Last Updated on: December 25th, 2024

- Licensed Agent

- - @M-LifeInsurance

CMFG Life Insurance Reviews have to say that their experiences with CMFG Life Insurance include that this firm offers financial services that meet the needs of their policyholders. CMFG Life Insurance provides various products that will keep a policyholder protected, hence Catering for customer support and financial stability, this company is well-equipped to meet clients’ needs. Most of the time, these reviews focus on cheap rates for the policies and clear policy conditions, thus, it has come to be regarded as a dependable source of life insurance coverage for families and individuals.

What Is CMFG Life Insurance?

CMFG Life Insurance is a life insurance company with operating experience exceeding eight decades in the insurance business. First, it existed as an affiche Credit Union National Association (CUNA), which is one of the largest trade associations that offer services to credit unions in the United States. As for insurance, CMFG Life Insurance has changed its name over the years and is represented now. The company is now affiliated with CUNA Mutual Group, which is a financial service provider assisting credit unions and their members and families.

Key Features of CMFG Life Insurance:

– Experience:

- Labels such as 80 Years of Service in insurance.

- Long history in serving credit unions and their member and their families.

– Wide Range of Products:

- Offers a variety of life insurance options, including:

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Final Expense Life Insurance

– Financial Strength:

- Holding a superior position on the financial condition and reliability that has been acknowledged by AM Best with the “A” rating.

- Illustrates the organization’s profitability with an outlook on its future commitments.

– Tailored to Credit Union Members:

- Focused and offering life insurance as well as other financial services to credit union members.

- It has expertise in providing affordable and flexible insurance solutions mainly to families.

– Reliability and Reputation:

- Recognized for coming up with reliable life insurance solutions.

- Has the characteristics of a reliable company that has been in operation for more than several decades.

– Affiliation with CUNA Mutual:

- Is a subsidiary of CUNA Mutual Group, which is involved in providing almost everything that a credit union might need, including insurance.

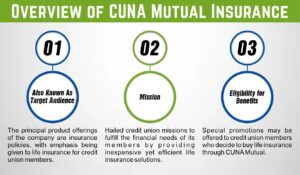

Overview of CUNA Mutual Insurance

- Also Known As: CUNA Mutual Insurance does business under the brand name of CMFG Life Insurance.

- Target Audience: The principal product offerings of the company are insurance policies, with emphasis being given to life insurance for credit union members.

- Mission: Hailed credit union missions to fulfill the financial needs of its members by providing inexpensive yet efficient life insurance solutions.

- Eligibility for Benefits: Special promotions may be offered to credit union members who decide to buy life insurance through CUNA Mutual.

– A.M. Best Rating

- Rating: A.M Best rates CUNA Mutual Insurance (sponsored by CMFG Life Insurance) at “A” which means Excellent.

- Significance: ‘A’ means a good financial position that is generally reflective of the stability of a company.

- Importance: It shows how CUNA Mutual has the financial capacity to meet the claims and run the business for several years which earns it an “A” rating.

- Consideration for Customers: This rating also messages potential policyholders that the company is sound and can pay the claims when they arise.

Types of Life Insurance Offered by CMFG Life Insurance

1. Term Life Insurance

Term life insurance is perfect for people who require life insurance only for a particular period in the future. Because it is relatively cheaper and easy to purchase it is one of the leading policies that most people with limited resources go for. Term life insurance only protects you for a certain number of years, in contrast to other types of life insurance that will cover you for the duration of your life. Usually in the tens or twentieths or thirtieths. If you die before the end of the term, your pocket will be collected by your beneficiaries as a death benefit that can be used to pay bills or even education fees.

Features of Term Life Insurance:

- Coverage Amount: You can select the coverage amount which starts from $10,000 and goes to $300,000, this decision is up to your desires and abilities.

- Ages: It is possible to take Term life insurance policies between 18 and 69 years, meaning that it is perfect for young couples or those with young children or other dependents.

- No Medical Exam: This article has captured how most of the term life insurance policies of CMFG do not require the policyholders to undergo through medical examination hence making the whole process of contracting for the policy much easier. All you have to do sometimes is respond to some questions concerning your health.

- Affordability: Term life insurance is always less expensive than other types of life insurance. The premiums are generally cheaper than the other forms of permanent life insurance products making it suitable for individuals who desire a large coverage amount but in return will be called on to pay more.

- Temporary Coverage: This policy is very suitable for individuals who require a certain period of coverage perhaps until one’s children grow up, the house is fully paid, or until one retires. This way it insulates one financially during this crucial time, yet you do not have a long-term financial obligation.

2. Whole Life Insurance

Whole life incorporates attributes of permanent insurance in the sense that it gives you insurance coverage for the whole of your life provided you are paying your premiums as required. It is different from term insurance where the insurance expires after a specific number of years and the insured has to renew for the policy to be active throughout his/her life. As well as offering a cash value for the amount insured that’s paid to a beneficiary upon a policyholder’s death, whole life insurance also accumulates cash value over time. This cash value can accumulate in a tax-privileged way and the funds can be borrowed or withdrawn to cater to various issues like expenses for education or even for retirement.

Features of Whole Life Insurance:

- Coverage Amount: The limit ranges from $1,000 to $100,000, which is adequate to protect your family for an indefinite period.

- Ages: Whole-life policies are issued to those who are between 18 and 85 years which offers whole-life coverage to both the young and elderly.

- No Medical Exam: The procedure for applying with CMFG Life Insurance for whole life insurance is quite simple. The health questions you have to answer are not as invasive as the medical questions that you have to answer in a physical examination making your application less stressful.

- Cash Value: The most important aspect of whole life insurance is that it has the aspect of accumulating cash value. This cash value continues to increase and can be borrowed in case of emergencies or to help pay for future premiums.

- Permanent Coverage: In a whole life insurance policy, you are assured that the policy stays active no matter the age of the insured because what you need to do is to pay the premiums continually. Such means make this a good choice for people who want to be protected for a lifetime.

3. Guaranteed Issue Whole Life Insurance

Guaranteed issue whole life insurance is meant for those who can be termed as high risk or perhaps senior citizens, that are struggling to get life insurance. This policy does not need medical check-ups or even ask any questions related to health which makes this policy favorable for many people who have been declined other life insurance policies. Guaranteed-issue policies are usually more expensive than traditional life insurance, yet they are beneficial for those people who have pre-existing conditions and can be denied, for instance.

Features of Guaranteed Issue Whole Life Insurance:

- Coverage Amount: The coverage ranges from $2,000 to $25,000, which is a much more affordable way to ensure people who need life insurance but do not require a lump sum payout.

- Ages: Also offered at forty-five to eighty years of age for the covered people, it is an ideal policy for people of such age as they might not meet requirements for other life insurance products.

- No Medical Exam: The name of the policy speaks for itself as there is no need for a medical examination or answer any health questions. Depending on the situation, it is more successful for people who are suffering from chronic diseases.

- Easy Approval: This policy comes with automatic approval, which means that even if you get turned down due to your health state, you will be approved. They get approved soon and such loans can be applied easily.

- Waiting Period: In guaranteed issues, there is always a waiting period within which the full face amount of the policy is not paid out in the event of the insured’s death. In the event the policyholder dies during the waiting period, the beneficiaries might be paid a partial amount only.

4. Final Expense Life Insurance

Whole life insurance as it is in final expense life insurance refers to an insurance policy specifically intended to pay for the funeral and other related expenses after death. These policies normally offer low amounts of coverage and low premium rates, that are easily accessible to seniors, who wish to spare their families the agony of paying for coffins.

Features of Final Expense Life Insurance:

- Coverage Amount: Common limits extend from $2,000 to $ 25,000 which is enough to meet average funeral and burial expenses.

- Ages: Final expense life insurance is mainly for consumers who are 50 years and above in age. That is particularly targeting the elderly people who have their burial fees catered for in case of their death.

- No Medical Exam: This is another plan that does not always need a medical exam so it is one of the easiest for seniors who want final expense fast and do not want to deal with any health bureaucracy.

- Affordable Premiums: By and large, the premiums are low, which are financially manageable for the elderly, especially those of fixed income. There are low premiums for the insurance, it will not be expensive when you are subscribing for the coverage.

- Simplified Application: It is usually easy to apply for final expense insurance, and policies are easy to obtain as well, especially if the applicant is not very elderly. This is a wise solution for people interested in health care insurance that will provide a quick and simple safety net.

TruStage Insurance: A Closer Look

TruStage is an insurance company with its link to the CMFG Life Insurance Company offering a flexible range of insurance services that includes life insurance for the different ages of a person. TruStage has long been acclaimed for offering basic, easy-to-understand, and cheap life insurance products such as term life insurance, whole life insurance, and guaranteed issue whole life insurance. This company’s approach is quite simple which is one of the reasons that makes TruStage different from the others; most of their products do not necessitate medical exams, and many of their products are possible to apply online. This way, TruStage makes it possible for an individual to purchase the coverage he or she wants without a lot of fuss.

TruStage Term Life Insurance

Term life insurance is one of the insurance covers sold by TruStage to customers who want temporary insurance at a low cost. This sort of insurance is meant to be good for a time of a standard contract length like 10, 20, or 30 years. This is ideal for people with young families, homeowners, or anyone who requires life insurance to meet certain obligations for a period, an amount needed to pay off a mortgage for instance, or until the children are through college.

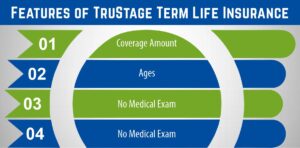

Features of TruStage Term Life Insurance:

- Coverage Amount: Your options are from $ 10,000 to 300,0000 in terms of the coverage you desire for your circumstances.

- Ages: Eligible for people between the ages of 18 and 69, hence many people get a chance to secure the plan, whether they are still young, in their career, rs, or family-bearing age.

- No Medical Exam: First, TruStage’s term life insurance policy has no medical examination as one of the critical advantages. This makes it a good choice for those people who are looking for a convenient way to lock in their life insurance needs.

- Application Process: The application process is very easy, and this can be done through the internet tool and should take between 10-15 minutes at most, hence a plus for those with busy schedules. This is usually the case because procuring this coverage does not have to take months and years to happen.

- Affordable Pricing: TruStage provides fairly good price offers, which makes it possible to buy insurance with not as high a cost as with a permanency of the insurance policy.

How to Get the Best Deal with CMFG Life Insurance and TruStage

In our search for a life insurance policy, we need to ensure that we are getting the right plan at the right price. Here are a few steps you can follow to ensure you’re getting the best deal on life insurance:

Step 1: Have an online quote calculator

First, check out an online life insurance quote that will provide an estimate of your possible life insurance needs and its costs. It will guide you to the particular selection of issues that you may be interested in and give you a good search ground.

Step 2: Fill Out Basic Information

Provide the details like the age, health condition and the amount of cover, which you wish to avail. The amount of details that we receive from you directly impacts the amount of quotes we give you.

Step 3: For any of these coverage plans to be effective, it is necessary to consult a licensed insurance agent.

After choosing a quote, contact an insurer licensed to sell policies on your behalf. It can be useful to talk to specialist insurance providers to clarify your choices and receive a pointer to the most suitable policy. Don’t forget to question the premiums, the options for coverage,g age, and any other extra features.

Step 4: A beginner’s guide to comparing life insurance plans with different life insurance companies.

Last, of all, spend your precious moments searching for the possibility of attempting to look for other insurance companies and providers offering lower rates and better policies for your life insurance needs. Which are the other insurance companies that you recommend comparing with CMFG Life Insurance in regards to the offers’ price? It helps avoid the problem of buyer’s remorse because comparing a variety of options guarantees that you are obtaining as much value as possible for your money.

Final Thoughts: Is CMFG Life Insurance Right for You?

These reasons make CMFG Life Insurance a good plan for a large number of customers because they provide nearly all types of life insurance policies. What you are looking for is either term life insurance, whole life insurance, or even final expenses, CMFG Life Insurance has them all here with us. TruStage is also under the CMFG brand which offers straightforward and affordable life insurance products to young and old alike.

FAQs about CMFG Life Insurance:

1- What is CMFG Life Insurance?

CMFG Life Insurance offers life insurance products, term life insurance, whole life insurance,e and final expense insurance. This they do to families by providing them with cash plans meant to meet funeral expenses.

How Much Does Life Isurance Cost?

2- Is CMFG Life Insurance a legitimate company or not?

Yes, CMFG Life Insurance is an existing company that has been engaged in the insurance business for a long time. It is a company that is under the CUNA Mutual Group and was established more than 80 years ago and deals in several financial products offered to credit unions and its members.

3- Which products does CMFG offer in the life insurance industry?

The life insurance plans that CMFG Life Insurance provides are term insurance, permanent insurance, and last expense insurance. They also offer products with different levels of coverage and flexible payment plans that suit the person.

4- In what ways can a claim be filed to CMFG Life Insurance?

Being an insurance company, the client can claim with CMFG Life Insurance Company through the company’s website or by providing a call to the company via phone. They will help you at this stage through the completion of the forms that are necessary for the completion of your claim.

5- Can I buy an affordable policy from CMFG Life Insurance?

Like most insurance companies, CMFG Life Insurance provides its policies at affordable prices to cater for the diverse classes. That in turn is determined by the type of policy, the amount of premium, and your age or health status. It is preferable to provide some items on the list and get a quote from a company to obtain more precise information.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.