Last Updated on: August 4th, 2025

- Licensed Agent

- - @M-LifeInsurance

Planning for the future, especially for the time we are no longer a part of that. It can be very hard and emotional. The one thing that many people think about to help their family and avoid money problems later at the funerals so, they consider buying prepaid funeral plans. This means that you are paying for the funeral before the time. But like any money decision, prepaid funeral also comes with good points as well as bad points. This article will explain what a prepaid funeral plan is and what it includes, as well as the cost of this plan and some other important options you can consider.

What Is a Prepaid Funeral Plan?

A prepaid funeral plan is a simple plan, and it means that you are paying for your funeral before you pass away. Simply, it is like you are paying to cover the expenses at today’s price, and this will help your family not to worry about money or make a hard decision later. With a prepaid funeral plan, you have the option to choose how you want your funeral to be held and how you want to be buried or cremated. You can also decide what service you want and other details about the funeral.

What Is Included in a Prepaid Funeral Plan?

The things you get with a prepaid funeral plan can be different, but usually, they include:

- Funeral director’s fees

- Basic coffin or casket

- Transportation of the deceased

- Preparation and embalming of the body

- Ceremony venue, like a church or chapel

- Burial or cremation fees

- Paperwork and administrative services

- Death certificates and permits

There are some other plans that include things like floral arrangements, obituary notices, and small keepsakes to remember the person.

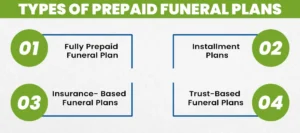

Types of Prepaid Funeral Plans

There are different kinds of prepaid funeral plans, and each one works in its own way and gives different benefits:

Fully Prepaid Funeral Plan

This is the type of prepaid funeral in which you have to pay the full amount all at once. The funeral providers keep the money safe until it is needed. This policy is good for people who want everything paid for right away.

Installment Plans

In this type, you don’t have to pay all at once. Instead, you make the smaller payments, like the small installments each month, until the full amount is paid. This is good for the people who can not afford to pay everything at once.

Insurance-Based Funeral Plans

This type of prepaid funeral is like a funeral insurance policy. It means that when you pass away, the insurance pays out money to cover your funeral costs. This is good for the people who want to pay over time and still leave money for funeral expenses.

Trust-Based Funeral Plans

In this plan, the money you pay goes into an account, this account is also called a trust. This account is only used for your funeral. This money is safe and saved until the time comes. It is a good choice if you want to make sure that your money is protected and your funeral goes as you planned.

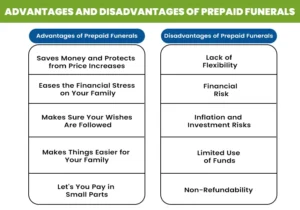

Advantages of Prepaid Funerals

There are so many benefits to buying prepaid funeral plans. This will help you to save money and reduce stress. Despite that, there are alot of things you have to know. Let’s have a look at the advantages of prepaid funerals.

1. Saves Money and Protects from Price Increases

The cost and prices of the funeral go up over time because of inflation. If you have a prepaid plan, you have to pay today’s price, even if your funeral happens many years later. This will help you and your family avoid higher future costs.

2. Eases the Financial Stress on Your Family

Funerals can be expensive, and this will cause a lot much stress for your family to arrange the money quickly. Paying in advance and buying a funeral plan is a good way to make your family stress-free. Your family dont have to worry about the cost when the time comes.

3. Makes Sure Your Wishes Are Followed

When you pre-plan a funeral, you get an option to decide everything regarding your funeral, like whether you want to be buried or cremated. You can also decide what kind of service you want.

4. Makes Things Easier for Your Family

Losing someone is already very hard and emotional. With a prepaid plan, your family doesn’t have to make quick or stressful decisions. Everything is already planned, which makes the process smoother and less emotional for them.

5. Let’s You Pay in Small Parts

Paying the full amount at once is too hard and difficult. There are many prepaid plans that will let you pay a small amount each month. This will make it easier to manage and still gives you the benefits of planning.

Disadvantages of Prepaid Funerals

1. Lack of Flexibility

Once you prepay, after that, if you change your mind, this will be so difficult and expensive to change the plan.

How Much Does Life Isurance Cost?

2. Financial Risk

Another big drawback of a prepaid plan is financial risk. If the funeral company shuts down or goes out of business, you will lose your prepaid money, especially if the money was noy kept in a safe account.

3. Inflation and Investment Risks

Some plans do not adjust payments based on inflation or may invest funds conservatively, potentially affecting the total available at the time of death.

4. Limited Use of Funds

Typically, prepaid plans can only be used for funeral services. If you pass away elsewhere or your circumstances change, the plan may not cover everything you want.

5. Non-Refundability

If you cancel a prepaid funeral plan, you may lose some or all of your money or face penalties and fees.

Conclusion

Prepaid funeral plans offer you and your family a stress-free time. You can easily buy the funeral plan at today’s price and manage all the things before you pass away. There are alot of advantages of the prepaid funeral and also some disadvantages that we have discussed. Compare each type and choose which type is best for you according to your budget. The goal is all about securing the funeral arrangements in your life and getting stress-free after that.

FAQs

1. What is a prepaid funeral plan?

A prepaid funeral plan means that you are paying for your funeral before you pass away. It helps you fix the price now so your family doesn’t have to worry about the cost later.

2. What does a prepaid funeral plan usually include?

The prepaid funeral plans include things that are needed for the funeral, like a coffin, moving the body, and taking care of the body. Cremation or burial. There are also some plans that include extra floral arrangements or some items to remember the person.

3. How much does a prepaid funeral plan cost?

Costs depend on what’s included in the plan. A basic cremation can cost $2,000–$4,000, while a full burial can cost $5,000–$12,000 or more. Extras can add the price in the total.

4. What are the benefits of a prepaid funeral plan?

It saves money, protects you from rising prices, reduces stress for your family, and lets you choose how your funeral should be done.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.