Last Updated on:July 21st, 2025

- Licensed Agent

- - @M-LifeInsurance

Have you ever thought about life insurance policies when you are buying one? It’s difficult for you to choose between term life and permanent life insurance. No problem if you are facing such an issue. Each type of life insurance has its good points. The right one depends on what you want and what your needs are. But it’s important to know how both types work. This will help you make the best money choice for you and your family. In this guide, we will explain and compare both types of life insurance. By the end, you’ll understand which one is better for you.

Comparing term vs. permanent life insurance

Before we compare term life and permanent life insurance, it’s good to know that both types give your family money when you die. But they work in different ways. Because of this, each type is better for different people.

Term Life Insurance

You are covered by term life insurance for a fixed number of years, like 10, 20, or 30. If you die during that time, your family or the person you choose will get money from the policy. Moreover, if you are still alive after the time ends. There is no payout until you renew a policy or buy another one.

Term life insurance is often purchased to cover temporary needs such as income replacement, mortgage protection, or children’s education, during your working years.

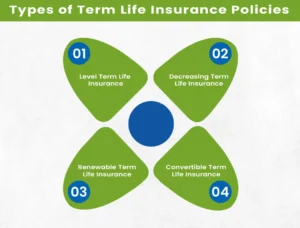

Types of Term Life Insurance Policies

There are different kinds of term life insurance you can choose from. Here are the main ones:

1. Level Term Life Insurance

This type gives you the same amount of coverage, and you pay the same price every year. It doesn’t change. It’s easy to understand and very predictable.

2. Decreasing Term Life Insurance

With this type, the amount of coverage goes down over time, and so does the price you pay. It’s a good choice if your money needs to go down over the years, like after your kids finish school or your house is paid off.

3. Renewable Term Life Insurance

This policy lets you renew your insurance when the term ends without needing a medical exam. That means you can keep your coverage even as you get older. But keep in mind, the price will go up when you renew.

4. Convertible Term Life Insurance

This one lets you change your term life insurance into permanent life insurance later on, without taking a medical exam. It gives you lifelong coverage, but it will cost more.

Permanent Life Insurance

Permanent life insurance is a type of insurance plan that gives you coverage for your entire life. As long as you are giving your monthly payments, your policy will remain active. There is a helpful benefit of permanent life insurance. It builds cash value over time. This means that a small part of your money goes into the savings. This money grows without any tax, and you can borrow or take out some of the money later when you need it.

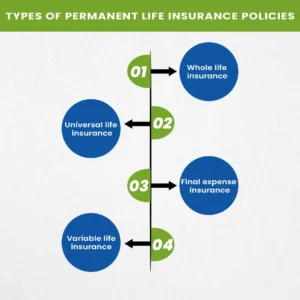

Types of permanent life insurance policies

There are different kinds of permanent life insurance policies. You have a choice of which policy you want and what suits your budget and needs better.

Whole life insurance

This type gives you a fixed death benefit and fixed premiums for your whole life. The cash value grows at a guaranteed, steady rate based on current interest rates. Because of this, whole life insurance is very predictable.

Universal life insurance

This type lets you change your premiums and death benefits. For example, you can pay less by lowering the death benefit or get a bigger death benefit by paying more. The cash value grows based on market rates. Usually, it costs less than whole life insurance, but that can depend on your situation and insurer.

Final expense insurance

This plan is made to help pay for funeral costs and other end-of-life expenses. It has a small death benefit, reasonable premiums, and cash value. You might not even need a medical exam to get it.

Variable life insurance

Variable life insurance also works like universal life insurance. This type will let you change how much you pay for the monthly premiums and also how much your family will get when you pass away. In variable life insurance, you can also invest money you build as cash value in things like stocks, bonds, and other mutual funds. This means that you can grow your money with the right guidance.

How Much Does Life Isurance Cost?

What are the differences between term and permanent life insurance?

Here are some key differences between term and permanent life insurance:

1. Coverage length

- Term life insurance gives you coverage of years, like 10, 20, or 30 years. If you don’t die during that time, the policy ends, and nothing is paid out.

- Permanent life insurance lasts your whole life, as long as you keep paying for it.

2. Cost

- Term life insurance is cheaper.

- Permanent life insurance is more expensive.

3. Cash value

- Permanent life insurance builds cash value, like a small savings account. You can borrow from it or take some money out whenever you want.

- If you cancel the policy, you can get the cash, but some fees may be deducted.

- Term life insurance does not build cash value. It only pays out if you die during the term.

| Feature | Term Life Insurance | Permanent Life Insurance |

| How long does it last | Temporary (10, 20, 30 years) | Lifetime |

| Cost | Lower | Higher |

| Cash value | No | Yes, builds over time |

| Best for | Short-term needs, affordable | Lifelong coverage and savings |

Final Thoughts

Wrapping up everything, both life insurance policies are good, but if you need something better that is within your budget, you have to check out both policies’ benefits and coverage. Both policies work differently. If you want cheap coverage for a few years, term life insurance is a smart choice. If you want coverage for a lifetime, then permanent life insurance will be a better option for you.

Ready to Find the Right Life Insurance Policy?

We’re here to help you find the right plan. Get your free quote today and take the first step to protect your family’s future.

Click here to compare plans and get covered now!

FAQs

1. How are term and permanent life insurance different?

Term life insurance covers you for a limited time, while Permanent life insurance lasts your whole life and also builds cash savings.

2. Which type of life insurance is cheaper?

Term life insurance is cheaper because it only covers you for a limited time.

3. Does permanent life insurance build savings?

Yes, permanent life insurance builds savings in the form of cash value. You can borrow this money whenever you want.

4. What happens when term life insurance expires?

If you’re still alive when the term ends, the policy stops. You won’t get any money unless you renew or buy a new one.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.