When you die, life insurance will help to take care of your family’s budget. For many people, purchasing a separate individual policy is out of the question due to the costs. Another solution is to participate in a savings group. Are you considering Life Insurance Saving Group for your coverage needs? Before you decide, it’s important to understand the potential drawbacks of working with this broker. But, the question is, how does this insurance savings group work and is it indeed more economical than purchasing a policy all on your own? Let’s get started!

Life Insurance Saving Group

Life Insurance Saving Group specializes in offering final expense insurance as well as term life insurance.

Do you have any concerns that they would pay a death benefit? You should check Savings Group complaints right now.

Oh, we, of course, looked at them, but, as for many others, they often find themselves questioning whether these plans will help them save money in the future!

We compare them with the other leading life insurance companies in the industry, and they do not meet the standard.

Is LI Savings Group the best life insurance company…Find it out with us. Many companies provide better life insurance products for expenses that pay death benefits.

Little about Life Insurance Saving Group:

Life Insurance Savings Group is a group of people (businesses, employees, and self-employed individuals) who save money together and share that money to pay for medical, dental, and vision expenses. LI Savings Group does this to bypass traditional financial institutions such as insurance companies and banks. Although the benefits of joining the savings group are similar to those offered by insurance companies and banks, which is the ability to pay for large expenses you otherwise couldn’t afford, their contract is what truly makes Savings Group different.

Getting the right life insurance policy for you should be the number one priority.

Life Insurance Group offers you the most reliable and convenient way to pay for medical and final expenses and save money on health insurance by combining the best features of widely accepted health plans like Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs), and Health Reimbursement Arrangements (HRAs).

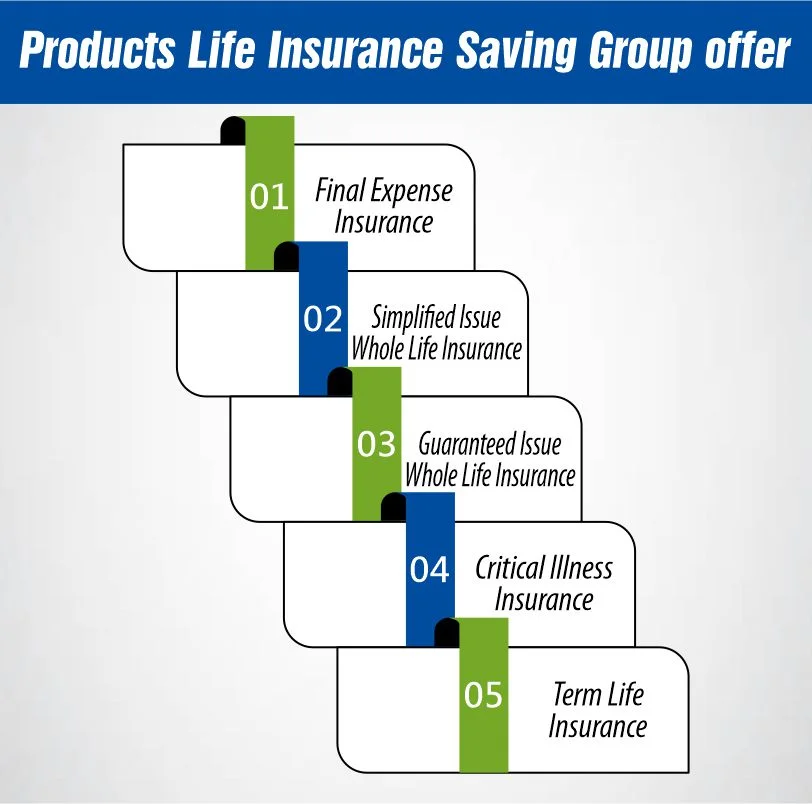

Products Life Insurance Saving Group offer:

– Final Expense Insurance

Final expense insurance focuses on the funeral and burial costs of an insured person and can assist the policyholder in helping the family pay for these costs when the insured dies with a small amount received.

In most cases, no conditions are placed on the amount of funds received from the death benefit. It may also be used to clear other expense debt charges like hospital bills and credit card bills.

The majority of life insurance savings groups promote policies with associated saving contributions and up to $25000 on death benefits.

Their age limit is 45 to 85 without having any medical examination or medical questions.

Most coverage begins immediately. However, specific guaranteed plans may not allow any payout to take place in the first two years of an accident. Through Life Insurance Saving Group, there are three different options for burial insurance:

– Simplified Issue Whole Life Insurance:

Simplified whole life insurance is cheaper and less complicated than a traditional or whole policy because no medical exam is required for the policy. Their age range is 45-85 years, and can get between $2,000 and $40,000 coverage. There is a health questionnaire they fill out with questions about medical history, health and lifestyles. This product is suitable for persons in the age of 45-85 years.

– Guaranteed Issue Whole Life Insurance:

So with this policy, you are certain to get coverage and there’s no compulsory medical examination. Also, there are no requirements for medical history, interviews, or database checks. The guaranteed issue does cover accidental death from the day the policy is implemented, but death by natural causes is not covered during the first two years of coverage. Those expenses will be paid out in premium form to your beneficiaries. This policy may be a good choice if you are 45-85 years old and have a face amount of up to $25000.

– Critical Illness Insurance:

Critical illness policies do not involve medical examination; policyholders can get lifelong insurance regardless of their future condition. After an incident such as a serious health complication, the payout can help replace your salary, meet medical expenses, and provide financial security while you recover. It means that you can get coverage even if in the future you may have a serious health problem like a stroke, heart attack or cancer.

How Much Does Life Isurance Cost?

– Term Life Insurance:

Term life insurance is one of the most popular types of life insurance due to its flexibility and low costs. It depends on; the term of coverage, the amount to be paid, age, sex, health, and habits. The duration varies between 10-30 years with locked-in premium payments that can be made on a monthly, quarterly, semi-annual, or annual basis. Now, if you die while the policy is in force, your beneficiaries will get the whole face amount of the policy, which is free of taxes in many cases.

For obtaining traditional term life insurance, it takes 30 minutes to complete a physical examination to measure your health and risk which in turn helps in deciding your coverage and the amount of your premium.

Can’t I Get Term Life Insurance as a Senior?

Well, it is still possible to qualify for term life insurance if you are a senior. Depending on your age, you could qualify for up to 15 or even 20 years of coverage if you are quite young, or if you have a young family.

And yes, you get term life insurance at a more affordable price. But this is because it then disappears when the term is up. And if you’re still alive, then you’re stuck having paid all that money for something you can’t keep.

Moreover, most seniors require permanent coverage since they cannot plan for funerals and other expenses. Term life insurance is ideal for accidental or short-term, such as paying off loans or accounts, or as an income replacement.

But for most seniors, whole life insurance remains the best option. You get to lock in your rates for life, and as long as you keep paying for the policy, you’ll be covered when the Good Lord calls you home.

Advantages of Life Insurance Saving Group

– No Medical Exam Required

- Coverage options that don’t require a medical exam.

- Ideal for those with health concerns or who have been denied coverage in the past.

– Flexible Payment Options

- Fixed premiums.

- Flexible payment schedules.

- Options for both burial and term life insurance to fit your budget.

– Comprehensive Coverage

- Plans offering up to 100% coverage for accidental death.

- Available even if other companies don’t provide such benefits.

– Easy Application Process

- Application completed via phone with an agent.

- Agents provide quotes and explain policy details.

- Answers to potential questions are readily available.

– Multiple Carrier Options

- Brokers partnered with multiple carriers.

- Flexibility in comparing rates and policies.

- Policy terms are not available on the website, requiring agent assistance for comparisons.

Disadvantages of Life Insurance Saving Group

– Limited Product Range

- Partnered with Mutual of Omaha and others, but does not offer their full range of products.

- Policies are available for ages 45-80, whereas Mutual of Omaha offers policies for ages 18-80, children’s whole life insurance, and multiple types of universal life insurance.

– Lack of Clarity

- Unclear representation of partnered companies.

- The website features logos of various life insurance companies but does not specify which they represent.

- Limited details on available plans, especially term life insurance.

– Initial Graded Benefit Period

- All guaranteed acceptance plans have an initial two-year graded benefit period.

Why Is Life Insurance Saving Group Not the Broker for You?

Another weakness of Life Insurance Saving Group is that they only offer rates and policies of very few companies. If you have some issues or concerns that are not covered by any of their policies, you may not get a policy that offers you real coverage for your family here are some pointed issues you face:

– Limited Carrier Options

- Offers rates and policies from only a few companies.

- May not cover specific concerns or needs.

– Lack of Comprehensive Comparison

- Limited ability to compare rates and policies across multiple carriers.

- Reduced likelihood of finding a policy that truly protects you and your loved ones.

Life Insurance Saving Group is partnered with several insurance providers. It is important to distinguish that they are a broker, not an insurance company. Notably, they are paired with United of Omaha, also known as Mutual of Omaha, and use its Living Promise Whole Life Policy. You can read our review of Mutual of Omaha here to learn more about Savings Group’s partner. LI Savings Group also offers policies from AIG, Trustage, Global Life, and Americo.

– Better Alternatives

To shop for the best rates that meet your needs, working with a broker that is partnered with a variety of carriers will ensure that you find the policy that meets your needs and your budget, while also giving you the peace of mind of knowing you found the policy tailored to your needs.

For example:

- Partnered with over 40 top-rated carriers rated “A” or better.

- Provides free quotes for comparison shopping.

- Connects you to specialized agents familiar with underwriting processes.

- Ensures you get the best policy for your needs and budget.

Conclusion

Before you choose a Life Insurance Saving Group, ask yourself if it truly meets your needs. With limited carrier options and unclear policy details, you might miss out on better coverage elsewhere. Consider exploring other brokers who offer a wider range of policies to ensure you find the best fit for you and your family. Why settle for less when you can have peace of mind with the right life insurance?

References:

https://lifequote.com/life-insurance-savings-group-reviews/

https://insuranceforburial.com/blog/life-insurance-savings-group-review/

https://finalexpensedirect.com/lifeinsurancesavings-com-review-of-options-pros-cons/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.