Last Updated on: April 4th, 2025

- Licensed Agent

- - @M-LifeInsurance

What is Estate Planning?

Estate planning is the process of organizing and managing your assets to ensure they are distributed according to your wishes after your passing. It includes creating legal documents such as wills, trusts, and powers of attorney. The goal is to protect your family, minimize taxes, and make asset distribution easier for your heirs.

A well-thought-out estate plan ensures that your loved ones are financially secure and that your assets are handled according to your desires. Without an estate plan, your assets may go through probate, which can be costly and time-consuming for your beneficiaries.

What’s the Difference Between an Estate Plan and a Will?

Many people think an estate plan and a will are the same, but they serve different purposes:

- A will is a legal document that outlines how your assets should be distributed after your death. It also names guardians for minor children and an executor to carry out your wishes. However, a will must go through probate, which can be a lengthy legal process.

- An estate plan is a broader strategy that may include a will but also incorporates trusts, life insurance, power of attorney, healthcare directives, and tax planning. An estate plan provides a more comprehensive approach to managing your assets, reducing tax burdens, and ensuring your family’s financial security.

While a will is an essential part of an estate plan, it does not cover all aspects of wealth management, asset protection, and tax efficiency.

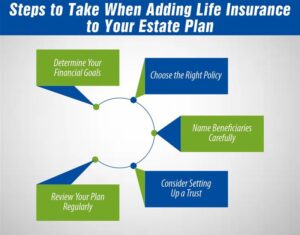

Steps to Take When Adding Life Insurance to Your Estate Plan

Life insurance can be a valuable tool in estate planning. Here’s how you can incorporate it into your strategy:

- Determine Your Financial Goals – Identify whether you need life insurance for income replacement, debt coverage, inheritance, or tax efficiency. Consider factors such as dependents, outstanding loans, and estate tax obligations.

- Choose the Right Policy – Decide between term life, whole life, or indexed universal life insurance based on your long-term needs. Permanent life insurance policies are often preferred for estate planning due to their lifetime coverage and cash value component.

- Name Beneficiaries Carefully – Ensure that your policy’s beneficiaries align with your estate plan. If a minor is a beneficiary, consider setting up a trust to manage funds until they reach an appropriate age.

- Consider Setting Up a Trust – A life insurance trust can help avoid probate and estate taxes. By placing your policy in an irrevocable trust, you can control how benefits are distributed while keeping the proceeds out of your taxable estate.

- Review Your Plan Regularly – Life changes such as marriage, children, or financial shifts may require updates to your estate plan. Regularly reviewing your policy ensures it remains aligned with your estate planning goals.

What Types of Life Insurance Are Used in Estate Planning?

Different types of life insurance serve various estate planning purposes:

- Term Life Insurance – Provides coverage for a specific period, ideal for income replacement and debt coverage. However, it does not build cash value and is not typically used for long-term estate planning.

- Whole Life Insurance – Offers lifetime coverage with cash value growth, often used to leave a guaranteed inheritance or fund a trust.

- Universal Life Insurance – Provides flexible premiums and death benefits, useful for estate liquidity and long-term planning.

- Indexed Universal Life Insurance (IUL) – Allows cash value accumulation linked to market performance, beneficial for wealth transfer and estate growth strategies.

- Survivorship Life Insurance – Covers two individuals (usually spouses) and pays out upon the second death, often used for estate tax planning and wealth preservation.

Choosing the right type of life insurance depends on your estate planning goals, financial situation, and beneficiaries’ needs.

When Should You Start Using Life Insurance in Estate Planning?

The sooner, the better. Key moments to consider life insurance in estate planning include:

- When you get married or start a family, ensuring your spouse and children have financial protection.

- When you buy a home or take on major financial responsibilities, covering mortgages and debts.

- When you start planning for retirement, ensuring a steady income and tax-efficient asset transfer.

- When you have significant assets and want to protect your heirs from estate taxes, structuring insurance for wealth preservation.

Starting early can help you secure lower premiums and maximize financial benefits for your heirs.

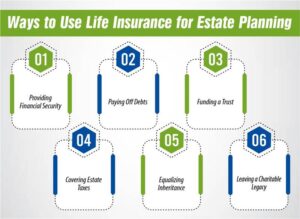

Ways to Use Life Insurance for Estate Planning

Life insurance serves multiple estate planning purposes:

- Providing Financial Security – Ensures your loved ones have financial support after your passing, replacing lost income.

- Paying Off Debts – Covers mortgages, loans, and other outstanding obligations so heirs are not burdened.

- Funding a Trust – Helps avoid probate and provides controlled asset distribution to beneficiaries, ensuring financial stability.

- Covering Estate Taxes – Helps your heirs cover inheritance taxes without selling valuable assets like family businesses or real estate.

- Equalizing Inheritance – If some heirs inherit non-liquid assets (e.g., a business or property), insurance can provide cash to balance distributions.

- Leaving a Charitable Legacy – You can designate a charity as a beneficiary to support a cause that is important to you.

Can You Use Life Insurance to Avoid Estate Taxes?

Yes, but proper structuring is key. Life insurance death benefits are usually tax-free for beneficiaries, but if owned personally, the payout may be subject to estate taxes. Strategies to avoid this include:

- Setting Up an Irrevocable Life Insurance Trust (ILIT) – Transfers policy ownership to a trust, keeping proceeds outside your taxable estate. This strategy ensures that your heirs receive the full benefit without estate tax deductions.

- Gifting the Policy – Transferring ownership to a beneficiary at least three years before death can help avoid taxes. However, this requires careful planning to comply with tax laws.

Using these strategies, you can preserve more wealth for your heirs while minimizing tax liabilities.

Is Life Insurance a Good Way to Leave an Inheritance?

Absolutely! Life insurance offers several advantages:

- Immediate Payouts – Unlike real estate or business assets, life insurance benefits are paid quickly, providing financial security for beneficiaries.

- Tax-Free Benefits – Beneficiaries receive payouts free of income tax, allowing them to access funds without financial burdens.

- Guaranteed Amounts – Ensures heirs receive a set amount, unaffected by market fluctuations or economic downturns.

With proper planning, life insurance can be an effective and reliable way to pass on wealth to future generations.

Frequently Asked Questions (FAQs)

1. Can life insurance be included in my estate?

Yes, if you own the policy, its proceeds may be considered part of your taxable estate. However, setting up an irrevocable life insurance trust (ILIT) can help keep it separate and avoid estate taxes.

How Much Does Life Isurance Cost?

2. Who should be the beneficiary of my life insurance policy for estate planning purposes?

It depends on your goals. Common choices include a spouse, children, a trust, or even a charitable organization. A financial advisor can help determine the best beneficiary designation for your situation.

3. What happens if I don’t include life insurance in my estate plan?

Without life insurance, your heirs may face financial difficulties, including estate taxes, unpaid debts, and probate delays. Life insurance ensures liquidity to cover these expenses smoothly.

4. Can I change the beneficiaries of my life insurance policy?

Yes, you can update your beneficiaries at any time, unless your policy is in an irrevocable trust. It’s important to review your policy regularly to ensure it aligns with your estate planning needs.

5. How often should I review my life insurance and estate plan?

You should review your estate plan and life insurance policy at least every few years or after major life events, such as marriage, having children, buying property, or changes in tax laws.

Conclusion

Incorporating life insurance into your estate plan is a smart way to protect your family, reduce financial burdens, and secure your legacy. With the right strategy, you can ensure your loved ones are taken care of and your assets are distributed efficiently.

If you need guidance on selecting the right policy or structuring your estate plan, consult an estate planning professional or financial advisor to create a tailored plan that fits your needs.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.