Last Updated on: September 23rd, 2025

- Licensed Agent

- - @M-LifeInsurance

Key Takeaways

- Life insurance for married couples provides financial security,

- Term life insurance is the most affordable option

- Whole and joint life policies offer long-term benefits

- The average cost of life insurance for a married couple

Getting married is a big moment in anyone’s life. This brings so much in your life with love and partnership, marriage also brings new responsibilities. There are a lot of couples who are sharing their financial matters like paying for a home, bills, and planning for the future. One important way to protect this future is by choosing the right life insurance.

In this guide, we’ll explain the best life insurance options for married couples. We’ll talk about joint life insurance, term life, whole life, and other choices. We’ll also cover how much they cost, the benefits, and what newly married couples should keep in mind.

Why Married Couples Need Life Insurance

Life insurance is not just about money, it’s about protecting your husband or wife and keeping life stable if something unexpected happens.

Shared responsibilities – Most married couples share debts like a house loan or car loan. Life insurance can help pay for these.

Income replacement – If one spouse passes away, life insurance makes sure the other spouse still has money to live on.

Future planning – It can help pay for children’s schooling, retirement, and everyday expenses.

Types of Life Insurance for Married Couples

Married couples have a lot of policy options. The best choice depends on their age, financial goals, and long-term needs.

1. Joint Life Insurance for Married Couples

Joint life insurance is one policy that will cover both husband and wife together. There are two main types. The first type is called a first-to-die policy. This means that the insurance company will pays money when the first spouse passes away. The money goes to the surviving spouse to help with things like paying the home loans, childcare, or other living expenses.

The second type of this plan is called a second-to-die policy, also known as survivorship insurance. This pays money only after both spouses have passed away. It is usually used for estate planning or leaving the money for children or family.

2. Term Life Insurance for Married Couples

Term life insurance gives coverage for a fixed time, like it will cover you for 10, 20, or 30 years. It is best life insurance policies for married couples who are just starting their life together.

This type of insurance usually has low monthly payments, which makes it affordable for the couples. It works well for covering big needs like paying off a mortgage, supporting children’s education, or replacing income if one spouse passes away.is a popular choice

3. Whole Life Insurance for Married Couples

Whole life insurance gives coverage for your entire life, it mean that this plan will never expire. , this plan will builds a cash value over time along with protection. This cash value can be taken from or used in the future if there is some emergency or you need it for something other.

Because of these extra benefits, whole life insurance is more expensive than term life insurance. This is a good choice for couples who want permanent protection and also want cash value within the plan because this cash value will grow over time and can be taken whenever couple needs.

Comparison Table: Term vs Whole vs Joint Life Insurance

| Policy Type | Best For | Pros | Cons | Cost Range (Avg. for Couple) |

| Term Life | Young married couples, families with debts | Affordable, simple, flexible | Expires after term | $30–$70/month |

| Whole Life | Long-term planners, estate building | Lifetime coverage, cash value | Higher premiums | $150–$300/month |

| Joint Life | Couples wanting one policy | Lower premiums than two policies | Limited flexibility | $50–$120/month |

Best Life Insurance Policy for Married Couples

The best life insurance for married couples depends on what stage of life they are in and what they need for their future and also how much they can afford. For young couples, term life insurance is a smart choice because it gives affordable protection during the early years when money may be tight. For couples with children, having a mix of term life and whole life can be helpful, it gives quick protection now and also supports long-term financial planning. For couples who are focused on wealth and inheritance, a joint survivorship policy works well because it helps with estate planning and leaving money for their family in the future.

Life Insurance for Newly Married Couples

Starting a life as a newly married couple brings so much fun but there are also so many new responsibilities such as paying rent, loans, and planning for the future. Getting life insurance in early marriage will help newly married couples stay financially safe and secure from the very beginning.

How Much Does Life Isurance Cost?

Some useful tips for newlyweds include:

- Buy coverage early while monthly payments are still low

- Think about joint term life insurance if both partners are working and sharing bills

- Always plan ahead for family growth, like having children or taking on a bigger mortgage in the future.

Average Cost of Life Insurance For Married Couples

Life insurance costs (called premiums) change depending on your age, health, policy type, and how much coverage you choose.

Term Life Insurance (20 years, $500,000 coverage):

- Healthy couple in their 30s: the price is about $40–$70 per month

- Healthy couple in their 40s: the price is about $70–$120 per month

Keep in mind that these are the estimated prices check the recent prices from the insurance company,

Whole Life Insurance (permanent coverage):

- Couple in their 30s: about $150–$250 per month

- Couple in their 40s: about $250–$400 per month

Joint Life Insurance (one policy for both people):

- Usually 10–20% cheaper than buying two separate life insurance policies.

Life Insurance Quotes for Married Couples

Insurance companies can also offer the customized life insurance quotes for married couples based on shared coverage needs.

Factors that are affecting quotes are:

- Age and health conditions.

- Smoking status.

- Length of coverage (10, 20, 30 years).

- Policy type (term, whole, joint).

Affordable Life Insurance for Married Couples

Affordability doesn’t mean sacrificing coverage. Many insurers offer policies starting at under $50/month for healthy young couples.

Ways to save:

- Buy coverage early.

- Choose term life over whole life.

- Opt for joint policies.

- Compare quotes online.

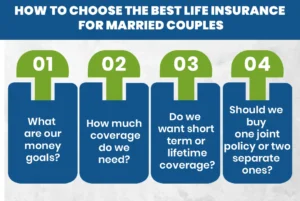

How to Choose the Best Life Insurance for Married Couples

When choosing a life insurance policy, think about these questions:

1. What are our money goals?

Do we want to pay off debts, save for kids, or build long-term wealth?

2. How much coverage do we need?

A common rule is 10–15 times your total yearly income.

3. Do we want short-term or lifetime coverage?

Term life is cheaper but ends after a set time, while whole life lasts forever.

4. Should we buy one joint policy or two separate ones?

A joint policy costs less, but separate policies give more flexibility.

Final Thoughts

Life insurance is a very smart choice for married couples. Like with sharing the everything together you can also save your future together. You can pick term life, whole life, or a joint policy, you can choose any of them that is best fit for your budget and needs. If you start early, you and your partner make sure to compare the prices from the different insurance companies, and balance cost with future security, you’ll be able to choose the right life insurance that protects both of you.

Secure Your Future Together – Get Life Insurance Today with Mlife insurance!

Protect your spouse, your family, and your financial future. Compare term, whole, and joint life insurance options for married couples and find the policy that fits your budget and goals. Get a free quote now and start building peace of mind together.

FAQS

1. What is the best type of life insurance for a married couple?

The best type depends on your needs and what are your goals. Term life insurance is affordable and good for covering big needs like a mortgage or raising kids. Whole life insurance costs more but lasts your entire life and builds cash value. Some couples choose a joint policy to save money.

2. Does life insurance cover both husband and wife?

Yes, if you buy a joint life policy, it covers both people under one plan. But if you buy individual policies, each person has their own coverage.

3. Which insurance is best for couples?

For most couples, term life insurance is the mos best choice, because this is the affordable option. But if you want lifetime protection or savings built into your policy, whole life insurance may be better. A joint policy can also be a good option if you want lower costs.

4. What is joint term life insurance for couples?

It’s a single term life policy that covers both partners for a set time (like 20 years). It usually costs 10–20% less than buying two separate policies, but it may only pay out once—when the first partner passes away.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.