Last Updated on: July 25th, 2025

- Licensed Agent

- - @M-LifeInsurance

People always think about long-term protection when it comes to protecting their future. But what if you need to access the money or funds now? Here, life insurance with immediate cash value comes in to help you out. These plans help you with the death benefit as well, and they build the cash value by day one. But you are wondering which type of life insurance policy generates immediate cash value. No need to worry, we have got you covered. In this article, we’ll explore the top life insurance options that provide immediate cash value, break down how they work, and help you decide which plan fits your goals best.

Basics Of Cash Value in Life Insurance

Before getting into the types, let’s have a quick look at the basics of cash value. What does it mean?

Cash value is a type of savings that comes with permanent life insurance policies. When you pay your monthly or yearly payments, a part of this payment goes to cover the insurance itself, and the rest of the amount goes into the savings account. This will grow over time without being taxed. This will help in a way that you are able to borrow this amount for any purpose whenever you need it. But keep in mind that not all insurance companies have cash value, and even if they do have it, the cash value does not always grow right away after starting the policy.

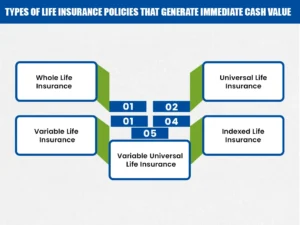

Types of Life Insurance Policies that Generate Immediate Cash Value

There are life insurance policies that build cash value after buying the policy, and you can borrow it whenever you need it. In the coming section, we’ll look at the types of life insurance policies that build cash value fast and how they work.

Whole Life Insurance

Whole life insurance offers a fixed monthly payment and it also guarantees cash value growth. From the start, part of your payment builds cash value that you can borrow or use later. It’s a stable choice with predictable growth, making it good for people who want steady, low-risk savings with their life insurance.

Universal Life Insurance

Universal life insurance is a type of life insurance that is flexible. You can change how much you pay and how much money your family gets after you pass away. It also saves money for you over time, and that money grows with interest. You can borrow from this saved money or use it to help pay your insurance costs. It’s good if you want to have control and be able to change your payments and benefits when you need to.

Variable Life Insurance

Variable life insurance lets you invest your cash value in stocks and bonds. This means your cash value can grow faster but can also go down if investments do poorly. It’s suitable for people comfortable with risk who want a chance for higher returns with their life insurance.

Indexed Life Insurance

Indexed life insurance links the money you save to a stock market index, like the S&P 500. This means your money can grow when the market does well. But even if the market goes down, your money usually won’t lose value because there’s a guaranteed minimum. It’s a good choice if you want to earn more like the market but with less risk.

Variable Universal Life Insurance

This policy combines flexibility and investment options. You control premiums and death benefits like universal life insurance, but your cash value is invested like variable life insurance. It offers the potential for higher growth but also comes with more risk. It’s good for those who want both control and investment choices.

All of these policies give the cash value that grows after buying the policy but keep in mind that each policy works differently. It’s important to think about what you want and how much risk you feel okay with before picking one.

Can You Access Cash Value Immediately After You Get a Life Insurance Policy?

This is an important question. Usually, with regular life insurance policies, you can not get your saved money quickly. It takes time to grow. But if the policy is set up the right way, you can use some of your saved money almost right away, even in the first year.

Factors That Affect Immediate Access:

- Policy design: Choose a plan that gives you more cash value early and lets you put in extra money.

- Premium size: if you pay more, at the start, the more cash you can use right away.

- Loan provisions: Some policies give an option that you can borrow money in the first year using your savings as backup.

Should I Buy Life Insurance With Immediate Cash Value?

The answer always depends on your financial goals. While cash-value life insurance can be a powerful asset, it is not for everyone. Here is a breakdown of who can get the most benefits;

Ideal For:

- Entrepreneurs & Investors: You can use the cash value from your life insurance like a personal bank, borrowing money from it without paying taxes.

- High-Income Earners: If you’ve already saved the maximum in accounts like IRAs, life insurance lets you save more money while delaying taxes.

- People Who Need Quick Cash: This type of life insurance gives you both coverage and access to emergency money when needed.

- Legacy Builders: You can use life insurance to grow wealth over time and pass it on to your children or grandchildren.

Not Ideal For:

- Those on tight budgets: These policies require higher premiums than term life.

- Short-term planners: Benefits shine over years, not months.

- People who need only death benefit coverage: Term insurance may be more suitable.

Pros and Cons of Life Insurance With Immediate Cash Value

Here’s a quick look at the benefits and drawbacks of these types of policies:

Pros:

- Immediate liquidity (in well-structured policies)

- Tax-deferred growth

- Tax-free loans

- Guaranteed death benefit

- No contribution limits, unlike IRAs or 401(k)s

Cons:

- High initial premiums

- Complex policy design

- Requires long-term commitment

- Some surrender penalties

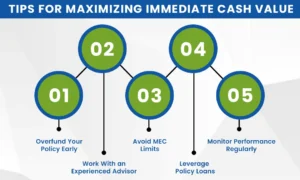

Tips for Maximizing Immediate Cash Value

You have to try these smart tips to maximize immediate cash value.

- Overfund Your Policy Early

Pay more than the minimum premium to front-load your policy and accelerate cash value. - Work With an Experienced Advisor

Policy structure is everything. A knowledgeable agent can help tailor your contract for early access and long-term benefits. - Avoid MEC Limits

A “Modified Endowment Contract” triggers tax consequences. Your policy must stay below certain funding thresholds to maintain tax-advantaged status. - Leverage Policy Loans

Borrow against your policy without taxes or penalties, often at lower interest rates than banks offer. - Monitor Performance Regularly

Review annual statements and adjust funding levels as needed.

Summary

Well-designed whole-life and indexed universal life insurance policies built cash value over time. These plans are not the same for everyone, but they offer a strong mix of life protection, savings, and financial flexibility. If this is a good fit for you, it’s important to speak with a qualified life insurance expert to set up the policy the right way.

How Much Does Life Isurance Cost?

The working of these policies is not the same for everyone, but they can be very helpful if you want both protection and a way to save money that you can use. If you’re thinking about getting one, talk to a life insurance expert to make sure it’s set up the best way for you.

FAQs

Where can I get immediate cash-value life insurance?

You can get life insurance policies with high early cash value from mutual companies like MassMutual and Guardian, or through independent brokers who focus on life insurance plans that help you grow your money.

How did life insurance cash value work?

Cash value grows over time from the money you pay (premiums) and from interest or investment growth. You can borrow or take out some of this money when you need it.

Should I buy life insurance with immediate cash value?

Yes, if you’re looking for liquidity, tax-deferred growth, and long-term wealth building. It’s not ideal for those seeking low-cost death benefit coverage only.

Can you access cash value immediately after you get a life insurance policy?

Yes, with properly structured policies like overfunded whole life or indexed universal life, you can access cash value within the first year.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.