Curious about National Family Assurance and how it could protect your loved ones? Well, you’re in luck! In this National family assurance review , we’ll take a closer look at what makes National Family Assurance unique. Whether you’re experienced with insurance or just getting started, we’ll explain it all in a way that’s easy to understand. So, get yourself a drink, sit back, and let’s explore together. After all, keeping your family safe shouldn’t be complicated. Let’s make it as simple as Sunday morning brunch!

About National Family Assurance

National Family Assurance is a corporation that’s all about one factor: defending your family. Whether it’s securing their financial destiny or making sure they have the assistance they need when you’re not around, National Family Assurance has yours again. From lifestyle insurance to final rate insurance, they offer a range of merchandise designed to present you with peace of mind. And the best component? It’s all performed along with your family’s acceptable pastimes at heart. So why wait? Take step one toward safeguarding your own family’s destiny with National Family Assurance nowadays!

Who Is National Family Assurance?

National Family Assurance is greater than just a coverage company; they’re a dependent best friend in safeguarding households’ futures. Established in 1995 by a group of passionate folks who understood the importance of protecting loved ones, National Family Assurance has grown into a respected name inside the enterprise. Their adventure started with a simple assignment: to offer reachable and reliable insurance answers that prioritize the well-being of families throughout the kingdom.

Over the years, they have stayed proper to their commitment, incomes, and the belief of countless customers through their willpower to provide satisfactory service and comprehensive insurance alternatives. Today, National Family Assurance continues to innovate and evolve, making sure that households can face existence’s uncertainties with self-belief and peace of thoughts.

Your Coverage Options With National Family Assurance

Let’s dive into your coverage options with a National family assurance review!

National Family Assurance Term Life Insurance:

Term Life Insurance from National Family Assurance is like having a monetary protection internet on your circle of relatives. It gives safety for a specific duration, usually starting from 10 to 30 years. During this time, if something unexpected happens to you, your loved ones acquire a lump-sum price, offering them economic safety. It’s a sincere and lower-priced way to ensure your own family’s future is safeguarded, especially at some point of crucial existence levels like raising kids or paying off a loan.

National Family Assurance Whole Life Insurance:

Looking for long-term protection that lasts your entire life? National Family Assurance Whole Life Insurance is a suitable suit. With this option, your insurance doesn’t have an expiration date – it’s there for you so long as you want it. Plus, in contrast to Term Life Insurance, Whole Life Insurance regularly includes a cash price factor, which grows over the years and may be accessed if wanted. It’s a dependable way to offer your own family enduring economic security and peace of mind, irrespective of what life throws at you.

National Family Assurance Universal Life Insurance:

If flexibility is what you are after, National Family Assurance Universal Life Insurance has you covered. With this feature, you get lifelong coverage combined with the capacity to modify your charges and loss of life gain as your wishes change. Whether you are making plans for retirement, estate planning, or leaving a legacy for your loved ones, Universal Life Insurance offers versatility to adapt to your evolving situations. It’s a smart desire for those searching for customizable coverage tailor-made to their particular economic dreams.

In summary, National Family Assurance provides more than a few insurance alternatives to help people shape their desires and lives. Whether you’re seeking out brief protection, lifelong security, or flexibility in your coverage, there may be a coverage answer designed to suit your own family’s desires. So, take the following step in securing your loved ones’ destinies with National Family Assurance nowadays!

Is National Family Assurance A Legitimate Life Insurance Company?

Absolutely, National Family Assurance is a legitimate life insurance company. They’ve been around for years, providing families with financial protection and peace of mind. You know, they’re the real deal! They offer a range of insurance products, from term life to whole life and everything in between. And hey, they’re not just some fly-by-night operation – they’re fully licensed and regulated, so you can trust that they’ve got your back when it comes to protecting your loved ones. So, if you’re looking for a reliable life insurance provider, National Family Assurance review is definitely worth considering.

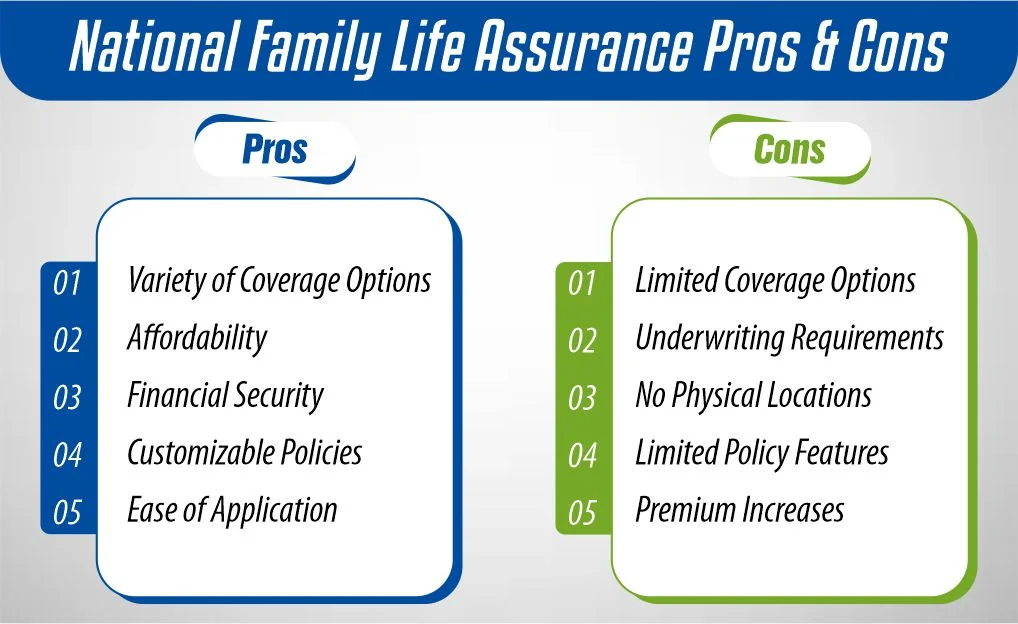

National Family Life Assurance Pros & Cons

National Family Life Assurance Pros & Cons

In this National family assurance review let explore Pros and Cons:

Pros

- Variety of Coverage Options: One of the most significant advantages of National Family Life Assurance is the range of coverage options they offer. Whether you’re looking for term life, whole life, or universal life insurance, they’ve got you covered.

- Affordability: National Family Assurance understands that protecting your loved ones shouldn’t break the bank. They offer competitive rates and flexible payment options to fit your budget.

- Financial Security: With National Family Life Assurance, you can have peace of mind knowing that your family will be financially protected in the event of your passing. This can alleviate stress and provide comfort during difficult times.

- Customizable Policies: Another benefit is the ability to customize your policy to suit your specific needs and circumstances. Whether you need additional coverage for critical illness or want to add riders for extra protection, National Family Assurance offers flexibility to tailor your policy accordingly.

- Ease of Application: National Family Assurance makes the insurance process as smooth as possible. Their application process is straightforward, with minimal paperwork and hassle. Plus, they provide excellent customer support every step of the way.

Cons:

- Limited Coverage Options: While National Family Assurance offers a variety of coverage options, some may find that their selection could be improved compared to other insurance providers. If you have unique insurance needs, you may need to explore alternative options.

- Underwriting Requirements: Like any insurance company, National Family Assurance has underwriting requirements that applicants must meet to qualify for coverage. Depending on your health and lifestyle factors, you may face higher premiums or be denied coverage altogether.

- No Physical Locations: National Family Assurance operates primarily online and may need physical locations in your area. While this can be convenient for some, others may prefer the option to meet with an agent face-to-face.

- Limited Policy Features: Some policyholders may find that National Family Life Assurance needs certain features or benefits offered by other insurance companies. It’s essential to carefully review the policy details to ensure it meets your needs and expectations.

- Premium Increases: Like many insurance companies, National Family Assurance reserves the right to increase premiums over time. While this is common in the industry, it’s essential to be aware of potential rate hikes and budget accordingly.

How to Apply?

Getting quotes and applying for life insurance with National Family is fairly simple and straightforward. The process involves just a few questions online so that the platform can provide you with a variety of suitable quotes for coverage.

You’ll be asked standard questions such as your name, date of birth, address, phone number, gender, and whether you have children. National Family will also want to know your:

- Marital status

- Height and weight

- Medical history

- Employment status

National Family will then offer you quotes from their partner insurers, based on the information you provided. If choosing term life insurance, you’re able to easily toggle between policy length options and view different prices for coverage from these providers.

If there are questions regarding the information you filled out, a guide will give you a phone call asking to verify the information. They will then transfer you to an agent who’s waiting on the other line. No in person consultation is needed to buy a life insurance policy from National Family.

Once you’ve selected your ideal life insurance plan, you will be directed to that company’s website to answer any additional questions and complete the insurance process. You may receive a call from an underwriter at this time, and you will also be told if you are required to complete a medical exam in order to purchase your policy.

How Much Does National Family Life Assurance Cost?

The cost of coverage with Assurance depends on various factors, including the specific product you choose, the level of coverage, your gender, tobacco usage, and overall health.

How Much Does Life Isurance Cost?

Your monthly payment could range from as little as $10 to as much as $500, depending on these factors.

Below is a table illustrating sample monthly costs for National Family final expense Assurance:

| Age | Female Non Tobacco $10,000 | Male Non Tobacco $10,000 | Female Non Tobacco $20,000 | Male Non Tobacco $20,000 |

| 40 | $19.43 | $23.88 | $38.87 | $47.77 |

| 45 | $24.00 | $27.00 | $48.00 | $54.00 |

| 50 | $26.08 | $32.06 | $52.17 | $64.12 |

| 55 | $31.56 | $42.23 | $63.12 | $84.47 |

| 60 | $35.92 | $46.70 | $71.83 | $93.40 |

| 65 | $40.98 | $56.36 | $81.97 | $112.72 |

| 70 | $57.43 | $74.14 | $114.87 | $148.28 |

| 75 | $80.76 | $107.47 | $161.52 | $214.93 |

| 80 | $120.00 | $156.24 | $240.00 | $312.48 |

| 85 | $181.78 | $220.23 | $363.57 | $440.45 |

National Family Life Assurance Reviews & Complaints

Despite being accredited by the Better Business Bureau, National Family Assurance has faced a significant number of complaints. Interestingly, they operate under two brand names, each with its own BBB profile:

- National Family: As of, the BBB review score stands at a low 1.04/5, with a concerning total of 146 complaints over the prior 36 months. Trustpilot reviews reflect a similar sentiment, with a score of 2.4/5 based on nine reviews.

- Assurance: On the other hand, the BBB review score for Assurance, as of the same date, is slightly higher at 1.07/5. However, they’ve garnered a more substantial 290 complaints over the past 36 months. Trustpilot paints a brighter picture for Assurance, with a commendable 4.6/5 score based on 908 reviews.

A common grievance among policyholders and prospective customers revolves around persistent and unwanted phone calls, which is a prevalent issue.

Conclusion

As we wrap up our National family assurance review , it’s clear that they’re more than just an insurance company – they’re a partner in protecting what matters most. With their comprehensive coverage and dedication to customer satisfaction, it’s no wonder they’ve earned their stellar reputation. So, if you’re ready to give your family the peace of mind they deserve, National Family Assurance is here to lend a helping hand. Don’t wait until tomorrow to secure your loved ones’ future – take action today and rest easy knowing you’ve made the right choice. After all, when it comes to safeguarding your family, there’s no such thing as being over-prepared.

FAQs

Is National Family Assurance a Good Company?

National Family Assurance is accredited by the Better Business Bureau, but there are numerous complaints, particularly regarding persistent phone calls. Customers’ experiences vary, with some praising the company’s services and others expressing dissatisfaction with their experiences. Before making a decision, it’s essential to research and consider individual needs and preferences.

Are Assurance IQ and National Family Assurance, the same company?

Yes, Assurance IQ and National Family Assurance are part of the same company, but they operate under different brand names. While they share a parent company, their products and services may differ. It’s advisable to review each brand’s offerings and policies to determine which best suits your needs.

References:

https://finalexpensebenefits.org/national-family-assurance-guide/

https://seniorsmutual.com/national-family-life-insurance-review/

https://choicemutual.com/blog/national-family-assurance-life-insurance-review/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.