Are you looking for a way to ensure your loved ones aren’t burdened with unexpected expenses during an already difficult time? State Farm burial insurance offers a compassionate solution to manage the financial aspects of end-of-life expenses. With reliable coverage options tailored to meet your specific needs, State Farm helps secure peace of mind for you and your family. Discover how easy it is to arrange for final expenses so you can focus on what truly matters—cherishing the memories of a life well-lived. Why not take the first step today and learn more about the benefits and ease of obtaining burial insurance through State Farm?

About State Farm

State Farm is one of the largest insurance and financial services companies in the United States, known for its wide range of insurance products and services. Established in 1922 by retired farmer and insurance salesman George J. Macherley, it was initially focused on car insurance for farmers. Over the years, the offering has expanded to include homeowners, life insurance, and banking products, among others.

State Farm operates through specialist employees and stands out through its local presence and personalized customer service. The company’s motto, “Like a good neighbor, there’s State Farm,” emphasizes commitment and trust in the community. In addition to insurance, State Farm also participates in several community education programs, reflecting its commitment to public safety and community development.

Medical or physical examination for state farm burial insurance

No Exam is required for state farm cemetery insurance. State Farm’s final expense insurance, commonly referred to as burial insurance, is designed to be convenient and straightforward, typically requiring no medical or physical examination. It is usually based on health questions that the application answers and provides such a system. It is primarily aimed at covering end-of-life expenses such as funeral expenses and is generally easier to qualify for than traditional life insurance plans.

Costs Associated with State Farm Burial Insurance

The factors that affect price

The cost of cemetery insurance from State Farm can vary depending on factors such as the applicant’s age, health, and how much coverage they want. Because burial insurance generally offers lower premiums, premiums are usually more expensive compared to traditional life insurance policies.

You received a quote.

To determine exact pricing, potential policyholders should contact State Farm directly or consult with a State Farm representative for a personalized quote that reflects their specific needs and circumstances.

State Farm Funeral Insurance Review

Financial security for loved ones

Funeral insurance from State Farm can reduce the financial burden on family members by paying final funeral expenses, ensuring that they do not have to spend their personal savings or assets role.

Consider your financial situation.

The advantages of investing in funeral insurance with State Farm should be evaluated based on a person’s financial stability, existing life insurance, and expected funeral expenses. For those without a large savings account or life for new insurance, funeral arrangements can be a lucrative investment.

The peace of mind

Aside from financial issues, having funeral insurance provides peace of mind, knowing that funeral expenses will be taken care of without putting financial pressure on loved ones.

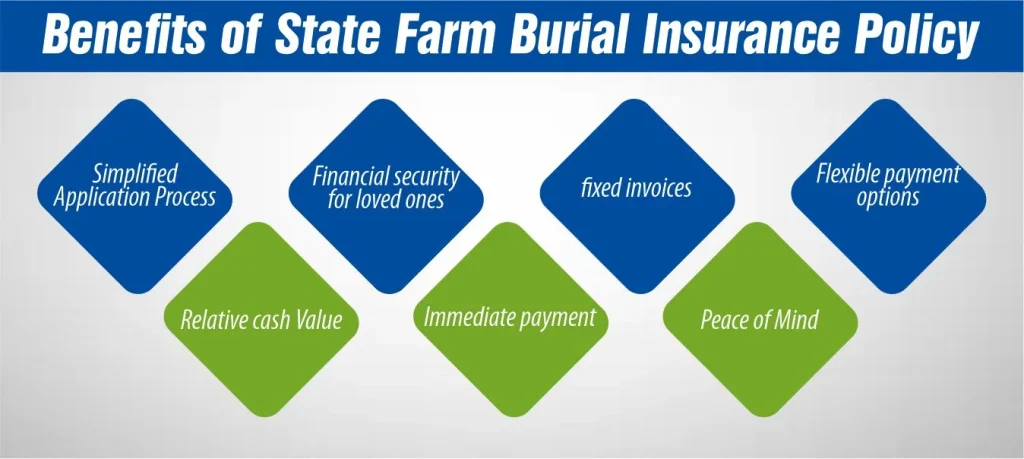

Benefits of State Farm Burial Insurance Policy

Simplified application process

One of the main advantages of State Farm cemetery insurance is the ease of application process. Potential insurers are not required to undergo a medical exam, which makes it easier to access, especially for the elderly or those with health problems. The guide answers a number of questions about health in general, making the process much easier.

Financial security for loved ones

State Farm’s cemetery insurance provides financial protection for family members by covering the costs of funerals and burials. This saves loved ones the financial burden of funeral expenses during difficult times.

fixed invoices

Premiums for State Farm funeral insurance are fixed, meaning they don’t increase as the policyholder ages. This forecast enables better financial planning and ensures that coverage remains affordable throughout the policyholder’s lifetime.

Flexible payment options

State Farm offers flexible payment options to fit a variety of needs and budgets. Policyholders can choose the amount of coverage that suits their anticipated funeral expenses and other final expenses, ensuring they are not underinsured or paying exorbitant premiums and unnecessary expenses.

Relative cash Value

State Farm’s cemetery insurance policies include a portion of the cash value, which accumulates over time and can be borrowed against if needed. This feature adds some financial flexibility, allowing policyholders to make money in condition in an emergency.

Immediate payment

State Farmer Funeral Insurance generally pays beneficiaries immediately after the policyholder’s death. This early financial assistance is crucial in meeting the immediate costs associated with funerals and burials without delay.

Peace of Mind

Ultimately, having a burial insurance policy from State Farm provides peace of mind, knowing that funeral expenses will be covered. This allows individuals and families to focus on mourning and honoring the deceased without the added stress of financial concerns.

These benefits make State Farm’s burial insurance an attractive option for those looking to secure their final arrangements and ensure their families are not burdened with end-of-life expenses.

Financial Strengths and Ratings of State Farm Burial Insurance:

State Farm burial insurance is backed by the agency’s sturdy financial status and favorable rankings from industry analysts. Known for its stability and reliability, State Farm has obtained high marks from major rating groups, reflecting its capacity to meet obligations and pay claims. This economic energy ensures that policyholders can trust State Farm to offer essential assistance and monetary security. At the same time, it subjects maximum, making it a legitimate desire for those searching for reliable burial insurance.

How To Buy State Farm Life Insurance?

Purchasing life insurance from State Farm is a straightforward procedure designed to offer ease and flexibility to its customers. Here’s how you can buy lifestyle insurance from State Farm:

Contact an Agent

State Farm operates with a community of neighborhood retailers. To begin the process, you may locate a nearby State Farm agent through their website or by calling customer service. The nearby agent can offer personalized service, helping you recognize different policy alternatives and decide on quality insurance based totally on your wishes.

Review Your Options

Your State Farm agent will discuss various existing insurance merchandise, including period life, complete life, and universal life policies. They’ll help you examine the advantages and costs of each kind, considering your financial dreams and family situation.

Customize Your Policy

Once you pick the form of existence insurance, you can customize your policy with unique riders or changes to coverage quantities and terms, making sure the coverage meets your genuine requirements.

Complete an Application

Your agent will guide you via the utility procedure, which may additionally include answering fitness-associated questions and probably presenting a scientific exam, depending on the policy kind.

Await Approval

After filing your utility, it’s going to go through underwriting, in which the insurer assesses the risk and confirms your top-class costs. This method can take some days to several weeks.

Finalize and Purchase

Once your utility is approved, you will acquire the coverage settlement. Review it cautiously, and if the entirety is so, make the initial price to start your insurance.

Regular Review

After shopping for your coverage, it’s smart to study it periodically with your agent, in particular after important life occasions like marriage, childbirth, or buying a house, to ensure that it continues to fulfill your evolving desires.

By following these steps, you may stabilize existing insurance coverage with State Farm, which gives monetary protection and peace of mind for your destiny.

Conclusion:

In conclusion, State Farm burial insurance is a smart choice for those looking to cover funeral costs without stressing their family financially. Choosing State Farm means you’re choosing a reliable company that helps make sure your final wishes are met without adding extra burden to your loved ones. Their easy-to-understand policies and helpful customer service make planning for the future simple and worry-free. With State Farm, you can rest easy knowing you’ve taken care of your family’s future needs today, allowing you to focus on enjoying life now.

FAQs

Are there any age or health regulations for purchasing State Farm burial coverage?

Yes, there are usually age and health regulations related to purchasing burial insurance. State Farm may additionally require some scientific facts or a questionnaire; however, no scientific examination is regularly required. Coverage availability and regulations can vary, so it is critical to test with a State Farm agent for precise eligibility requirements.

How much burial insurance coverage do I need?

The quantity of coverage wished can vary totally based on individual situations, including the anticipated cost of funeral offerings, any outstanding debts, and other final expenses. It’s recommended to estimate these costs and speak with an insurance agent to determine the perfect insurance amount.

Can the beneficiary use the dying benefit for costs aside from burial expenses?

Yes, the beneficiary is usually unfastened when applying for the dying benefit for any reason, not simply burial fees. While the coverage is supposed to cover final costs, once the advantage is paid out, the beneficiary can allocate the budget as they see healthy.

Meet Haider, our expert Life Insurance Content Writer and Editor. With a passion for clarity, he simplify the complex world of life insurance, delivering informative, polished content tailored to our clients’ needs.