Do you think what would happen to your family financially if something were to happen to you? It’s a tough question, but an important one to consider. Guardian Voluntary Life Insurance can be the solution to this concern, offering a safety net for your loved ones.

Thank you for reading this post, don't forget to subscribe!This type of insurance is designed to provide financial security and peace of mind, ensuring that your family is taken care of even in your absence. In this comprehensive guide, we’ll explore the key features, benefits, and workings of Voluntary Life Insurance. By the end, you’ll clearly understand how this insurance can fit into your financial planning and why it might be the right choice for you.

Let’s have a look together!

What is Guardian Voluntary Life Insurance?

Guardian Voluntary Life Insurance is a type of life insurance offered through employers, giving employees the option to purchase additional coverage beyond what may be provided by their employer-paid life insurance. Unlike traditional insurance plans that are fully funded by the employer, voluntary life insurance is typically paid for by the employee through payroll deductions. This insurance is flexible, allowing employees to choose the coverage amount that best suits their needs and financial situation.

Key Features

- Flexible Coverage Options: Employees can select from a range of coverage amounts, tailoring the policy to their personal and family needs.

- Affordable Premiums: Because it’s a group insurance plan, premiums are often lower than those for individual policies, making it an economical choice.

- Convenient Payment: Premiums are deducted directly from the employee’s paycheck, ensuring seamless and consistent payment without the need to remember to pay monthly bills.

- Portability: Some plans allow you to take your coverage with you if you leave your job.

- No Medical Exam for Basic Coverage: For lower coverage amounts, no medical examination is required, making it easy for employees to qualify for coverage quickly.

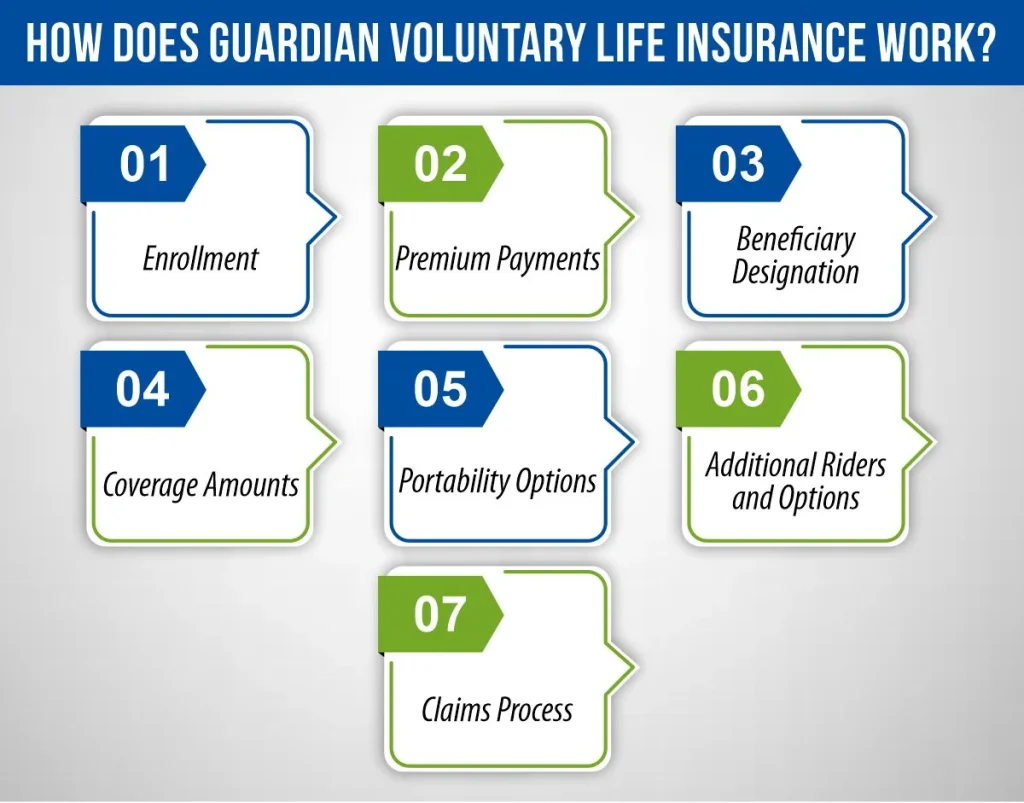

How Does Guardian Voluntary Life Insurance Work?

Understanding how Voluntary Life Insurance works can help you make an informed decision. Here’s a breakdown of the process:

1- Enrollment

Enrollment usually occurs during your employer’s open enrollment period. During this time, you’ll have the opportunity to review your options and choose the coverage level that best suits your needs. The process is straightforward and typically involves filling out a few forms provided by your employer.

2- Premium Payments

Premiums for Voluntary Life Insurance are deducted directly from your paycheck. This automatic deduction ensures that you never miss a payment, keeping your policy active without the need for manual payments. The convenience of payroll deductions simplifies managing your insurance costs.

3- Beneficiary Designation

When you enroll, you’ll need to designate one or more beneficiaries. These are the individuals who will receive the policy’s death benefit in the event of your passing. It’s important to choose your beneficiaries carefully and update them as necessary, such as after major life events like marriage, divorce, or the birth of a child.

4- Coverage Amounts

This insurance plan offers a range of coverage amounts, allowing you to select the level that meets your needs. Whether you need a basic policy to cover final expenses or a larger amount to ensure your family’s financial stability, you can tailor your coverage accordingly.

5- No Medical Exams for Basic Coverage

For many voluntary life insurance plans, including Guardian’s, basic coverage amounts do not require a medical exam. This feature makes it easy to obtain coverage quickly and without the need for extensive health screenings. However, higher coverage amounts may require medical underwriting.

6- Portability Options

One of the significant advantages of Voluntary Life Insurance is the option for portability. If you leave your job, you can take your coverage with you, typically by converting it to an individual policy. This ensures that you don’t lose your valuable life insurance protection when changing employers.

7- Additional Riders and Options

Guardian offers various riders that can be added to your policy for additional benefits. These may include accidental death and dismemberment (AD&D) coverage, waiver of premium in case of disability, and accelerated death benefit riders. These options allow you to customize your policy to better meet your needs.

8- Claims Process

In the event of your passing, your beneficiaries will need to file a claim to receive the death benefit. Guardian has a streamlined claims process to ensure that your loved ones receive the benefits quickly and without unnecessary hassle. Beneficiaries typically need to provide a death certificate and complete a claims form.

Types of Guardian Voluntary Life Insurance

The plan offers several types of policies to meet various needs. Here’s an overview of each:

1- Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It’s ideal for those looking to ensure financial protection during critical years, like while raising children or paying off a mortgage. Premiums are fixed for the term, making it easier to budget.

2- Whole Life Insurance

Whole life insurance is a permanent policy that provides coverage for your entire life, as long as premiums are paid. This type of insurance includes a savings component known as cash value, which grows over time. Whole life insurance offers guaranteed death benefits and fixed premiums, making it a reliable option for lifelong coverage.

3- Universal Life Insurance

Universal life insurance combines the protection of term insurance with a savings element that grows at a variable interest rate. It offers flexible premiums and death benefits, allowing you to adjust your policy as your needs change. The cash value component can potentially grow more than with whole life insurance, depending on market conditions, although it comes with some risk.

4-Accidental Death and Dismemberment (AD&D) Insurance

AD&D insurance provides additional benefits if you die or suffer serious injuries due to an accident. It’s typically added to a primary life insurance policy to enhance coverage. This type of insurance pays out specified amounts for different types of injuries, such as loss of limbs or vision.

How Much Does Life Isurance Cost?

5- Supplemental Life Insurance

Supplemental life insurance allows you to purchase additional coverage to enhance your existing employer-paid life insurance. This ensures that your total life insurance coverage is enough to meet your family’s needs. Premiums are usually paid by the employee through payroll deductions, making it an affordable option.

6- Voluntary Dependent Life Insurance

Voluntary dependent life insurance provides coverage for your spouse and dependents, extending financial protection to your entire family. This type of insurance allows you to choose from different coverage levels, ensuring that your loved ones are protected. It is an affordable way to provide additional security for your family members, often offered at group rates through your employer.

7- Key Riders and Add-Ons

Voluntary Life Insurance policies can be customized with various riders and add-ons to better meet your needs. These might include a waiver of premium rider, which waives your premium payments if you become disabled and unable to work, or an accelerated death benefit rider, which allows you to access a portion of your death benefit if diagnosed with a terminal illness.

What Does Guardian Voluntary Life Insurance Cover?

Guardian Voluntary Life Insurance offers a range of coverages that provide financial security and peace of mind for you and your loved ones. Here’s a breakdown of what it typically covers:

-

Death Benefit

The main component of Voluntary Life Insurance is the death benefit. This is a lump sum payment made to your beneficiaries when you pass away. The death benefit can be used for various purposes, such as paying for funeral and burial expenses, covering outstanding debts, and others.

-

Terminal Illness Coverage

Voluntary Life Insurance often includes a terminal illness rider. This provision allows you to access a portion of the death benefit if you are diagnosed with a terminal illness. The funds can be used to cover medical expenses, hospice care, or any other needs during your remaining time, giving you financial flexibility when you need it most.

-

Family Coverage

Many Voluntary Life Insurance policies offer the ability to extend coverage to your spouse and dependents. This means you can ensure your entire family is protected under the same policy, simplifying the management of your life insurance and providing peace of mind that your loved ones are covered.

-

Waiver of Premium

Guardian policies often include a waiver of premium rider. If you become disabled and are unable to work, this rider waives your premium payments while keeping your policy active. This ensures that your life insurance coverage remains in place even if you face financial difficulties due to disability.

Benefits of Guardian Voluntary Life Insurance

Guardian Voluntary Life Insurance comes with several notable benefits that make it a worthy consideration.

1- Financial Security

The primary benefit of life insurance is the financial security it provides for your loved ones. In the event of your passing, the death benefit can help cover various expenses, such as funeral costs, outstanding debts, and everyday living expenses.

2- Supplemental Coverage

Voluntary Life Insurance can act as a supplement to any employer-paid life insurance you might already have. This additional coverage ensures that your overall life insurance protection is adequate to meet your family’s needs.

3- Tax Benefits

Life insurance benefits are generally tax-free for your beneficiaries. This means they can receive the full amount of the death benefit without worrying about taxes, providing them with the financial support they need during a challenging time.

4- Hassle-Free Claims Process

Guardian is known for its streamlined claims process, ensuring that your beneficiaries receive the death benefit quickly and without unnecessary hassle. This efficiency is crucial during a time of loss, providing your loved ones with timely financial support.

5- Continuous Protection

By opting for Voluntary Life Insurance, you ensure continuous protection for your family. The automatic payroll deductions keep your policy active, eliminating the risk of missed payments and lapses in coverage.

Comparing Guardian Voluntary Life Insurance to Other Options

It’s essential to compare different life insurance options to find the best fit for you. Here’s how Voluntary Life Insurance stacks up against other types.

-

Employer-Paid Life Insurance

Employer-paid life insurance is often limited in coverage. It may not be sufficient for all your needs. Guardian Voluntary Life Insurance allows you to increase your coverage beyond what your employer provides.

-

Individual Life Insurance

Individual policies can be more expensive and require a medical exam. Guardian Voluntary Life Insurance offers the convenience of group rates and, often, no medical exam for basic coverage amounts.

-

Other Voluntary Life Insurance Policies

While many insurers offer voluntary life insurance, Guardian’s reputation for reliability and customer service makes it a standout choice. They provide flexible, affordable, and comprehensive coverage options.

The Bottom Line

Guardian Voluntary Life Insurance is a valuable option for employees seeking flexible, affordable life insurance coverage. With its customizable plans, ease of enrollment, and financial security, it stands out as a top choice. Whether you’re looking to supplement existing coverage or secure a new policy, Guardian offers reliable solutions which can meet your needs. Take the time to evaluate your options and make an informed decision that ensures your loved ones are protected.

References:

https://www.investopedia.com/terms/v/voluntary-life-insurance.asp

https://www.usnews.com/insurance/life-insurance/guardian-life

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.