Cremation Insurance for Seniors

We all spend our lives in the best way, and every phase goes smoothly because we’ve Pre-planned it to perfection. Cremation insurance for seniors is a practical way to ensure that your final arrangements are not only taken care of but also provide peace of mind both emotionally and financially.

For many seniors, securing the right cremation insurance policy is about providing a thoughtful gift to their loved ones – a gesture of foresight and care. It ensures that the financial aspects of your farewell are not a source of stress during an already emotional time.

This guide will help you understand cremation insurance, including what it covers, how much it costs, and what alternatives there are. It will also explain why many seniors choose to purchase cremation insurance as a thoughtful gift for their loved ones.

By the end of this guide, you will have the knowledge you need to make informed decisions about cremation insurance and give yourself peace of mind.

What is Cremation Insurance for Seniors?

Cremation insurance for seniors is a specialized type of insurance policy designed to provide financial coverage for the expenses associated with cremation after the insured individual’s passing. It’s an essential component of end-of-life planning, specifically tailored to alleviate the financial burden on loved ones during a challenging time.

Seniors often opt for cremation insurance to ensure that their final wishes are respected and to spare their families from the financial responsibilities that come with cremation. This type of insurance is a form of final expense insurance, which focuses on covering the costs associated with end-of-life arrangements.

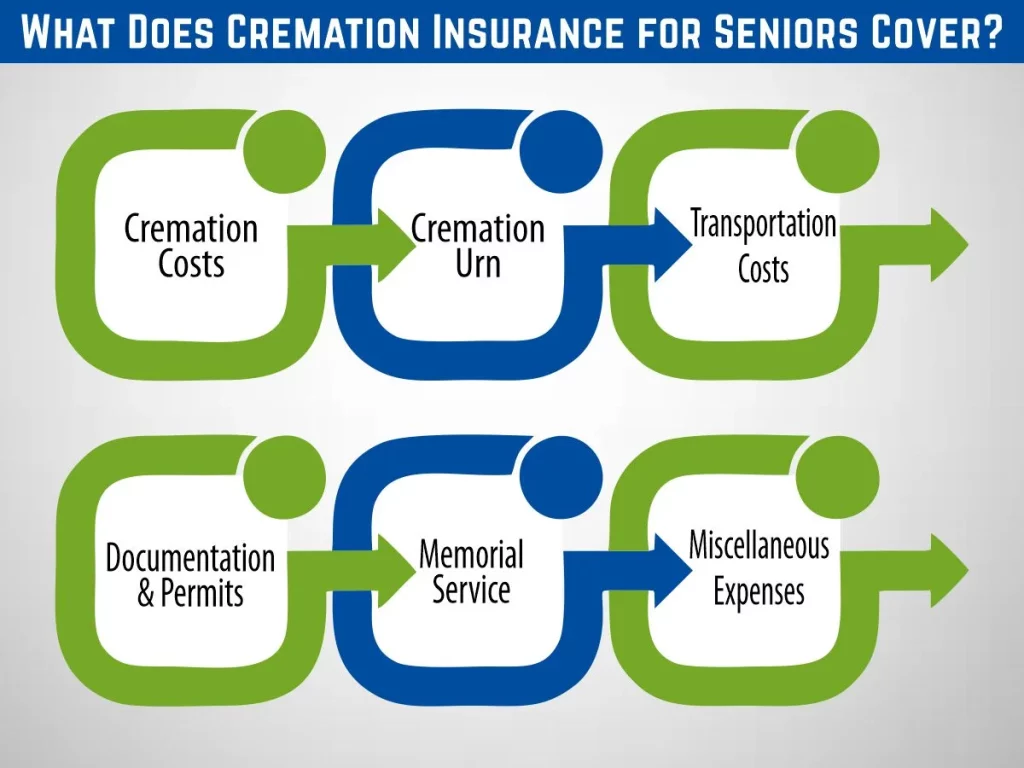

What Does Cremation Insurance for Seniors Cover?

Cremation insurance for seniors is designed to cover a range of expenses associated with the cremation process. While the specific coverage can vary depending on the insurance provider and policy terms, here are the typical expenses that cremation insurance for seniors may cover:

- Cremation Costs: This includes the expenses related to the cremation service itself. It covers the cost of using a crematory facility and the actual cremation process.

- Cremation Urn: Many policies include coverage for the purchase of a cremation urn, which is used to hold the cremated remains.

- Transportation Costs: The policy may cover the expenses associated with transporting the deceased to the crematory facility.

- Documentation and Permits: Cremation requires various permits and documentation. Cremation insurance often covers these administrative costs.

- Memorial Service: Some policies may provide coverage for a memorial service or a gathering to remember the deceased.

- Miscellaneous Expenses: There can be various additional costs that arise during the cremation process, and these may also be included in the coverage.

It’s important to carefully review the terms and conditions of your specific cremation insurance policy to understand exactly what is covered. Policies can vary, and some may offer more comprehensive coverage than others.

What is the Cheapest Form of Cremation Insurance for Seniors?

The cheapest form of cremation insurance for seniors often comes in the shape of term life insurance policies with a burial rider. Term life insurance is generally more affordable than whole life insurance and offers a way to specifically address final expense needs, such as cremation costs.

Here’s why term life insurance with a burial rider is often considered the most cost-effective choice:

How Much Does Life Isurance Cost?

- Affordability: Term life insurance typically has lower premiums compared to whole life insurance, making it an attractive option for seniors looking to manage costs.

- Customizable Riders: Term life policies allow you to customize coverage with riders. Adding a burial rider ensures that a portion of the policy’s death benefit is allocated to cover cremation or burial expenses.

- Sufficient Coverage: Term policies can be tailored to provide coverage for the specific amount needed to cover cremation costs, so you’re not paying for more coverage than necessary.

While term life insurance with a burial rider is often the cheapest option, it’s essential to consider that term policies have a limited duration (typically 10, 15, 20, or 30 years). If the insured individual outlives the policy term, coverage expires, and no benefit is paid. However, if your primary concern is managing the immediate cost of cremation, this is an excellent choice for cost-effective coverage.

What’s the Most Expensive Cremation Insurance for Seniors?

The most expensive cremation insurance for seniors is typically whole life insurance with a specialized cremation insurance rider. Whole life policies come with higher premiums, but they offer a lifetime of coverage and build cash value over time. Adding a cremation insurance rider to a whole life policy can further increase the cost.

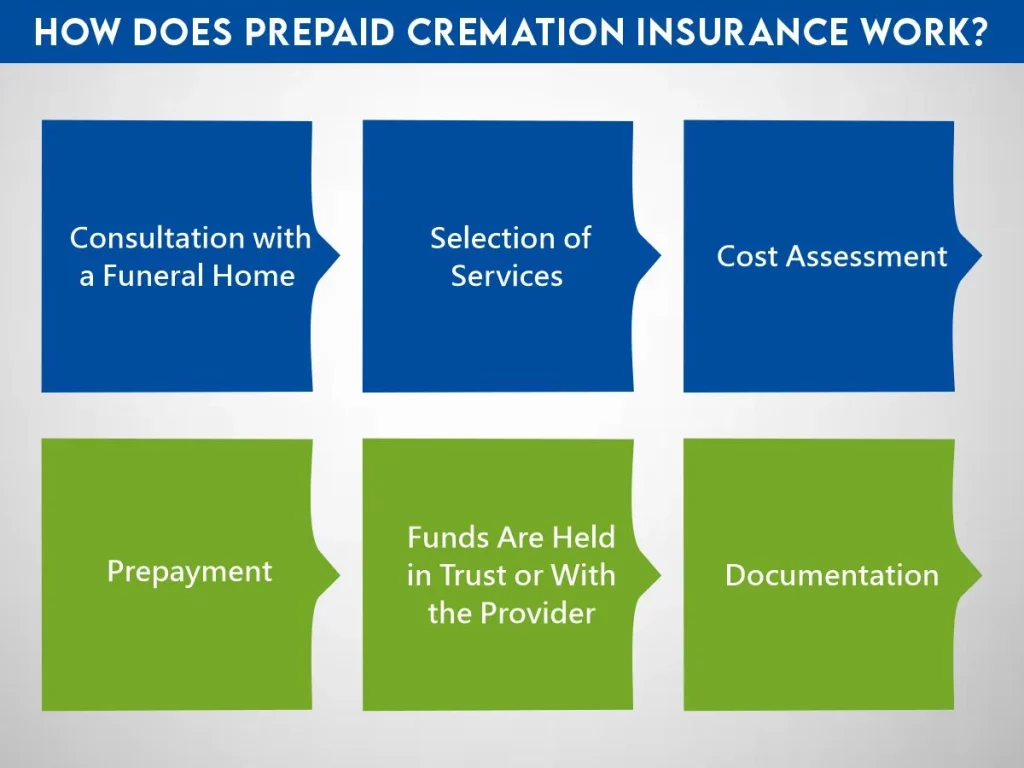

How Does Prepaid Cremation Insurance Work?

Prepaid cremation insurance, also known as pre-need cremation insurance, is a financial arrangement that allows individuals to pre-arrange and pre-pay for their cremation services. This type of insurance helps ensure that your final wishes are carried out and that the associated expenses are covered when the time comes.

Here’s how prepaid cremation insurance works:

1- Consultation with a Funeral Home or Provider

The process typically begins with a consultation with a funeral home, crematory, or a pre-need provider. You discuss your specific wishes and plan the cremation service according to your preferences.

2- Selection of Services

During the consultation, you’ll select the services you want, including the type of cremation, urn, memorial service, and any other details you’d like to customize.

3- Cost Assessment

The funeral home or provider will calculate the total cost of the chosen services and provide you with a breakdown of expenses.

4- Prepayment

Once you’ve agreed on the services and costs, you make a pre-payment to cover these expenses. This payment can be made in a lump sum or through installments, depending on the provider’s policies.

5- Funds Are Held in Trust or With the Provider

The prepaid funds are typically held in a trust account or with the pre-need provider. This ensures that the money is safeguarded until it is needed.

6- Documentation

You will receive documentation outlining the pre-arranged services, costs, and other relevant details. This documentation is often shared with family members, ensuring that your wishes are known and can be easily executed when the time comes.

How Much Does Cremation Insurance for Seniors Cost?

Cremation insurance for seniors can vary in cost based on several factors, including age, health, coverage amount, and the type of policy. To provide a general idea of the potential costs, here is a sample table outlining estimated monthly premium ranges for different coverage amounts and age groups.

| Coverage Amount | 50-55 Years Old | 60-65 Years Old | 70-75 Years Old |

| $5,000 | $15 – $30 | $25 – $45 | $40 – $70 |

| $10,000 | $30 – $60 | $50 – $90 | $80 – $140 |

| $15,000 | $45 – $90 | $75 – $135 | $120 – $210 |

| $20,000 | $60 – $120 | $100 – $180 | $160 – $280 |

Please note that the actual cost may vary depending on your specific circumstances, the insurance provider you choose, and the state you live in. Additionally, premiums may differ based on individual health assessments and underwriting.

It’s crucial to request personalized quotes from insurance providers to obtain accurate pricing information. This allows you to compare policies and choose the one that best fits your needs and budget.

How to Find the Best Cremation Insurance for Seniors?

Finding the best cremation insurance for seniors involves careful consideration of various factors to ensure that the policy aligns with your specific needs and circumstances. Here’s a step-by-step guide to help you find the most suitable cremation insurance:

- Determine Your Needs

Start by identifying your specific requirements. Consider factors like the amount of coverage you need, any particular cremation preferences, and your budget.

- Research Insurance Providers

Begin by researching reputable insurance companies that offer cremation insurance for seniors. Look for providers with a history of reliable service and positive customer reviews.

- Compare Policies

Request quotes from multiple insurance providers. Compare the policies they offer, paying attention to coverage details, premiums, and any additional riders or benefits.

- Consider Additional Riders

Evaluate whether you need any additional riders to customize your coverage. Common riders include burial riders, accidental death riders, and waiver of premium riders.

- Check Financial Stability

Verify the financial stability of the insurance company. Ratings from agencies like A.M. Best and Standard & Poor’s can offer insight into the company’s financial health and ability to fulfill claims.

- Review Customer Feedback

Look for feedback from other policyholders and customers. Reviews and testimonials can provide insights into the quality of service and the claims process.

- Consider Pre-Paid Plans

Evaluate whether prepaid cremation plans offered by local funeral homes or crematories might be more suitable for your needs.

- Get Multiple Quotes

Don’t settle for the first quote you receive. Request quotes from several providers to ensure you get the most competitive offer.

Finding the best cremation insurance for seniors involves a combination of research, personal assessment, and expert advice. Take your time, consider your options, and make an informed decision that aligns with your financial goals and end-of-life preferences.

Does Burial Cover Cremation Insurance?

Burial insurance and cremation insurance are similar in that they both cover end-of-life expenses. However, they are not the same. While burial insurance is specifically designed for traditional burial expenses, it can often be used for cremation costs as well. The key difference is that cremation insurance is designed with cremation in mind, while burial insurance may also cover casket and plot expenses.

Final Thoughts

In conclusion, cremation insurance for seniors is an essential financial planning tool, providing peace of mind for individuals and their loved ones during a challenging time. By understanding the coverage options, costs, and alternative solutions available, you can make an informed decision that suits your specific needs and circumstances.

Frequently Asked Questions (FAQs)

1- Is cremation insurance only for seniors?

Cremation insurance is designed for seniors, but it can also be purchased by individuals of any age. However, it’s more commonly associated with seniors due to its focus on end-of-life planning.

2- Can burial insurance be used to cover cremation costs?

Yes, burial insurance can often be used to cover cremation costs, as they both serve the purpose of covering end-of-life expenses. The key difference is that cremation insurance is specifically designed with cremation in mind.

3- Is cremation insurance necessary if I already have life insurance?

Cremation insurance can be a helpful addition to traditional life insurance, as it ensures that a specific portion of your coverage is allocated to cover cremation expenses. It provides targeted financial support for your end-of-life wishes.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.