Are you a high net worth individual seeking the right life insurance coverage to protect your assets and loved ones? High net worth life insurance could be the solution you’re looking for. It’s a policy that not only offers increased coverage limits but also provides customized options tailored to your unique needs.

Want to know more about this insurance plan? We have covered you! In this blog post, we’ll explore everything you need to know about high net-worth life insurance. Read on to this guide to discover how this unique insurance can safeguard your wealth and secure your family’s future.

What is High Net Worth Life Insurance?

High net worth life insurance, also known as private client life insurance or high-value life insurance, is a specialized type of insurance designed for individuals with substantial assets and wealth. Unlike standard life insurance policies, which may have coverage limits that don’t adequately reflect the assets of high net worth individuals, these policies offer higher coverage limits and more customization options.

High net-worth life insurance is tailored to the specific needs of affluent individuals, providing comprehensive coverage for estate planning, wealth transfer, and legacy protection. It offers flexibility in premium payments and may accumulate cash value over time, providing additional financial benefits beyond the death benefit.

Key Features of High Net Worth Life Insurance

High net-worth life insurance is designed to meet the unique needs of well-off individuals, offering several key features that set it apart from standard life insurance policies:

- Higher Coverage Limits: High net-worth life insurance policies provide coverage limits that are more aligned with the assets and lifestyle of wealthy individuals.

- Customized Coverage Options: These policies offer a high degree of customization, allowing policyholders to tailor their coverage to meet their specific needs, such as estate planning, wealth transfer, and legacy protection.

- Flexible Premium Payments: High net-worth life insurance policies often offer flexible premium payment options, allowing policyholders to choose how and when they pay their premiums.

- Cash Value Accumulation: Some high net-worth life insurance policies accumulate cash value over time, which can be accessed by the policyholder during their lifetime. This feature provides additional financial flexibility and can be used for a variety of purposes.

- Estate Planning Benefits: High-net-worth life insurance can be an important tool in estate planning, helping to protect assets from estate taxes and ensuring a smooth transfer of wealth to future generations.

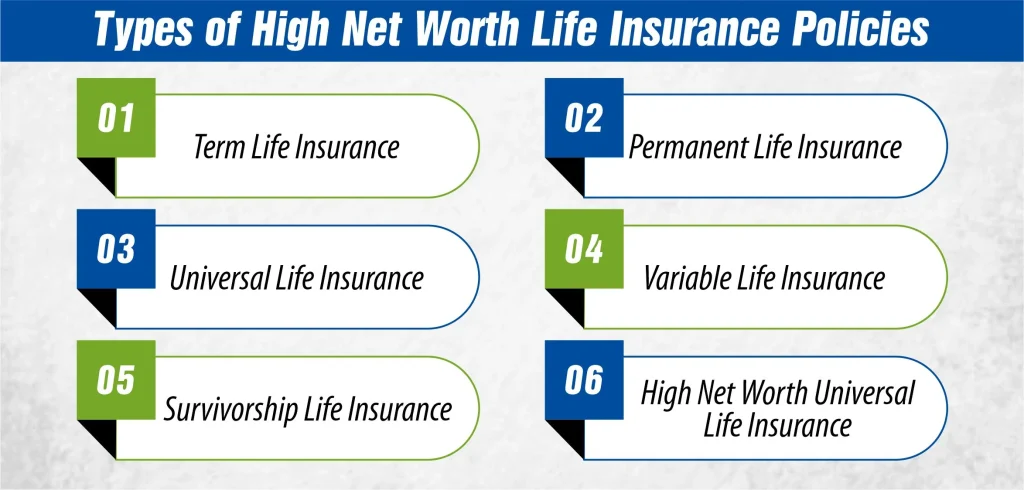

Types of High Net Worth Life Insurance Policies

High net-worth individuals have unique insurance needs that require specialized coverage. There are several types of high-net-worth life insurance policies available, each offering different features and benefits. Here are some of the most common types:

1- Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. This insurance policy is often more affordable than permanent life insurance but does not accumulate cash value.

2- Permanent Life Insurance

The policy offers lifetime coverage and includes a cash value component that grows over time. Permanent life insurance policies, such as whole life or universal life insurance, can be more expensive but provide lifelong protection and a cash value component that can be accessed during the policyholder’s lifetime.

3- Universal Life Insurance

A type of permanent life insurance that offers flexibility in premium payments and death benefits. Universal life insurance policies accumulate cash value, which can be used to pay premiums or taken as a loan by the policyholder.

4- Variable Life Insurance

Similar to universal life insurance but allows the policyholder to invest the cash value portion of the policy in investment accounts. The cash value and death benefit of variable life insurance can fluctuate based on the performance of the investment accounts.

5- Survivorship Life Insurance

Also known as second-to-die life insurance, this type of policy insures two people and pays out the death benefit upon the death of the second insured. Survivorship life insurance is often used in estate planning to provide liquidity for estate taxes.

6- High Net Worth Universal Life Insurance

A specialized form of universal life insurance designed for high net worth individuals. This type of policy offers higher coverage limits and more customization options to meet the unique needs of affluent individuals.

Why is High-Net-Worth Life Insurance Important?

High-net-worth life insurance is important for several reasons. Firstly, it helps wealthy individuals protect their assets and provide financial security for their loved ones. Since high-net-worth individuals often have complex financial situations, standard life insurance policies may not offer adequate coverage. High-net-worth life insurance provides higher coverage limits and more customization options to meet the unique needs of affluent individuals.

Secondly, high-net-worth life insurance plays a crucial role in estate planning. It can help mitigate estate taxes, ensuring that heirs receive their inheritance without the burden of hefty tax liabilities. This is particularly important for individuals with significant assets, as estate taxes can diminish the value of the estate.

Moreover, high-net-worth life insurance is crucial for business owners as it can finance buy-sell agreements. This ensures a seamless transfer of ownership in case of the policyholder’s demise, safeguarding the interests of both the family and business partners and ensuring business continuity.

Benefits and Drawbacks of High Net Worth Life Insurance

High net-worth life insurance offers a range of benefits tailored to the unique needs of affluent individuals. However, like any financial product, it also has its drawbacks. Here’s a closer look at the benefits and drawbacks of high-net-worth life insurance:

Benefits:

- Estate Tax Mitigation

One of the primary benefits is the mitigation of estate taxes. Upon death, significant estates can be subject to substantial taxes. High-net-worth life insurance provides liquidity to pay estate taxes, preserving valuable assets for heirs.

How Much Does Life Isurance Cost?

- Wealth Preservation

High net-worth life insurance helps preserve wealth by providing a financial cushion. This ensures that heirs receive the intended inheritance without the burden of large tax liabilities or other financial obligations.

- Business Succession Planning

For business owners, high-net-worth life insurance is essential for succession planning. It can fund buy-sell agreements, ensuring a smooth transition of ownership and continuity of the business. This protects the interests of both the family and business partners.

- Charitable Giving

Many wealthy individuals have philanthropic goals. High net worth life insurance can facilitate significant charitable donations. By naming a charity as a beneficiary, policyholders can leave a lasting legacy and support causes they care about.

- Financial Security for Dependents

High net-worth life insurance provides a financial safety net for dependents, ensuring they are taken care of in the event of the policyholder’s death. This can include family members, business partners, or other individuals who rely on the policyholder for financial support.

Drawbacks:

- Cost

High net worth life insurance policies can be more expensive than standard life insurance policies, due to the higher coverage limits and customization options.

- Complexity

High net worth life insurance policies can be complex, with a variety of features and options to consider. It’s important for policyholders to fully understand their policy and how it works.

- Investment Risk

Some high-net-worth life insurance policies, such as variable life insurance, allow policyholders to invest the cash value portion of their policy in investment accounts. While this can provide the potential for higher returns, it also comes with investment risk.

- Liquidity

High net-worth life insurance policies that accumulate cash value may not provide immediate liquidity. Policyholders may need to wait several years before they can access the cash value of their policy.

- Underwriting Requirements

High net-worth life insurance policies may have stricter underwriting requirements than standard life insurance policies, which can make them more difficult to qualify for.

Overall, high net-worth life insurance can be a valuable tool for affluent individuals looking to protect their assets and provide for their loved ones. However, it’s important to carefully weigh the benefits and drawbacks before purchasing a policy to ensure it meets your financial goals and needs.

Cost of High Net Worth Life Insurance Policy

The cost of a high net-worth life insurance policy can vary depending on several factors, including the coverage amount, the policyholder’s age, health, and lifestyle, and the insurance company’s underwriting criteria. Generally, high-net-worth life insurance policies tend to be more expensive than standard life insurance policies due to the higher coverage limits and customization options.

Here is a simplified table showing the estimated monthly premiums for a high-net-worth life insurance policy with a $1 million coverage amount for a non-smoking individual:

| Age | Male | Female |

| 30 | $100 | $80 |

| 40 | $150 | $120 |

| 50 | $250 | $200 |

| 60 | $450 | $350 |

| 70 | $800 | $600 |

Note: These are approximate premiums and actual costs may vary based on individual circumstances and insurance company policies.

How to Apply for High Net Worth Life Insurance Policy?

Applying for a high-net-worth life insurance policy is a straightforward process, but it requires careful consideration and preparation. Here’s a step-by-step guide to help you navigate the application process:

1- Evaluate Your Requirements

Determine the amount of coverage you need based on your assets, liabilities, and financial goals. Consider factors such as estate planning, wealth transfer, and legacy protection.

2- Research Insurance Providers

Look for insurance companies that specialize in high-net-worth life insurance and have a strong financial rating. Compare their policies, coverage options, and customer reviews to find the right fit for your needs.

3- Contact an Insurance Agent or Broker

Work with an experienced insurance agent or broker who can help you understand your options and guide you through the application process. They can also help you compare quotes from different insurers.

4- Gather Required Documents

You will need to provide certain documents during the application process, such as proof of income, financial statements, and medical records. Be prepared to submit these documents to the insurance company.

5- Complete the Application Form

Fill out the application form accurately and honestly, providing all requested information. Be prepared to answer questions about your health, lifestyle, and financial situation.

6- Undergo Medical Underwriting

Depending on the policy and coverage amount, you may need to undergo a medical exam as part of the underwriting process. This helps the insurance company assess your risk profile and determine your premium.

7- Review and Accept the Policy

Once your application is approved, carefully review the policy terms and conditions. Make sure you understand the coverage, premiums, and any exclusions. If you are satisfied with the policy, accept the terms and sign the agreement.

8- Pay the Premium

Pay the initial premium to activate your policy. Some policies may offer flexible payment options, so choose the one that best suits your financial situation.

9- Stay in Touch with Your Agent

Keep in touch with your insurance agent or broker to stay informed about any changes to your policy or coverage options. They can also help you make adjustments to your policy as your financial situation evolves.

By following these steps and working closely with your insurance agent, you can successfully apply for a high net worth life insurance policy that meets your needs and provides the financial protection you desire.

Conclusion

High net worth life insurance is a vital tool for wealthy individuals seeking to protect their legacy and achieve their financial goals. By understanding the benefits, types of policies, and key considerations, you can make informed decisions that provide you peace of mind and financial security for your families and businesses.

References:

https://www.aon.com/en/capabilities/health-and-benefits/high-net-worth-life-insurance

https://www.legalandgeneral.com/insurance/life-insurance/guides/high-net-worth-life-insurance/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.