Last Updated on: February 25th, 2025

- Licensed Agent

- - @M-LifeInsurance

Introduction

Life insurance for children is financial protection against sudden, unforeseen events. The primary purpose of child life insurance differs from adult life insurance because it establishes future insurability while accumulating savings value.

Why Securing Financial Protection Early Matters

Life insurance policies acquired early have several specific advantages for your child. The premium cost remains low, together with a guarantee that coverage will not be affected by future health conditions. Early financial planning adds essential protection through adulthood for your child.

Common Reasons Parents Consider Child Life Insurance

Parents explore child life insurance for several reasons, including:

- Future Insurability: Lock in coverage regardless of future health issues.

- Savings Growth: Some policies build cash value, which can be used for education or major expenses.

- Final Expenses: Although difficult to consider, it provides funds for unforeseen medical or funeral costs.

- Peace of Mind: Knowing you’ve taken steps to protect your child’s future offers lasting comfort.

A child life insurance purchase offers both protection and security, which enhances your child’s ability to fulfill their financial requirements in the future.

What Is Life Insurance for Children?

The purchase of life insurance by parents or guardians protects their child’s financial needs for the future through a policy. The policy offers a death benefit upon the child’s death, yet its most valuable feature is the accumulating cash value through time. A policy owner can access the built-up cash value to fund education expenses or launch a business at a later stage. The premiums for this insurance type stay steady from policy inception until policy expiration.

Key Differences from Adult Life Insurance

Life insurance for adults provides income protection and debt relief, while child life insurance offers protection against potential health issues together with savings benefits. Children’s insurance covers them no matter what health issues develop in the future, yet adult policies must evaluate health status during enrollment. Young children pay lower insurance premiums, and thus early coverage acquisition is an economic decision.

Policies Designed Specifically for Minors

Whole-life insurance policies cover children specifically through insurers. These plans:

- People who increase premium payments will get unlimited coverage benefits.

- The policy accumulates cash value through tax-free growth.

- This policy should enable later ownership transfers to the child.

The purchase of child life insurance provides dual benefits of protection and financial opportunities, thus bringing comfort to families.

Types of Life Insurance for Children

A. Whole Life Insurance for Children

Whole life insurance for children is a type of permanent insurance that provides the policyholder with coverage for the entire lifetime. This specialized plan is not just coverage that pays out in the event of death but serves as an investment for your child’s future.

What It Covers & Benefits:

- Lifetime Protection: Ensures that your child receives the death benefit for his or her lifetime.

- Fixed Premiums: Provides fixed low prices that do not escalate at any particular age range of the client.

Cash Value Accumulation & Borrowing Options:

- Tax-Deferred Savings: Customers who make premium payments see their policies accumulate a cash value that grows into a beneficial savings resource.

- Flexible Borrowing: Policyholders gain access to cash reserves by taking out loans that they can apply toward educational needs as well as emergencies and vital objectives.

Long-Term Financial Planning Benefits:

Whole-life insurance for children proves to be a strategic financial decision that establishes long-term safety measures. Your child will keep their eligibility for insurance no matter what happens to their health through whole-life insurance and simultaneously accumulate funds to support life’s defining moments.

B. Term Life Insurance for Children

Children typically do not qualify for pure-term life insurance, but there are viable alternative insurance solutions.

- Child Riders on Parent Policies: Insurance companies provide rider coverage benefits, which include protection for children under parental policies. These riders protect children who are still growing at affordable rates so they stay covered by their family’s policy.

What is the Best Type of Life Insurance for a Child?

Life insurance selection for your child depends on three main considerations, including price, protection span, and enduring financial advantages. Families often ask, What is the best type of life insurance for a child? to ensure both immediate protection and future financial growth.

Factors to Consider

- Cost: The initial premium cost for whole-life policies might be higher, yet premiums remain affordable throughout the policy period.

- Coverage: The protection from whole life insurance continues indefinitely, yet parents can access term life insurance coverage through their child rider policies.

- Long-Term Benefits: The cash value accumulates over time through savings features in some policy functions to cover educational needs and support unplanned financial requirements.

Comparing Options

Children often choose whole life insurance because it provides permanent coverage alongside cash value accumulation. The main features of child-term life insurance differentiate from whole life programs because they supply basic coverage through parental policies but offer no cash value and provide temporary insurance benefits at a low cost. The long-term growth objective of dedicated savings plans excludes a death benefit as one of its main benefits.

Best Providers & Unique Features

Most of these firms have unique ways of setting their premiums, ways of lending money, and riders that are associated with these policies. Thus, the most suitable type of insurance for a child is the one that stipulates the financial aims and objectives of the family and should guarantee a perfect, safest kind of life ahead.

Can You Get Life Insurance as a Kid?

Many parents ask, Can you get life insurance as a kid? and the answer is yes. It is possible to buy life insurance for a child for purposes of long-term financial planning and getting future insurability. This is because policies set for children do not involve much paperwork when it comes to approval for young applicants.

How Much Does Life Isurance Cost?

Eligibility and Requirements

A child has to ensure the experienced general conditions, including age, domicile, and others. Due to the legal regulations of contract laws, which do not allow their signing by minors, they are supposed to be represented by parents or legal guardians who fill out the application forms on their behalf. This requires inputs of identification and parental consent in compliance with all the legal measures required in this procedure.

Age Restrictions & Medical Check-Up Requirements

Age restrictions vary among insurers. While some providers may start with infancy up to the teenage years, others may only need a health questionnaire. Medical examinations are frequently brief, exclude screening for risks, and are primarily oriented toward other goals.

Life insurance is a type of insurance that people often take to have protection for life, and effectively, it has an element of savings that is invested as soon as a policy is purchased. It is an innovative one, making certain that your child will always be taken care of, in addition to being free in structuring. Policies should be looked into, and the advice of an insurance professional should be sought in a bid to identify the most suitable one for one’s family.

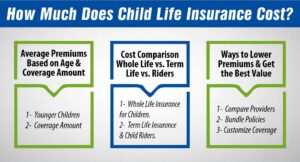

How Much Does Child Life Insurance Cost?

Therefore, what affects How much a child’s life insurance costs is the age of the child, the specified amount, as well as the type of policy to be purchased.

Average Premiums Based on Age & Coverage Amount

- Younger Children: Generally have lower premiums resulting from superior health status.

- Coverage Amount: Higher coverage entails a higher premium. Hospitals and other medical facilities may provide affordable care plans based on your desired payment plans and finances.

Cost Comparison: Whole Life vs. Term Life vs. Riders

- Whole Life Insurance for Children: Provides benefits for life and also has a cash value component, but has higher premiums since it is a permanent product.

- Term Life Insurance & Child Riders: The policies or riders serving as affordable solutions grant temporary coverage, which acts as a budget-friendly protection option for families requiring basic insurance.

Ways to Lower Premiums & Get the Best Value

- Compare Providers: One can easily compare the provider rates and get the best deal that they need.

- Bundle Policies: You should note that some insurers will give discounts when you take child insurance with other family or parent policies.

- Customize Coverage: Tailor your coverage to match your child’s needs without overpaying for unnecessary benefits.

Life Insurance Quotes for Children: How to Get the Best Deal

When searching for life insurance quotes for children, it’s essential to use trusted online tools that offer instant comparisons. You can generate instant quotes on multiple reputable sites through their online tools by filling in basic information. The platforms showcase different policy choices while delivering quick comparison data about costs and protection details.

Where to Get Instant Quotes Online

- Insurance Comparison Sites: Users can view several policy quotes simultaneously using specialized comparison services.

- Direct Provider Websites: Many insurance providers operate online quote calculators that deliver customized policy estimates for children.

- Financial Advisor Platforms: The process guidance along with best deal selection is provided to clients through digital resources by certain advisors.

Factors That Affect the Quotes

Several key factors determine your child’s life insurance quote:

- Child’s Age: Younger children usually enjoy lower premiums due to their excellent health.

- Coverage Amount: Insurance premiums increase automatically as coverage extent rises.

- Policy Type: Whole-life insurance policies exceed the cost of both term policies and child riders in premium rates.

- Additional Riders: Additional features or riders will hike up the total expense.

Tips for Securing Affordable Rates

- Compare Multiple Providers: Analyze numerous insurance quotes to identify the most favorable pricing.

- Bundle Policies: Research the possibility of acquiring discounts by adding your child to existing family insurance.

- Tailor Coverage: Select a policy that meets your family’s needs without paying for unnecessary extras.

Is Life Insurance for Children Worth It?

The decision to buy life insurance for children requires an examination of its advantages together with its potential disadvantages.

Pros and Cons of Child Life Insurance

Pros:

- Guaranteed Insurability: The policy provides coverage no matter what health problems arise in the future.

- Cash Value Growth: Insurance policies generate cash reserve benefits that users can retrieve at a later stage.

- Affordable Premiums: The enrollment period allows you to secure rates that stay low.

Cons:

- Limited Immediate Returns: Long-term-oriented employees’ benefits fail to meet the needs of short-term financial requirements.

- Opportunity Cost: The premium money could instead be directed to build specific savings accounts and educational funds.

Alternative Investment & Savings Options

Families should consider establishing educational savings accounts or multifunctional investment plans that provide security and educational fund accumulation.

Real-Life Scenarios Where Child Life Insurance Helps

Most families utilize child life insurance as a dependable foundation for their long-term financial preparations in actual life situations. Protection plans provide both future financial security and a safe feeling while children become adults when you purchase them to handle emergencies such as medical issues or school funding requirements.

Frequently Asked Questions (FAQs)

What is the best type of life insurance for a child?

A whole life insurance policy guarantees life coverage and has a cash-funded value, which can be pocketed in the future. The term is relatively cheaper but limited in duration, while savings is an investment for growth without any death benefit. In choosing one of these options, the factors that have to be considered include the cost factor, the value of benefit options, and flexibility concerns.

Can you get life insurance as a kid?

Yes, parents or legal guardians can apply. Coverage is available from infancy without requiring medical exams, making the process simple.

How much does child life insurance cost?

Premiums typically range from $5 to $30 monthly, depending on age, policy type, and coverage limits. Early enrollment often secures lower rates.

At what age does a child need their own life insurance?

Purchasing early ensures affordable premiums and a smooth transition to adult policies, providing long-term financial security.

What happens to a child’s life insurance when they turn 18?

Most policies convert to adult coverage without exams, allowing continued benefits and cash value growth into adulthood.

Conclusion

Long-term financial stability benefits from the valuable asset that child life insurance offers. Whole life insurance combines permanent protection with growing cash values; term life insurance delivers cost-effective short-term coverage; and savings plans build financial capital through deposits. When selecting a child’s life insurance plan, parents need to analyze both premium costs and insurance coverage along with policy benefits for the future. Premium rates and insurability assurance become better with early applications to the policy. Parents need to research different insurance providers while reviewing their quotes in order to choose a policy that meets their financial and personal objectives for their child.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.