When we think about health insurance, we often focus on coverage for medical expenses like doctor visits and prescriptions. However, there’s one aspect of planning for the future that many people overlook: funeral costs. Understanding whether health insurance can help cover these expenses is an important part of financial planning.

Thinking about does health insurance cover funeral costs or not? Well! You are at the right place. In this blog post, we’ll explore the relationship between health insurance and funeral costs. Moreover, we’ll also discuss alternative options for covering funeral costs and provide insights to help you make accurate decisions about planning for the future.

Let’s get started!

If health insurance doesn’t cover funeral costs, there are several alternative options to consider:

Understanding Health Insurance

Having health insurance is an essential aspect of the healthcare management plan in terms of the costs involved. It is used to pay for medical services that are offered in hospitals and other healthcare facilities, these are for example doctor visits, hospitalization, prescription medicines and preventive screening. Here’s a closer look at the key aspects of health insurance:Premium:

This is the sum deducted from your salary every month and goes for your healthcare coverage. It will be a monthly, quarterly or yearly payment.Deductible:

The amount you are expected to pay off before the carrier begins to bear the expenses. Thus, in case if you have a deductible of $1,000 then you will be liable to pay the first $1,000 of medical expenses before the coverage begins.Copayment (copay):

It refers to a specific amount billed for a covered healthcare service which is normally medical visitation of the doctor or drug prescription. Copays to be paid are usually done upon the delivery of service.Coinsurance:

This is the amount of costs you pay provided your healthcare services have been used up after you met your deductibles. In this case, for example, if your coinsurance is 20%, you will pay 20%, while the remainder, i.e. 80%, will be covered by your medical insurance.Out-of-pocket maximum:

It is the amount that you will have spent for the entire plan year where all covered services were included. Upon reaching this limit, you will be helped to pay with 100% of covered services by your health insurance.Network:

Health insurance plans usually tend to collaborate with a selected group of doctors, clinics, and other health institutions to provide healthcare. In the majority of cases, the use of network providers is the cheaper option instead of treatment provided by out-of-network providers.Types of plans:

Comprehensively, health insurance plans are of numerous types that include HMO, PPO, EPO, and POS plans. While different people often have different money rules, the fees are different.What are Funeral Costs?

Funeral expenses mean the amount you will need for arranging and carrying out a funeral ceremony which is being conducted for a dead person. These variables can cover a big range from location, to where to choose a funeral home, to type of service and extra services chosen. Here are some common components of funeral costs:Funeral Home Services:

This encompasses the basic functions of the undertaker and his staff, the management of the funeral proceedings and the use of the funeral home for viewing and funeral space.Transportation:

This involves the collection of the body from the place of the death to the funeral home and conducting funeral services plus the process of the body disposal or the cremation.Casket or Urn:

Casket/urn cost may vary a lot, according to material, style and artistry.Embalming and Body Preparation:

First the body is to be watched, and then the process of embalming will be applied. Other body preparations, such as dressing, cosmetology, and hairdressing, may also be subject to costs.Cemetery or Crematory Fees:

This includes the price of housing the grave in a burial plot, the cost of the burial vault, the price of opening and closing of the grave or the cost of cremation.Funeral Service Costs:

The funeral ceremony expenses, including the worst funerals, will include the remuneration or fees of the clergy or officiants, music, flowers and printing materials such as the memorial cards or programs should be included.Additional Services:

Other overheads that you may run include obituary charges, funeral attendance from the family member, and a reception or gathering after the funeral. It is advisable to read the fine print of the funeral and various expenses involved so that you can be able to make well-informed decisions during this challenging time and also be prepared to cover the financial aspects of memorializing your loved one.Does Health Insurance Cover Funeral Costs?

Health insurance does not have such a thing as funeral costs as a part of its coverage. It is an insurance plan to cover the medical billing associated with the treatment of diseases or injuries; examples include visits to a doctor, hospital stays, and prescription medications. Usually, medical insurance policies leave out funeral costs, including money for the funeral service itself, burial or cremation, and other service-related expenses. Still, however, there are some cases in which funeral costs can be reduced by health insurance sometimes indirectly. For instance, if a person dies of a health-care condition taken by their health insurance, the policy can be reimbursed for the medication paid before death. Furthermore, several health insurance policies include cash benefits that are paid out to the beneficiary following the death of the insured person. This extra benefit provided may also be different though and used to cover funeral expenses and others. It is advisable to take a close look at your health policy and understand what is covered and not is the next step. If you are tired of covering the funeral cost, you might consider buying some funeral or burial insurance as an extra policy. Alternative Options for Funeral Expenses

Alternative Options for Funeral Expenses

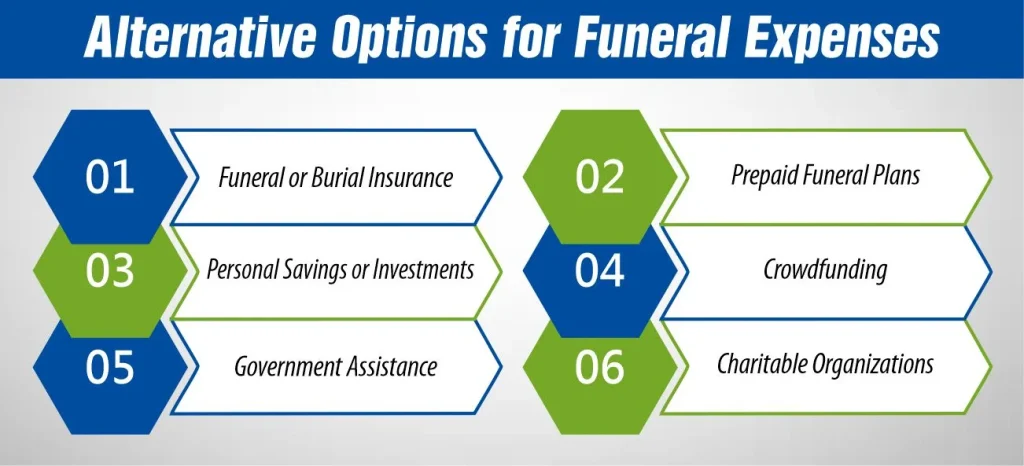

If health insurance doesn’t cover funeral costs, there are several alternative options to consider:

-

Funeral or Burial Insurance

-

Prepaid Funeral Plans

-

Personal Savings or Investments

-

Crowdfunding

-

Government Assistance

-

Charitable Organizations

The Bottom Line

As we are summing up, we hope you are clear about does health insurance cover funeral costs or not. Although health insurance will not cover the cost of a funeral directly, it may give some financial help in specific cases. It is necessary to read your health insurance policy carefully and think about adding additional choices, like funeral insurance or pre-paid planning, to protect your expenses for the funeral. By making arrangements in advance, you can relieve the burden on those who love you and make their time of grief much easier.Frequently Asked Questions (FAQs)

1- Can I use my life insurance to cover funeral expenses?

Recommend researching local funeral homes and requesting price lists to estimate the average cost of a funeral for your area. The beneficiary can use the death benefit from the life insurance policy to pay for funeral expenses.2- Are there any tax benefits for funeral expenses?

In some cases, funeral expenses may be tax-deductible if they meet certain criteria and if the estate exceeds the applicable exclusion amount. It’s advisable to consult with a tax advisor to determine if you qualify for any tax benefits related to funeral expenses.3- What is the average cost of a funeral?

Funeral costs can vary significantly depending on your location, the funeral home, and the type of services you choose. Recommend researching local funeral homes and requesting price lists to estimate the average cost of a funeral for your area.4- Can I pre-plan and pre-pay for my funeral?

Yes, many funeral homes offer pre-need funeral planning services, allowing individuals to make arrangements and pre-pay for their funeral expenses in advance. Pre-planning can help alleviate the financial and emotional burden on your loved ones in the future.5- What happens if I pass away without any funds set aside for funeral expenses?

If you pass away without any funds set aside for funeral expenses, your family may be responsible for covering the costs. They may need to use personal savings or assets from your estate or explore alternative options such as crowdfunding or government assistance.References:

https://www.ehealthinsurance.com/medicare/coverage/does-medicare-cover-funeral/ https://www.gohealth.com/medicare/coverages-benefits/funeral-expenses/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.