Exploring the world of life insurance can be a daunting task for anyone, but for pilots, it often comes with its own set of challenges and considerations. As professionals who soar through the skies, pilots face unique occupational hazards that insurers carefully evaluate when assessing their life insurance applications.

From the risks associated with flying to the importance of maintaining a healthy lifestyle, there’s a lot to consider when a pilot applies for life insurance. In this guide, we’ll explore the journey of a pilot applying for life insurance, exploring the steps involved, common challenges faced, and tips for navigating the process successfully.

Whether you’re a seasoned aviator or just beginning your career in the skies, understanding the ins and outs of life insurance as a pilot is essential for protecting yourself and your loved ones.

Understanding the Pilot Profession

The pilot profession is distinctive in the world of insurance due to the inherent risks associated with flying. When a pilot applies for life insurance, insurers take into account several critical factors to assess the risk profile and determine appropriate coverage:

- Occupational Hazards

Piloting involves operating aircraft, which inherently carries risks such as accidents or health issues related to prolonged exposure to altitude and irregular work schedules. Insurance companies carefully evaluate these risks to understand the level of coverage required.

- Health and Lifestyle

Insurers examine a pilot’s overall health and lifestyle habits, including factors like smoking or drinking. These habits can impact the pilot’s health and, consequently, their insurability and premium rates.

- Flying Experience

The pilot’s flying experience is a crucial aspect considered by insurers. Factors such as the type of aircraft operated and the pilot’s training and proficiency influence the insurer’s assessment of risk.

- Medical Certification

Pilots are required to maintain a valid medical certificate issued by aviation authorities to ensure they are physically and mentally fit to operate the aircraft safely. Insurers often review these certificates as part of the application process to gauge the pilot’s health status and assess associated risks.

Therefore, insurers evaluate various aspects of a pilot’s profession and personal circumstances to determine their eligibility for life insurance and establish appropriate coverage levels and premium rates.

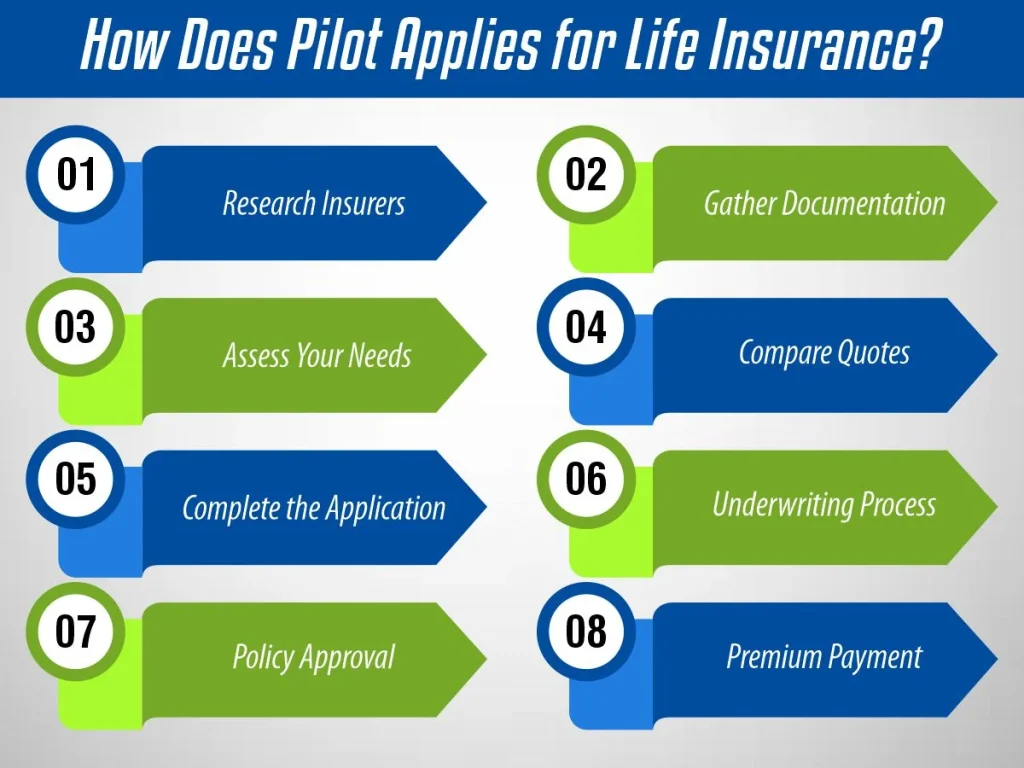

How Does Pilot Applies for Life Insurance?

Whenever a pilot applies for life insurance, the process involves several important steps to ensure a smooth and successful application process:

1- Research Insurers

Start by researching insurance companies that specialize in providing coverage for pilots. Look for insurers with experience in underwriting aviation-related risks. Consider seeking recommendations from fellow pilots or aviation professionals.

2- Gather Documentation

Collect all necessary documents to support your application, including your pilot’s license, medical certificate, and medical history. These documents provide essential information for insurers to assess your risk profile accurately.

3- Determine Your Needs

Assess the amount of coverage you need based on your financial obligations and plans for your family. Consider factors such as outstanding debts, mortgage payments, education expenses, and income replacement needs.

4- Compare Quotes

Obtain quotes from multiple insurers to compare rates and coverage options. Working with an insurance broker who specializes in aviation insurance can help you navigate the market and find the best policy for your needs.

5- Complete the Application

Fill out the life insurance application accurately and provide all requested information. Be thorough in disclosing details about your flying experience, health history, and any other relevant information requested by the insurer.

6- Underwriting Process

The insurer will review your application and may request additional information or medical exams to assess your risk profile accurately. Be prepared to provide any necessary documentation promptly to expedite the underwriting process.

7- Policy Approval

Once your application is approved, carefully review the policy details to ensure it meets your needs. Pay attention to any exclusions or limitations related to your occupation as a pilot.

How Much Does Life Isurance Cost?

8- Premium Payment

Pay your premiums on time to keep your policy active. Consider setting up automatic payments to avoid lapses in coverage and ensure financial security for your loved ones.

By following these steps and working with experienced professionals, you can successfully navigate the process of applying for life insurance as a pilot and secure the coverage you need to protect your family’s financial future.

Best Life Insurance for Pilots

The best life insurance for pilots depends on individual needs and preferences. However, several insurance companies specialize in providing coverage for pilots and aviation professionals. Here are some top-rated insurance companies known for offering life insurance policies tailored to pilots:

AOPA (Aircraft Owners and Pilots Association) Insurance Services: AOPA offers life insurance coverage specifically designed for pilots, including term life and permanent life insurance options.

Pilot Insurance Center: Pilot Insurance Center specializes in providing life insurance for pilots and aviation professionals. They offer a range of coverage options tailored to the unique needs of pilots.

Aviation Insurance Resources: Aviation Insurance Resources is another company that focuses on providing insurance solutions for pilots. They offer life insurance policies designed to meet the specific needs of aviation professionals.

Global Aerospace: Global Aerospace is a leading provider of aviation insurance, including life insurance for pilots. They offer customizable coverage options to suit individual pilot’s needs.

Traverse Insurance: Traverse Insurance offers life insurance solutions for pilots, including term life and whole life insurance policies. They specialize in providing coverage for aviation professionals.

When a pilot applies for life insurance policy, it’s essential to consider factors such as coverage options, premium rates, and the financial stability of the insurance company. Working with an experienced insurance agent who understands the unique needs of pilots can also help you find the best life insurance policy for your specific situation.

What to Know When Pilot Applies for Life Insurance?

When a pilot applies for life insurance, there are several crucial factors he should be aware of to ensure a smooth application process and obtain the right coverage:

1- Occupational Risks

Understand that being a pilot involves inherent occupational risks. Insurance companies will assess these risks when underwriting your policy, which may affect your premiums and coverage options.

2- Specialized Underwriting

Seek out insurance companies that specialize in underwriting policies for pilots. These insurers have expertise in evaluating aviation-related risks and can offer tailored coverage options suited to your needs.

3- Medical Certification

Ensure that your medical certification is up-to-date and in compliance with aviation regulations. Insurance companies will review your medical history and may require additional medical exams to assess your health and insurability.

4- Flying Experience

Your flying experience, including the type of aircraft you operate and your training, will be evaluated by insurers. Be prepared to provide detailed information about your experience to demonstrate your proficiency and safety record.

5- Lifestyle Factors

Be aware that lifestyle factors such as smoking, drinking, and participation in hazardous activities can impact your insurance premiums. Maintaining a healthy lifestyle can help improve your insurability and lower your premiums.

6- Policy Exclusions

Understand any exclusions or limitations related to your occupation as a pilot that may be included in your policy. These exclusions could affect your coverage in the event of a claim, so it’s essential to review them carefully.

7- Look Around

Don’t settle for the first insurance offer you receive. Take the time to shop around and compare quotes from multiple insurers to find the best coverage and rates for your needs.

8- Disclosure

Be honest and transparent when providing information to insurers during the application process. Failure to disclose relevant information could result in a denied claim or cancellation of your policy.

By keeping these factors in mind and working with experienced insurance professionals, pilots can navigate the life insurance application process effectively and secure the coverage they need to protect their families and financial futures.

Challenges and Tips for Pilot Applies for Life Insurance

- Challenges for Pilots

- High Premiums: Pilots often face higher life insurance premiums due to the perceived risks associated with their profession. The cost of coverage can vary based on factors such as age, health, flying experience, and the type of aircraft flown.

- Coverage Limitations: Some insurance companies may impose limitations or exclusions on coverage for pilots, especially for hazardous activities or types of aircraft. It’s essential to review the terms of your policy carefully to understand any restrictions that may apply.

- Health Requirements: Pilots are required to meet strict medical standards to maintain their pilot’s license. Insurance company may require additional medical examinations or tests to assess a pilot’s health and insurability, which can be time-consuming and costly.

- Tips for Pilots

- Maintain a Healthy Lifestyle: Adopting a healthy lifestyle can help improve your insurability and lower your life insurance premiums. This includes maintaining a balanced diet, exercising regularly, and avoiding tobacco and excessive alcohol consumption.

- Shop Around: Don’t hesitate to compare quotes from multiple insurance companies to find the best coverage and rates for your needs. Working with an insurance broker who specializes in aviation insurance can help you navigate the market and find the right policy.

- Review Policy Terms Carefully: Before purchasing a life insurance policy, carefully review the terms and conditions, including any exclusions or limitations that may apply to your profession as a pilot. Ensure that the policy meets your coverage needs and financial goals.

- Consider Term Life Insurance: Term life insurance may be a cost-effective option for pilots looking for temporary coverage. Term life policies provide coverage for a specified period, typically 10, 20, or 30 years, and can be a more affordable alternative to permanent life insurance.

- Work with an Experienced Agent: Partnering with an insurance agent who has experience working with pilots can help you navigate the complexities of aviation-related insurance and find the right coverage for your needs.

By understanding these challenges and following these tips, pilots can make informed decisions when applying for life insurance and ensure they have the coverage they need to protect their loved ones and financial futures.

Conclusion

Navigating the world of life insurance as a pilot involves understanding the unique challenges and considerations that come with the profession. From assessing occupational hazards to maintaining a healthy lifestyle, there are several factors to keep in mind when applying for coverage.

By following the steps outlined in this guide and working with experienced insurance professionals, pilots can secure the right coverage to protect their loved ones and financial futures. Remember, being proactive and informed is key to successfully applying for life insurance as a pilot.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.