understanding the terms and structure of your policy helps ensure you and your family aren’t caught off guard.

How Face Value Supports Final Expenses

Many people buy life insurance to ensure that their family has enough money to handle end-of-life expenses, which can be surprisingly high. The face value can be used for:

- Funeral and burial costs (often $10,000 or more)

- Cremation services, which are slightly less expensive

- Medical bills, especially if there was a long illness before death

- Legal or probate fees involved in settling the estate

- Outstanding debts, like credit cards, loans, or unpaid taxes

- Ongoing household expenses until your loved ones get back on their feet

Having sufficient face value ensures your family is not financially overwhelmed while grieving.

Frequently Asked Questions

Is face value the amount my beneficiary will receive?

Yes, as long as the policy is in good standing and no loans or deductions apply, the beneficiary will receive the full face value.

Is the face value taxable?

Generally, no. Life insurance payouts are usually tax-free. However, interest earned on the payout or situations involving large estates may have tax implications.

Can I increase the face value later?

Some policies allow increases, often with additional underwriting. Others may not permit changes once the policy is issued. Always ask your insurer before buying.

What happens if I outlive my term life policy?

If you reach the end of your term, the policy expires, and no payout is made. You may have the option to renew, convert, or buy a new policy depending on your age and health.

Conclusion:

The face value of your life insurance policy is more than just a number — it’s the financial legacy you leave behind. It represents peace of mind, security, and protection for your loved ones when they need it most.

When choosing a life insurance policy:

- Understand your financial obligations now and in the future

- Estimate your family’s long-term needs in your absence

- Select a face value that fits your budget and goals

A properly chosen face value ensures your family is not left struggling financially. Take the time to evaluate your needs or speak with a licensed insurance advisor who can guide you to the best solution.

Need help choosing the right face value for your policy? Talk to one of our licensed insurance experts today and get a free, personalized recommendation. Let’s build the protection your family deserves.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.