Last Updated on: February 7th, 2025

- Licensed Agent

- - @M-LifeInsurance

Introduction:

Understanding Life Insurance and Its Importance

Life insurance is a financial tool that will help your family and loved ones in case something happens to you. It guarantees that your family is covered whenever expenses such as debts, mortgages, daily living costs, or any future education burdens occur. The most important thing is to choose the right type of life insurance to ensure long-term financial stability.

Why Compare Term vs Permanent Life Insurance?

When choosing to purchase a life insurance policy you may hear the terms term and permanent life insurance. Making an informed decision when choosing an insurance company comes your way largely depends on how well you understand the differences between these insurers.

Table of Contents

Toggle- Term Life Insurance If the coverage is needed for a temporary period, term life insurance is a cheaper option.

- Permanent Life Insurance Permanent life insurance provides lifelong coverage and builds cash value over time, making it suitable for long-term financial planning.

Key Factors to Consider

Before choosing between term and permanent life insurance, consider the following factors:

✔️ Cost: Term life insurance is more budget-friendly, while permanent life insurance has higher premiums.

✔️ Coverage Duration: Term life lasts for a set period, whereas permanent life offers lifelong coverage.

✔️ Benefits: Permanent life insurance builds cash value, while term life only provides a death benefit.

What is Term Life Insurance?

Term life insurance functions as a specific-period protection coverage, so it plays an essential role when comparing term insurance with permanent coverage. The following section describes all essential aspects of term life insurance, including its structure and operational mechanism alongside its advantages and disadvantages.

Definition of Term Life Insurance

Term life insurance specifies a set duration of protection as it continues for 10, 20, or 30 years. Your beneficiaries receive a death benefit in case you die during the length of the term. The accumulated value remains absent from term life insurance because it only offers temporary coverage.

How Term Life Insurance Works

- Fixed-Term Coverage: Under this type of coverage, the policy protects for a designated period that is not indefinite.

- Expiration: Your policy terminates after the established term becomes complete unless you decide to renew it.

- Renewal Options: Renewal possibilities exist in many insurance plans, yet premium costs tend to rise because of age progression alongside health condition modifications.

Pros and Cons of Term Life Insurance

– Pros:

- Affordability: Permanent life insurance premiums remain higher than those of term life insurance.

- Simplicity: The concept employs plain language along with simple terminology.

- Ideal for Temporary Needs: Suitable for covering short-term financial obligations such as mortgages or education costs.

– Cons:

- No Cash Value: Lacks saving or investment development.

- Limited Duration: Insurance protection ends following the defined term duration but stops completely unless customers renew their policy.

What is Permanent Life Insurance?

The policy of permanent life insurance serves as a central topic when analyzing the difference between term and permanent insurance policies. This part describes the features and operation principles together with both the advantages and disadvantages of permanent life insurance policies.

Definition of Permanent Life Insurance

You can obtain complete lifelong insurance coverage through permanent life insurance if you continue premium payments. Permanent life insurance includes cash value accumulation along with its coverage benefits, which steadily increase with time.

How Permanent Life Insurance Works

- Lifelong Coverage: Your beneficiaries can receive a death benefit from your policy because the active policy status continues throughout your entire life span.

- Cash Value Component: The funds you pay as premiums dedicate some amount to grow into cash value throughout your policy term. Tax-deferred manifestation of cash value grows within the policy while available for sharing through loan or withdrawal options, which maintain extra monetary adaptability.

- Premiums: Typically higher than term life insurance, the premiums contribute to both the death benefit and the cash value.

Pros and Cons of Permanent Life Insurance

– Pros:

- Lifelong Protection: The policy provides permanent coverage that continues indefinitely so long as premium payments remain active.

- Cash Value Accumulation: The plan entails an investment section usable during your time of living.

- Estate Planning Benefits: Can assist in transferring wealth efficiently.

– Cons:

- Higher Premiums: Its cost exceeds the price of term life insurance coverage.

- Complexity: A policy framework that contains many layers must be handled and deciphered thoroughly.

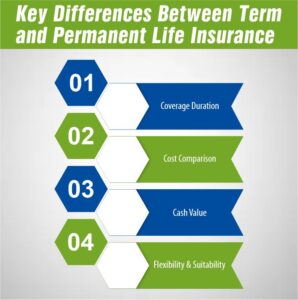

Key Differences Between Term and Permanent Life Insurance

Deciding between term and permanent life insurance needs a clear understanding of their features to reach financial objectives. They have three basic differences in their features.

– Coverage Duration

- Term Life Insurance:

- The plan offers protection for a set duration ranging from ten to thirty years.

- Ideal for covering short-term financial obligations.

- Permanent Life Insurance:

- The policy remains in effect for the lifetime of the insured member as long as they keep paying premiums.

- Your survivors will always receive the life insurance benefits when you die.

– Cost Comparison

- Term Life Insurance:

- Your survivors will always receive the life insurance benefits when you die.

- Permanent Life Insurance:

- Insurance policies that offer lifetime coverage at a higher price become available due to their dual protection and cash value features.

– Cash Value

- Term Life Insurance:

- The policy neither creates cash value nor includes any savings benefits.

- Permanent Life Insurance:

- The policy builds cash value through time so policyholders can borrow from it or receive supplemental retirement funds.

– Flexibility and Suitability

- Term Life Insurance:

- Straightforward and simple, suitable for young families or those with temporary financial needs.

- Permanent Life Insurance:

- Whole, universal and variable coverages are available from this policy type which caters to individuals interested in estate planning and long-term financial stability.

Term vs Permanent Life Insurance: Cost, Coverage, and Choosing the Right Policy

Among the two main categories of life insurance products people consider are term life insurance and permanent life insurance. Evaluating the price contrasts and recognizing the distinct features together with common characteristics and the right match between options represents vital factors for making a proper decision. The following guide reveals comprehensive details necessary to select a policy that fits both your financial targets and personal way of living.

Term vs Permanent Life Insurance: Cost Comparison

– Average Costs for Term Life vs Permanent Life Insurance

Term life insurance proves significantly cheaper than permanent life insurance because of their divergence in cost. Term life insurance provides better affordability than its counterpart, known as permanent life insurance. Here’s why:

- Term Life Insurance:

- Lower Premiums: Life insurers offer reduced premiums because term policies protect a defined period of 10 to 30 years. Due to their limited timeframe, insurers can offer premiums that stand much lower on a monthly or annual basis.

- No investment Component: A term policy lacks the cash value-building component that would otherwise lower its total cost.

- Permanent Life Insurance:

- Higher Premiums: Permanent life insurance policies provide continuous coverage and fund accumulation benefits which grow over time because they have higher premium expenses. Premium rates for the enhanced benefit rise because of its addition to the policy.

- Additional Features: Savings capabilities within the policy structure augment its value which in turn raises the premium cost.

– Factors Affecting Premiums

The overall policy cost depends on multiple elements when determining between term and permanent life insurance coverage.

- Age: People in younger age groups tend to secure more affordable insurance coverage since insurers view them as less risky. Premium costs rise with each passing year of your age.

- Health: Your medical background together with your present health state determines premium prices. A person in good health typically receives reduced premiums.

- Coverage Amount: The more you choose for a death benefit and the higher the premium. How much you can afford pretty much goes along with balancing how much you need.

- Lifestyle Choices: The danger and consequently the premiums are affected by factors such as smoking, occupation and perhaps even hobbies.

- Policy Duration and Type: Costs for the term policies are fixed and costs for the permanent policies include the lifelong coverage with extra benefits such as the cash value accumulation.

– Long-Term Cost-Effectiveness

The long-term cost-effectiveness would depend on considering your current financial state and the future needs:

How Much Does Life Isurance Cost?

- Term Life Insurance:

- Best for Temporary Needs: For times when you need interim financial security to meet certain needs such as a mortgage or children’s education then term life insurance provides efficient coverage options.

- Lower Initial Investment: Your investment will gain from reduced premium costs because your money can now be reserved for alternative investments.

- Permanent Life Insurance:

- Lifelong Security: People who need coverage that lasts forever should choose permanent insurance because it provides long-term security.

- Cash Value Accumulation: A whole life insurance policy requires higher premiums but its cash value function operates as a savings tool which could reduce the overall expenses with time.

- Long-Term Investment: A tax-deferred cash value accumulation system exists within the policy that provides enduring financial rewards in addition to the death benefit.

Types of Permanent Life Insurance

There are several types of permanent life insurance, each of which is characterized by different features. Depending on those, one can draw conclusions regarding the policy he/she needs to choose to achieve his/her financial objectives.

– Whole Life Insurance

- Fixed Premiums: Premiums for such a plan are fixed to remain the same for the entire life of the policy.

- Guaranteed Cash Value: This policy pays money at a fixed return and thus it provides the facility of processing cash savings guarantees.

- Simplicity: Whole Life provides a simple and clear understanding of its operations, making it one of the most preferred products in the market.

– Universal Life Insurance

- Flexible Premiums: Allows you to choose and change the frequency of the premium payments that you can afford.

- Adjustable Death Benefit: Death benefit amounts through this policy can typically adjust when your life needs change.

- Potential Market Growth: Several insurance plans enable changing premiums according to market conditions, which can increase policy cash value potential.

– Variable Life Insurance

- Investment-Based: Money inside the cash value component requires investment through multiple accounts that function like mutual funds.

- Higher Risk, Higher Reward: The return potential exceeds whole or universal life insurance whereas risk levels also increase as a result.

- Customizable Investments: The policyholder maintains investment control over cash value which can be adjusted based on personal risk capacity and financial objectives.

– Indexed Universal Life Insurance

- Linked to Stock Market Index: Policyholders can relate their cash value accounts to specific stock market indexes, including the S&P 500.

- Potential for Enhanced Growth: The investment strategy provides potential market gain during boom times but also offers defense against market declines.

- Hybrid Flexibility: This product combines universal life structures with market-related growth potential to offer a balanced mix of financial benefits between risk and reward.

Similarities Between Term and Permanent Life Insurance

The main purpose of these insurance types remains distinct but complementary because they function in different financial scopes.

- Financial Security: Your beneficiaries can receive a death benefit payment through both term and permanent life insurance coverage.

- Medical Underwriting: A health assessment is necessary before approval for both policies. Your risk level together with your premium rates are determined through the underwriting process.

- Customizable Coverage Options: Most life insurance policies enable policyholders to tailor both their death benefit amounts and other features explicitly according to their financial requirements.

- Essential Part of Financial Planning: These kinds of policies can often be useful aspects of any sound financial plan as they provide a safety net and financial security for the family members.

Who Should Choose Term Life Insurance?

People who need insurance along with budget restrictions should choose term life coverage. Consider the following groups:

- Young Families: The financial needs of your young children can be secured by choosing term life insurance that provides an affordable solution.

- Budget-Conscious Individuals: People who need temporary coverage for specific tasks including home mortgage payments and education expenses should choose term insurance.

- Temporary Financial Obligations: A term policy becomes an ideal protection option when you expect future decreases in your financial duties because your children will graduate or your debts will end.

- Simple Coverage Needs: The main advantage of term life insurance lies in its simple approach since this coverage does not offer cash value accumulation or investment opportunities.

Who Should Choose Permanent Life Insurance?

Permanent life insurance stands as a suitable choice for people who need ongoing protection and a combined financial investment feature. Consider this option if you:

- Value Lifelong Coverage: Permanent life insurance offers financial security during any point of your lifetime thus making it the right choice for policyholders.

- Engage in Estate Planning: Permanent insurance stands as an attractive solution for people who aim to create inheritances and effectively handle estate taxation through its cash value accrual feature.

- Seek Cash Value Benefits: A policy offering savings and investment functions holds value through its permanent life insurance cash value component.

- Require Flexibility: Permanent life insurance provides better options for users to adjust premiums or death benefits compared to term policies.

- Long-Term Financial Goals: Long-term financial goals together with value growth objectives can be achieved through permanent life insurance because it provides protection as well as investment potential.

Conclusion

Your selection between term and permanent insurance rests on different requirements, financial capacity, and long-term investment targets. To recap:

- Cost Comparison: Term life insurance provides greater affordability because it exists temporarily, but permanent life insurance becomes expensive owing to its long-term coverage and cash value element.

- Types and Flexibility: Permanent life insurance comprises four diverse variants, which include whole universal and variable, and the additional indexed universal option, allowing flexibility for different financial objectives.

- Similarities: The two policy types deliver vital financial protection while needing medical evaluation for coverage but allow adjustment of policy features to fit personal requirements.

- Suitability: Young families, together with budget-conscious people and those dealing with temporary financial needs, should choose term life insurance. The preferred choice for individuals who need assurance until the end of their lives, along with estate planning access and cash value benefits, is permanent life insurance coverage.

When comparing term and permanent, you have to look at the short-term cost and also the long-term cost, as well as what the policy can offer. Before you make your decision, go to a financial planner to ensure your choice of a general working model for your financial status in the future and to make sure that your loved ones are protected.

Knowing these key differences and similarities, you will easily be in a position to decide on the policy that will suit you best, hence having a cushion throughout the years to come

Frequently Asked Questions (FAQs)

1. What is the Difference Between Term Life Insurance and Permanent Life Insurance?

Answer:

- Term Life Insurance: A policyholder gets Term Life Insurance coverage that lasts from 10 to 30 years by selecting the term length; the insurance activates the death benefit if the insured person dies during the term period. Despite providing reasonable costs, this insurance structure does not build up any cash accumulation, such as other insurance products.

- Permanent Life Insurance: Permanent Life Insurance provides individuals with life-long death benefit coverage and accumulates cash value that grows progressively with time. This policy requires increased payment for its entire duration but operates as a strategic spending tool that provides death coverage.

2. How Do the Costs Compare Between Term and Permanent Life Insurance?

Answers:

- Term Life Insurance: The temporary character along with no investment potential results in inexpensive premiums.

- Permanent Life Insurance: The higher premium rates of whole life insurance ensure lifelong coverage and generate a cash accumulation value. Protection amounts together with individual health and age determine how much policy premiums will cost in all varieties of coverage.

3. What Are the Benefits of Permanent Life Insurance vs Term Life Insurance?

Answer:

– Permanent Life Insurance Benefits:

- The coverage continues until death without any time limitations.

- The policy builds cash value throughout its term, through which you can withdraw funds or borrow money.

- Useful for estate planning and long-term financial security.

– Term Life Insurance Benefits:

- More affordable, making it an excellent choice for young families or those with temporary financial obligations

- Simple policy structure.

4. Who Should Consider Choosing Term Life Insurance?

Answer:

- Perfect for people or young families working on a limited budget due to a mortgage or children’s tuition fees.

- Ideal for those looking for basic and affordable coverage and do not need any cash-value features.

5. Who Should Opt for Permanent Life Insurance?

Answer:

- Ideal for those looking for enduring safety and benefits from long-term financial strategies.

- The policy caters to individuals who want to plan their estate while transferring wealth and want investment opportunities in addition to its cash value benefits.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.