Last Updated on: May 8th, 2025

- Licensed Agent

- - @M-LifeInsurance

Introduction: Understanding Medicaid and Funeral Costs

Funerals can be expensive, often costing between $7,000 and $12,000 in the United States. This includes expenses like the casket, burial plot, funeral home services, and transportation. For many families—especially those living on a fixed income—these costs can create a serious financial burden during an already emotional time.

That’s where questions like “Does Medicaid cover funeral expenses?” or “Does Medicaid pay for funeral expenses?” often come up. Medicaid is a government program that provides health coverage to low-income individuals, seniors, and people with disabilities. While it helps with medical bills, its support for funeral costs is limited and varies by state.

Although Medicaid itself does not directly pay for funerals in most cases, some states offer burial or cremation assistance programs through local Medicaid offices or public health departments. These programs may help cover basic funeral costs or offer free cremation for qualifying low-income families.

In this article, we’ll explore how funeral costs are handled, what kind of help Medicaid may offer, and what state-specific programs are available. Understanding your options can help ease the stress of planning a funeral and ensure your loved one is honored respectfully even with a limited budget.

Does Medicaid Cover Funeral Expenses?

Many people wonder, “Does Medicaid cover funeral expenses?” or “Does Medicaid pay for a funeral?” The short answer is: Medicaid does not directly pay for funeral or burial costs. Medicaid is a health insurance program for low-income individuals, and its coverage focuses on medical services, not non-medical expenses like funerals.

However, there is a key difference between medical vs non-medical end-of-life benefits. While Medicaid may cover hospice care, pain management, or in-home nursing during the final stages of life, it does not cover funeral arrangements, caskets, embalming, or burial plots. These are considered personal expenses and are generally the responsibility of the individual or their family.

That said, some states offer Medicaid-related funeral assistance programs. These programs vary widely depending on location. For example, New York, Illinois, Pennsylvania, and Washington State offer limited burial or cremation help for Medicaid recipients through state-funded or county programs. The amount of aid may range from a few hundred to a few thousand dollars, depending on the state’s budget and eligibility rules.

If you are searching for Medicaid funeral expenses support, it’s best to check with your state’s Medicaid office or Department of Human Services to see if any assistance is available in your area.

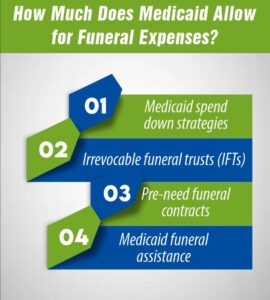

How Much Does Medicaid Allow for Funeral Expenses?

When it comes to how much Medicaid allows for funeral expenses, the rules can vary by state. Still, there are some general guidelines you should know, especially if you’re planning ahead through Medicaid spend-down strategies.

Medicaid has strict income and asset limits. To qualify, applicants often need to “spend down” their excess resources. This is where funeral planning becomes useful. Most states allow individuals to set aside money for funeral expenses in a way that won’t affect Medicaid eligibility. This is typically done through irrevocable funeral trusts (IFTs).

An irrevocable funeral trust is a legally binding agreement that allows a person to set aside funds specifically for their funeral. These trusts are not counted as assets by Medicaid, which means you can protect this money while still qualifying for benefits. Most states allow up to $15,000 to be placed in an IFT, though some states may have lower or higher limits.

In addition to IFTs, you may also be allowed to prepay for funeral arrangements through pre-need funeral contracts, as long as they are irrevocable. This helps secure your funeral plans while ensuring that your Medicaid eligibility remains unaffected.

Overall, Medicaid funeral assistance doesn’t cover costs directly, but with proper planning, you can legally set aside funds to ease the financial burden on your family.

State-by-State Medicaid Funeral Assistance Programs

While Medicaid doesn’t directly pay for funerals, many states offer specific funeral and burial assistance programs to help low-income families. These benefits vary widely by state and may include burial allowances, cremation aid, or funeral expense coverage under public assistance or Medicaid-related programs. Here’s a breakdown of available options by state:

1. New York (NY)

New York offers a burial allowance through public assistance programs.

- Medicaid may not directly pay for cremation, but low-income families can receive up to $1,700 toward funeral costs.

- Learn more through the NYC Human Resources Administration.

2. Washington State

Washington offers free cremation for low-income residents through local county programs and donation-based services.

How Much Does Life Isurance Cost?

3. Arizona

In Arizona, free cremation services may be available for low-income families through nonprofit organizations and county social service departments.

4. Texas

Texas provides cremation assistance through city or county indigent burial programs.

- Availability depends on local policies.

5. New Jersey (NJ)

- Medicaid funeral assistance NJ supports burial costs under general assistance.

- You can also seek state help with funeral costs via municipal welfare departments.

6. Illinois

Illinois has a funeral and burial assistance program for low-income residents.

- Medicaid funeral assistance may help cover essential services under strict guidelines.

7. Pennsylvania

- Pennsylvania offers limited burial assistance through county human services.

- Medicaid funeral assistance varies by case.

8. Maryland (MD)

- Burial assistance in MD is managed by local departments and can help with cremation and basic funeral expenses.

9. Washington D.C.

- Burial assistance in DC offers up to $1,000 toward funeral costs for eligible residents.

10. Colorado

- Colorado burial assistance is available through county-level indigent burial programs and nonprofits.

11. Ohio

- Ohio burial assistance programs vary by county but typically provide aid for direct cremation or basic burial services.

What If Medicaid Doesn’t Cover It? Alternative Options

If Medicaid doesn’t cover funeral or cremation costs, don’t worry—there are several alternative options available to help low-income families manage these expenses. These include local government programs, nonprofit organizations, and community support. Here are some of the most effective ways to seek help:

1. County or City-Level Assistance

Many counties offer indigent burial or cremation programs for residents who cannot afford final expenses. These are often run through social services or public health departments and typically cover direct cremation or simple burial.

2. Nonprofit and Church Support

Religious organizations and local nonprofits often assist families in need. Some churches provide free or discounted funeral services, while others may offer financial help or connect you with affordable service providers.

3. Crowdfunding Funeral Expenses

Online platforms like GoFundMe allow families to raise money for funeral or cremation costs. Sharing your story with friends and the community can lead to generous support during difficult times.

4. Veterans’ Funeral Benefits

If the deceased was a veteran, the Department of Veterans Affairs (VA) may provide burial benefits, including a free gravesite, headstone, and partial funeral reimbursement.

5. Health Department or Coroner Assistance

In some areas, the county coroner or health department may arrange cremation for unclaimed or low-income individuals, especially if there are no known family members or resources.

These options are valuable when you’re exploring how to pay for cremation with no money or seeking cremation assistance for a loved one. Always contact local agencies and organizations for up-to-date information.

Burial vs. Cremation: Which Is More Affordable?

When it comes to final arrangements, many families must decide between burial and cremation. For low-income households, cost is often the deciding factor—and cremation is typically the more affordable option.

Cremation vs. Burial Costs

On average, a traditional burial can cost between $7,000 and $12,000. This includes the casket, embalming, funeral service, plot, and headstone. In contrast, cremation usually costs between $1,000 and $4,000, depending on whether there’s a service or viewing.

For example, the price of cremation in NY can range from $700 for a direct cremation (no ceremony) to about $3,000 if additional services are included. Burial costs in the same state often exceed $10,000.

Why Cremation Is a Popular Choice

Cremation has become increasingly popular among low-income families because it:

- Requires fewer services and products

- Avoids cemetery costs (plots, maintenance fees)

- Can be delayed, giving families time to plan a memorial

Some cremation assistance programs help cover or reduce costs, especially for seniors, veterans, or those on Medicaid. If cost is a major concern, cremation is often the most practical and dignified option.

Choosing between funeral vs burial or cremation depends on budget, personal beliefs, and available assistance—but financially, cremation tends to offer the most relief.

FAQs: Medicaid & Funeral Costs

Q1: Does Medicaid cover burial expenses in every state?

No, Medicaid does not provide a nationwide burial benefit. Funeral and burial assistance varies by state, and in many cases, support comes from local or state-funded programs not directly from Medicaid. Some states like New York, Illinois, and Pennsylvania offer burial allowances through their Medicaid offices or social services departments.

Q2: What is an irrevocable funeral trust?

An irrevocable funeral trust (IFT) is a legal arrangement that allows Medicaid applicants to set aside funds specifically for funeral expenses without affecting their eligibility. These trusts are not counted as assets and are commonly used to meet Medicaid spend-down requirements. Most states allow IFTs up to $15,000.

Q3: Will Medicaid pay for cremation in New York?

Medicaid in New York does not directly pay for cremation, but certain counties offer burial assistance that can be used for cremation. The coverage amount depends on the county’s specific guidelines. Direct cremation is typically the most affordable option supported.

Q4: Can I pre-plan my funeral on Medicaid?

Yes, you can pre-plan your funeral through an irrevocable funeral trust or pre-need funeral arrangement. This helps reduce future burdens on your family and ensures your wishes are followed.

Q5: How can I find free cremation options in my area?

Check with your local Department of Social Services, public health office, or county coroner’s office. Some nonprofit groups and state-funded programs also offer free cremation for low-income families, especially in states like Washington, Arizona, and Texas.

Final Thoughts: Planning Ahead with or without Medicaid

Planning funeral arrangements ahead of time can ease the emotional and financial burden on your loved ones. Whether or not Medicaid covers funeral expenses in your state, understanding your options—like irrevocable funeral trusts, state burial assistance, or free cremation programs—can make a big difference. Each state offers different levels of support, so it’s important to research local programs and start early. Taking proactive steps allows families to make informed, cost-effective decisions that align with their wishes and budget, ensuring peace of mind during a difficult time. Empower your family by preparing today.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.