Last Updated on: June 5th, 2025

- Licensed Agent

- - @M-LifeInsurance

Getting life insurance when you have bipolar disorder might seem very hard and difficult but it’s not impossible. In fact, many people living with bipolar disorder are able to secure quality life insurance coverage that protects their families and provides peace of mind. Understanding your insurance options is the very first step to take. No matter what the situation is, if you’ve been recently diagnosed or you are managing and fighting with this condition for years.

Let us explain everything you need to know about getting life insurance when you have bipolar disorder. We’ll talk about the different types of life insurance you can choose from, and also what insurance companies check when you apply. You’ll also find helpful tips to improve your chances of getting approved and finding the best price for your insurance coverage.

With the right information and some planning, it’s very simple to secure life insurance while living with bipolar disorder. Let’s explore your options and help you take the next step toward financial security.

Bipolar Life Insurance

Bipolar life insurance means life insurance for the people who have bipolar disorder. There are no special policies that are being offered by the insurance companies for the people having bipolar but they are simply referring to the regular life insurance that considers a person’s mental health while having bipolar I or II and this is decided by the company when the person qualifies by the insurer.

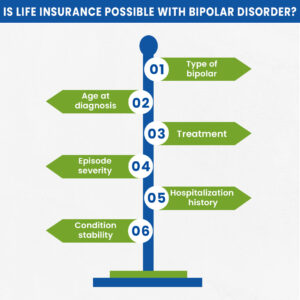

Is Life Insurance Possible with Bipolar Disorder?

Yes, you can, but the decision depends on your health details and treatment. The insurer will look at your overall risk.

Type of bipolar

There are different types of bipolar, like Type I and Type II. Some types might be seen as higher risk than the others.

Age at diagnosis

If you were diagnosed at a young age, insurance companies may see more risk. Older diagnosis can sometimes mean a better outlook.

Treatment

If you are following a treatment plan with medication or therapy it will help to show that you’re managing the condition. This can improve your chances.

Episode severity

It is important to know how often and how strongly your mood changes. Having fewer or milder mood swings makes you less risky to insure.

Hospitalization history

If you’ve been hospitalized or had suicide attempts, insurance companies see more risk. They may charge higher rates or deny coverage.

Condition stability

If your bipolar disorder is stable and under control, you have a better chance of approval of insurance policies at good rates.

Insurance companies base their decision on how well you manage your condition and do consider your overall health.

Why Life Insurance Companies Are Careful About Bipolar Disorder

Insurance companies when giving any coverage they do look at how likely someone is to die early. They are very careful about people with bipolar disorder because if it’s not treated or stable, it can lead to:

People who are not properly treated with bipolar disorder can face serious problems. They may have a higher risk of suicide, and they might need to go to the hospital more often. Some also have trouble with drug or alcohol use. It’s also common for them to deal with other mental health issues like anxiety or depression.

These are the risks that make it more likely that the insurance company will have to pay a claim, so they are extra careful. But today, many insurance companies look at each person’s situation. If your bipolar disorder is well-managed, you will get normal or even better rates.

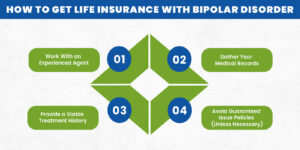

How To Get Life Insurance With Bipolar Disorder

When you are applying for insurance while having bipolar disorder you need to pay extra attention while applying. Here are the few steps you have to take and do it in right way;

How Much Does Life Isurance Cost?

1. Work With an Experienced Agent

Find an insurance agent who has experience helping people with health conditions. They know which companies are more understanding and can help you get a better deal.

2. Gather Your Medical Records

Insurance companies will ask to see your medical records. If you have everything ready and you are honest, it will make the process faster and smoother.

3. Provide a Stable Treatment History

If you take your medicine regularly and go to therapy, let the insurance company know. It’s a good sign if you haven’t been in the hospital recently and are managing your condition well.

4. Avoid Guaranteed Issue Policies (Unless Necessary)

These policies don’t ask health questions, so they’re easy to get. But they cost a lot more and offer less coverage. Only choose this option if you can’t get approved anywhere else.

Tips for Buying Life Insurance With Bipolar Disorder

Buying life insurance with bipolar disorder is a lot like buying regular life insurance, but there are a few extra things to keep in mind when buying bipolar life insurance.

- Start by comparing different insurance companies, some are more understanding about mental health than others.

- Learn about the types of policies you can get. Term life insurance is usually cheaper and covers you for a set number of years.

- Always be honest about your bipolar disorder. Hiding it could lead to problems later, like having a claim denied.

- Also, be ready for a medical exam, which may include blood tests, checking your vitals, and answering some health questions

Best Life Insurance for Bipolar Disorder: Top Policy Options

The best life insurance for someone with bipolar disorder depends on their health and situation. If your condition is well-controlled, term life insurance is a good choice. It’s affordable and covers you for 10 to 30 years. If you are planning for long term Whole life insurance lasts your whole life and builds cash value. If you don’t want a medical exam, simplified issue life insurance might work for you. It only asks some health questions and is good if your symptoms are mild. If you’ve had serious health issues and can’t get other plans, guaranteed issue life insurance is a last option. It’s easy to get but costs more, covers less, and has a 2-year waiting period before full benefits.

Best Life Insurance for Mental Illness Overall

If you have mental health conditions like depression, anxiety, PTSD, or schizophrenia, some insurance companies are more flexible.

Prudential is known for helping people with different mental health issues.

Mutual of Omaha offers easy-to-get policies with simple health questions or guaranteed acceptance.

Banner Life is good if your mental illness is mild or moderate. Pacific Life is more lenient if your treatment is steady and you’re doing well.

FAQs About Bipolar Life Insurance

Does bipolar disqualify you from life insurance?

No, bipolar disorder does not automatically disqualify you from getting life insurance. Your eligibility depends on the severity of your condition and your treatment history.

How Does Having Bipolar Disorder Affect My Life Insurance?

It can increase premiums or lead to policy exclusions if the insurer views you as high-risk. But with proper treatment, many people qualify for standard or even preferred rates.

How To Qualify For Life Insurance With Bipolar Disorder?

To qualify:

- Stay compliant with treatment

- Maintain consistent mental health checkups

- Have no recent hospitalizations or suicide attempts

- Apply through an agent who understands high-risk underwriting

How much does life insurance cost for someone with bipolar disorder?

Premiums depend on age, health, and stability. People with mild, controlled symptoms may pay just slightly more than standard rates. Severe cases may pay 2–3x more or be limited to guaranteed issue policies.

Final Thoughts

If you or a loved one has bipolar disorder, life insurance is not out of reach. The best life insurance for bipolar disorder depends on your condition’s stability and the insurer’s underwriting guidelines. It’s important to shop around, stay transparent, and work with a knowledgeable broker who can guide you toward the most favorable outcome.

No matter if you’re newly diagnosed or have been living with bipolar for years, you deserve financial protection and peace of mind. Start by getting a free quote, reviewing your treatment plan, and connecting with a professional who understands your unique situation.

Take the First Step Toward Peace of Mind Today

Don’t let bipolar disorder stop you from protecting your future. Start by comparing quotes, reviewing your treatment details, and working with an experienced life insurance agent who understands your needs.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.