Last Updated on: February 19th, 2025

Reviewed by Dylan Whitman

- Licensed Agent

- – @M-LifeInsurance

What Exactly Is Preneed Insurance?

Preneed insurance is a special type of policy designed to cover future funeral and burial costs. It helps individuals plan and pay for their end-of-life expenses in advance, easing the financial and emotional burden on loved ones.

Purpose of Preneed Insurance

Preneed insurance facilitates coverage of expenses necessary for a funeral before the actual need exists. Prepayment through insurance enables your family to grieve without financial distractions. Your prepayment allows you to have confidence that your funeral arrangements will be carried out according to your preferences.

Benefits of Preneed Insurance

- Locks in Costs: Preneed insurance protects your financial interests by securing present-day funeral prices, which you can hold at a reduced cost.

- Eases Burden on Family: Your family members will be free from two tasks: arranging your funeral and paying its costs.

- Ensures Your Wishes Are Followed: You can organize specifics about services, caskets, and burial locations.

How It Differs from Life Insurance

Preneed insurance has different purposes than life insurance due to its exclusive focus on funeral cost payments. An insurance provider or funeral home controls prearranged service operations alongside insurance providers.

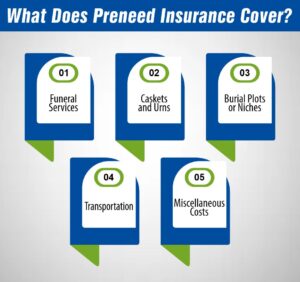

What Does Preneed Insurance Cover?

Preneed insurance serves to pay for funeral expenses while fulfilling the planned arrangements that guide the aftermath of death. Preneed insurance provides financial security that saves your family from financial burden during their time of grief.

Funeral Services

Preneed insurance covers various funeral services, including:

- Memorial Ceremonies: The expenses required for funeral ceremonies, including both wakes and memorial services.

- Viewing, Cremation, or Burial: Expenses for the selected farewell method need consideration.

Caskets and Urns

- Pre-Selected Containers: The purchase of a casket for burial and an urn for cremation methods is a part of the costs.

Burial Plots or Niches

- Cemetery Expenses: The cost includes burial spaces, grave markers, and columbarium niches for cremated remains.

Transportation

- Hearse and Limousine Services: The policy arranges transport solutions for bodies and mourner relatives to the memorial event or burial site.

Miscellaneous Costs

- Flowers, Obituaries, and Death Certificates: The budget includes expenses for flowers as well as newspaper spreads and formal paperwork.

Exclusions

Preneed insurance does not cover:

- Medical Bills or Debts: Hospital bills and individual debts must be completely paid before eligibility can be determined for any benefit.

Key Steps to Take When Starting with Preneed Burial Insurance

Preneed insurance for burial will help you plan for the final wishes and it eases your loved ones’ financial burden. This will take you through step by step to get started.

1. Choose a Funeral Home

Research funeral facilities that serve your local area. Assess their business offerings and service prices along with customer feedback. Verify that the funeral home provides preneed contracts as this allows you to make arrangements in advance.

2. Schedule a Consultation

After choosing your provider, you need to contact them to arrange an appointment about your preferences. Before moving forward, decide between burial and cremation and evaluate unique services such as memorial events and tribute opportunities.

3. Understand the Plans

You should inquire about plan coverage scope and verification of any plan restrictions. Select insurance plans have limitations regarding specific medical services, which need to be examined before making any choices. Check if the plan includes price protection against inflation by maintaining current rates.

4. Select Your Desired Arrangements

Choose the elements that are included in your funeral service, such as music, readings,, or certain religious or cultural traditions. By taking this step, you can be sure that your funeral will be conducted according to your wishes.

5. Review the Contract

Review the terms of the contract very carefully. Check for details about the cancellation and refund policy. Make sure you don’t get any surprises regarding all fees on the table.

6. Consider Payment Options

Determine whether to pay in cash or installments. Secondly, confirm if you are to keep your funds in a trust or an insurance policy for additional security.

7. Review Beneficiary Information

You can keep your beneficiary details updated so that the benefits can be properly allocated when required.

Important Factors to Consider When Choosing a Preneed Burial Insurance Plan

It is vital to choose a proper preneed burial insurance plan so your final wishes are fulfilled and also so that your family isn’t burdened with financial stress. Key factors to consider here are:

How Much Does Life Isurance Cost?

Price Stability

Funeral costs are constantly rising due to inflation. Pick a budget that holds today’s costs in place to prevent paying more in the future. If price protection is guaranteed, find out if the plan does this.

Flexibility

Your funeral preferences may change, and life circumstances change. Make sure the plan enables changes to the service, burial choice, or other arrangements without charge. There should be some flexibility in the good policy

Refund Policy

Check before committing to the plan cancellation policy. See whether there is a full or partial refund if you’ve changed your mind or re-based. This understanding upfront saves from the financial loss.

Reputation of the Funeral Home

Select an insurance provider or funeral establishment with a solid reputation. You should use customer reviews to evaluate the funeral home while also checking Better Business Bureau (BBB) ratings and making sure they maintain all required credentials. Your preneed plan receives reliable and transparent administration from a trustworthy service provider.

To select a confident preneed burial insurance plan that fulfills your requirements, you should consider these important elements.

The Wise Way to Purchase a Preneed Funeral Contract

Funeral planning is a smart concept where you can purchase a preneed funeral contract and prevent anyone of your loved ones from facing your financial crisis. The below checklist explains how you can a wise decision.

Compare Multiple Providers

There are a number of funeral homes and insurance providers that do not have the same plans. Compare the services, pricing, and contract terms of the different suppliers you are considering taking time to do this. Find providers who give clear prices and a good reputation. To find a trustworthy trader, read customer reviews and check ratings with the Better Business Bureau (BBB).

Involve Family Members in Decisions

Talking about your funeral arrangements will affect your loved ones so it is important to do so. Including family members also allows them to know what your wishes are and can help make those decisions. It is also to avoid confusion or other disagreements in the future.

Ensure the Contract Is Transferable

Future uncertainty dictates that people might need to change their residence to different cities or states. Your preneed funeral contract needs to come with transferable features that permit use at other funeral homes. A transferable preneed funeral contract enables you to continue using it regardless of your current location.

Confirm State Regulations for Preneed Plans

State requirements regarding preneed funeral contracts differ across all jurisdictions. A state may expect preneed funds to be held in a trust structure, yet alternative refund procedures exist among different states. Consult your state’s insurance or funeral regulatory board to validate that your plan follows local legislative requirements.

By following these steps, you can confidently purchase a preneed funeral contract that secures your final wishes and provides peace of mind for your family.

What Should I Expect When Purchasing Preneed Insurance?

Purchasing preneed insurance creates a plan for the future that reduces economic distress on your family members. The purchasing process of preneed insurance follows these steps.

Consultation: Discussing Your Wishes

Your first action must be to visit both a funeral home and an insurance provider to discuss your requirements. The initial step is to select a burial or cremation option, along with the ceremony type and unique requirements. This process will ensure that your desired funeral preparations are carried out properly.

Customization: Tailoring Services to Your Needs

Preneed insurance enables people to customize their funeral service arrangements. With preneed insurance, you maintain the authority to select various aspects, such as burial receptacles or urns in addition to musical selections and scriptural passages as well as floral displays. With preneed insurance, you have complete authority to determine how people will remember you.

Payment Plans: Options to Fit Your Budget

Almost all funeral service providers present flexible payment plans for customers. Customers can choose between paying one large amount or spreading the payments through installments. Some funeral plan providers give you the choice to pay either on a yearly or monthly installment basis to help budget funeral costs more effectively.

Contract Review: Legal and Financial Transparency

The review of the contract must happen before you finalize your plan. Your review of the contract must include a complete understanding of coverage details, refund procedures, and price lock to protect against cost increases. Prior evaluation of the contract brings clarity to avoid unexpected events.

Beneficiary Setup: Assigning a Trusted Contact

When choosing preneed insurance, you must pick someone to become your beneficiary, which will commonly be one of your family members or a trusted one you have chosen. The designated person has the duty to enforce the correct usage of the policy once the need arises.

Your informed choice toward selecting preneed insurance will lead to a suitable plan that ensures comfort for your loved ones.

FAQs About Preneed Insurance

The process of preneed insurance raises various questions in the minds of potential applicants. This article presents responses to the most frequently asked questions about preneed insurance.

Q: Is preneed insurance the same as life insurance?

Preneed insurance operates separately from the insurance programs related to life insurance strategies. Preneed insurance operates exclusively for funeral and burial expenses while life insurance offers financial benefits to beneficiaries to fulfill different costs.

Q: Will it cover all funeral expenses?

The scope of coverage depends on the specific plan that customers select. Different funeral insurance policies provide full coverage of expenses, yet specific plans come with restrictions. Make sure to study the coverage details to grasp what is included in each policy.

Q: Can I transfer my plan if I move?

Preneed insurance contracts allow transfers to different funeral homes yet the transfer capability depends on the provider. Check whether your preneed insurance plan can be transferred before you buy it because you might move to another place.

Q: What if I cancel my policy?

The refund policy for providers operates under specific state laws and individual provider guidelines. Plans differ between full or partial refunds although some may enforce restrictions during refund procedures. Providers set different terms about refunds so read all conditions before agreeing to them.

Q: Can I buy preneed insurance if I’m in poor health?

Yes! The unique nature of preneed insurance differs from standard life insurance since it does not need medical examinations or wellness checks for policy purchases. People having various health conditions can still buy insurance coverage under preneed policies.

Using this knowledge helps you determine if preneed insurance suits your needs.

Conclusion

The purchase of preneed insurance serves as an intelligent way to determine future arrangements that preserve your end-of-life wishes. Your loved ones maintain peace of mind when you cover funeral expenses ahead of time because it eliminates both their financial and emotional burden during the challenging period.

To select an effective preneed insurance plan, you should first evaluate its adaptability features together with its provider reputation and payment transparency system. The policy should enable changes while a trustworthy group manages it and provides clear details about pricing and refund systems.

Beginning funeral planning at this present moment delivers the most favorable results. Your present actions will bring both you and your family an opportunity to rest easy in knowing all arrangements follow your exact preferences.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.