Last Updated on: January 16th, 2025

- Licensed Agent

- - @M-LifeInsurance

Accidental death insurance for seniors provides an extra layer of protection for older adults in case of an unexpected death caused by an accident. This type of insurance is designed to cover incidents that happen suddenly and unintentionally, offering financial peace of mind to seniors and their families.

What Does Accidental Death Insurance Cover?

Accidental death insurance for seniors offers an additional safeguard in case of death due to a mishap in the later extracting stage of life. This insurance type is meant for cases when an incident occurs unexpectedly and by mistake, that is why it protects seniors and their loved ones financially.

Types of Accidents Covered by Accidental Death Insurance

Accidental death insurance normally comes with coverage for any dying that results from many odd occurrences. Common examples include:

- Car Accidents: Accidents that may lead to the death of people involved in car accidents, motorcycle accidents, or pedestrian accidents.

- Slip and Fall Accidents: Fatality caused by falls on the same and other levels in workplaces and other areas accessible to the public and in residential areas.

- Workplace Accidents: Injuries occurring in the field of work, for example falling while on duty, or being caught in a machine.

- Drowning or Other Accidental Injuries: Death by drowning, through fir,e, and any other form of death that was not planned for.

In other words, if the cause of an injury is not a disease, but an accident, then accidental death insurance is intended to protect the survivors financially.

Financial Benefits for Beneficiaries

In case of death by an accident, the policyholder is succeeded by the beneficiaries in the policy and they receive a payout in a lump sum. This payout is meant to enable people to meet various expenses that arise following the death of their loved one. Some of the most common expenses the payout can be used for include:

- Funeral and Burial Costs: Burials and cremations are not cheap and this insurance can be used to cater to those needs as well as others.

- Medical Bills: In the case where the policyholder had incurred some medical expenses before they died because of the accident, then payment can go to such accounts.

- Daily Living Expenses: The payout can also be used to support the other dependent members of the family after the loss to meet their basic needs.

Since accidental death insurance covers financial needs during such a trying time, it means that a family is relieved of further worry.

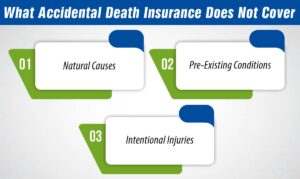

What Accidental Death Insurance Does Not Cover

Accidental death insurance helps to financially support your family in the case of an accidental death. However, it is very important to note that this type of coverage is associated with certain limitations. Accidental insurance is intended only for deaths that occur due to accidents and includes coverage for any other type of death. Knowledge of the gaps will help you to decide whether this type of insurance is enough for you or you can try other types of insurance. Here are the key exclusions:

– Natural Causes

Therefore, Accidental death insurance does not involve payment of claims arising from natural causes including diseases. However, if the policyholder dies from diseases such as cancer, heart problems, diabetes, or any other chronic diseases, there will be no payout. This exclusion has the effect of excluding coverage of death due to such illnesses rather than from an accident in the process of their progression.

– Pre-Existing Conditions

A primary reason why people choose accidental death insurance is that underlying medical conditions do not provide coverage. Any disease, illness, or condition that existed at the time the policy was removed is simply referred to as a pre-existing condition. For instance, if a man has a heart complication, or is involved in an accident, his accidental death insurance may not take his death as covered under the policy. The medical history should be declared in full to the insurer to prove that there will not be any complications with the claims.

– Intentional Injuries

It is standard practice with accidental death policies to provide no coverage for death by intentional injuries. When the death happens due to this case, for example, by committing suicide or when a person gets injured due to reasons such as negligence of own life and the injury is severe, the insurance will exclude a payment. It is mutually understood that suicide is not an accident and hence insurance policies typically contain suicide exclusions.

Acts of War or Terrorism

The majority of accidental death insurance also lacks cover in case of death by war, acts of terrorism,m or even civil unrest. Murders, which are a definite result of war or terrorist acts, may not be compensated at all, and the degree of specificity may even vary from one insurance company to another. This way one should always check the policy provision and see if the above events are excluded or not.

This means that the U.S. citizen should read carefully about the conditions of the accidental death insurance policy so that he or she is prepared when the need for the insurance comes. This article focuses on group and individual lifetime death benefit insurance for seniors.

In death benefit life insurance, senior citizens ensure the provision of financial resources to their families after they die. This type of coverage is aimed to help minimize the financial loss due to expenses that can appear in connection with death. In Death Benefit Insurance, the beneficiary is paid out for funeral costs, hospital bills, for any other the policyholder may require after the demise of that particular individual. The accidental death benefit for seniors is usually limited to five thousand dollars.

Regarding accidental death benefits, the benefit amount is normally payable in cash to the named legal beneficiaries. Of course, the size of the payout can depend on the specifics of the policy, but it intends to provide for immediate needs, such as funerals, unpaid medical bills, or any other expenses that relate to the loss. In particular, for seniors, who cannot save as tough people and sometimes launch expensive medical treatments, this peremptory payment may become a real salvation in the hard times.

Why Death Benefit Insurance is Important for Seniors

To seniors, the death benefit insurance means they will be relieving their family of a burden knowing that they will be financially taken care of each time they die. This may mean that families will not be left to bury their relatives financially drained and have to struggle with even funerals and hospital bills. Also, the lump sum payment can go to satisfying all the possible financial obligations, or just meet other needs of the heirs if any.

Does It Cover Death?

It is also worth understanding that accidental death is not covered under gap insurance. It is intended to shield auto owners from having to pay the difference between the money they still owe on their vehicle financing and the car’s actual cash value after an accident or theft. In case you want to have insurance against accidental death, you will have to get accidental death insurance. This type of insurance covers your beneficiaries in the event you meet your premature death as a result of an accident. Hence, while it is stated that gap insurance assists in the relative differences in vehicle finance costs, it is said that it is not sufficient for covering death costs as required.

How Much Does Life Isurance Cost?

The second type is the Mutual of Omaha Accidental Death Insurance.

For families in America, Omaha is relied on to offer constant accidental death insurance that can reassure seniors. As one of the insurance providers with relatively lower rates as compared to their counterparts, while offering very simplistic terms for their policies, it is a perfect bet for anyone who seeks affordable and quite straightforward insurance service. Accidental death insurance from Mutual of Omaha strives to guarantee that loved ones will be rewarded if the policyholder dies a horrible death, with provisions for compensation for expenses that range from funeral charges to medical expenses as well as lucky chances. A silver lining of this coverage is that it provides seniors with some level of financial comfort in case anything unfortunate happens knowing that their loved ones will be taken care of.

What Are the Benefits of Accidental Death Insurance Coverage?

Free life insurance covers are meant to help the family or dependents financially in case of an unintended demise. It eliminates a situation where the beneficiary of his or her benefits is left with lots of problems to solve financially during a time that is already tough. This type of coverage is also apparently helpful to the elderly and that means their families would not suffer to pay the cost that emerges after an accidental death. Below are the key benefits of having accidental death insurance coverage:

– BURIAL COSTS AND EXPENSES including the expenses of the funeral.

The first advantage of accidental death insurance is that it intervenes when it comes to honoring funeral and burial expenses. Funerals cost money and are not a cheap occurrence, with averages of at least several thousand dollars usually. These costs can be met through the Accidental Death benefits so the expense does not fall to the relatives at the time of grief. It affords them coverage to enable them to meet funeral expenses without burden.

– Medical Expense and Other Cost

All these may entail a need to be treated in a hospital in a bid to pay medical bills in the event they die due to an accident. Accidental death insurance may be of great help in reimbursing such costs, besides, there may be many other expenses that might occur in such a situation. These are such things as unpaid balances, bills, hospital expenses, or any other related charges that may have been left behind. Thus, the families can rest assured that they do not need to pay for these punishing bills in the meantime.

Peace of Mind for Seniors and Their Families

Thus, accidental death insurance helps to share some concerns with the elderly population and their families if the worst happens. For instance, seniors are often worried about their families becoming poor once they are gone. This coverage gives them assurance in the event of an accident and that their family members will be financially taken care of.

– Avoiding Misery on Your Close Ones

Loss of a loved one causes upset among the family and the final thing that the families should have to consider is charges. Accidental death insurance can ensure the flow of cash in the family’s hands so that these relatives can take time and mourn without worrying about the burial and other costs. It offers support as a backup plan so that the family is not worried about searching for ways to pay such bills.

– Fast and Easy disbursement

Every sort of life insurance can have complex approaches to claims, however, accidental death insurance doesn’t necessarily contain complex approaches to the payment of the claim amount. Those with serious emergencies can benefit from this especially those needing funds to take care of burial and medical fees. These payments can be made as a lump sum that helps families meet other financial needs without first having to wait.

Conclusion

It also is an essential way of assuring that elderly people have financial protection in case of an untimely demise. With the right coverage, seniors and their families don’t have to worry about how they will other for medical treatment in case of an accident. When shopping for the policies always compare them even for this type of insurance so that you can find the best death insurance policy you need so that you can be very certain that you have the right cover.

FAQs

1- What kinds of fatalities fall under accidental insurance coverage?

Accidental death insurance entails paying for death through a given protocol such as through an accident, for instance through auto accidents, falls, and other mishaps. It does not even address the natural situation such as illness or disease in the natural space.

2- What is the accidental death benefit maximum amount?

The maximum depends on the policy and the insurer involved in the policy contract. It does, depending on the plan, so it is advisable to look at the specific policy being offered.

3- What distinguishes natural death from accidental death?

Accidental deaths are those that die in an event that was not expected such as a car accident while natural death is caused by disease or old age.

4- What sum is paid for accidental death?

The coverage amount of accidental death drastically varies under a specific policy. It’s usually a single amount, intended for the payment of burial fees and other related charges.

5- Does accidental death cover illness?

Thus, accidental death insurance also does not cover illnesses. It only confers an advantage for accidental deaths.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.