Last Updated on: January 3rd, 2025

- Licensed Agent

- - @M-LifeInsurance

When planning for your financial future, it’s common to hear about two important options: the conservative portfolio of permanent life insurance and a Roth IRA. They are important sources for attaining financial security with some differences between them. Knowledge of these differences can assist in decision-making regarding future objectives to achieve your financial potential. Today, I would like to share with you a few major differences between permanent life insurance and a Roth IRA, so you will be able to make your choice.

What is Permanent Life Insurance?

This one here is called permanent life insurance because of the provisions that guarantee a death benefit without fail regardless of when it may occur to the insured, provided that premiums are being made continually. Term life insurance duration is predetermined while a permanent life insurance policy will cover you throughout your lifetime.

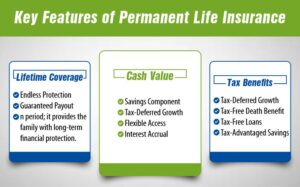

Key Features of Permanent Life Insurance:

– Lifetime Coverage

- Endless Protection: While term policies end ona specific date, permanent life insurance coverage lasts for the entire lifespan of the policyholder provided he pays premiums.

- Guaranteed Payout: This policy promises to pay out a lump sum to the beneficiaries when you die, thus protecting your loved ones should that event happen at any time.

- Peace of Mind: This means you do not have to fret over a policy expiring after a given period; it provides the family with long-term financial protection.

– Cash Value

- Savings Component: Concerning the policy, a part of the premiums paid is contributed to the cash value, which is a saving or investment-like account.

- Tax-Deferred Growth: It continues to earn interest year after year and you will not be taxed on your investment until you decide to withdraw the money that is held by the company to grow your cash value.

- Flexible Access: Policy loans or withdrawals are available to you to use the cash value for any emergencies or to meet your financial needs throughout the policy.

- Interest Accrual: Such cash value may earn interest, dividends, and investment returns depending on the type of policy,y and in the process, the policy grows.

– Tax Benefits

- Tax-Deferred Growth: The cash value component has tax advantages; that is, the earnings won’t attract taxes if they are kept inside the policy.

- Tax-Free Death Benefit: The monies paid to the beneficiaries as death benefits, are often exempted from income tax, an aspect that is very encouraging when the need arises.

- Tax-Free Loans: And policy loans that are borrowed against the cash value of the insurance policy are generally tax-free which allows you to access funds freely without penalty of taxes being levied.

- Tax-Advantaged Savings: To the same effect, the policy has the advantage of growing wealth without taxes on such an increase making it an ideal long-term savings plan.

Types of Permanent Life Insurance

Whole Life Insurance:

- Fixed Premiums: The cost of premiums depends on the type of policy to be paid all the same period the policy exists.

- Guaranteed Cash Value: It provides for a guaranteed cash value growth and death benefit to the person who owns the policy.

- Predictability and Stability: This suits the clients who want to have a constant uninterrupted signal to provide a stable connection.

Universal Life Insurance:

- Flexible Premiums: It allows flexibility in that premium payments as well as the amount of the death benefit can also be changed over some time.

- Flexible Cash Value: It saves cash value at a minimum interest rate, and you may be allowed to invest the cash values in different accounts.

- Adaptable: Recommended for those who wish to have control over the patterns in which their coverage and cash value progress.

Variable Life Insurance:

- Investment Options: The policy enables you to direct the cash value’s investment to securities like shares, bonds, or mutual funds.

- Variable Death Benefit: The death benefit as well as cash value is flexible and may rise (or fall) depending on the performance of the invested sum.

- Risk and Reward: This type of account is ideal for those people who understand more risks inherent in investments and those who are willing to take them in return for the probability of achieving higher yields.

Additional Features and Benefits

- Loan Options: The cash value can be used to secure loans and these normally attract less interest than a personal loan or credit card.

- Accelerated Death Benefit Riders: Some policies provide options to the rider that allow the death benefit to be consumed early if you have a terminal disease.

- Living Benefits: The policies may have living assurance riders under which the client can receive a section of the full amount of death benefits for the medical expenses and or expenses of long-term care if required.

- Dividends: There are contractual permanent life insurance policies that are linked to the performance of the business, such as whole life and thus can offer policyholders dividends. They can be used to lower premium rates, expand coverage, or be cashed.

Cost Considerations

- Higher Premiums: Some variations are more expensive than others due to the lifetime coverage and added present cash value options of permanent life insurance.

- Value Over Time: In the long run, though, you are likely to spend more money for comparable coverage if it is a temporary policy or if your coverage is limited to a specified age or time frame. The ability to collect cash value while living also offsets the high starting cost of an entire life policy.

Alcoholism: Utilisation as an Estate Planning Strategy

- Wealth Transfer: Whole life insurance is particularly important in estate planning because it allows the heirs to pass property to the beneficiaries without incurring taxes.

- Funding Trusts or Charities: Now, some people prefer to use the money as a death benefit, to fund a trust, or to make charitable contributions, which will allow them to receive certain tax deductions.

- Legacy Planning: It assists in the leaving of a legacy in as much as it offers your family a source of income and possibly helps to lower the taxes on the estate.

What is a Roth IRA?

It is an Individual Retirement Account that taxes its earnings differently so that the money withdrawn in retirement also does not attract taxes provided that certain conditions have been met. Unlike other retirement accounts where what is invested is determined after a tax is done on it, the Roth IRA is funded with money that has already been taxed. The main benefit of a Roth IRA is that distributions taken later in life can be made with no taxes owed on them.

Key Features of a Roth IRA:

Tax-Free Growth

- Investment Earnings Grow Without Taxation: Those dollars that you contribute towards the acquisition of a Roth IRA benefit from compounding without attracting tax. This entails any level of income from such activities as trading in stocks, bonds, or mutual investment instruments.

- Long-Term Benefits: The longer your money remains in the account you make, the more the money will have an opportunity to earn without having to be trimmed by taxes making it an ideal wealth creation tool for retirement gainsTax-Free Income in Retirement

- Tax-Free Distributions: If you are 59½ or older and have had the Roth IRA for at least five years.

- No Tax on Earnings: While many retirement accounts make you pay taxes on the money you use, Roth IRAs allow you to both your initial investment and any earnings on the money without paying taxes on it during the retirement period, which can be beneficial in the long run.

No Minimum Distributions

- Flexibility in Retirement: Roth IRAs also have some differences from a regular IRA and 401(K) contribution – you don’t have to take mandated minimum distributions starting at the age of 73. This means your money can continue to accumulate tax-free till the bitterness of theмещтtea is fully within, with or without having reached retirement age.

- Control Over Your Funds: You get to choose when you want to retire and how much you want to take out from your retirement fund.

Contribution Limits

- Income-Based Limits: The contribution limit for Roth IRA is however based on the income of the contributors. However, if you make over a certain amount of money, you cannot contribute to a Roth IRA on your own. But there are ways such as backdoor Roth IRAs that would provide high earners with a way into Roth benefits.

- Annual Contribution Limits: Roth IRAs like all the other individual retirement plans have contribution ceilings which are reviewed yearly by the IRS, usually with consideration to the inflation rates. For the year 2024, the contribution limit is as follows, $6,500 for anyone under the age of 50, and $7,500 for anyone over the age of 50.

Eligibility Requirements

- Age and Income Restrictions: In order to contribute to a Roth IRA, you have to have earned income, whether it is from a job, or from being a self-employed individual. The aspect of contribution is also earmarked by income limits depending on the tax status of the individual.

- No Age Limit on Contributions: Unlike other types of IRA, you can contribute to a Roth IRA at any age provided you have received income from employment hence making it quite suitable for individuals who want to continue saving for retirement past fifty-nine and half years.

Withdrawals Before Retirement

- Contributions Can Be Withdrawn Anytime: It is very flexible for any given year because since you have already paid taxes on the money that you contributed, you could cash out on your contributions anytime, free from penalties and taxes.

- Earnings Withdrawals: Under no circumstances should you take your earnings from this account before the age of 59 ½ or before it has been five years since the beginning of the year you opted for the program; there will be penalties as well as taxes imposed. Nevertheless, there are some emergency exceptions for its application including first home purchase or qualified education expenses.

Suits Long-Term Investment for Retirement.

- Compound Interest: The beauty of Roth IRAs is that your money can grow in a tax-deferred manner so you never lose any interest on your investments to the federal government. This makes it very useful in long-term investments especially from a retirement perspective.

- Maximizing Retirement Savings: That is why Roth IRAs are so popular: all this money grows tax-free, and withdrawals are tax-free as well, which makes this type of IRA a perfect choice for those who anticipate being in a higher tax bracket in the future or do not wish to pay taxes on their future earnings.

Estate Planning Benefits

- Tax-Free Inheritance: Roth IRAs can be left behind to the heirs and they do not pay any taxes on the distributions so long as they distribute the IRA within five years of the owner’s death. This makes it an ideal tool in estate planning, especially for those people who would wish to leave behind tax effect legacies.

With a contribution to the Roth IRA, you get benefits like long-term tax-free savings, non-forced withdrawal, and a means to optimize your retirement annuity. It is quite useful in an endeavor to guarantee one’s financial stability in the post-work years with a bonus of possibly paying less tax.

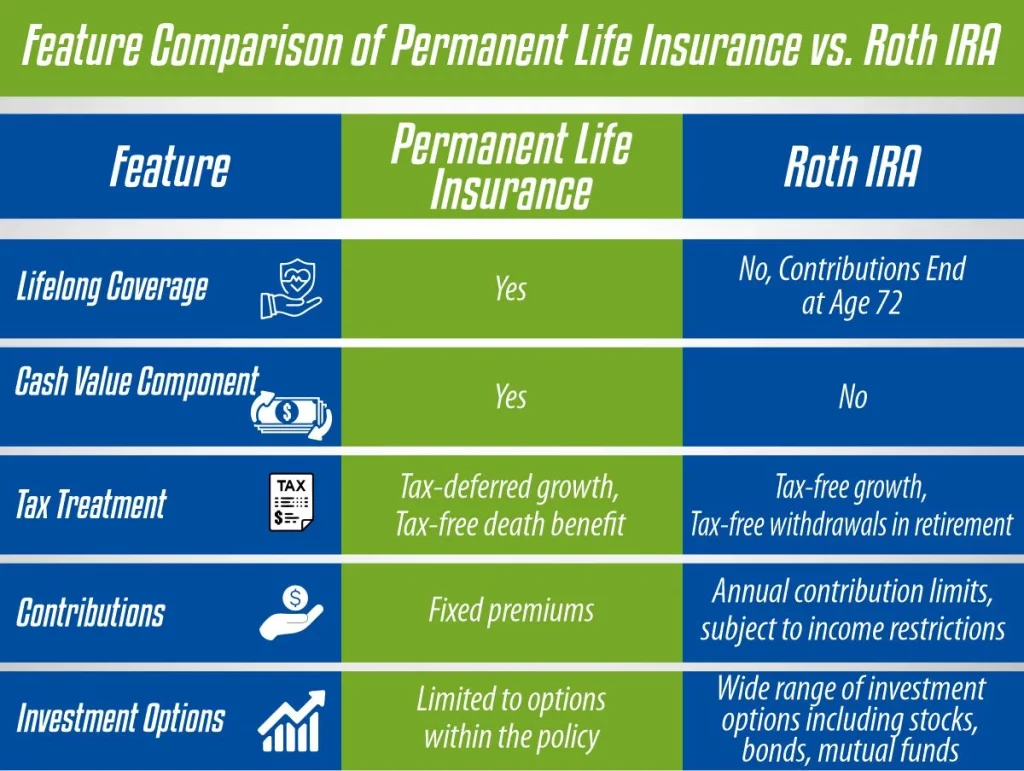

Feature Comparison: Permanent Life Insurance vs. Roth IRA

| Feature | Permanent Life Insurance | Roth IRA |

| Lifelong Coverage | Yes, as long as premiums are paid, there will be lifetime coverage. | No, ends at age 72 |

| Cash Value Component | Yes, accumulates cash value over time | No, no cash value component |

| Tax Treatment | Tax-deferred growth, tax-free death benefit | Tax-free growth, tax-free withdrawals |

| Contributions | Fixed premiums (vary by age, health, and coverage) | Annual limits: $6,500 (under 50), $7,500 (50+) for 2024, income restrictions apply |

| Withdrawal Flexibility | Loans/partial withdrawals available | Penalty-free withdrawals on contributions; earnings have penalties if taken early |

| Investment Options | Limited to policy investment options (low flexibility) | Wide range of options (stocks, bonds, mutual funds) |

| Estate Planning | Tax-free death benefit for beneficiaries | Tax-free inheritance for heirs |

| Required Minimum Distributions | Not applicable | Starting at age 72 |

Prices/Costs:

Permanent Life Insurance Premiums:

- Range: Ranges from $100 to more than $1000 which depends on the age, coverage amount, type of policy, and more.

- They are relatively expensive compared to term assurance because of the lifelong protection offered together with the cash value.

Roth IRA Contribution Limits:

- $6,500 annually by 2024 for anyone under 50 mostly based on the personal savings allowance.

- $7,500 annually for people who are fifty and above or with an adjusted gross income not exceeding $ 12,000 (2024).

- Donations are calculated according to the income and depend on it, although there are income caps (reduces for higher earners).

Pros and Cons of Permanent Life Insurance

– Pros:

- Lifelong Coverage: Permanent life insurance provides life coverage, which means that in the event of your death, your loved ones will be financially taken care of.

- Cash Value Accumulation: It also saves money in the long run, potentially giving you a source of income on which to base it with cash value.

- Tax Benefits: The death benefit is usually tax-free for your beneficiaries, and the cash value grows tax-free.

- Estate Planning Tool: They can facilitate estate planning by providing for estate taxes and a form of extending a lineage.

– Cons:

- Higher Premiums: Permanent type of insurance attracts high premiums compared to term type of insurance.

- Complexity: Some of the policy features detailed can be rather intricate and therefore a few people may need an advisor to fully grasp them.

- Surrender Charges: The policy may be canceled early which has surrender fees decreasing the cash value.

Pros and Cons of a Roth IRA

– Pros:

- Tax-Free Growth: The money in a Roth IRA does not earn any taxes, and this helps to build up larger fortunes over the years.

- Tax-Free Withdrawals: When you reach retirement age, you can withdraw from your account without incurring taxes from it, except if…

- No Required Minimum Distributions (RMDs): It’s not as though you’ll be compelled to begin withdrawing money at some predetermined age, which can help prevent the temptation to use the money prematurely.

- Flexible Contributions: You can participate at any given age provided you have an earning income.

- Estate Planning: However, it is an ideal way of transferring wealth because Roth IRAs can be taken to heirs tax-free.

– Cons:

- Income Limits: In this case, if you earn too much money, then you cannot contribute to a Roth IRA.

- No Upfront Tax Deduction: To compare with other retirement accounts, while you don’t receive a tax deduction at the time of contribution to a Roth IRA, the money is put into the account after tax.

- Penalties for Early Withdrawals: The withdrawn amount early before reaching 59 ½ will attract taxes and penalties on the earnings even though the contributions can be withdrawn early without attracting penalties.

Which One Should You Choose? Permanent Life Insurance vs. Roth IRA

So, whether to choose permanent life insurance or a flexible Roth IRA depends on what is valued more at the moment. Here are some things to consider:

Consider Permanent Life Insurance If:

- You need lifelong protection and assurance in case of the death of a breadwinner in the family.

- You want your money to grow tax-deferred and be guaranteed with a death benefit for your beneficiaries.

- You want more stability and are not exactly that bothered by having to pay more for the policy.

- It is important that estate planning is in place, and you require assets to help you address estate taxes.

Consider a Roth IRA If:

- It is the case that you want growth that is tax-free and further, withdrawals in retirement which are also tax-free.

- You need to be able to make and receive contributions and withdrawals with a certain amount of ease.

- You are aware of market risks and intend to seek stock and bond investment.

- You would like to leave your heirs tax-free money.

Conclusion

Permanent life insurance as well as Roth IRA are both great kinds of investments that can help in improving the clients’ financial security. In permanent life insurance, there is life coverage, accumulation of cash value and tax-free amounts to be paid at death and thus suitable for will preparation. On a parallel side, a Roth IRA as an investment tool provides the Namespace benefit of tax-free growth, retirement savings, and flexibilities, with no limitations of required minimum distributions for withdrawals from the account.

(FAQs) for Permanent Life Insurance vs. Roth IRA:

1- What is the primary distinction between a Roth IRA and permanent life insurance?

Permanent Life Insurance is a type of life insurance that provides lifelong coverage and includes a cash value component, while a Roth IRA is a retirement savings account that allows tax-free growth and tax-free withdrawals in retirement.

2- Is it possible to apply for a Roth IRA for life insurance?

However, a Roth IRA cannot be used for any life insurance plan. However, some people have permanent life insurance and a Roth IRA since the two are financial instruments that are employed to address different needs.

3- Which one offers better tax advantages: Permanent Life Insurance, or Roth IRA?

A Roth IRA provides tax-exempt distributions in retirement and the money is contributed with taxed income. Endowment Life Insurance includes an investment in the growth of cash value on a tax-preferred basis, and the payoff is usually tax-exempt for beneficiaries.

4- Is it permissible to take a loan from a Permanent Life Insurance policy or a Roth IRA?

Permanent Life Insurance has funds against which you can take a loan, usually at relatively small interest charges. Except that contribution to a Roth IRA is tax-free, the major drawback is that there are no loans for a Roth IRA but one may take a distribution from another plan, say a 401K.

5- Between the offered options, which one is most suitable for an effective strategy of long-term savings?

It depends on your goals. This makes it possible for people to achieve their estate planning goals in the course of the contract which offers a death benefit with increasing cash value. A Roth IRA is mainly for retirement purposes; it provides tax-sheltered growth and is free in retirement. Others use the two together as they form a perfect package when it comes to financial planning.

Resources

Feature Comparison of Permanent Life Insurance vs. Roth IRA

Here’s a feature comparison table for Permanent Life Insurance vs. Roth IRA:

How Much Does Life Isurance Cost?

| Feature | Permanent Life Insurance | Roth IRA |

| Lifelong Coverage | Yes | No, Contributions End at Age 72 |

| Cash Value Component | Yes | No |

| Tax Treatment | Tax-deferred growth, Tax-free death benefit | Tax-free growth, Tax-free withdrawals in retirement |

| Contributions | Fixed premiums | Annual contribution limits, subject to income restrictions |

| Withdrawal Flexibility | Partial withdrawals or loans available, subject to policy terms | Contributions can be withdrawn penalty-free, earnings may be subject to penalties if withdrawn before age 59 ½ |

| Investment Options | Limited to options within the policy | Wide range of investment options including stocks, bonds, mutual funds |

| Estate Planning Benefits | Tax-free death benefits for beneficiaries may be used as an estate planning tool | Tax-free inheritance for beneficiaries can be passed on tax-free |

| Required Minimum Distributions | Not applicable | Required starting age of 72 for distributions, except for original account holders |

Pros and Cons of Permanent Life Insurance

Here are the pros and cons of permanent life insurance:

Pros

- Lifelong Coverage: Permanent life insurance provides coverage for your entire life, ensuring that your beneficiaries receive a death benefit whenever you pass away, regardless of age.

- Cash Value Accumulation: A portion of your premium payments goes into a cash value account, which grows over time on a tax-deferred basis. This cash value can be accessed through policy loans or withdrawals, providing a source of tax-free income during retirement or for other financial needs.

- Tax Benefits: Death benefits are generally tax-free to beneficiaries, and the cash value grows tax-deferred. This can be advantageous for estate planning and creating a tax-efficient legacy.

- Flexible Premiums: Depending on the policy type, you may have the flexibility to adjust your premium payments or even skip payments under certain conditions.

- Estate Planning: Permanent life insurance can serve as a valuable estate planning tool, providing access to cover estate taxes and ensuring that your loved ones are financially protected.

Cons

- Higher Premiums: Permanent life insurance typically has higher premiums compared to term life insurance, making it more expensive to maintain coverage.

- Complexity: Understanding the various policy features, fees, and investment options within permanent life insurance policies can be complex and may require guidance from a financial advisor.

- Surrender Charges: If you decide to surrender or cancel your permanent life insurance policy early, you may be subject to surrender charges or fees, which can reduce the cash value of the policy.

Pros and Cons of a Roth IRA

Here are the pros and cons of a Roth IRA:

Pros

- Tax-Free Growth: One of the most significant advantages of a Roth IRA is that all earnings within the account grow tax-free. This means you won’t owe taxes on investment gains, dividends, or interest earned within the account.

- Tax-Free Withdrawals in Retirement: Qualified withdrawals from a Roth IRA in retirement are tax-free. This provides you with tax-free income during your retirement years, helping to maximize your retirement savings.

- No Required Minimum Distributions (RMDs): Unlike traditional retirement accounts, Roth IRAs have no required minimum distributions during the original account holder’s lifetime. This allows you to leave your money in the account to continue growing tax-free for as long as you wish.

- Flexible Contributions: You can contribute to a Roth IRA at any age, as long as you have earned income, and there is no age limit for contributions. This flexibility allows you to continue saving for retirement even after reaching retirement age.

- Estate Planning Benefits: Roth IRAs can be passed on to heirs tax-free, providing a valuable estate planning tool for transferring wealth to the next generation. This can help you leave a tax-efficient legacy for your loved ones.

Cons

- Income Limits: Roth IRA contributions are subject to income limits. If your income exceeds the threshold set by the IRS, you may not be eligible to contribute to a Roth IRA directly.

- No Upfront Tax Deduction: Unlike traditional retirement accounts, contributions to a Roth IRA are made with after-tax dollars so that you won’t receive an upfront tax deduction for your contributions.

- Penalties for Non-Qualified Withdrawals: Withdrawals of earnings from a Roth IRA before age 59 ½ may be subject to taxes and penalties unless they meet certain exceptions such as first-time home purchase or qualified education expenses.

- Limited Contribution Limits: The annual contribution limits for Roth IRAs are relatively low compared to other retirement accounts, which may limit your ability to save for retirement in this account alone.

Choosing Between Permanent Life Insurance vs. Roth IRA

Choosing between permanent life insurance vs. Roth IRA depends on various factors, including your financial goals, risk tolerance, and long-term objectives. Here’s a guide to help you make an informed decision:

Consider Permanent Life Insurance If:

1- Lifelong Coverage is a Priority

If you want to ensure that your beneficiaries receive a death benefit regardless of when you pass away, permanent life insurance provides lifelong coverage, offering peace of mind.

2- You Seek Tax-Deferred Growth and Tax-Free Death Benefits

Permanent life insurance policies accumulate cash value over time on a tax-deferred basis, and death benefits are generally tax-free to beneficiaries. This can be advantageous for estate planning purposes and for creating a tax-efficient legacy.

3- You Want a Conservative Investment Option

Permanent life insurance offers a conservative investment option with guaranteed death benefits and a cash value component that grows steadily over time, making it suitable for those who prefer stability over higher-risk investments.

4- Estate Planning is a Priority

If passing on wealth to your heirs tax-efficiently is a priority, permanent life insurance can serve as a valuable estate planning tool, providing liquidity to cover estate taxes and ensuring financial security for your loved ones.

Consider Roth IRA If:

1- Tax-Free Growth and Withdrawals are Important

Roth IRAs offer tax-free growth on investment earnings and tax-free withdrawals in retirement, providing a significant advantage for long-term wealth accumulation and retirement income planning.

2- You Want Flexibility in Contributions and Withdrawals

Roth IRAs allow flexible contributions with no age limit, and there are no required minimum distributions during the original account holder’s lifetime. This flexibility gives you control over your retirement savings and allows you to tailor withdrawals to your financial needs in retirement.

3- You Seek Estate Planning Benefits

Roth IRAs can be passed on to heirs tax-free, providing a valuable estate planning tool for transferring wealth to the next generation. This can help you leave a tax-efficient legacy for your loved ones.

4- You’re Comfortable with Market Risk

Roth IRAs offer a wide range of investment options, including stocks, bonds, and mutual funds, allowing you to potentially achieve higher returns over the long term. If you’re comfortable with market fluctuations and willing to take on some level of risk, a Roth IRA may be a suitable option.

Conclusion

Permanent life insurance vs. Roth IRA are both valuable tools for securing your financial future and achieving long-term goals. While they serve different purposes and have distinct features, understanding the complexities of each can help you make informed decisions about your financial strategy.

Whether you prioritize lifelong coverage, tax-free growth, or estate planning benefits, there’s a solution that aligns with your needs and objectives. Consult with a financial advisor to explore your options and create a customized plan that meets your unique circumstances.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.