Last Updated on: May 14th, 2025

- Licensed Agent

- - @M-LifeInsurance

Introduction: Understanding State Regulated Life Insurance Programs

In today’s world, where financial security and peace of mind matter more than ever, life insurance has become an essential part of responsible planning. Among the many options advertised to consumers, you may have come across the term “state regulated life insurance program.” It often appears in mailers, online ads, or TV commercials, accompanied by phrases like “new benefit,” “government-approved,” or “exclusive to residents in your state.”

But what does this term actually mean? Is it a legitimate insurance product? Is it free? Is it tied to your state government?

This article answers those questions and more. By the end, you’ll fully understand what a state regulated life insurance program is, how much it costs, who it’s for, and how to avoid misleading offers while protecting your loved ones with the right type of policy.

What Is a State Regulated Life Insurance Program?

Despite the official-sounding name, a state regulated life insurance program is not a government-sponsored or taxpayer-funded plan. Instead, it’s a marketing label used by private insurance companies to describe life insurance policies—primarily final expense or whole life coverage—that are regulated by your state’s department of insurance.

These programs typically offer:

- Whole life or final expense policies

- Fixed monthly premiums

- Permanent coverage (as long as premiums are paid)

- Small benefit amounts (usually $5,000 to $30,000)

- Simplified underwriting (no medical exam required)

So, the term “state regulated” only means that state laws oversee and enforce how insurance companies market, price, and manage these policies. It doesn’t mean the state is paying for it or offering it as a public benefit.

For example, if you live in California or Texas, the respective state insurance departments make sure that the insurance carriers operating in their state follow local regulations—but they do not administer or fund any life insurance plans themselves.

Debunking the Myth: Is It Sponsored by the Government?

A common question people ask is: “Is a state regulated life insurance program funded or run by the government?”

The answer is no. These are not part of Medicare, Medicaid, Social Security, or any other public benefit program.

What causes the confusion?

Some insurance advertisements deliberately use official-sounding language, seals, or bolded headlines like:

- “Attention: Seniors aged 50–85 in [your state]”

- “You may qualify for a new state regulated benefit”

- “This program is available due to recent changes in state law”

While technically legal, these tactics can be misleading. The truth is, while the state plays a role in regulating the insurer, the policies themselves are 100% private and come with monthly premiums.

How to Tell It’s Not a Government Program:

- There’s no .gov website associated with the offer

- You’re asked to speak to a licensed agent or request a quote

- There’s no enrollment via your state health exchange or social services

Always read the fine print. If something claims to be “state approved” or “state regulated,” it doesn’t mean it’s free or sponsored.

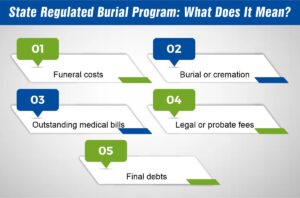

State Regulated Burial Program: What Does It Mean?

Another variation of this marketing term is “state regulated burial program.” This is another phrase used to advertise final expense insurance, also known as burial insurance or funeral insurance.

These are small whole life policies designed specifically to cover:

- Funeral costs

- Burial or cremation

- Outstanding medical bills

- Legal or probate fees

- Final debts

While the benefits are similar to regular life insurance, final expense policies are geared toward older adults who may not qualify for traditional life insurance due to age or health conditions.

They offer:

How Much Does Life Isurance Cost?

- Coverage amounts from $5,000 to $30,000

- No expiration as long as premiums are paid

- Level premiums for life

- Minimal or no medical underwriting

- Quick approval times (sometimes same-day coverage)

Just like with the life insurance counterpart, the term state regulated burial program simply reflects that the plan follows state insurance laws—not that it’s a free public benefit.

What Is the Cost of a New State Regulated Life Insurance Program?

One of the most frequently asked questions is: “How much does a state regulated life insurance program cost?”

Because these policies are marketed to seniors or people with limited health history, they are designed to be simple, accessible, and relatively affordable. However, the premium you’ll pay depends on various factors, including:

Key Pricing Factors:

- Age: The older you are, the higher the premium.

- Gender: Women generally pay slightly less than men.

- Tobacco Use: Smokers pay more due to increased health risks.

- Health Condition: Guaranteed acceptance policies cost more because they don’t require medical exams.

- Coverage Amount: Higher death benefits come with higher premiums.

Average Monthly Costs by Age:

| Age | $10,000 Policy | $20,000 Policy |

| 50 | $25–$35 | $45–$65 |

| 60 | $35–$55 | $65–$100 |

| 70 | $55–$80 | $100–$150 |

| 80 | $80–$120 | $160–$200 |

Note: These are ballpark figures and may vary by provider and state.

Can the State Take Life Insurance Money After Death?

Generally speaking, no, the state cannot take life insurance benefits after someone passes away—if the policy has a named, living beneficiary.

However, there are a few exceptions you should be aware of:

When the State Might Get Involved:

- No Named Beneficiary: If the policyholder didn’t name a beneficiary, or if all named beneficiaries have passed away, the death benefit goes to the estate. Once it enters probate, creditors and the state may make claims against it.

- Medicaid Estate Recovery: If the deceased received long-term care through Medicaid, the state may attempt to recover those costs from the estate—but life insurance with a named beneficiary is typically protected.

- Court-Ordered Settlements: In rare legal cases (divorce, lawsuits, etc.), courts can sometimes place claims on life insurance proceeds.

How to Protect Your Benefits:

- Always name a primary and secondary beneficiary

- Keep your policy updated as family circumstances change

- Avoid making your estate the beneficiary unless you have a trust in place

Proper planning ensures your loved ones receive the money directly—without delays or deductions.

What Are the Benefits of State Insurance Regulation?

While state regulated doesn’t mean state funded, it does mean you’re protected by consumer safeguards that help ensure fair treatment and transparent offerings.

Key Benefits of State Regulation:

- ✅ Licensing Requirements: Insurers must be approved by your state’s insurance department.

- ✅ Rate Review: States can deny unfair premium increases.

- ✅ Complaint Resolution: Consumers can file complaints and receive assistance.

- ✅ Agent Oversight: Insurance agents are licensed and monitored for misconduct.

- ✅ Policy Approval: All policies sold must be reviewed and approved by the state for clarity and fairness.

If you ever feel misled or mistreated, you can contact your state’s Department of Insurance to file a formal complaint or verify a company’s license.

Is It a Scam or Legitimate Offer? How to Know the Difference

While most insurance companies offering these plans are legitimate, deceptive marketing is still a problem.

Red Flags That May Indicate a Scam:

- ❌ No company name listed

- ❌ Urgent language like “limited time offer” or “final notice”

- ❌ Claims of “no cost” or “guaranteed government benefit”

- ❌ No license number or way to verify the agent

- ❌ Pressure to make a decision on the spot

Signs of a Legitimate Offer:

- ✅ Provided by a known insurance company (e.g., Mutual of Omaha, Aetna, or Liberty Bankers)

- ✅ The agent is licensed in your state

- ✅ You receive full policy documents and a “free look” period

- ✅ There’s transparency about premiums, benefits, and limitations

If it sounds too good to be true or feels pushy, trust your instincts and seek out more information before agreeing.

Who Should Consider a State Regulated Life Insurance Program?

This type of policy isn’t ideal for everyone, but it works well for certain groups.

Best For:

- Seniors ages 50–85

- People who don’t want a medical exam

- Those with fixed or low income

- Individuals without existing coverage

- Anyone looking for affordable burial and funeral protection

If you’re simply trying to ensure your family isn’t left with unexpected expenses, a state regulated life insurance program offers a practical solution.

Final Thoughts: Choose Wisely, Stay Informed

Understanding how life insurance works—especially when marketed under vague or official-sounding terms—can save you from making costly mistakes.

Here’s a quick recap:

- A state regulated life insurance program is privately offered and state-monitored—not government-funded.

- It’s ideal for final expense needs, especially for seniors and those with limited savings.

- Costs vary, but many plans are accessible for under $100/month depending on age and coverage.

- Always verify company and agent credentials before buying.

Don’t rush your decision. Take the time to compare quotes, ask questions, and work with a licensed professional who can tailor a policy to your exact needs.

Frequently Asked Questions (FAQs)

Q1: What is the difference between state regulated and federal life insurance?

A: State regulated plans are offered by private insurers under state law, while federal life insurance (like FEGLI) is for federal employees.

Q2: Can I get state regulated life insurance if I have health issues?

A: Yes, many of these programs offer guaranteed issue policies with no health questions or medical exams.

Q3: Is it mandatory to buy state regulated life insurance?

A: No, it’s completely optional. However, it’s a smart way to cover final expenses and avoid burdening your loved ones.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.