Last Updated on: April 9th, 2025

- Licensed Agent

- - @M-LifeInsurance

Introduction

When people think of life insurance, they often imagine a policy designed for a married person with children and a mortgage. But what about single individuals? If you’re not married and don’t have dependents, you may be wondering, “Do I really need life insurance?”

The short answer is: it depends on your personal circumstances.

Even without a spouse or children, there are many reasons why life insurance might still be a smart investment for you. From covering funeral costs to protecting co-signed debts, this guide will break down everything you need to know about life insurance when you’re single, so you can make a confident, informed decision.

Why Life Insurance Isn’t Just for Families

It’s a common misconception that life insurance is only for married people or parents. While it’s true that those with dependents often have a greater need for life insurance, being single doesn’t necessarily mean you have zero financial responsibilities.

In fact, single people can benefit from life insurance in the following ways:

- Protecting loved ones from co-signed debt

- Covering their own funeral and final expenses

- Leaving behind a financial legacy

- Locking in low rates while young and healthy

- Supporting aging parents or other family members

Let’s explore each of these situations more closely.

1. Do You Have Debt That Someone Else Could Be Responsible For?

One of the most important reasons to consider life insurance is outstanding debt. If you have any loans that are co-signed by someone else, they may be held responsible for paying off the remaining balance if you pass away.

Examples of debt that may impact others:

- Private student loans: Unlike federal loans, these don’t always get discharged upon death.

- Co-signed car loans or personal loans: Your co-signer will be on the hook.

- Credit card debt in community property states: In some states, families may be responsible for debts even if they didn’t sign for them.

Having a life insurance policy ensures that your loved ones won’t be burdened financially by your debts.

2. Who Would Pay for Your Funeral?

Funerals aren’t cheap. According to the National Funeral Directors Association, the average cost of a funeral with burial is over $8,000, and that doesn’t include cemetery costs, headstones, or obituary placements.

Without life insurance, your family or next of kin would have to cover these expenses out of pocket.

A basic life insurance policy or final expense insurance can cover:

- Funeral and burial costs

- Cremation services

- Memorials

- Medical bills

- Final taxes or legal fees

Even if you don’t have dependents, having coverage for final expenses is a thoughtful way to take care of your loved ones.

3. Do You Want to Leave Behind a Legacy?

Even without children or a spouse, many single people want to leave behind something meaningful.

With life insurance, you can name a charity, niece/nephew, godchild, or close friend as your beneficiary.

Some ideas for using life insurance to create a legacy:

- Donate to a charity or non-profit: Leave a lasting impact on a cause you care about.

- Fund a scholarship: Help future students in your field of study.

- Support a family member’s education: A life insurance policy can be used to fund a grandchild’s or relative’s college costs.

Life insurance offers a simple and affordable way to leave something behind, even if you don’t have a traditional heir.

4. Are You Taking Care of Aging Parents?

You may be single now, but if you’re helping care for aging parents, your financial support may be more important than you realise.

Ask yourself:

- Would your parents be able to afford care without your income?

- Do they rely on you for rent, food, or bills?

- Would their lifestyle change dramatically if something happened to you?

If you’re one of the millions of Americans who help support elderly parents, life insurance can be a vital safety net for them.

How Much Does Life Isurance Cost?

5. What If You Become Uninsurable Later?

One of the biggest benefits of buying life insurance when you’re young and healthy is that you lock in low rates for life.

As you age, premiums rise, and certain health conditions (diabetes, high blood pressure, heart disease, etc.) can make you ineligible or force you to pay higher premiums later.

If you think there’s even a chance you might need life insurance in the future — for example, if you plan to marry, buy a house, or have children — it’s smart to get coverage now while it’s affordable.

6. Do You Own a Business or Have Business Partners?

If you’re a single entrepreneur or small business owner, life insurance can help keep your business afloat if something happens to you.

A few ways life insurance supports business owners:

- Key person insurance: Protects the business if you’re the main source of revenue.

- Buy-sell agreements: Ensure partners can buy out your share in the event of your passing.

- Debt coverage: Helps repay business loans or investor obligations.

Even as a single person, your business may depend heavily on you, and life insurance provides peace of mind to your partners and employees.

7. Do You Want to Save Money or Build Cash Value?

Some types of life insurance — like whole life or universal life — include a cash value component, which functions like a savings or investment account.

Benefits of cash value policies:

- Builds tax-deferred savings over time

- You can borrow against it if needed

- Offers lifelong coverage

While these policies cost more than term life, they can act as a form of financial planning, even if you’re single, especially if you’re maxing out other retirement vehicles like 401(k)s or IRAs.

8. What Type of Life Insurance Is Best for Singles?

There are several types of life insurance, and the best option depends on your goals.

| Type | Best For | Duration |

| Term Life | Affordable, temporary coverage | 10–30 years |

| Whole Life | Lifelong coverage + cash value | Lifetime |

| Universal Life | Flexible premiums + cash value | Lifetime |

| Final Expense | Covers funeral costs only | Lifetime |

For most single people:

- Term life is great for debt protection or income replacement.

- Final expense insurance works well if you’re only looking to cover funeral costs.

- Whole or universal life is best if you want cash value or a long-term investment.

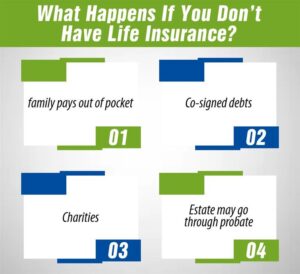

9. What Happens If You Don’t Have Life Insurance?

If you pass away without life insurance, here’s what could happen:

- Your family pays out of pocket for your funeral.

- Any co-signed debts may fall to loved ones.

- No funds are available for charities, causes, or family legacies.

- Your estate may go through probate, delaying access to assets.

A life insurance policy simplifies everything and helps your loved ones avoid unnecessary financial and emotional strain.

10. Real-Life Scenarios Where Life Insurance Helps Singles

Scenario 1: The Freelancer

Alex is 34, single, and works as a freelance designer. He doesn’t have a spouse or kids, but he’s supporting his mom part-time. He buys a $250,000 term policy for 20 years for $18/month. If he passes away, his mom has financial protection.

Scenario 2: The Digital Nomad

Tina is 29 and travels the world while working remotely. She has private student loans co-signed by her dad. She gets a $100,000 term life insurance policy to ensure her dad won’t be saddled with debt.

Scenario 3: The Business Owner

Jordan is 42 and owns a small consulting business. He uses life insurance to fund a buy-sell agreement with his business partner and protect his employees in case something happens to him.

Conclusion: So, Do You Need Life Insurance If You’re Single?

Yes — in many cases, single people still need life insurance.

Whether it’s to protect your family from debt, cover your funeral costs, leave a legacy, or lock in affordable rates while you’re young, life insurance is a smart financial tool for many singles.

Final Tips:

- Assess your debts, dependents, and long-term goals.

- Start with term life if you’re unsure or on a budget.

- Use online tools to compare quotes and coverage options.

- Reevaluate your insurance needs regularly — life changes, and so should your plan.

Don’t wait for a life milestone like marriage to start planning for your future. Life insurance can provide peace of mind now, no matter your relationship status.

FAQs

How much life insurance do I need if I’m single?

Start by calculating your debts, funeral costs, and any amount you’d like to leave behind. Most single people choose between $50,000 to $250,000, depending on their situation.

Is term or whole life better for singles?

Term life is usually more affordable and great for covering temporary needs. Whole life is better for building long-term value, and if you want lifelong coverage.

Can I name a friend or charity as my beneficiary?

Yes! You can name anyone — including a charity, friend, or organization — as your life insurance beneficiary.

What if I get married later?

No problem. You can always update your beneficiaries or adjust your policy as your life changes.

Can I get life insurance without a medical exam?

Yes. Many policies offer no-exam or simplified issue coverage, especially for smaller amounts like $25,000–$100,000.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.