Last Updated on: August 22nd, 2025

- Licensed Agent

- - @M-LifeInsurance

Planning for the future in your life is the most important step to take and the most thoughtful thing to do for your loved ones. Cremation has become the most popular choice due to its affordability, and also cremation is the simple and the easy way than the traditional burial. But here is the thing to keep in mind that cremation also has costs and it can be hard for the families to pay if there is no plan. That is why cremation insurance for seniors can be very helpful.

In this detailed guide, we will walk you through everything you need to know about the cremation insurance and what this plan covers, how it works and how much does this plan cost. And we will also help you to find the best policy that is specially designed to your needs.

What is Cremation Insurance for Seniors?

Cremation insurance for seniors is the type of final expense insurance of burial insurance. This insurance plan is specifically made and designed to cover the cremation-related costs. It is not like the other traditional policies, cremation insurance has the lower coverage amount that is usually between $2,000 and $25,000. This plan only focuses on paying the end of life expenses.

In simple words, the cremation insurance policy is help the families to make sure that when the seniors passes away, their family will not be burdened with the end life expenses like cremation and funeral services

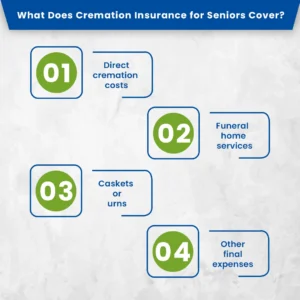

What Does Cremation Insurance for Seniors Cover?

Cremation insurance for seniors will help and make sure that all the final expenses are taken care of, so the families do not have to worry about paying the cremation bills during a hard time. Most cremation policies cover things like;

Direct cremation costs

The plan covers the direct cremation expenses. This includes the actual cremation process and the all required paperwork, and the transportation expenses. This makes sure that the basic steps are covered without any extra stress on the family.

Funeral home services

Some plans help to pay for the services at the funeral homes like planning for the memorials and arranging the viewing ceremony and hosting a celebration of life. These services let the families say goodbye to their loved ones in a very good and meaningful way.

Caskets or urns

Depending on the plan, cremation insurance plans also help to cover the cost of a casket or Urn to hold the ashes of a dead body. This helps the families to choose a very respectful way to keep or display the remains of their loved one.

Other final expenses

Cremation insurance also covers some of the small remaining expenses, such as any unpaid medical bills, or any unpaid loans or other small debts.This helps lighten the financial burden on the family during a difficult time.

The insurance coverage depends on the insurance company and the policy you choose. Some policies are basic and only pay for the cremation. Other policies are bigger and can also pay for things like memorial services, burial options, or travel costs if the person dies far from home.

What is the Cheapest Form of Cremation Insurance for Seniors?

The direct cremation insurance is also known as the cheapest cremation insurance that comes with minimal coverage. This insurance plan skips the process of embalming, funeral services and expensive caskets. This cremation plan only covers the basic things like transporting the body, the cremation process, and a simple container to put the body.

Premiums for these cremation insurances can start as low as $15–$25 per month. The price depends on the age and the health conditions.

For seniors with a small budget, a smaller policy that only pays for direct cremation can be the more practical choice.

What’s the Most Expensive Cremation Insurance for Seniors?

On the other end of the spectrum, the most expensive cremation insurance policies are those that cover not only cremation but also:

- Full funeral and memorial services

- Premium urns or keepsakes

- Burial options in addition to cremation

- Travel protection for family members

- Additional funds for medical bills or debts

These policy plans can range from $50 to over $150 per month, but this price depends on the coverage amount and the policyholder’s age and health.

Process of Cremation Insurance

Prepaid cremation insurance is a little different from normal final expense plans. Instead of getting a usual insurance plan, seniors can pay before in their lives for cremation services straight with a funeral home or cremation company.

How Much Does Life Isurance Cost?

Let’s have a look how it works:

- The senior chooses a cremation package in advance.

- Payments are made upfront or in installments.

- When the time comes, the services are guaranteed regardless of inflation.

How Much Does Cremation Insurance for Seniors Cost?

The price of cremation insurance depends on many things, like your age, health, how much coverage you want, and the kind of policy. Let’s look at the average and estimated costs. Remember, these prices are not fixed and can change depending on the policy rules.

Ages 50–60: $20–$40 per month for $5,000–$10,000 coverage

Ages 61–70: $30–$60 per month for $10,000 coverage

Ages 71–80: $50–$90 per month for $10,000 coverage

Ages 81–85+: $90–$150 per month for $10,000 coverage

Talking about the prices, there are some insurance companies who are offering guaranteed acceptance policies with no medical exams. While they are easy to qualify for, they often come with higher premiums.

How to Find the Best Cremation Insurance for Seniors

Choosing the best cremation insurance requires careful comparison. Here are some key steps:

- Determine Coverage Needs

Decide if you want just direct cremation coverage or additional funds for services and debts.

- Compare Multiple Providers

Look at both national insurance companies and local funeral home prepaid options.

- Check Health Requirements

If you have health conditions, you may need a guaranteed issue policy.

- Review Waiting Periods

Some plans have a 2-year waiting period before full benefits apply.

- Read the Fine Print

Understand exclusions, premium increase policies, and coverage details.

- Work with an Independent Agent

Agents can help compare plans from multiple insurers to get the best value.

Does Burial Cover Cremation Insurance?

This is a common question among seniors and their families. Burial insurance and cremation insurance are very similar.

- Burial insurance covers funeral and burial costs, but it can also be used for cremation.

- Cremation insurance is marketed specifically for the cremation-related expenses but works the same way as burial insurance.

Pros and Cons of Cremation Insurance for Seniors

Like any other financial product, cremation insurance comes with so many advantages and disadvantages.

Pros:

- Affordable monthly premiums compared to full life insurance

- Ensures family isn’t burdened with final expenses

- Easy qualification, often no medical exam

- Flexible coverage options to match budget

Cons:

- Smaller death benefit compared to traditional life insurance

- Some policies have waiting periods

- Premiums can be higher for older seniors or those with health issues

- Prepaid cremation plans may lack flexibility if you move or change providers

Alternatives to Cremation Insurance for Seniors

While cremation insurance is an excellent option for many, some seniors may consider alternatives:

- Savings accounts dedicated to funeral expenses

- Payable-on-death bank accounts for quick transfer of funds

- Traditional life insurance policies with higher coverage amounts

- Veterans benefits for eligible military members

- Employer or union death benefits (if applicable)

These alternatives for the cremation insurance can work, but cremation insurance remains one of the simplest and most reliable ways to cover final expenses and let your family stress free during hard times.

Final Thoughts

Talking about the best cremation insurance plan , keep in mind that the best cremation insurance plan for seniors is the one that is affordable and gives good coverage, and makes you feel safe and your family stress-free at the times when they are already dealing with grief. You have a lot of options, you can pick a simple direct cremation plan or the full plan that also covers the funeral services. The thing that matters the most is to start now to help your family for the future to not worry about money. By looking at prices, knowing what is covered, and checking your choices, you can find a cremation insurance plan that fits your budget and your final wishes.

Get Peace of Mind Today with Mlife insurance. Find the Best Cremation Insurance for Seniors! Protect your family from unexpected expenses and secure an affordable plan that fits your needs. Start Now!

FAQs

1. What is cremation insurance for seniors?

Cremation insurance for seniors is a type of plan that helps pay for cremation and other funeral expenses. The cremation insurance plan makes sure that the families don’t have to worry about money during a hard time.

2. What does cremation insurance cover?

It usually covers direct cremation costs, funeral home services, urns or caskets, and sometimes other small expenses like unpaid medical bills or debts, depending on the plan.

3. How much does cremation insurance for seniors cost?

There is no fixed cost for the cremation insurance for the seniors. The cost depends on age, health, coverage amount, and type of policy. For example, seniors aged 50–60 might pay $20–$40 per month for $5,000–$10,000 coverage, while those 81+ may pay $90–$150 per month.

4. What is the difference between prepaid cremation plans and regular cremation insurance?

Prepaid cremation plans let seniors pay in advance directly to a funeral home or cremation provider. Regular cremation insurance is an insurance policy that pays for cremation costs after the senior passes away.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.