Last Updated on: March 11th, 2025

Thank you for reading this post, don't forget to subscribe!- Licensed Agent

- - @M-LifeInsurance

Employers provide voluntary life insurance policies that enable their employees to obtain supplementary coverage above their essential company-provided life insurance benefits. The insurance’s availability through group rates allows employees to get affordable coverage, increasing their family’s financial safety. Employees can select policy coverage amounts, while some plans will allow them to extend coverage to include their spouse and children.

The main reason why people choose voluntary life insurance is to gain peace of mind through financial security for their family during times of unexpected death. Voluntary life insurance stands apart from standard individual policies because it has minimal or zero medical examination requirements, allowing people who face challenges in obtaining standard coverage to obtain protection.

Voluntary life insurance’s primary advantages are low costs, automatic premium withdrawals from paychecks, and multiple policy choices. Individuals must evaluate policy portability features, coverage restrictions, and their need for outside-of-work coverage before making decisions about voluntary life insurance. This guide examines voluntary life insurance, including its operational principles and different plans and costs, and provides methods to help you decide if it suits your needs.

How Does Voluntary Life Insurance Work?

Employers provide voluntary life insurance benefits to employees who can buy supplemental coverage through group rates at discounted prices. The insurance coverage safeguards employees’ loved ones financially when they pass away. Workers can select their coverage amount according to their requirements, and specific plans enable them to add spouse and child coverage.

Employer-Sponsored vs. Individual Voluntary Life Insurance

- Employer-Sponsored: Workplace health insurance comes from employee benefits packages that offer reduced rates and automatic paycheck withdrawals.

- Individual Voluntary Insurance: The coverage continues beyond employment because workers buy the policy independently.

Enrollment Process & Premium Payments

- Staff members choose their health plans when open enrollment begins or following a qualifying personal change.

- Insurance policies provide guaranteed acceptance benefits for limited amounts, but medical underwriting becomes necessary for higher amounts.

- Employees can easily access employer-sponsored plans through payroll deduction, yet individual policyholders must make payments directly to their insurer.

Coverage Limits & Policy Options

- The coverage typically equals between one and five times the employee’s yearly salary.

- Options include term life insurance (temporary coverage) or whole life insurance (lifelong coverage with cash value).

The understanding of voluntary life insurance operations enables people to select the most appropriate plan for securing their finances.

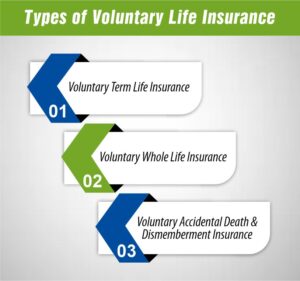

Types of Voluntary Life Insurance

Different kinds of voluntary life insurance exist to meet the distinct needs and financial requirements of individuals. Staff members can select between term life insurance, whole life insurance and accidental death & dismemberment (AD&D) insurance to obtain suitable coverage.

Voluntary Term Life Insurance

A policy under this category extends insurance benefits for definite time lengths such as 10, 20 or 30 years. The term policy represents the least expensive insurance choice which serves people who need temporary financial protection. Beneficiaries of a policyholder who dies during the term period will receive the death benefit payment. The insurance terminates automatically when the specified term period ends unless the policyholder chooses to renew it.

Voluntary Whole Life Insurance

Whole life insurance differs from term life insurance through its constant coverage duration as well as its cash value accumulation feature that builds steadily throughout time. Policyholders can access the cash value of their policy both through borrowing privileges and by using it to fulfill upcoming financial requirements. Whole life insurance premiums exceed those of term life insurance but include both death benefit protection and investment benefits.

Voluntary AD&D (Accidental Death & Dismemberment) Insurance

Additional benefits become available through this coverage when the policyholder experiences accidental death or severe injuries. Most people buy accident death coverage and term or whole life insurance to enhance their financial security.

Key Differences Between Term and Whole Voluntary Life Insurance

- You can get term life at a lower cost for a specific duration, yet whole life offers permanent protection and a cash value component.

- Term life insurance ends with the term, but whole life insurance builds value and continues indefinitely as long as policyholders make their premium payments.

Choosing the right voluntary life insurance depends on financial needs, budget, and long-term goals.

What Does Voluntary Life Insurance Cover?

The primary purpose of voluntary life insurance is to give death benefits to beneficiaries, which protects their financial position when the policyholder dies. The death benefit payment from voluntary life insurance enables beneficiaries to handle expenses, including funeral costs and debts, as well as mortgage payments and the future financial needs of their family members.

The policy protection gets enhanced through optional riders which policyholders can add to their coverage. Daily policy riders include critical illness benefits that give a cash payout upon serious illness diagnosis, alongside disability riders that provide income protection or premium waiver benefits when the insured person becomes disabled. The waiver of premium rider allows policy benefits to stay active without premium payments when the insured person suffers from long-term disability.

Insurance coverage scope depends on which policy type a person selects. A term life policy provides coverage for a specific period whereas whole life insurance creates lifetime coverage along with building cash value. Additional financial protection comes from accidental death and dismemberment (AD&D) benefits which some policies provide.

Can You Cash Out Voluntary Life Insurance?

Your ability to receive money from a voluntary life insurance policy depends on your coverage type. Policyholders who buy voluntary whole life insurance access funds through its built-in cash value component. The premium payments you make result in money being deposited into an interest-bearing savings fund. The cash value accumulated in the policy is a funding source for policy loans, withdrawals, and complete policy surrender.

The policy’s cash value allows insured individuals to borrow money without losing their policy through a loan process. Unpaid loans from life insurance policies lower the death benefit money beneficiaries receive. A partial withdrawal acts as another choice to decrease both cash value and lifetime payout benefits permanently.

Policyholders who want to end their insurance coverage can return their policy to receive the total cash value that has built up. Early surrender of a policy usually results in fees and penalties that reduce the received funds. Understanding policy options leads to better decisions regarding voluntary life insurance coverage.

How Much Does Life Isurance Cost?

Which Benefits Does Voluntary Life Insurance Offer?

A policyholder’s loved ones obtain tax-free death benefits from voluntary life insurance when the policyholder passes away. Death benefits from voluntary life insurance policies pay for essential needs, including funeral expenses, mortgage payments, debt repayment, and everyday costs, which reassure families during challenging periods.

The main benefit of voluntary life insurance through employer plans includes accessing reduced group rate coverage, which exceeds individual policy rates. Through employer negotiations, employers obtain reduced premiums that lower the cost of coverage for their workforce. The insurance policies feature adaptable coverage extension options which enable employees to buy supplementary coverage for their family members, including spouses and children and dependents.

Many employer-based voluntary life insurance policies avoid medical exams, allowing simple access to coverage for individuals with pre-existing health conditions. The streamlined enrollment process allows more people to obtain financial protection because it omits complex health screenings and lengthy waiting periods.

Should I Get Voluntary Life Insurance?

The decision to join voluntary life insurance depends on your financial condition and family requirements and existing health coverage. The insurance plan provides helpful advantages yet lacks suitability for all individuals.

Factors to Consider Before Enrolling:

- Current Life Insurance Coverage: Evaluating additional coverage needs is essential for anyone who currently holds a personal life insurance policy.

- Financial Responsibilities: Consider your debts, mortgage, and dependents’ financial needs.

- Employer-Sponsored vs. Individual Plans: Employer-provided health plans provide lower costs yet lose their coverage when you leave the organization.

When Voluntary Life Insurance Makes Sense:

- The situation applies to people who need more life insurance but want it at a reduced cost.

- People who maintain dependents who depend on their earnings should consider this factor.

- Individual policies become costly and challenging to obtain when your health conditions exist.

Alternatives to Voluntary Life Insurance:

- Individual Term or Whole Life Insurance: This coverage operates without depending on your current job.

- Savings and Investments: Financial security can be achieved without premium payments.

Voluntary life insurance is an appropriate option for employees who need additional insurance from their employer yet stand to gain more from personal policies over time.

FAQs

Is voluntary life insurance worth it?

People who need supplemental financial protection at reasonable rates should consider voluntary life insurance coverage. The insurance benefit proves most useful for employees who lack enough personal coverage or want to enhance their employer-provided plan.

Do I lose my voluntary life insurance if I leave my job?

Most voluntary life insurance policies that employers provide to their workers remain connected to employment periods. Several policies enable you to switch employer-sponsored coverage to personalized individual insurance. Before using this coverage as your long-term solution you need to confirm transferability first with your employer and insurer.

How much voluntary life insurance coverage do I need?

Your selected life insurance coverage amount relies on your income and debts and dependents, and future financial targets. The recommended amount of life insurance should be 5 to 10 times your yearly income to provide adequate financial protection for your family.

Does voluntary life insurance require a medical exam?

Employer-based voluntary life insurance policies that do not need medical examinations allow accessibility to people with health issues. Higher coverage selections in voluntary life insurance might need medical underwriting procedures.

Can I have both voluntary life insurance and personal life insurance?

Yes, you can have voluntary life insurance through your employer and a separate personal life insurance policy. Combining both types of coverage can provide additional financial security and ensure your family is adequately protected regardless of employment status.

Conclusion

Your family can get affordable financial protection through voluntary life insurance policies, typically from employer-backed plans. Supplemental insurance enables policyholders to protect their existing coverage, safeguarding their mortgage obligations, debts, and daily expenses against death.

The insurance policy provides unique advantages to people with dependents, limited personal insurance coverage or health issues preventing them from getting standard insurance coverage. Employer-sponsored plans come with affordable premiums and skip medical examinations, allowing employees to access this coverage easily.

Your voluntary life insurance policy selection should consider your financial standing combined with your long-term requirements and employment type. Evaluating coverage options, understanding portability features, and determining your actual insurance needs becomes vital for your decision. Selecting an insurance policy that suits your objectives will guarantee financial security and a worry-free family life for your family’s future.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.